‘Competitive’ Distractions

What proponents of corporate tax cuts argue: A central argument proponents of corporate tax cuts make is that U.S. corporations face higher tax rates than those of our peer countries; they claim that this differential hurts U.S. “competitiveness” (a word they rarely define) and discourages companies from investing in the U.S. Consequently, they further claim that cutting corporate tax rates would increase American companies’ “competitiveness,” which they imply (but rarely argue directly) would redound to the benefit of most American families.

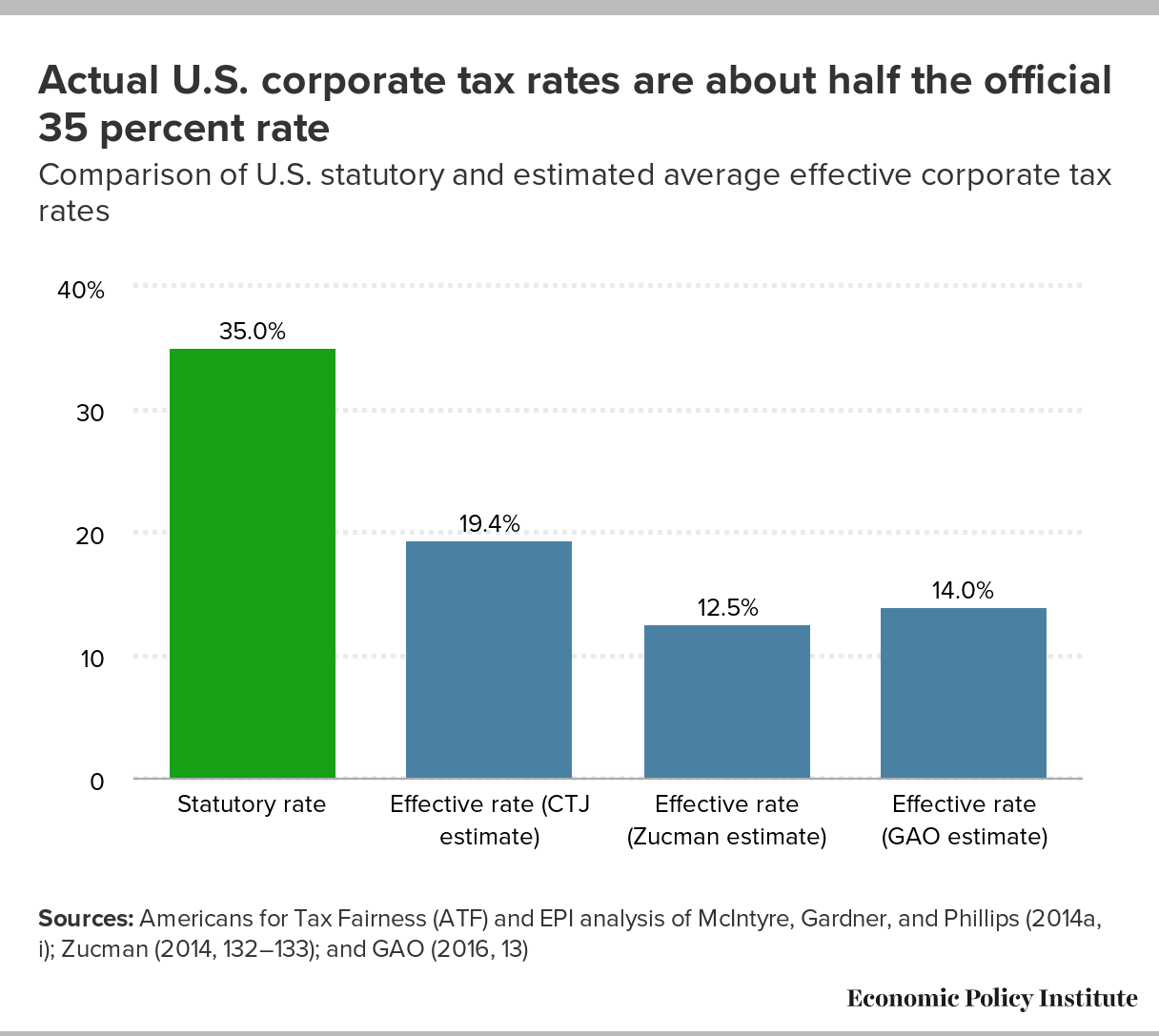

What this report finds: We find their central argument—that U.S. corporations face high corporate taxes—to be empirically false. While U.S. statutory tax rates are higher, the effective tax rate paid by corporations is in fact roughly equivalent to the effective tax rates of our peer countries, due to loopholes in the U.S. tax code. Further, we find that even if the effective corporate tax rate were higher (if loopholes were closed), economic theory and data do not support the idea that cutting these rates would encourage further investment in the U.S. or benefit Americans in general; we find that such cuts would primarily benefit a small number of high-income capital owners while increasing the regressivity of the tax system overall.

Recommendations: If we wish to reform corporate tax policy to benefit the vast majority of Americans—and not just a wealthy few—we should not be talking about lowering corporate tax rates or offering other tax breaks to corporations; we should instead be focusing on closing loopholes in the system that have eroded the corporate income tax base, to ensure the corporate sector is paying its appropriate share of taxes.

Introduction and key findings

Tax reform has moved to the center of the policy stage. In recent months, proposals to reform the American corporate tax code have included relatively new and untested ideas that have garnered much of the attention, with the “destination-based cash-flow tax” being the exemplar.1 In the end, however, we predict that calls for corporate tax “reform” will end up where they have too often been in recent years: with loud claims that American corporate income tax rates are too high, and that these allegedly too-high rates somehow hurt American “competitiveness.” Indeed, the recent Trump administration tax proposals provide large rate cuts for corporations.

Claims that current rates are excessive and harmful to American economic performance are untrue. The central problem with the American corporate income tax system is not that it raises too much money; it is that it has become so loophole-ridden that it raises far too little. Reform should focus on increasing, not decreasing, the tax share contributed by American corporations.

This report provides context and evidence for debates about the potential payoff to American families from cutting corporate tax rates. It finds this payoff to be clearly negative for the vast majority of American families. It then assesses some common arguments made by proponents of cutting corporate tax rates. Calls to lower the statutory tax rates faced by American corporations are often justified with claims that these rates render American firms “less competitive” in the global economy. It may seem intuitive to a lay reader that cutting the statutory tax rate faced by American corporations from 35 percent to (say) 20 percent would make them somehow “more competitive,” but both economic theory and data indicate that the competitiveness argument for lower corporate tax rates is completely empty. To be clear—cutting these rates would make corporations more profitable (at least in post-tax terms), but policy needs to focus on larger and more important goals than maximizing corporate profits, like boosting the incomes of typical American families.

Key findings of this report are:

-

Claims regarding the economic benefits of cutting corporate tax rates rarely relate these cuts to the three influences that could boost living standards for the vast majority of American households: employment generation, productivity growth, and a more progressive distribution of income. Unless corporate tax rate cuts help boost any of these influences, they will not raise living standards for the vast majority.

- Cutting corporate tax rate cuts would do very little to boost employment generation. In fact, cutting corporate tax rates ranks as the least effective form of fiscal support for employment generation, since corporate tax cuts primarily benefit rich households—who are less likely to increase their consumption than low- or middle-income households when they receive tax cuts.

