Why the `Spreadsheet Scandal' Should Kill Obama's Social Security Cut

Elementary Misuse Of Spreadsheet Data Leaves Millions Unemployed

Why the ‘Spreadsheet Scandal’ Should Kill Obama’s Social Security Cut

A recent “Spreadsheet Scandal” has rocked the economics world. It also seems to have eliminated the last remaining technical argument in support of the President’s “chained CPI” Social Security cut.

Not weakened it. Eliminated it.

I believe the President proposed the chained CPI in good faith. I don’t know if the same can be said about his campaign pledges on that subject, but I think he genuinely believed these cuts were needed. I think his economic advisors thought they were doing the right thing by proposing them. And I think that this now-discredited spreadsheet helped convince them.

Why do I think so? Because I had a run-in with the President’s top economic official on this very subject back in 2010, and his position seemed to be strongly influenced by that spreadsheet and the economists who created it.

I hadn’t thought about that exchange for a long time. But last night I was catching up on this scandal when it struck me:

That’s why they’re doing this.

Shallow Background

I first learned of the Administration’s plans to cut Social Security in a deep-background briefing which a “Senior Administration Official” held for a small group of writers in August of 2010.

I honored the “deep background” (no quotes or names) commitment, but Mike Allen of Politico did not. Allen wrote that the unnamed Official believes that “action on Social Security … demonstrates the ability to begin to affect the long-run deficits … strengthens the odds of a political consensus behind other spending cuts or tax increases … (and) would establish more CREDIBILITY with the MARKETS.”

Some of the other attendees were outraged at what they considered Allen’s unfair reporting. Tim Fernholz said Allen failed to note that the Official had cited Paul Krugman. (More about that shortly.) But the shift-key-abusing Allen was right on this one.

Then the Washington Post revealed that the unnamed official was Treasury Secretary Tim Geithner. Several other attendees did the same. So much for “deep background” …

The Secretary

Those Social Security comments were part of a heated exchange with me. It took place after we were told that some form of Social Security cut was likely, probably after a “bipartisan” recommendation from the Simpson/Bowles Deficit Commission.

What if the Commission deadlocks? I asked.

Then the recommendation will come from a bipartisan subgroup, came the answer. If we can’t get that we’ll get a bipartisan recommendation from the two co-chairs themselves. (That’s what eventually happened.)

I asked why they wanted these cuts. Because the international markets want them, was the reply. But the international bond markets love US government debt right now, I said.

That’s when things got heated.

Social Security adds to government debt, said the (as yet unnamed) official.

But, I said, the Social Security Act forbids it from drawing down on general funds and adding to the debt. It’s a creditor, not a …

He cut me off. Even your hero agrees with me, he said.

Who?

Paul Krugman. Your hero Krugman agrees that Social Security spending is categorized as government spending.

He’s talking on a macro level, I began. But –

The Official cut me off again, turned away and said, Next question.

The 90 Percent Solution

Here’s why that exchange matters: The most powerful economic official said in 2010 that a Democratic President needed to cut Social Security, even though it doesn’t contribute to Federal debt, because Social Security payments are classified on the books as “government spending.”

That troubled him because of a policy panic fueled in large part by that now-discredited spreadsheet. That spreadsheet didn’t distinguish between “trust fund” expenditures like Social Security and other forms of spending and debt. It said that things fall apart when aggregate “government debt” crossed a certain line.That would presumably make that nation a poor place to invest, which was the source of Geithner’s concern.

Those conclusions came from a paper published earlier that year by Carmen Reinhart and Ken Rogoff. Reinhart and Rogoff argued that one number represented a kind of tipping point beyond which government debt became a destructive drag on the entire economy.

That number was 90 percent. Once the ratio of government debt to annual GDP reaches or passes it, wrote Reinhart and Rogoff, the economy shrinks. What bond investor in his right mind would invest in a government whose economy is about to shrink?

No wonder the Treasury Secretary was concerned. At the time of our meeting, the Federal debt was 100 percent – and rising.

The Scandal

But they were wrong. Thomas Herndon, Michael Ash, and Robert Pollin analyzed their original Excel spreadsheet and discovered a simple and significant calculation error. When it was corrected, the 90 percent number became meaningless. Not just misinterpreted, as many people felt Reinhart and Rogoff had done at the time, but meaningless.

