Another Reading of Milanovic: Worlds of Inequality - Globalization's Winners and Losers

This book begins by posing a question: “Who has gained from globalization?” Many thoughtful Americans have the confidence to answer in a sentence. The gains have been captured by the top 1 percent. And the book ends with another question: “Will inequality disappear as globalization continues?” Many might be just as quick to answer: Of course not, the rich will get richer! But life is not so simple. Between these two questions Branko Milanovic offers us not just a plethora of facts about income inequality that will surely make his readers think twice. More importantly, he shows us the power of bringing the facts into focus by putting a new lens over these pressing issues—a global perspective. He takes more than 200 pages to answer the first question, and only a sentence to answer the second.

Milanovic is a senior scholar with the Graduate Center of the City University of New York, but he’s lived many interesting lives. Think of him as an intellectual refugee from the former Yugoslavia at a time when Belgrade was not exactly the most career-friendly place to express an interest in the measurement of inequality; imagine, say, an opposition figure like the famous dissident Milovan Djilas who had aspirations of being a statistician. Think of him as a World Bank apparatchik, data cruncher par excellence, not for any one country but for each and every country, for the world. And think of him as a reflective academic, deeply read in history and economics, and motivated by an abiding curiosity about how people lead their lives; a close student of the way people organize themselves politically (or don’t) and how that affects the material welfare of the majority, and sometimes bounds the powerful elite. You get the idea—his many interesting lives put Milanovic in the position to offer, in this tightly written book, a global perspective on what is too often thought of as a national issue.

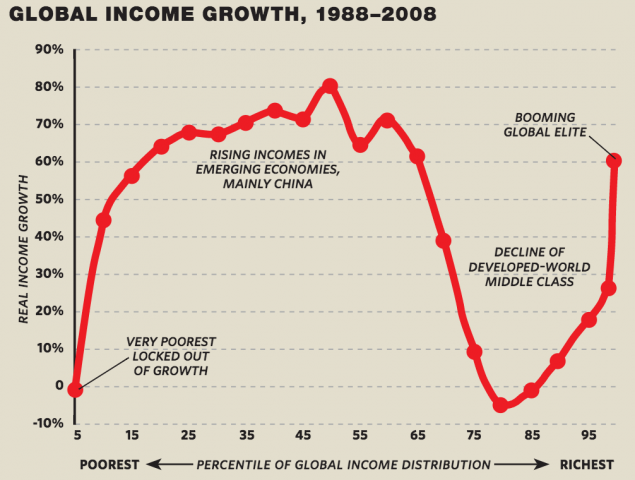

The most striking fact that motivates his book is a graph that the Twittersphere has already termed “the elephant curve.” This is the one-sentence, or rather one-picture, answer to the first question: “The gains from globalization are not evenly distributed.”

This is the one-sentence, or rather one-picture, answer to the first question: "The gains from globalization are not evenly distributed."

The elephant curve ranks the world’s citizens from those with the very lowest incomes to those with the very highest. It shows how much each group standing on the same rung of the 1988 global income ladder saw their income increase by 2008. The percentage increase in income over this period was significant for some, strikingly so for many others, but disappointing for others.

Clearly evident are the rise of a global middle class, in some important measure reflecting the great march out of poverty in China, and the equally amazing rise in the incomes of the top 1 percent globally. The winners of globalization were many people who three decades ago were dirt-poor, and though a big percentage increase in a very low income still amounts to a rather low income by the standards of the average person in the rich countries, it is a major movement in the right direction. But the great winners of globalization were also a relatively few people in the already-rich countries, a global plutocracy who also experienced income gains of over 50 percent, but from a much higher starting point. Both of these changes are without precedent in the history of humanity.

But the elephant curve also shows that even though some have gained, others have not seen their prospects improve at all—indeed, probably leading lives of more insecurity and more worry, not just about their prospects but also the prospects of their children. The big losers in these global income sweepstakes have been middle- and lower-income people of the rich countries—the part of the curve that shows the big dip. It is their plight, and its sharp contrast with the rich and richer minority in their countries that explains the increasing salience of inequality in American politics. As Milanovic makes clear, this puts public policy at a very caustic crossroads. “Politicians in the West,” he writes, “who pushed for greater reliance on markets in their own economies and the world after the Reagan-Thatcher revolution could hardly have expected that the much-vaunted globalization would fail to deliver palpable benefits to the majority of their citizens—that is, precisely those whom they were trying to convince of the advantages of neoliberal policies compared with more protectionist regimes.”