- Corporate tax rate cuts would do nothing on their own to boost productivity. If they were “paid for” with spending cuts or lump-sum tax increases,2 and if the economy were at full employment, then they could theoretically boost productivity. But today’s U.S. economy is not at full employment and proposals to cut corporate tax rates rarely provide such pay-fors.

- Corporate tax rate cuts will unambiguously redistribute post-tax income regressively. The corporate income tax is a progressive tax, with the top 1 percent of households accounting for 47 percent of the incidence of corporate income tax (CBO 2016).3 Because of this, cutting it would clearly boost post-tax incomes substantially more for richer households.

-

Proponents of corporate rate cuts rarely explain how these cuts would affect these three key channels that connect American families’ incomes to taxes. Instead, they often provide misleading and context-free empirical and theoretical claims that cutting these tax rates will somehow boost American “competitiveness.”

- The most common claim is that U.S. corporate tax rates are the highest in the developed world (and that this adversely affects the “competitiveness” of U.S. companies). While it is essentially true that U.S. statutory rates are higher than those of other countries, the effective rates faced by U.S. corporations (i.e., the taxes they actually pay) are roughly equivalent to the effective tax rates of our large industrial peers: the difference between U.S. average effective corporate tax rate and the weighted average of rates in other advanced economies is less than a single percentage point.

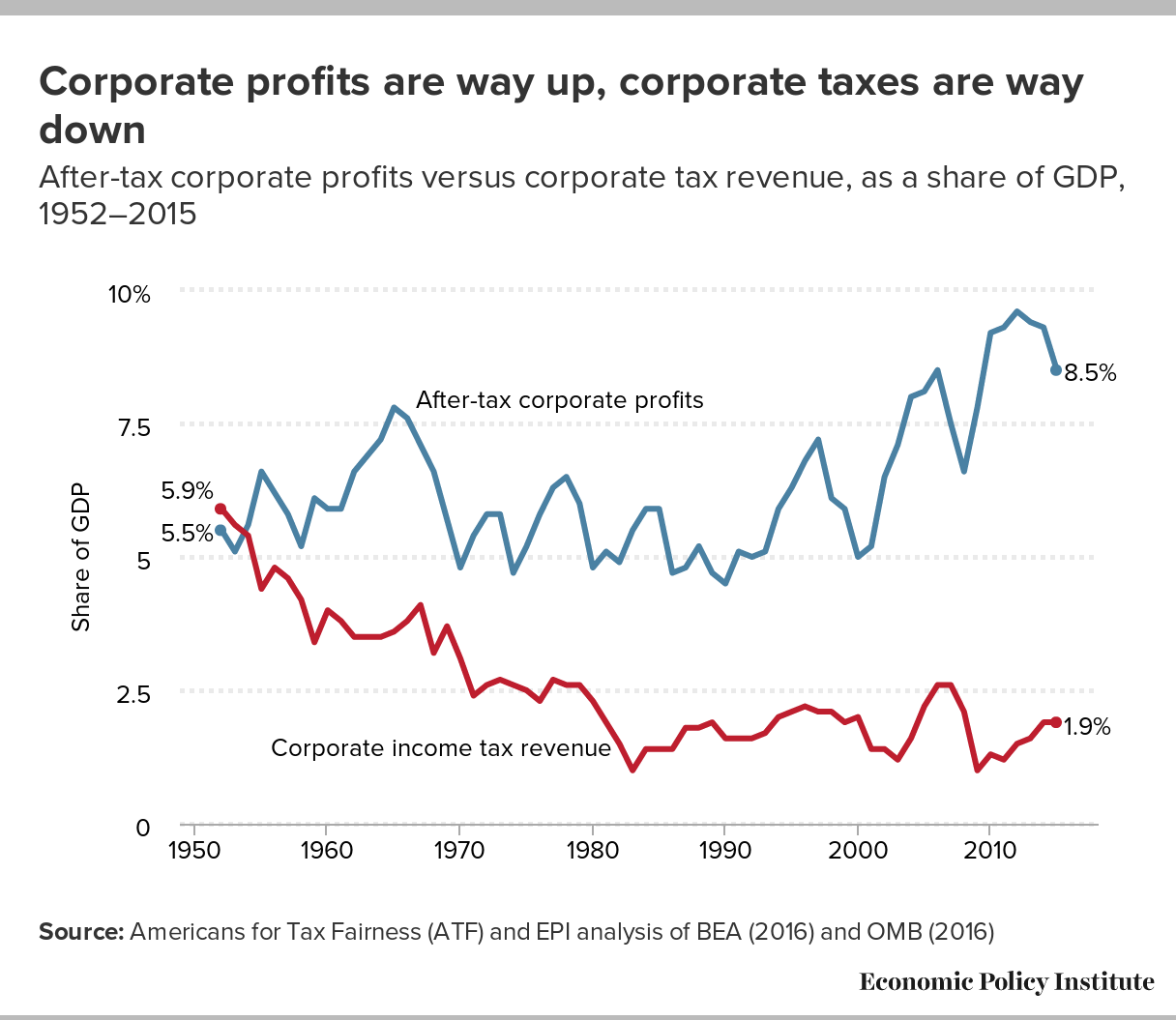

- As a share of overall gross domestic product (GDP), corporate tax revenues have fallen precipitously relative to past recent decades, from 5.9 percent in 1952 to 1.9 percent in 2015. This fall in the corporate tax burden, despite the historically large profits of recent years, largely reflects the success of U.S. corporations in exploiting loopholes in our current tax system.

- Many claims about corporate taxes rendering U.S. firms uncompetitive implicitly compare the U.S. with notorious tax havens that impose minimal taxes on global corporations. The idea that we should be letting U.S. tax policy be set by these global tax havens has no serious economic basis, as these tax havens attract investment on paper only.

- The claim that corporate income faces an unusual burden under the U.S. tax code because it is “double-taxed” is flat-out wrong. Many income flows end up being taxed twice, not just corporate income flows. Further, a large majority of corporate sector income (75.8 percent) is not double-taxed at all, and the share of income escaping any taxation at the corporate level has increased dramatically in recent years.

Economic background: The three determinants of income growth

Any debate about the U.S. corporate income tax system gets deep into the technical weeds pretty quickly. To keep this discussion clear and productive, we focus on three simple questions:

- Would cutting corporate tax rates boost employment generation—that is, would it help Americans who want to work more hours be able to do so?

- Would cutting corporate tax rates boost labor productivity—that is, would it increase the amount of income generated in an average hour of work in the U.S. economy?

- Would cutting corporate tax rates boost the progressivity of income distribution—that is, would it raise (and not lower) the share of economy-wide productivity (income generated) that accrues to the vast majority of American households?

The logic of these questions is simple. Growth in living standards for the vast majority of American households is essentially determined by three things—how much these households work, how much income an hour of work generates on average in the economy, and what share of that average income generated in an hour of work actually accrues to the vast majority of American households. We can label these three influences as employment generation, productivity growth, and income distribution, respectively.4

Any policy change—including corporate tax reform—that is supported by claims that it will boost the living standards of the vast majority of American households must tell a convincing story of how it will (a) generate employment, (b) raise productivity, or (c) distribute income toward the vast majority. Needless to say, any policy change that cannot claim to boost the living standards of the vast majority is not worth doing.