Paul Krugman – my “hero” – has a good writeup on this. Mike Konczal has an excellent overview. There’s more, including what appears to be some cherry-picking of information to support their thesis, but the bottom line is: The 90 percent red-line means nothing. Nothing happens when it’s crossed.

For the anti-government austerity crowd, however, the 2010 Reinhart/Rogoff paper was the right argument at the right time. They ignored economists like Josh Bivens, John Irons, and Dean Baker, who expressed doubts.

The new findings by Herndon, Ash, and Pollin are a very important story. I followed it with great interest, but didn’t think I had anything to add to it.

Then I remembered that Senior Administration Official.

Article of Faith

He was looking at figures which showed Federal debt well above that “red line” – and going up, not down.

That’s panic time, if you believe Reinhart and Rogoff. I didn’t then, and I certainly don’t now. But the Administration did. I can imagine where that led them.

Social Security self-funded payments don’t contribute to that debt, but it’s a very big program. This year’s outlays will come to nearly 5 percent of our total GDP. And the Federal government owes the Social Security Trust Fund (and therefore all its current and future recipients) more than two trillion dollars.

If you’re panicked over government debt and genuinely believe it will eventually sink the entire economy, you’ll want to cut those large Social Security payments. You’ll want to do everything you can to reassure investors that you’re addressing the debt, and you’ll want to start with the big numbers first.

If you’re up above the Reinhart/Rogoff “red line,” where terror sets in, you’ll want to raid the Social Security Trust Fund too. (To be fair, the Administration never explicitly said that it would, but that’s what behind all those “they’re only IOUs” arguments.) If the Trust Fund’s money is used to pay down other debt, you can panic a little less.

And you’ll do all of this with the firm conviction that you’re acting in the country’s best interests.

That Treasury Department meeting took place August 2010, eight months after the “90 percent” figure was published. It had already become an article of faith in Washington DC.

Math as Mantra – and Absolution

But why did it catch on?

The alien-hunting Agent Mulder on The X-Files had a poster which read, “I Want to Believe.” In the policy world, numbers can take on a magical aura. They can make ideologically-driven decisions look like the unbiased conclusions of wise technocrats. Your conscience need trouble you no longer, however harsh your deeds. It’s no longer your fault.

The numbers told you to do it.

Reinhart and Rogoff offered the policy world a magic number which absolved them of responsibility or sin. A typical reaction came from Peter Orszag, who was President Obama’s Director of the Office of Management at the time. “I don’t think it’s too much of an exaggeration to say that everything follows from missing the call on Reinhart-Rogoff,” said Orszag in 2011. “I didn’t realize we were in a Reinhart-Rogoff situation until 2010.”

We now know that Reinhart and Rogoff offered myth, not math. And today the whole world’s in a “Reinhart-Rogoff situation” as it suffers the financial after-effects of their negligent numerology.

(Well, not the whole world. Orszag became “Vice Chairman of Corporate and Investment Banking, Chairman of the Public Sector Group, and Chairman of the Financial Strategy and Solutions Group” at the bailed-out megabank Citigroup. Sounds like a pretty austerity-proof gig.)

Among the Believers

If you believe in Reinhart and Rogoff’s magic number, you’ll come to believe that Social Security is unsustainable. You’ll think that its legal protections are merely an inconvenience. You’ll eventually conclude that the government must welsh on its debt to the Social Security Trust Fund – and to all of its future beneficiaries – to prevent a catastrophe.

You’ll oppose lifting the payroll tax cap to shore up Social Security, even though it fixes most actuarial problems, because that doesn’t address the Reinhart/Rogoff number. Neither does a financial transaction tax.

You’ll oppose increasing benefits and raising taxes for everyone, too, even though voters across the political spectrum say they’re willing to pay more in return for better benefits. But that doesn’t move the 90 percent “red line” either.

You’ll have very little patience for arguing with economic writers you perceive as left-wing and “ideological.” You’ll think to yourself, Hasn’t this guy read Reinhart and Rogoff? And you’ll turn away. Among the “147 people” you know, the people you really know, you’d get a lot of support and praise for hanging tough against these diatribes from uninformed outsiders.

You’ll tell yourself that the people giving you a hard time don’t understand: You’re doing it for them. You’ll tell yourself it’s hard to be a leader, hard to make the tough choices, hard to take the heat for doing the right thing.

A lot of people will say it for you, too, over cocktails or a good meal. Al Simpson will say it. Pete Peterson will say it. Bill Clinton will say it. The defense contractors and too-big-to-fail bank CEOs behind Fix the Debt will say it.

