All The Horrific Details Of The Gop's New Obamacare Repeal Bill: A Handy Guide

Republicans in the House say they have the votes to pass the American Health Care Act, a measure that will repeal the Affordable Care Act, or Obamacare. The vote is scheduled for Thursday. We analyzed the AHCA in March, when the original version was scheduled for a vote that eventually was canceled.

The new version is appreciably worse. Like the original, it threatens the health coverage of more than 24 million Americans but includes provisions that are even crueler. Here’s a handy guide to the worst elements of a nasty bill that will harm you and your neighbors.

1. The AHCA guts protections for those with pre-existing conditions.

Safeguards for people with pre-existing conditions long was thought to be the line in the sand, the last frontier, the third rail of Obamacare repeal — the point that Republicans wouldn’t cross. The final version of the AHCA crosses it.

The measure allows states to opt out of ACA rules prohibiting insurers from charging sick people higher premiums. (The ACA allows only a limited surcharge on smokers and slightly higher premiums for older customers.) This represents a return to the pre-ACA era, when insurers closely scrutinized applicants’ medical histories for any hint of conditions that could result in higher claims now or in the future.

Some people with a history or heart disease or cancer, or even acne, heartburn, back pain, asthma, hay fever or hives could be rendered uninsurable for life. (See this detailed 2011 guide for medical underwriters from Blue Shield of California for a list of conditions warranting higher premiums or automatic rejection.)

How many people could be affected? The Department of Health and Human Services in 2011 estimated the number of Americans with conditions that could result in insurance denials at 129 million. The ratio of those with such conditions rose sharply with age — from about 35% of Americans 18 to 24 to 86% of those 55 to 64.

Do Republicans understand the magnitude of this threat to the average American? It’s doubtful. On May 1, right-wing Rep. Mo Brooks (R-Ala.) explained to CNN’s Jake Tapper that people with higher-cost conditions should “contribute more to the insurance pool” to offset the cost “to those people who lead good lives, they’re healthy, they’ve done the things to keep their bodies healthy.” Suggesting that the sick are guilty of some sort of moral turpitude is essential right-wing dogma, but it has no place in the making of sane healthcare policy.

Republicans say that sick people would be protected from higher prices because even in states allowing medical underwriting, higher premiums couldn’t be charged unless the customer had allowed a lapse in his or her insurance for more than 63 days — the so-called continuous coverage provision. That’s cold comfort, however, because gaps in insurance coverage are relatively common, typically because buyers run into a bad financial stretch. The Commonwealth Fund estimated that in 2016, some 30 million Americans would have faced a premium surcharge if they tried to buy insurance in the individual or small group markets.

2. Its high-risk pools are a scam that won’t protect sick Americans.

The flaws in the Republican mantra that sequestering sick people in high-risk pools to save money for everybody else have been outlined so often it’s shameful to have to do it again. The truth is that high-risk pools can work — if they’re properly funded. They have not been properly funded in the past, and the GOP repeal bill doesn’t do it now.

As Abigail Barker, Timothy McBride, and Lyndsey Wilbers of Washington University in St. Louis estimate in an new policy brief, shifting patients with costs greater than $60,000 in a year into a high-risk pool would save almost $300 in average premiums and other costs for those in the low-risk group. But it would require funding of more than $18 billion annually.

The AHCA doesn’t provide anything near that amount. The measure appropriates $130 billion over 10 years for a range of state-based initiatives, including high-risk pools, plus $8 billion over five years in a last-minute addition to win moderate votes. Even assuming that all that money went to high-risk pools, it wouldn’t be enough.

The Center for American Progress estimates that it would cover about 700,000 people a year — but if only 5% of today’s individual and small-group enrollees needed high-risk coverage, 800,000 would still be left out. And there are no guarantees that every state would use its entire allocation for a high-risk pool.

High-risk pools were tried by 35 states before the ACA. In almost every case, they failed because of underfunding. California gives a good window into the consequences.

When California's pool, the Major Risk Medical Insurance Program, or "MR. MIP," was started In 1990 with a $30-million budget funded by tobacco taxes, that was sufficient to Californians who qualified. In 2009, enrollment was cut back to 7,100. Premiums were set as much as 37% higher than market rates for individual policies. The plans came with annual caps of $75,000 in benefits, not enough to cover treatments for some major diseases.

The same problem was seen nationwide. Enrollment in state pools was so meager that "you could almost invite some of these pools over for dinner," Georgetown University health policy expert Karen Pollitz reported. "They're really dinky.”

3. Even people with employer plans could lose coverage.

Matthew Fiedler of the Brookings Institution puts his finger on a provision of the AHCA that could gut safeguards against catastrophic costs for people with coverage through large employer plans across several states.