Careful readers will notice that there is not much in these questions about “competitiveness.” That’s because “competitiveness,” particularly as it’s invoked in corporate tax debates, is a near-meaningless concept. It is never defined with any precision, and no link between enhanced “competitiveness” and the incomes of the vast majority of Americans is ever provided. Those following the corporate tax reform debate should be clear that any claimed increase in competitiveness accompanying a cut in corporate tax rates will only redound to the benefit of the vast majority of American workers if it somehow translates into increased employment, higher productivity, or a more progressive distribution of income. As we demonstrate below, this would not be the case.5

The standard analysis of how corporate tax cuts could affect the three determinants of income growth

Much of this report focuses on evaluating specific claims made about U.S. corporate income tax rates. But in evaluating these claims, we continually return to the same question: Is there any relationship between these claims and a goal of influencing income growth for the vast majority (by generating employment, boosting productivity, or promoting a more progressive distribution of income)?

As a foundation for our analysis, we start with some examples of how economic theory predicts that tax cuts—and particularly tax cuts on corporate sector income—would affect these three determinants of income growth for the vast majority.

How would corporate tax cuts affect employment generation?

In the short run, employment generation is primarily influenced by the level of aggregate demand in the economy. The economy only reaches full employment when desired spending by households, businesses, and governments (“aggregate demand”) is high enough to support sufficient hiring to ensure that all workers are getting as many hours of work as they want. If aggregate demand is not high enough to absorb all the potential hours of work available from willing American workers, then the economy will not reach full employment and policy changes that boost aggregate demand can increase employment.

Tax cuts will, all else being equal, boost demand by increasing the post-tax incomes of businesses and households. If the economy is below full employment, then tax cuts can boost employment through their effects on demand. However, very few proponents of cutting corporate income tax rates actually make the argument that boosting aggregate demand through tax cuts will boost employment. There are a couple of reasons why they don’t.

First, in an economy that has already achieved full employment, tax cuts will not boost demand. While disposable incomes and personal consumption would rise following a tax cut, the increase in the federal budget deficit spurred by tax cuts will push up interest rates in a full-employment economy and lead to a reduction in investment in plant and equipment that depresses demand. Before the Great Recession and its aftermath, policy changes were routinely evaluated as if the economy generally spent most of its time at full employment, or as if deviations from full employment were short and rare and could be solved quickly by the Federal Reserve lowering interest rates. While this view that most policymaking can proceed on the assumption of full employment has been (reasonably) shaken by the events of the past decade, most fiscal policy analysis is still done utilizing this assumption, for better or for worse.

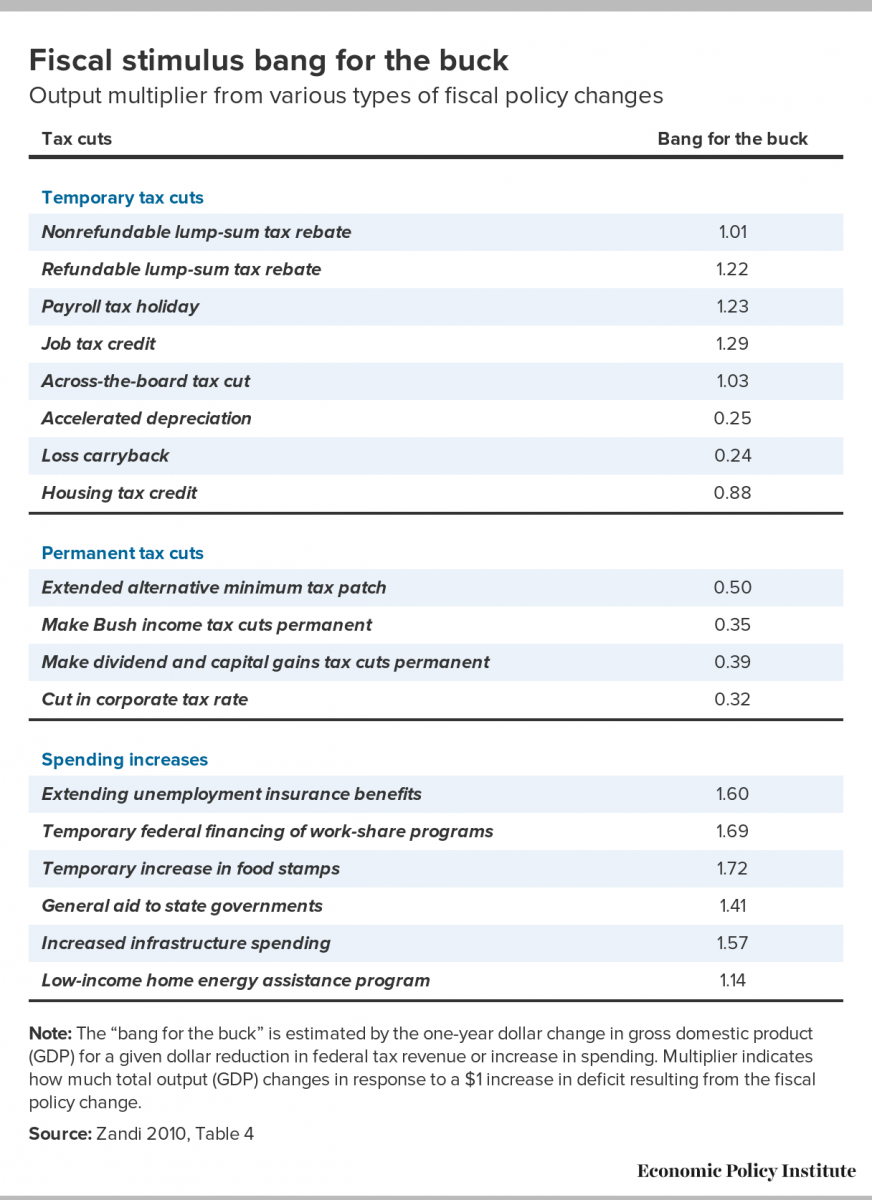

Second, even if economic growth is constrained by too-low aggregate demand and employment generation is seen as a problem that needs to be solved by boosting demand (and to be clear, we think this is the case), cutting corporate income tax rates is widely agreed to be among the least efficient forms of stimulus to employment generation. The reason is simple: cutting taxes works to spur aggregate demand and generate employment by increasing consumption spending by households. But boosting consumption by cutting taxes depends crucially on the marginal propensity to consume of the households getting the tax cuts—meaning how much of the tax cut they will turn around and spend instead of save. High-income households have significantly lower marginal propensities to consume than middle- or low-income households. This means that a strategy aimed at cutting taxes to spur consumption should focus on taxes that fall heavily on low- and middle-income households. This does not describe corporate income taxes. The Congressional Budget Office (CBO), for example, assumes that three-quarters of the incidence of corporate income taxes falls on capital owners (shareholders, business owners, and partners, for example). And the top 1 percent of households earns roughly 54 percent of total capital income, while the bottom 90 percent earns just 22 percent. As Table 1 makes clear, cutting corporate income taxes is an extraordinarily inefficient way to boost employment. Increasing government spending or cutting taxes that fall more heavily on low-income households is a much more effective means to that end.

How would corporate tax cuts affect labor productivity growth?