They’ll all say it. You’ll believe it. If …

If you believe in Reinhart and Rogoff’s number. But it’s been disproved. What now?

A Test of Character

I don’t think the President and his advisors have been acting out of undiluted cynicism and venality. I think they believed these cuts were needed. I think they were swayed by the pro-austerity biases of the people in their social bubble, then seduced by Reinhart and Rogoff’s bad math.

But Europe’s experience has proved that austerity doesn’t grow economies. It hurts them. We now know that austerity increases, rather than reducing, government deficits in times like these. New studies like the Bureau of Labor Statistics’ “CPI-E” indicate that that the chained CPI is a move in the wrong direction. And now Herndon et al. have conclusively disproved Reinhart and Rogoff’s findings.

There’s nothing left.

One could argue that the Senior Administration Official’s argument was only partly based on Reinhart and Rogoff. But The Official was fixated on lower debt as a percentage of GDP. That’s pure Reinhart/Rogoff. And we now know they gave the world bad information. It’s clear that their inaccurate paper fueled and amplified a debt panic among leaders and advisors in both parties, and helped turn the tide in favor of austerity.

This new revelation undercuts the last remaining technical argument in favor of the chained-CPI benefit cut (which also includes a middle-class tax hike.) The White House and this President now face a test of character: Will they change their position in the face of new information?

That’s a question only they can answer.

Postscript: How Should a Naked Economist Behave?

I initially felt both sympathy and empathy toward Reinhart and Rogof, despite their arguments. If you’ve ever calculated large numbers for a living you’ll know what I mean. They’re living your worst fear, the one that fuels a flop-sweat feeling in the pit of your stomach: Did I get the math right? Did I double-check the figures enough?

It’s like those children’s nightmares where they show up in school and then realize that they’re naked.

But there’s a protocol for this sort of nakedness. You acknowledge your error immediately, and then work on correcting you error’s impact on your corporation, your organization or your community (which, in Reinhart and Rogoff’s case, is pretty much the entire planet).

Bu, as Krugman points out, they responded instead with disingenuous arguments that reflect very poorly on themselves. Meanwhile, the story has exploded around the world’s economic circles: “How an Excel error fueled panic over the Federal debt,” wrote Michael Hiltzik in the Los Angeles Times.

Reinhart and Rogoff should do what others in their position usually do: Own up and make things right. Think of it as a debt - one they owe their profession, their country, and their world. It’s what they should have done immediately.

They can still do it. The White House can do it too. It’s not too late – yet.

Elementary misuse of spreadsheet data leaves millions unemployed

I have discussed the problem of poor IMF forecasting in the past. For example – Governments that deliberately undermine their economies.

Earlier in the year (January 3, 2013), the IMF published a paper – Growth Forecast Errors and Fiscal Multipliers – which attempted to explain why the planned fiscal austerity measures in advanced economies have been more damaging than they and their fellow mainstream economists had predicted.

Forecast errors are a fact of life and are not in themselves a reason for considering the forecaster deficient. But the IMF and other major neo-liberal inspired organisations produce systematic errors – which mean they do not arise from the stochastic nature of the underlying forecasting process.

It is easy to trace these systematic mistakes to the underlying ideological biases, which shape the way they create their economic models.

The IMF admitted that the spending multipliers were, in fact, “larger” than they had predicted and which they had used in their modelling. These models underpin their policy advice and have been instrumental in the imposition of fiscal austerity on many nations.

The IMF admitted that:

… a significant negative relation between fiscal consolidation forecasts made in 2010 and subsequent growth forecast errors. In the baseline specification, the estimate … [implies] … that, for every additional percentage point of GDP of fiscal consolidation, GDP was about 1 percent lower than forecast.

In more accessible language, the larger was the planned fiscal consolidation at the start of 2010, the larger the actual decline in real GDP relative to what the IMF thought it would be.

Millions of workers have lost their jobs as a consequence of these forecasting errors.

The IMF forecasts are always systematically wrong because they use flawed macroeconomic approaches, which allow ideology to triumph over understanding.

But while we are on forecasting errors, lets go to Cyprus for a moment.

There was an interesting article in the Cyprus Mail (April 15, 2013) – Our view: Exiting the euro is a debate we must have.

The austerity troglodytes have been successful in convincing people, particularly the Cypriots, that there is no other solution to the banking problem than the measures imposed upon the nation by the Troika.

