When most people think of housing, they separate it into two types: single-family suburban homes that people own, and apartments, largely in cities and urban centers, that people rent. Until recently, the popular image was more or less correct. Most single-family houses provided homes for the families that owned them.

But more than 12 million single-family homes are currently being rented in the United States. Those homes, valued at more than $2.3 trillion, make up 35 percent of all rental housing around the country. In the past, the great majority of single-family homes that were rented out were done so by their owners or small real-estate companies. But today, a large and growing share of single-family rental homes are owned and managed by large corporations, real-estate firms, and financial institutions. The percentage of home owners is at its lowest level since the 1960s.

Those are the big takeaways of a recent study by Andrea Eisfeldt of UCLA’s Anderson School of Management and industry expert Andrew Demers, published as a working paper by the National Bureau of Economic Research (NBER).

This is yet another of the economy-shifting consequences of the financial crisis of 2008. The crisis took a huge bite out of housing prices, and rising unemployment put large numbers of homeowners underwater in their mortgages. A good many fell victim to foreclosures, and plummeting housing values meant that they often had to sell their homes for a fraction of their value.

Into the breach stepped large corporations, real-estate investors, and financial institutions that saw a huge investment opportunity in these bargain-basement-priced single-family homes. According to a 2018 report in Curbed, a handful of large companies like Invitation Homes, American Homes 4 Rent, Progress Residential, Main Street Renewal, and Tricon American Homes own approximately 200,000 single-family rental homes and that number is growing. The Curbed story cites research finding that these homes tend to be concentrated in areas that were hit hard by the housing crisis; that many of their renters are low- and moderate-income families with children (including many minority families); and that these large companies frequently charge higher rents and are more likely to evict tenants.

These homes are not just properties that are rented out to house families; they have been transformed into a new class of financial asset and investment vehicle. According to the NBER study, the homes have been capitalized into single-family rental bonds, which has grown into a $15 billion-plus market. Three Real Estate Investment Trusts (REITs) backed by single-family rental assets have had IPOs with a market capitalization of more than $18 billion.

It’s a disturbing twist to the phenomenon I’ve dubbed the Great Reset. A large and growing component of the shift, or reset, from homeownership to rental housing is made up of single-family homes that were once owned but are now rented. The NBER study estimates that the 4 percent decline in America’s homeownership rate, from 67 percent before the crash in 2007 to 63 percent in 2014, means that roughly 1.5 million American households have shifted from owners to renters.

This represents more than $220 billion in housing value—a huge transfer of wealth from Americans who once owned, or would have owned, these homes, to large corporations.

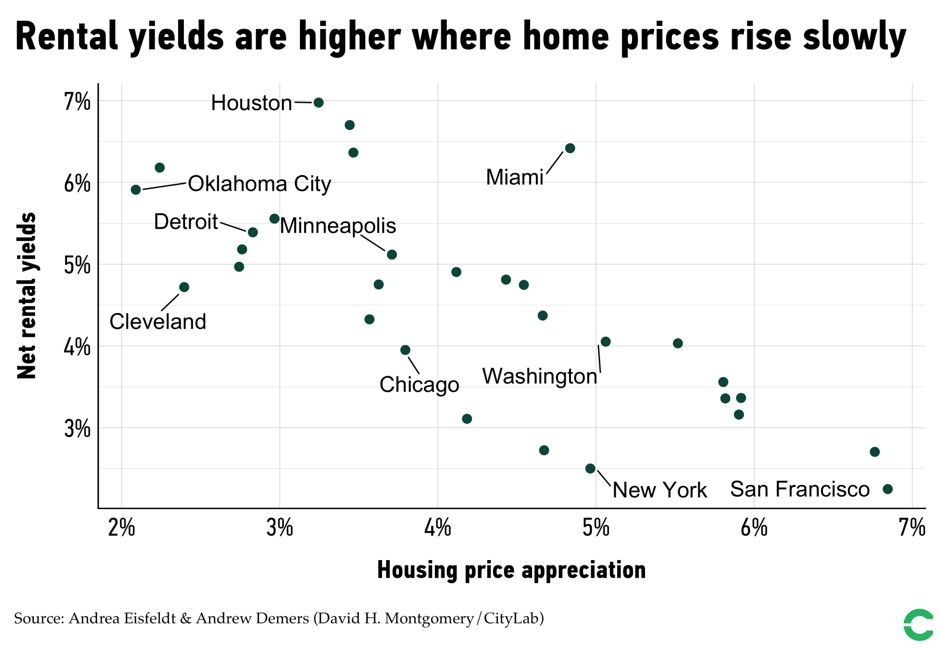

As the NBER study shows, these large-scale investors in single-family homes have essentially made money two ways: by collecting rents, and also by gaining from the appreciation in the value of these homes. To get a sense of this, the study tracks both rental yields and housing-price appreciation for the 30 leading cities using a combination of data from American Housing Survey, from the U.S. Census Bureau, and CoreLogic’s House Price Index data.

The numbers add up fast. When it comes to rent, gross rental yields (that is, before expenses) averaged 7.4 percent, while net yields averaged 4.5 percent a year. Housing prices appreciated by 4.3 percent over this time. The chart below shows how the 30 cities stack up over this period.

A basic pattern jumps right off this graph. On the one hand, in cities with lower overall housing prices, the rate of housing-price appreciation is lower, but rental yields are higher. On the other hand, in more expensive cities, yields are lower but appreciation is higher.

In fact, rent yields in the lowest-priced quintile of cities were about double those in the highest-priced quintile—an average of 6.1 percent versus 2.9 percent between 1986 and 2014. “[R]ental yields tend to be highest in the lowest price tier cities, and monotonically decline with price tier,” is how the study puts it. And it adds that “high quality houses should, all else equal, have both higher rents and higher purchase prices. Empirically, however, rental yields are substantially higher in lower price tier cities.”

On the flip side, housing in more expensive cities has seen greater appreciation. Between 1986 and 2014, housing-price appreciation averaged 5.3 percent in the most expensive cities, versus 3.2 percent is the least expensive cities. The large corporate owners of single-family rentals make more money off rents in poorer cities, and more money off appreciation in expensive cities.

In a twist that is both ironic and disturbing, the Great Reset turns out to be more than just a simple shift from owners of single-family homes to renters of urban apartments. It has been bound up with the broader financialization of housing—the transformation of housing from shelter into yet another investment vehicle.

Just as high-priced condos in expensive cities have become a new kind of asset for large companies and wealthy foreigners, so too have larger and larger numbers of single-family homes been turned into investment vehicles for large corporations. For a growing number of families, the American Dream of owning their own home and the wealth and financial security that comes from it have given way to renting a place to live from a mega-corporation.

CORRECTION: A subheading on this story previously misstated the proportion of single-family homes that are rentals. In fact, single-family homes make up 35 percent of all U.S. rental housing.

Richard Florida is a co-founder and editor at large of CityLab and a senior editor at The Atlantic. He is a university professor in the University of Toronto’s School of Cities and Rotman School of Management, and a distinguished fellow at New York University’s Schack Institute of Real Estate and visiting fellow at Florida International University.

CityLab is committed to telling the story of the world’s cities: how they work, the challenges they face, and the solutions they need.

Spread the word