There is a better theoretical case that cutting corporate income tax rates could boost labor productivity. But the real-world evidence for this case is extremely weak. Labor productivity is the amount of income generated in an average hour of work in the economy. Labor productivity can grow for one of three reasons: workers become more skilled and/or educated, workers are given more and better capital goods with which to do their jobs (capital deepening), or technology advances.

The case for cutting corporate tax rates to spur productivity hinges mostly on the capital-deepening effect. The economic logic of this case starts with the recognition that corporate rate cuts increase the post-tax return to capital owners’ savings. If, for example, you own shares in General Electric (GE), and if GE faces lower corporate income taxes, GE would have more money available to pay dividends to you and the other shareholders. Because the post-tax return on your savings is higher, you would have more incentive to save your money rather than spend it.

When the economy is at full employment, a boost in savings will translate smoothly into lower interest rates and a resulting increase in capital investment, such as the purchase of a new plant and equipment.6 This increase in investment provides a firm’s workers with more and newer capital goods, hence increasing capital deepening. This in turn boosts labor productivity.

However, while there is a respectable theoretical case for why cutting corporate income tax rates might boost productivity, the real-world evidence argues that this effect would be extraordinarily modest, for two reasons.

First, investment in the U.S. economy has not been constrained by insufficient savings for quite some time. We know this is true because interest rates have been low for years and look poised to remain low for years to come. Given that interest rates are a measure of the price of loanable funds, when this price is historically low it is hard to claim that there is a shortage in the supply of loanable funds (savings).7 Until interest rates rise sharply, there is zero evidence that the U.S. economy is being constrained by a lack of savings.

Second, even if the economy were at full employment and savings were a binding constraint on capital investment, cutting corporate income tax rates in and of itself would not boost national savings. Instead, it would boost private savings, as households and businesses would respond to higher post-tax returns to capital by saving more. But all else being equal, a corporate income tax cut would increase the federal budget deficit, which would reduce public savings and lead to higher interest rates. If corporate income tax cuts were “paid for” in budgetary terms through cuts to government spending, or through tax increases that did not discourage savings, then this policy package might boost productivity through higher savings. But corporate tax rate cuts on their own would not do this, even if the U.S. economy were at full employment.

In summary, the real-world evidence strongly indicates that cutting corporate income tax rates would not significantly boost productivity.

How would corporate tax cuts affect income distribution?

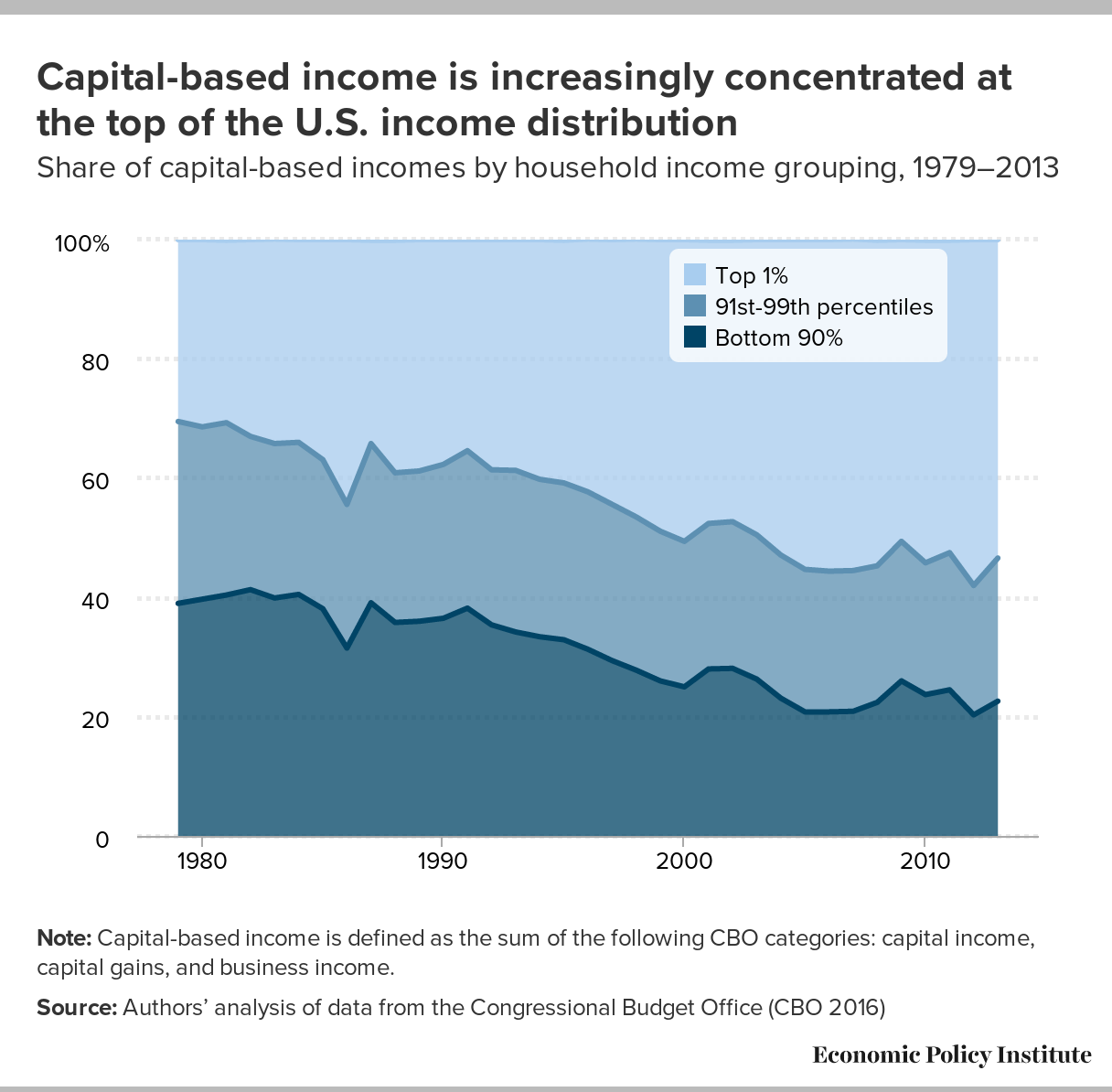

The effect of corporate income tax rate cuts on income distribution is near-unambiguously regressive. The first-round effects of cuts are clearly regressive—analysts typically assume that somewhere between 75 percent and 100 percent of the incidence of corporate income taxes falls on capital owners. In the United States, capital income is quite concentrated at the very top of the income distribution. Figure A shows the share of capital income accounted for by various groups within the income distribution. Roughly 54 percent of all capital income is earned by just the top 1 percent of households, and only 22 percent by the bottom 90 percent. Further, as the figure shows, the concentration of capital income at the top of the distribution has increased significantly in recent decades.