Some of us clearly think differently.

It emerged last week that the revised forecasts for the contraction in real GDP (as of April 2013) are nearly 2.5 times higher than the EC had projected in February 2013.

On February 22, 2013 (yes, just two months ago), the European Commission released their updated – Winter Forecast 2013 – under the title “Winter forecast 2013 – The EU economy: gradually overcoming headwinds”

So these were the most updated thoughts on how things would turn out.

The specific country forecast and analysis for – Cyprus – predicted that real GDP growth would be -3.5 per cent in 2013 and -1.3 per cent in 2014. This is a total shrinkage in the Cypriot economy of 4.8 per cent.

On April 9, 2013, the EC produced a report – Assessment of the public debt sustainability of Cyprus. I was sent a provisional draft of the Report – unofficially, of-course. It was not published publicly by the EC.

The Macroeconomic projections (in Table 1) show that the Troika were forecasting a fall of -8.7 per cent in real GDP in 2013 and -3.9 per cent in 2014 a total decline in the size of the economy by 12.6 per cent over the two years.

The internal Troika briefing is an extraordinarily cold-blooded document outlining the assassination of a nation.

We read about an “ambitious but achievable fiscal adjustment path … Is essential to contribute to the sustainability of Cyprus’ public debt”.

The aim is to achieve a 3% of GDP primary surplus by 2017, a fiscal shift of around four percentage points of GDP between 2013 and 2016.

The document admits that the consolidation targets will be challenged by the economic conditions they create.

For example, Paragraph 17 says:

The fiscal consolidation implies that the improvement in the primary balance over 2013-14 will contribute to reducing the debt ratio substantially within the programme period, in spite of the rather strong debt-increasing effects from interest expenditure and the projected recession.

The Troika demand that the budget be presented to the “before submission to the House of Representatives”. No democracy here!

What happens if the automatic stabilisers accompanying the recession increase the debt ratio?

That’s easy. The Troika has the answer (Paragraph 18):

In the event of underperformance of revenues or higher social spending needs, the Cypriot government has committed to stand ready to take additional measures to preserve the programme objectives, including by reducing discretionary spending, taking into account adverse macroeconomic effects.

At that point, you realise that we are dealing with sociopaths. They are morons, but worse, they actually seem to enjoy their jobs.

In terms of the “bail-in” package, the revised growth forecasts mean that the amount of Euros Cyprus will need to salvage its banks and are 23 billion euros rather than the original estimate of 17 billion euros.

The Troika will continue to provide 10 billion euros ( European Stability Mechanism (ESM) €9 billion and IMF €1 billion) under the agreement. Cyprus now has to come up with an addition 6 billion on the 7 billion it originally agreed to.

The Cypriot government as a lackey of the Troika will abandon public purpose by:

1. Stealing depositors money in their banking system.

2. Increasing taxes at a time that the economy is collapsing.

3. Privatisation of state-owned (that is, people-owned) assets.

4. Sale of Gold reserves (at a time that the price is plummeting – Austrian schoolers go suck it).

5. Allowing private (productive) investment to collapse by a staggering 41.5 per cent (estimated) over 2013-2014

6. Requiring a fall in domestic demand of 19.8 per cent over 2013-14.

Interestingly, but not surprisingly, in the 8-page document, there is only ONE mention of unemployment – we read that under macroeconomic developments that “unemployment rose” (page 3).

At least the EC Winter Forecast 2013 thinks the unemployment rate will rise from 12.1 per cent in 2012 to 13.7 per cent in 2013 and 14.2 per cent in 2014. Remember it was 5.5 per cent in 2009.

They will be wrong though. When they started bullying Greece into austerity the unemployment rate there was 7.7 per cent (2008).

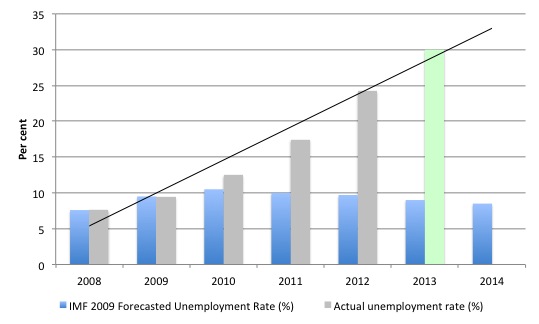

In August 2009, the IMF issued its updated – Country Report – for Greece with their latest forecasts out to 2014. They claimed the unemployment rate would peak at around 10.5 per cent in 2010 and then drop away. They also claimed that real GDP growth would be positive in 2011 and become stronger from then.