To this group of Americans, Germans, Japanese, and others, the claim is all starting to ring hollow, and it is little comfort to be told that they still enjoy a standard of living vastly superior to many in the world. That was not supposed to be the deal, particularly when inequality within their own countries skyrocketed as a narrow slice of their countrymen got a much bigger slice of the pie.

Yet, global inequality has fallen; it has fallen in a major and unprecedented way; and it fell even as the income differences within countries increased substantially. It fell because the average difference between countries shrank all the more. And that’s the rub. The forces driving income growth and its distribution are global, stretching well beyond the nation-state; yet our politics, and hence our policy imaginations, remain national.

The elephant curve lays this challenge out all too clearly, and the good Dr. Milanovic then engages us in a careful discussion of the nature, evolution, and forces behind inequality within countries, and then inequality between countries. These two chapters are the analytical heart of this five-chapter book.

Even the most expert readers should pause for a moment and marvel, in a way free of jaundice, at the apparatus and technical elegance. The standard measure of income inequality is the Gini coefficient, named after the Italian statistician who devised it about a century ago. Sure, it is only one of many possible measures in our toolbox, having particular strengths but also weaknesses, most notably not being terribly sensitive to a growing share of income going to a narrow slice of those already at the top. A colleague once whispered into my ear as the two of us listened to a conference presentation, “Branko’s never met a Gini he didn’t like.” And indeed, if you visit his website you can download a dataset affectionately called “All the Ginis.” He does mean all: an inequality statistic for all places, from many different surveys, over much of the postwar period. And while we can debate him about the meaning and measurement of incomes, the capacity to devise comparable purchasing powers across countries, and the best way to transform these numbers into measures of inequality, it is nonetheless amazing that we now have more and more high-quality, representative samples of individuals in almost all of the world’s countries. The building of this infrastructure, principally at the World Bank where Milanovic had a front-row seat, is something to be respected and nurtured by policymakers. We live in an information age full of noise, and this is one case in which we have signal, perhaps at times fuzzy and intermittent, but signal nonetheless.

I stress this because Milanovic’s thesis has to do with the disconnect between national politics and global economics. Surely the first step in making global policy for a global citizenry has to be a data infrastructure that is global in reach. The almost seamless flow of capital and the amazing capacity for incomes to be hidden from national authorities, and for that matter from some of the statistics Milanovic uses, raises big concerns that still need to be addressed.

The elephant curve invites many more interesting questions about inequality within and between countries, and Milanovic takes a good deal of pride in putting forth a theory to explain the long-run trends of within-country inequality. The starting point is the Kuznets curve, the 1950s idea from Simon Kuznets that economic growth first raises inequality, before causing it to fall. The transition from an agrarian economy to a manufacturing economy leads to higher incomes as workers move to better-paying urban jobs, and as entrepreneurs make gains from the higher returns on their capital. But eventually labor becomes scarcer in the rural areas, switching the demand-supply calculus and lowering the margin for profits, both forces signaling the beginning of a slide down the Kuznets curve to lower inequality. Thomas Piketty did much to challenge this idea in his book Capital in the Twenty-First Century, suggesting it is contradicted by the major increase of inequality in countries like the United States since the late 1970s. Even if the earlier part of the century seemed to follow the predicted pattern, the longer timespan of data now lets us see the full picture.

Milanovic is subtler, suggesting that economic growth moves us through “Kuznets waves.” China is going through the first Kuznets wave in transitioning from agriculture to manufacturing, the U.S. through a second in moving from manufacturing to services. This second wave is all the more challenging from an inequality perspective because the returns to skills in a service economy vary much more between individuals, who are more sharply differentiated by skills and power. It looks increasingly like the Chinese economy may have crested and begun its downward slide toward greater equality, or perhaps will be stuck for some time and not make the much harder transition to a fully participatory middle-class society. But it looks like the U.S. will continue to ride the uplift of its inequality wave.