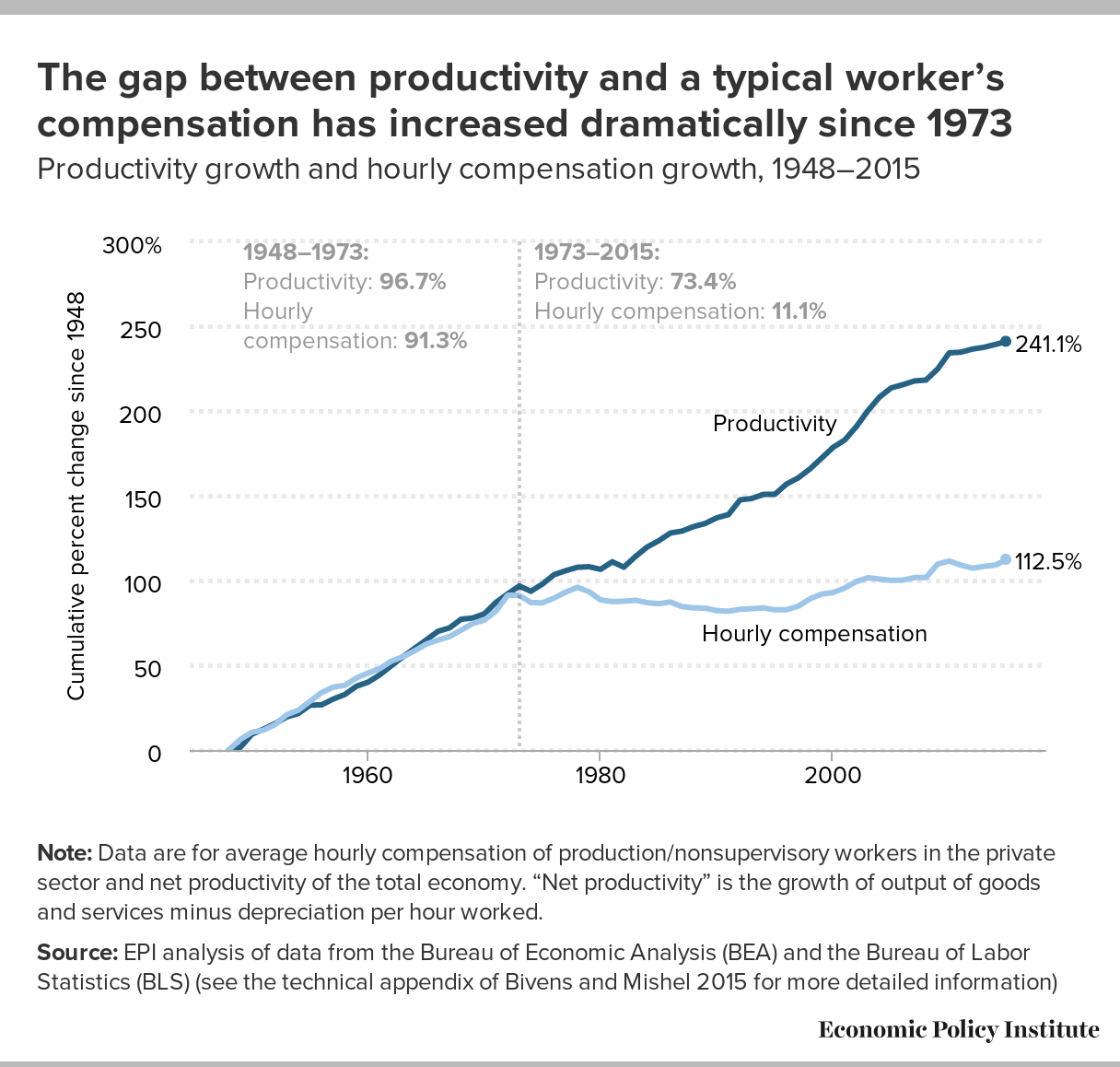

Further, the theoretical boost to productivity spurred by corporate income tax rate cuts cannot guarantee a reversal of these poor distributional outcomes. As shown in Figure B, in recent decades the hourly pay of the vast majority of U.S. workers has lagged far behind the growth of productivity as a result of rising inequality.

Finally, there remains the issue raised above about how corporate income tax rate cuts are financed. If they are financed with debt in an economy that is at full employment, they will not even raise productivity, so there will be nothing to neutralize their regressive incidence. If they are financed with debt in an economy that is below full employment (as is the case currently), they will boost aggregate demand, but in an extremely inefficient way relative to nearly any other tax cut and especially relative to an increase in government spending. If they are financed with cuts to government spending, their regressive distributional effects will be severely worsened, as the distribution of government spending is quite progressive (see CBO on this point).8 Finally, even if they are financed with increases in other taxes, it would be hard to neutralize the regressive distributional consequences of corporate income tax cuts, since there are few other taxes that are as progressive as the corporate income tax.

Cutting corporate income tax rates would clearly exacerbate the rise in inequality that has been a primary factor throttling growth in low- and middle-income households’ income in recent decades.

Conclusion: Corporate tax cuts would not benefit the vast majority

This section has made clear that cutting corporate tax rates would not boost living standards for the vast majority of American households. If evidence and logic drove the outcome of policy debates, this should be enough to end the drive to cut corporate taxes. Unfortunately, proponents of corporate rate cuts have managed to confuse this debate with a number of arguments that are wrong, misleading, or irrelevant. The following section examines some of the more common of these arguments.

Analysis of common arguments in favor of corporate tax rate cuts

Proponents of lowering America’s statutory corporate income tax rates rarely provide a crisp, coherent argument linking those cuts to employment generation, productivity growth, or progressive distribution of income. Instead, they rely on a number of odd, mostly meaningless (and often flat-out wrong) assertions about U.S. tax rates and vague notions of economic “competitiveness.” Below, we highlight a number of common claims made by proponents of corporate rate cuts and assess the underlying economics embedded in these claims. What unites most of these claims is that they are economically meaningless, even in those rare instances when the factoids accompanying them are not totally wrong. We sort these claims into two categories—those arguing that the U.S. imposes unusually high corporate tax rates relative to peer countries and that reforms are needed to make the U.S. more “competitive” and to bring profits home from offshore tax havens; and those simply arguing that lowering U.S. tax rates, regardless of what other countries do, will be good for the American economy.

Arguments claiming that corporate tax cuts are needed to make the U.S. more ‘competitive’ with peer countries

Claim: The U.S. has the world’s highest corporate tax rate, hence putting our corporations at a competitive disadvantage with foreign companies.

Response: This is perhaps the single most ubiquitous claim made by proponents of cutting corporate taxes. Below we demonstrate that (1) this claim is empirically false since U.S. corporations do not actually pay higher taxes than foreign companies, and (2) even if it were true that U.S. corporations pay higher taxes, there is no economic channel that would translate a reduced differential between U.S. and foreign corporate tax rates into gains for the vast majority of American households.

This claim is empirically false. It is true that the United States has one of the highest statutory corporate income tax rates in the world. But because the U.S. corporate system is so full of loopholes, the effective rate actually paid by corporations is substantially lower than the statutory rate and is roughly equivalent to the tax rates of our advanced industrial peer countries.

To assess what U.S. corporations are actually paying in taxes, there are two useful rates to consider—the average effective tax rate and the marginal effective tax rate. By both measures there is not much difference between the tax rate levied on U.S. corporations and tax rates levied in other countries.

The average effective tax rate is simply the total of taxes paid by corporations divided by corporate profits. This rate gives us a sense of the differences in relative corporate tax burdens between countries. A theoretically more appropriate measure of the effect of a nation’s corporate tax system on economic decision-making is the marginal effective tax rate. This tells us the effective rate that is faced by the returns on the last dollar of corporate investment undertaken. While this is the more theoretically appropriate rate to monitor, it is a much harder rate to reliably calculate in real time, particularly since it varies by type of investment asset.