The following graphs (constructed from those forecasts and the actual outcomes) should illustrate how poorly the IMF has performed on this front. The Greek unemployment recently was published at 27.20 percent in January 2013 up from 25.7 in December 2012 with no ceiling in sight. By now the IMF claimed it would be 9 per cent.

The light-green bar in the unemployment graph is my estimate of where we will be at year’s end. It is conservative. The IMF have been grossly mistaken because they do not understand how the economic system operates.

They deploy deeply flawed macroeconomic models and impose socio-pathic and ideological assumptions, which will always generate these gross errors.

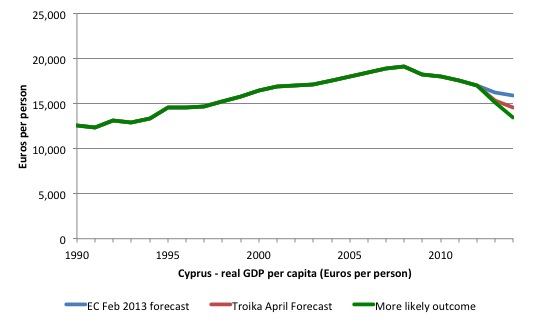

This graph is for the real GDP forecasts.

The same goes for Cyprus. The unemployment rate is already at 14.7 per cent (February 2013) and is rising fast. It will chase the Greek experience over the course of 2013 and be closer to 20 per cent by the end of the year if not 25 per cent.

When the EU economic affairs commissioner Olli Rehn was asked about the major errors in forecasts for Cyprus he had this to say (Source):

I don’t deny that there is uncertainty about the precise figure whether it will 10 percent, 12.5 percent or 15 percent,

As if we are playing for pennies!

A lost two decades in a year. At least it took a decade for Japan to lose only one decade and then the losses were nothing like this at all.

What does it mean?

The following graph, which shows real GDP per capita, based on three different growth assumptions. The blue line is based upon the February 2013 EC winter forecasts. The red line is based upon the April 2013 Troika estimates. The green line is the more probable outcome (and in my view is conservative).

I used the data from the latest – IMF WEO April 2013 database.

Population growth has been running at an average annual rate of 1.8 per cent, although in 2012 it slowed to just 1.2 per cent as the implications of the crisis started to become obvious.

I have assumed that the population growth rate will slow further to 1 per cent per annum over the next two years. I have also assumed that real GDP will contract by 9 per cent per annum over the next two years.

As you can see, the euro experience has done nothing for Cyprus in terms of improving real living standards (on average). If the current green scenario is realised then real living standards in Cyprus will be back to their 1991 levels.

In addition, the Troika will have demolished most of the productive capacity of the economy and decades of immiserisation await.

The Cyprus Mail article notes that the economy is “in free-fall and has yet to hit the bottom”. The reality is that the bottom just got deeper as a result of the bail-in and will not be seen for some years.

I agree with their assessment that:

Friday’s announcement that the “Eurogroup is confident that determined action in line with the reform measures spelled out in the MoU will allow the Cypriot economy to return to a sustainable path based on sound public finances, balanced growth and financial stability,” could at best be described as wishful thinking and, at worst, a joke.

I also agree that the “chances of macroeconomic targets being met are almost non-existent”.

They then conjecture:

Perhaps the economy’s interests would be better served if Cyprus exited the eurozone, defaulted on its debts and re-adopted the Cyprus pound. The government has taken a dogmatic stand against such a move, citing all the obvious negative effects, but the option needs to be explored and studied in-depth by experts. The government should either hire a top consultancy firm or put together a team of economists, market analysts, technocrats, etc to carry out studies of the short- and medium-term effects of leaving the euro.

My research centre will do the job for cheap! But based on my analysis to date, there is no way that staying in the Eurozone will end up being better than leaving it now. There are huge costs either way, but the costs incurred by the exit will be borne within a growth environment. Under current forecasts, there will be no sustainable growth for years. Just look at Greece across the water!

Which brings me to the austerity cultists biggest authorities – Rogoff and Reinhart – and their paper – Growth in a Time of Debt – which is without doubt one of the most cited academic papers in modern times.

On their WWW site, Rogoff and Reinhart have been very keen to point out how many journalists, media programs etc have been citing their work – Growth in a Time of Debt Home Page.