The problem is that the ACA’s ban on annual and lifetime benefit limits and its requirement that insurance plans cap enrollees’ annual out of pocket spending apply only to essential health benefits as they’re defined by law. But the GOP bill allows states to opt out of or redefine essential benefits. If a state defines them narrowly, these protections could be eviscerated. “Indeed, if nothing was considered an essential health benefit,” he writes, “then these requirements would be completely meaningless.”

As Fiedler observes, current regulations allow large employer plans to “apply any state’s definition of essential health benefits for the purposes of determining the scope of the ban on annual and lifetime limits and the requirement to cap out-of-pocket spending.” Employers with workers in several states could choose which state’s regulations to comply with for all its employees.

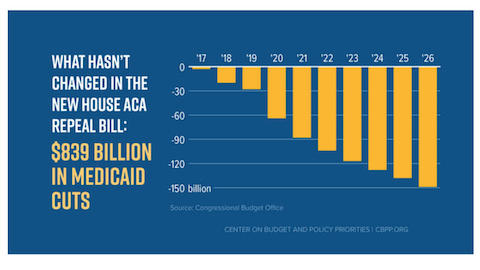

4. The bill kills Medicaid expansion and cuts traditional Medicaid by a massive $800 billion.

Under the GOP plan, Medicaid expansion, which currently provides coverage to some 10 million low-income Americans, would be killed as of 2020. It also converts Medicaid into a block-granted program, stripping more than $800 billion from the program over 10 years. Because block-granted program can’t keep up with the needs of beneficiaries, this means that states would have to respond to fiscal stringencies by cutting benefits or throwing enrollees out.

5. It defunds Planned Parenthood and threatens abortion protections in many states.

The AHCA strips funding for Planned Parenthood for at least one year — a provision almost certain to be renewed every year as long as Republicans control Congress and the White House.

It could also render enrollees in health insurance plans in states such as California and New York, where abortion coverage is a required benefit of all health plans, ineligible for premium subsidies. As my colleague Melanie Mason reported, the GOP plan would prohibit subsidies from being spent on plans that cover abortion — a ban that would make virtually all health plans in California ineligible for such credits.

The provision goes further than the existing ban on using federal funds for abortion — it would disallow spending on health plans if they so much as included abortion in their roster of coverage, as is required in California. The House GOP proposal “is directly at odds with California law and California’s constitutional protection of an individual’s right to have access to abortions,” Dave Jones, the state insurance commissioner, says.

6. More than 24 million Americans could lose their coverage.

The House GOP is planning to vote on the repeal bill without submitting its latest version to hearings or to analysis by the Congressional Budget Office. That’s unsurprising, because the CBO’s analysis of the original bill was horrific. The CBO projected that the bill would cost 24 million Americans their health coverage.

Moreover, premiums would rise by 15% to 20% in the first two years after repeal, the CBO said. They would fall thereafter, compared with their level under current law. But that’s largely because the repeal measure would allow insurers to offer junkier insurance by eliminating requirements that qualified plans cover a specified percentage of medical costs.

Several provisions added after the CBO analysis would constrain the individual market even more, raising the prospect that a new analysis would show even more dire consequences.

7. It’s really a poorly disguised tax cut for the rich.

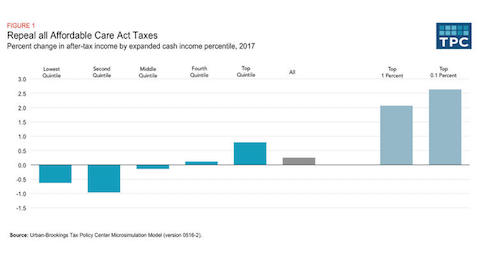

As we reported earlier, repeal of the Affordable Care Act’s tax provisions would provide America’s wealthiest taxpayers with an immediate tax cut totaling $346 billion over 10 years. Every cent of that would go to taxpayers earning more than $200,000 a year ($250,000 for couples). As Nicholas Bagley of the University of Michigan observed a few days after the election, the imperative of handing their wealthy patrons a gift of this magnitude may well outweigh their solicitude for the mostly middle- and low-income constituents whose individual insurance plans would be at risk from repeal.

“However ambivalent Republicans may be about health reform,” he wrote, “they are not at all ambivalent about big tax cuts to the wealthy.”

Obamacare repeal would reduce the average incomes of Americans in the lowest 60% of income earners, mostly because of the reduction of tax subsidies for insurance premiums, according to the Tax Policy Center. But it would give the incomes of those in the top 20% — and especially the top 1% — a significant boost. “In general,” the TPC found, “repealing the health reform law would, on average, cut taxes for the rich and raise them for low-income households.”

Put it all together, and the Republicans are preparing to gut health coverage for millions of Americans in order to fund a tax cut for the rich. The most remarkable aspect of this effort is that the GOP caucus in the House of Representatives is proud of itself for doing this.