Gravelle (2014) surveys the evidence on corporate tax rate differentials between countries. She finds that compared with other large and advanced economies, the U.S. charges similar average and marginal effective tax rates. Gravelle (2014) refers to a PricewaterhouseCoopers report finding that the average effective U.S. corporate tax rate in 2008 was 27.1 percent, while a weighted average of rates in other advanced economies (a group of countries from the Organization of Economic Cooperation and Development ) in the same year yields an effective tax rate of 27.7 percent. The weights used to construct these averages are based on the size of each economy (this will be important in a later discussion that examines the bases of proponents’ ongoing claims that U.S. corporate taxes are excessively high). Various other measures of the U.S. effective corporate tax rate show a similar story: U.S. corporations face nearly the same average effective corporate tax rates as corporations in other advanced countries.

Gravelle (2014) also calculates marginal effective rates across types of investment assets and combines them to create an overall marginal effective rate estimate. She estimates that, from 2005 to 2010, the overall average annual marginal effective tax rate in the U.S. was 20.2 percent, while a weighted average of other OECD countries’ rates during the same period yields an average annual marginal effective tax rate of 18.3 percent. Since the data in her survey only go up to 2010, some could argue that the data do not account for recently legislated tax changes in foreign countries. However, the data also miss the significant growth in multinational corporate tax avoidance in recent years (this erosion is highlighted below). Without further evidence, it is not clear which of these effects would be larger.

Gravelle’s (2014) findings are generally mirrored, or even strengthened, by other researchers, as is shown in Figure C. A single conclusive data set is hard to come by in the area of effective corporate tax rates, but multiple studies using distinct methodologies put the effective tax rate in the same ballpark as Gravelle’s estimate and suggest far smaller differentials in effective tax rates between the U.S. and peer countries than in statutory rates.

For example, Zucman (2014) uses aggregate data to find an effective tax rate paid to U.S. (including federal and state/local) and foreign governments that averages about 19 percent from 2010 to 2013. The effective rate levied by the federal government alone is roughly 12.5 percent. Zucman’s (2014) data include offshore corporate profits that pay little tax due to tax havens and the deferral feature of the U.S. tax code. His profit data are net of losses and profits.

The Government Accountability Office (GAO) focuses on large corporations with positive profits and finds they paid an effective tax rate of about 22 percent between 2008 and 2012, including foreign, federal, and state and local income taxes (GAO 2016). However, the GAO’s data do not take into account offshore profits that face little taxation, possibly biasing their worldwide estimate upward. The effective federal rate levied is 14.0 percent.

Finally, Citizens for Tax Justice (CTJ) finds an effective federal corporate tax rate of 19.4 percent for 288 consistently profitable Fortune 500 corporations (McIntyre, Gardner, and Phillips 2014a). Since this estimate focuses on large profitable corporations, and since their data are taken from corporate reports to shareholders, the estimate is more likely to represent what these corporations actually face, given their large offshore profits that face little taxation because the profits are ostensibly earned overseas. Another report by CTJ (McIntyre, Gardner, and Phillips 2014b) finds an average state effective corporate income tax rate of 3 percent.

Due to different methodologies and data, it is hard to perfectly compare these estimates either with each other or with the statutory rate of 35 percent. But, even with this caveat in mind, Figure C shows a huge gap between estimated effective rates and the statutory rate.

Why does the myth of high U.S. corporate tax rates persist?

Given this clear evidence, how do proponents of corporate tax rate cuts continue to claim U.S. rates are higher than those of our international peers? Generally, they obfuscate the situation in two ways.

First, they repeat data on statutory top marginal tax rates again and again. Gravelle (2014) finds a top U.S. statutory rate of 36.3 percent compared with a 29.6 percent weighted average of other OECD countries. But as we have already noted, this is not a measure of what corporations actually pay; it is a rough measure of the rate they would pay without any loopholes. Since our effective rates are generally similar to those of other advanced economies, the differences in statutory rates simply highlight the extent to which our corporate tax code is riddled with loopholes, particularly for large multinational corporations.

Second, they compare the U.S. effective rates with unweighted averages of the effective rates of our developed country peers. Turning back to Gravelle’s (2014) OECD example, the unweighted average of other OECD countries’ effective corporate tax rates is 23.3 percent, significantly lower than the 27.7 percent weighted average. But using an unweighted average gives tiny OECD tax havens like Ireland, Luxembourg, Netherlands, and Switzerland the same influence on the average effective tax rate as larger economies such as Germany or Japan.

Proponents of cutting tax rates for “competitiveness” reasons argue that tax havens should be included at full weight since their near-zero tax rates attract large foreign investments. But this ignores the fact that these investments are mostly just investments on paper. Clausing (2016) finds, for example, that seven tax havens (Netherlands, Ireland, Luxembourg, Bermuda, Switzerland, Singapore, and the Cayman Islands) hold 50 percent of the foreign profits of U.S. multinational firms, but account for only 5 percent of their foreign employment. In short, the low rates offered by tax havens do not affect economic decisions of multinational firms about where to deploy capital and hire workers; these low rates just affect accounting decisions about how to maximize tax avoidance. Make no mistake about it—the low tax rates in these countries interact with the mammoth loophole that allows U.S. corporations to defer taxes on profits reported abroad, creating a real problem for the United States. But the problem is not that U.S. corporations have moved en masse to these countries (they have not); the problem is that U.S. profits have moved there on paper to exploit the deferral loophole, and this has reduced U.S. tax revenue. The solution to this problem is not to lower U.S. corporate tax rates; the solution is to change the rules of tax accounting to end deferral so that corporations can no longer evade taxes in this way.

Does a recent CBO report contradict our findings about U.S. effective rates? No—and here’s why.

CBO recently released an updated report comparing corporate income taxes across G-20 countries (CBO 2017). Uncareful readers might be led into thinking that the CBO report overturns the empirical evidence cited above that indicates that corporate taxes actually paid by American companies are not notably high relative to international peers. But a careful read shows that the CBO report does not contradict this other evidence.

The headline findings of the CBO study claim that the United States has the highest statutory corporate tax rate, the third-highest average corporate tax rate, and the fourth-highest effective marginal corporate tax rate. However, when we dig into the study, we are able to show that the latter two claims are simply not true. We’ll take each of the CBO estimates in turn and show why they do not contradict the evidence presented in Figure C.

The statutory tax rate. As we have already noted, it is absolutely true that the United States has one of the highest statutory rates, but widespread loopholes make this rate irrelevant to the broader question of what corporations are actually paying in corporate income taxes.

The average corporate income tax rates. CBO notes in its own table that the average corporate tax rate estimated for the United States is not directly comparable with the rates for other countries. And far from refuting earlier evidence that loopholes substantially erode the corporate taxes paid by American firms, CBO’s measures of average effective tax rates actually reinforce this evidence.

To explain why, we will first start with CBO’s estimates of rates for other countries, which are far from intuitive. CBO defines these rates as the average worldwide corporate tax rates faced by U.S.-owned foreign companies (companies in which more than half the stock is owned by a single U.S. taxpayer). As a rough approximation,9 we can think of these rates as the average worldwide corporate tax rates faced by the offshore subsidiaries of multinational corporations. But this estimate of these firms’ tax rates clearly hinges on profit-shifting and on the firms’ use of the deferral loophole.