While one can understand the self-promotion by Rogoff and Reinhart, it seems that none of these media outlets or journalists did much checking.

A paper came out this week (April 15, 2013) – Does High Public Debt Consistently Stifle Economic Growth? A Critique of Reinhart and Rogoff – from the Political Economy Research Institute (at University of Massachusetts) – written by Thomas Herndon, Michael Ash and Robert Pollin.

It is a devastating critique of Rogoff and Reinhart because it exposes major errors in their basic handling of the data. I will come back to that.

In this blog from last week (April 10, 2013) – It’s simple math – I considered the Rogoff and Reinhart paper in question. I noted that Rogoff and Reinhart’s paper – Growth in a Time of Debt – talks extensively about “debt intolerance limits” arising from “sharply rising interest rates” – and then “painful fiscal adjustments” and “outright default”.

I also pointed out that they seem fit to engage in correlation analysis but leave the causality issue hanging. All the financial journalists and politicians – right up to the top – have not told the world that R&R were providing correlations. They treated the results as if they were causal – from public debt ratios to growth.

Up until now, their work has also been widely discredited by other economists for conveniently manipulating the way they conducted the analysis to suit their conclusions, for picking “the 90% figure almost arbitrarily” and most of all, in the context of my previous comments, for not admitting that “it’s much more likely that causality runs in the other direction” (quote from paper).

The causality issue is crucial because it is more likely that countries with rising public debt to GDP ratios are those which are facing recession. The denominator (GDP) falls while the numerator (outstanding debt) rises, given the cyclical response of the budget balance (independent of any discretionary fiscal stimulus that such a nation might enjoy).

Madam Reinhart responded to a Washington Post article (April 8, 2013) – Why do people hate deficits? – which had criticised their work, saying that:

We’re quite aware that you have causality going in both directions …

But not aware enough to qualify their analysis in the paper? There were no standard causality tests presented.

In this 2010 blog – Watch out for spam! – I also noted that in other related work, R&R are content to conflate nations that operate within totally different monetary systems (gold standards, convertible non-convertible, fixed and flexible exchange rates, foreign currency and domestic currency debt etc).

They seem oblivious to the fact that there can never be a solvency issue on domestic debt issued by a fiat-currency issuing government irrespective of whether the debt is held by foreigners or domestic investors.

R&R pull out examples of sovereign defaults way back in history without any recognition that what happens in a modern monetary system with flexible exchange rates is not commensurate to previous monetary arrangements (gold standards, fixed exchange rates etc). For example, Argentina in 2001 is also not a good example because they surrendered their currency sovereignty courtesy of the US exchange rate peg (currency board).

Their 2010 American Economic Review paper, which is now the subject of renewed scandal, also fell into the error of conflating monetary systems. I concluded last week that the fact that such a tawdry bit of work gets published in this journal tells me that the AER has no status in the context of “knowledge dissemination”. It is just another medium via which the ideological message of a degenerative paradigm (in the Lakatosian sense) uses to maintain its hegemony.

The same point was made in an excellent analysis from my friends – Randy Wray and Yeva Nersisyan – http://www.levyinstitute.org/pubs/wp_603.pdf.

But all those criticisms aside, some of which might be contestable (such as the way averaging was done), things have deteriorated very badly overnight for Rogoff and Reinhart.

As is now widely-known, the PERI paper is devastating for the credibility of Rogoff and Reinhart – it shreds it!

I should note that when the paper came out in 2010, I immediately tried to replicate the results and failed. I wrote to Carmen Reinhart because I had met her a few years earlier at a function in the US. I requested the data. It appears I was in a queue of researchers asking for the data. I received no reply.

As a long-standing researcher you learn that if an author will not send you their data then something is wrong. Perhaps they were too busy. Perhaps they didn’t want anyone getting their exact dataset because they knew what might be found.

Whatever! But the upshot was that I couldn’t be sure that something was empirically at fault because there are several data sets that one could reasonably assemble in the context of their enquiry which would generate slightly different and perhaps even substantially different results. It wasn’t clear to me how they generated their results despite attempts to reverse engineer them. But without having the exact dataset it becomes meagre surmise and legal considerations then prevent one from shouting fraud!

It does bring into the frame the long-standing debate about the policies of academic journals.

In some academic disciplines, it is a requirement that data sets be provided to the journal editors and be made publicly available as a condition of publication.