Many economists may question how solidly this stands as a theory of growth and inequality. Milanovic is very close to the facts, and is offering up patterns seen and interpolated in the data with his careful eye. This does not lead to a theory that moves through logic from a few self-evident assumptions to a number of testable hypotheses. It is not apparent how the predictions he makes could in principle be falsified with the data. The Kuznets waves may have a tendency to shift to match any anomalous data point. But in my mind this is not terribly disconcerting. Let the theorists pick up this ball and add more rigor, and let’s see where it takes them.

But it clearly takes Milanovic into interesting territory, as the last two chapters of the book turn more speculative, written almost as opinion pieces. Here he turns his hand to forecasting where we are going, and assessing the malign and benign forces that will lower and raise inequality. Wars, epidemics, and civil conflicts have all erupted, both before and after the Industrial Revolution, to decimate populations or destroy the capital stock, and in turn shrink the income differences between the elite and the rest. But social choices have also mattered in the democracies that have grown ever more influential after the Industrial Revolution, so that politics, widespread education, and technological changes that favor the less-skilled have also reduced inequalities. This leads Milanovic to a discussion of a series of policy challenges that many readers will find as the most insightful parts of these concluding chapters.

If we really can get into this global mindset that he is asking us to adopt, then we might think more creatively, and perhaps less dogmatically, about a series of challenges that we face as citizens of individual nations. There are a number of examples in the last chapter, but perhaps the most striking deals with citizenship and migration, examples that cut at the very core of the approach.

There remains a huge boost to incomes depending upon where an individual lives, and this creates big incentives for migration from poorer to richer countries. American politics has long been struggling with meaningful immigration reform, driven by the large inequalities between countries but also formed, informed, and misinformed by the large inequalities within the country. The refugee crisis now afflicting Europe is partly geopolitical but also deeply economic. Better lives are to be had if one can make it to Germany or Sweden. “Physical walls between jurisdictions,” Milanovic tells us, “are being built, in part, because there is a huge financial wall between being and not being a citizen of a rich country.” In his view, this is because our national politics ties us to a binary notion of citizenship. He speculates that Americans and other citizens of the rich countries might be more amenable to immigration if there were what he calls an intermediate level of citizenship, a level that would have less economic value than full citizenship because it would entail higher taxation, less access to social services, or perhaps an obligation to return to the country of origin.

In other words, put aside the idea of a “path to citizenship” as a right. Americans have tolerated a de facto inferior form of residency, but in a way that keeps many immigrants and their children in the shadows. Milanovic is advocating bringing them out of the shadows through, for example, a legally administered program for temporary foreign workers, giving migrants the right to work in the country but also the obligation to return home. This is something actually done in Canada, but the policy went afoul politically because it made the competition for jobs between natives and migrants more transparent. It may be a policy particularly appropriate to the European Union, where the walls are something more than metaphorical. This is context that Milanovic probably has in mind. But it is hard to imagine how much traction a temporary foreign-worker program, or the other variants he suggests, would have in the U.S., because the perception that immigrants compete for jobs and lower wages of the native-born will still bite.

Indeed, at the same time, Milanovic makes clear that he feels the “great middle-class squeeze” is not over, and will likely lead to more polarization in rich societies and their politics. This will not only ensure immigration policy will continue to be challenging, it may also be all the more troubling for policy directed to equality of opportunity. In the coming years, the observed differences in the skills and abilities between the top echelons and everyone else will not be that great, with chance, family background, and inheritances playing a bigger role in allocating incomes. “The new capitalism will resemble a big casino, with one important exception: those who have won a few rounds (often through being born into the right family) will be given much better odds to keep on winning.” If this is so, then it will be harder and harder to sustain the story that inequality is somehow the precursor of opportunity, offering rewards and incentives for the more productive among us to contribute to higher growth and incomes for all. And the status quo will become politically less and less sustainable.

We are left with one final question posed on the last page of the book: “Will inequality disappear as globalization continues?” It is easy enough for you to imagine a one-word, or perhaps one-sentence, answer without reading the book. But if you do read it, your focus will be sharper, you will be able to see further, perhaps even globally, and your image of a whole host of public policy challenges will be clearer and much more nuanced.