In lieu of some measure of taxable income, the denominator in the CBO estimate is worldwide before-tax profits and earnings. Now, if a multinational corporation is deferring the taxes it owes on its offshore profits, then those profits and earnings will show up in the denominator of CBO’s estimate but won’t show up in its worldwide taxes paid—the numerator. This has the effect of driving down the average rate faced by a U.S.-owned company’s foreign subsidiary, and hence makes other countries’ tax rates look low relative to those of the U.S.

Further, using the worldwide profits and earnings of the offshore subsidiary as the denominator means that the effects of further profit-shifting are also being captured. If a U.S. multinational’s offshore subsidiary shifts its profits out of that country into a tax haven with an even lower tax rate, this will likewise drive down the CBO measure of the average effective rate in other countries.

This result isn’t a surprise; it just bolsters our earlier evidence. Closing the deferral loophole and clamping down on profit-shifting would increase the average corporate income tax rates faced by U.S. multinational corporations’ offshore subsidiaries. In the CBO data, this would boost the tax rates of other countries.

Moving on to the estimated U.S. tax rate, CBO notes that the best comparison for this would be the U.S. average tax rate for the U.S. affiliates of U.S. multinationals. But because that data are not available, CBO instead uses a measure of the average U.S. corporate rate faced by foreign-owned U.S.-based corporations. Significantly, rather than using worldwide income and taxes, CBO creates this measure of average corporate rates using the U.S. taxes paid and U.S. corporate income. But this choice of sample by definition misses the effect of profit-shifting that holds down effective U.S. rates.

To see why, imagine that a U.S. multinational decides to invert (merge with a foreign company to incorporate abroad as a non-U.S. corporation) to avoid paying its U.S. corporate income taxes. It may now instead appear as a foreign-owned U.S. corporation. But the entire point of inverting is to strip income out of the U.S. and move it into the tax haven for better access to the now tax-free profits.

Since the CBO measure only takes into account U.S. taxes paid and U.S. income, the money that is stripped out of the U.S. by the inverted multinational corporation does not show up in the CBO estimate. Instead, what is left behind in CBO’s sample is those companies that haven’t (yet) engaged in accounting gimmicks and profit-shifting to avoid their U.S. income taxes.

It is thus unsurprising (and consistent with the evidence we presented earlier) that this rate looks high. As CBO notes, its measure of the U.S. average tax rate would likely be lower if it were estimated with worldwide income and taxes. It is likely further biased upward by CBO’s assumption that average state tax rates are the same as state statutory tax rates, whereas CTJ finds that average state rates are closer to half the state statutory rates due to tax breaks (McIntyre, Gardner, and Phillips 2014b). Presumably for all of these reasons, CBO includes a footnote in its table of average effective rates telling readers that the U.S. average tax rate is not comparable with the rates estimated for other countries.

The effective marginal tax rate. Finally, CBO’s measure of the effective marginal tax rate also doesn’t deal with profit-shifting and tax avoidance. CBO’s effective marginal tax rates are not based on data. They are based instead on a hypothetical corporation in a theoretical model. CBO notes that the model emphasizes two features of countries’ tax systems: the statutory corporate income tax rate and the treatment of depreciation, including the tax treatment of debt vs. equity. CBO’s estimates are certainly interesting estimates as far as those features are concerned, though CBO does not include the effects of the research and experimentation credit and bonus depreciation in its headline estimates, which CBO note in its appendix would lower the U.S. effective marginal tax rate. CBO also does not address the effects of multinational corporations’ tax avoidance (which makes the statutory rate largely misleading if not totally irrelevant), and are therefore not germane to the discussion of whether the U.S. corporate tax burden is particularly high or is a drag on growth.

Even if it were true that U.S. corporations are paying higher taxes, there is no gain to be had from cutting corporate rate differentials between the U.S. and its peers. The argument that U.S. taxes are much higher than our industrial peers and that this harms us through a “competitiveness” channel is not just wrong empirically; its economic logic is incoherent. It is simply not at all clear how cutting the empirically small differential—or even a larger differential, if there were one—between U.S. corporate tax rates and rates faced abroad would translate into employment generation, productivity growth, or a more progressive distribution of income. Proponents of the argument that rate cuts will boost competitiveness rarely sketch out any economic logic for this claim, but below we hazard a few guesses as to what they may actually be trying to argue.

Does “competitiveness” imply reducing the trade deficit?

This “competitiveness” argument could imply that lowering corporate income tax rates would somehow reduce the U.S. trade deficit. This has often been what “competitiveness” has been taken to mean in past economic policy debates. And reducing the trade deficit would be a good thing for the U.S. economy today. Because the U.S. economy currently has a gap between aggregate demand and the underlying productive capacity of the economy, it has yet to achieve full employment, and any exogenous reduction in the trade deficit would boost this aggregate demand and hence boost employment generation.

But in fact economic theory and evidence do not support the idea that boosting firms’ after-tax profits would lead to a reduction of the trade deficit. Perhaps proponents of corporate rate cuts think that corporate taxes are passed on one for one in the form of higher prices, and thus rate cuts will reduce the cost of U.S. output and make it more competitive in world markets? If so, their thinking is wrong.

First (and least importantly), only a small portion of U.S. output is tradeable (let alone exportable), so cutting taxes on all corporations in the name of fostering price competitiveness for a small subset of firms is a terribly targeted strategy to begin with.

Further, economic theory and evidence provide no support for assigning the incidence of corporate taxes to prices of output; the price of these firms’ output will not fall in response to a cut in corporate tax cuts. And even if something did cause the price of U.S. output to fall, exchange rate adjustments should move to swamp any impact on trade deficits. It is simply not possible to make the link between cutting corporate income taxes and reducing the U.S. trade deficit.

Finally, perhaps some proponents of corporate rate cuts think that higher U.S. rates incentivize U.S.-owned firms to set up production facilities overseas rather than in the U.S., and that this in turn displaces domestic production. But this idea does not have a sound economic basis either—since American firms must pay the same rate on profits earned overseas and those earned domestically when they are returned to the firms’ owners. It is only the possibility of deferring foreign-generated profits that provides any incentive at all for U.S.-based firms to relocate overseas, not any difference in statutory rates. Given this, the solution to this particular incentive pushing U.S. firms offshore clearly should not be to cut U.S. rates, but instead to end deferral.

Does “competitiveness” imply attracting capital from abroad?

Alternatively, claims about enhancing “competitiveness” through corporate tax rate cuts could be implying the U.S. could attract more capital from abroad by increasing the after-tax return to saving in the U.S. relative to other countries. The logic of how this argument boosts productivity follows our introductory example: a higher after-tax return to savings would attract savings from abroad, which would lower interest rates in the U.S. and boost capital investment. But this argument again runs afoul of both empirical facts and economic logic.

First, it’s worth noting that this is the exact opposite of the trade deficit argument made above. The trade deficit and foreign capital inflows into the U.S. are by definition mirror images of each other. Any increase in the trade deficit necessarily implies a reduction in capital inflows and vice versa. So “competitiveness” proponents really should be pressed on what exact argument they’re making here—they can only have one or the other, not both.