This clears up any issues of replicability. It is also useful because simple mistakes are sometimes made by researchers, no matter how experienced they might be.

As an academic referee for many journals I have often asked the editors to provide the supporting data sets for articles I’ve been asked to review so that I can be sure of the results in advance.

The problem is, that in most cases, economics journals do not have any such requirements. Some do, but most do not.

A long time ago there was an article entitled “Let’s Take the Con out of Econometrics” by equally by Edward Leamer (1983 American Economic Review). Sadly, the American Economic Review has not taken his advice.

However, the Rogoff and Reinhart work is not even an econometric study. It was much more basic than that – some simple spreadsheet formulas.

While it seems many researchers were unable to get their exact data, one lucky team of researchers (at PERI) it seems, did succeed and were thus in a position to replicate the results of Rogoff and Reinhart.

Now we know, courtesy of the PERI paper, that the results they generated from their spreadsheet were not legitimately derived from the data they used.

The PERI authors initially failed to replicate the results. Upon further investigation they discovered the reason for being unable to replicate the results lay in “mistakes” made by the original authors.

The PERI work is summarised in this article – Researchers Finally Replicated Reinhart-Rogoff, and There Are Serious Problems.

Was it a simple spreadsheet coding error? Or was it a case of academic fraud? We will never be in a position to distinguish between incompetence or fraud. At the very least it is very sloppy work.

Randy Wray has provided a recent critique (April 17, 2013) – No, Rogoff and Reinhart, This Time is Different! Sloppy research and no understanding of sovereign currency.

So I won’t write much more.

But I will emphasise this. Apart from all the other issues that the PERI authors take issue with Rogoff and Reinhart (which I largely agree with), the substantive point, which ties in with the IMF multiplier errors, is that the policy advice forthcoming from the Rogoff and Reinhart work is exactly the opposite to the policy advice that would have been implied if they had used the data appropriately.

The PERI authors found that nations who have public debt to GDP ratios that cross the 90 per cent threshold experienced average real GDP growth of 2.2 per cent rather than -0.1 per cent as was published by Rogoff and Reinhart in their original paper.

That is the same quality of error as the IMF using multipliers below one when in fact, they are somewhere between 1.5 and 1.75.

In the IMF case, fiscal austerity would have been growth conducive using their flawed multiplier estimates where is, in fact, as they were forced to admit, fiscal austerity destroyed growth. It also means that fiscal expansion would increase growth by 1.7 dollars per 1 dollar spent (or thereabouts). In other words, fiscal expansion is required to address the malaise not austerity.

In Rogoff and Reinhart’s case, those who believed their results, would conclude that if a nation could reduce their public debt ratio below the 90 per cent threshold through fiscal austerity, then they would stimulate growth and avoid the real GDP contraction that Rogoff and Reinhart claimed would accompany any lingering above the 90 per cent threshold.

This type of conclusion has been fundamental in driving austerity policies throughout the advanced world and has been the cause of millions of workers losing their jobs.

In their reply today (April 16, 2013) – Reinhart-Rogoff Response to Critique – Madame Reinhart seems oblivious to this fact. Arrogant to the core.

First, is interesting that they do not acknowledge their empirical errors. I find that level of arrogance uncompelling.

Second, they claim that the PERI authors “also find lower growth when debt is over 90%”. And so they do.

But, notwithstanding the causality and other conceptual issues noted above, there is a world of difference between an economy that slows from 3.1 per cent to 2.4 per cent when their public debt ratio rises from 89 per cent to 90 per cent, and an economy that goes from 2.8 per cent per annum real GDP growth to a -0.1 per cent negative position when they cross the same threshold.

A policy maker would hardly support a fiscal strategy that would devastate their economy for years and drive unemployment rates up towards an over 30 per cent, just because their growth rate might fall from 3.1 per cent to 2.4 per cent. It would make no sense at all.

Rogoff and Reinhart know damn well that they left the indelible impression on policy makers that such a strategy would, in fact, increase growth and avoid an overall contraction.

Conclusion

The PERI work is devastating for the mainstream fiscal austerity putsch. The cultists have been relying not only on the flawed macroeconomic theories of the mainstream but also, as we now know, on shoddy empirical research. Whether that research is the product of incompetence or deliberate academic fraud is one issue that should be explored.

But independent of the answer to that question, it destroys the credibility of those who raise the work as an authority for their destructive policy positions.

Congratulations to the PERI team!

That is enough for today!

Spread the word