Second, as an empirical fact, the U.S. economy attracts more capital from abroad than any other country on the planet, and by a long shot. This can be seen in data on countries’ current accounts (a comprehensive measure of the trade balance) maintained by the International Monetary Fund’s World Economic Outlook Database (IMF 2016). The data are constructed by definition to make a country’s current account the mirror image of the capital account. This means that a current account deficit implies a large inflow of capital into a country (or, a capital account surplus) and vice versa.10 For 2016, the data indicate that the U.S. drew in $469 billion from abroad. This is roughly three times as much as the country with the next-largest current account deficit (the United Kingdom), roughly eight times as much as the third-largest (Canada), and more than 10 times as large as any other country in the world.

Third, as we note above, the extent to which increased availability of savings can boost productivity is quite modest, even when considering any possible “competitiveness” channel of attracting savings from abroad. Gravelle (2014) finds that a 10 percentage point cut in the corporate tax rate is likely to boost output and wages by only 0.18 percent. And even this estimate is probably too high for today’s U.S. economy, which remains clearly constrained by too-low aggregate demand, not too-low savings. Given that it is demand, not savings, that is scarce in today’s U.S. economy, any benefit at all from attracting more savings to the United States in coming years is extremely speculative.

Finally, maybe the “competitiveness” argument is a restatement of the argument that increasing after-tax profits of U.S. companies would boost productivity through the domestic savings channel that we sketched out in the introductory section. But such a claim does not make any sense for this particular argument, because this channel has nothing to do with the relative after-tax profit positions of U.S. corporations compared with foreign companies. It would just imply a level increase in U.S. corporate after-tax profits, with no concern for the after-tax profits of foreign companies.

In conclusion, the claim that corporate rate cuts would aid the U.S. economy because they would make the U.S. more “competitive” by closing large gaps between U.S. rates and rates in peer countries is, first of all, based on inaccurate assertions (there aren’t actually any gaps to close) and, second, lacking a solid economic basis even if such gaps did exist.

Claim: The competitive disadvantage of U.S. corporate tax rates being significantly higher than those of its international peers makes U.S. corporations weaker and more vulnerable to foreign takeovers.

Response: Again, it is simply not true that U.S. corporate tax rates are higher than those of its international peers. Further, the “foreign takeovers” that proponents of corporate rate cuts usually point to are generally those known as “corporate inversions”—which are yet one more scheme to avoid paying U.S. taxes and are not the result of any comparative weakening of U.S. companies in the world market.

The first and sufficient rebuttal to this claim is that it is simply not true that U.S. corporate tax rates are significantly higher than those of its international peers, as we show in the previous section.

Beyond this fact, the “foreign takeovers” that proponents of corporate rate cuts usually point to are generally what are known as “corporate inversions.” A corporate inversion occurs when a U.S. multinational merges with a foreign company to incorporate abroad as a non-U.S. corporation. But the recent spate of well-publicized offshore corporate mergers and inversions has largely been driven simply by an effort to dodge U.S. taxes, not by any comparative weakening of U.S. companies in the world market.

For a concrete example that these inversions have not been about “uncompetitive” American companies, consider the pharmaceutical company Pfizer. Pfizer is a U.S.-based multinational corporation that recently canceled a planned merger with Ireland-based Allergan after the Treasury Department closed certain tax advantages to the merger (Blair 2016).

In the corporation to be formed after the merger, it was Pfizer whose current shareholders would still have owned the majority of the new supposedly “foreign” company. Pfizer’s shareholders would have owned 56 percent of the new company (Johnson 2015). The number 56 percent was no accident. In order to gain the tax advantages that Pfizer was after, Pfizer’s shareholders needed to own less than 60 percent of the new company. But Pfizer certainly did not want to actually become a foreign company, so its shareholders would still need to retain a majority share of the new company.

Recent evidence suggests that we should have expected neither Pfizer’s management nor its workforce to have shifted abroad as a result of it being “taken over” by a foreign firm. Recall that seven tax havens (including Ireland) are responsible for 50 percent of all foreign profits of U.S. multinational firms but for only 5 percent of foreign employment (Clausing 2016). This means that corporate inversions have largely not affected economic decision-making by firms about where to deploy capital and hire workers. Instead, these rate differentials have affected accounting decisions about how to use financial engineering to make profits appear in low-tax havens. Because inversions have generally not led to a loss of jobs and productive capacity from the U.S., but have just led to a loss of tax revenue, responding to them by cutting tax rates makes no sense. The response to the erosion of the corporate income tax base through inversions should be to stop inversions.

Why are these tax havens responsible for so much of U.S. multinational offshore profits? Why are they so alluring to companies like Pfizer?

First, there’s the ease with which companies like Pfizer can shift U.S. profits overseas. They do so through a variety of accounting gimmicks, like manipulating transfer pricing rules—the prices of goods and services sold between a parent company and its subsidiary. Intellectual property rights, such as patents, are inherently hard to price, which allows multinational corporations to assign the intellectual property “asset” to a low-tax country subsidiary (often Ireland for drug companies). The low-tax country subsidiary then “charges” the high-tax country parent company expensive royalty payments. This decreases profits in the U.S. and increases them in the tax haven. What makes such creative accounting lucrative is that currently U.S. multinationals can avoid taxes on those offshore profits through a loophole known as deferral, whereby multinationals can defer paying taxes indefinitely on their offshore profits, facing taxation only when profits are repatriated into the U.S. Offshore profits have grown from 4.3 percent of GDP to 13.5 percent since the 2004 repatriation tax holiday, when multinationals were given the option to repatriate overseas profits at a discounted 5.25 percent tax rate.

Second, while corporations should have to eventually pay taxes on their offshore profits, the 2004 tax holiday has given them hope (backed by lobbying) that Congress will give them another holiday in the future and so they will never have to pay the full tax bill. This incentivizes them to book their profits offshore whenever they can, while their lobbyists pound away year after year in favor of enacting a new tax holiday.

What is left after such a corporate inversion is an ostensibly foreign company, but one that has changed almost nothing about its business practices except for its tax bill. It should be clear that whether a company has placed its on-paper headquarters in the U.S. or in Ireland will not necessarily make a difference in employment or productivity, and it will exacerbate growing inequality within the U.S. income distribution. If firms were being incentivized to actually shift production facilities overseas, then that could affect productivity and possibly employment. But the “foreign takeovers” hyped by proponents of corporate rate-cutting do not tell us anything about any competitiveness effect of U.S. corporate tax rates in an international context.

Claim: American corporations are forced to keep profits offshore to avoid our high tax rate, and this in turn prevents them from investing here.

Response: There is no evidence that firms would be more likely to invest in the United States if their offshore profits were repatriated. Corporations already have the means and the incentive to increase their investment in the U.S.—domestic liquidity is high, interest rates are low, and profit rates are high—but they are not currently investing the cash they already have on hand (possibly because of demand constraint). The direct evidence—of what companies actually do with repatriated offshore profits—backs this up.

One often hears reports in the press—and not just from clear proponents of cutting corporate tax rates—that American firms’ profits are “trapped” offshore. The corollary claim is often that because their profits are “trapped” overseas, investment and employment in the U.S. are suffering and would be boosted if policymakers could figure out how to induce this “trapped” mass of profits back home. This argument is false in every particular.

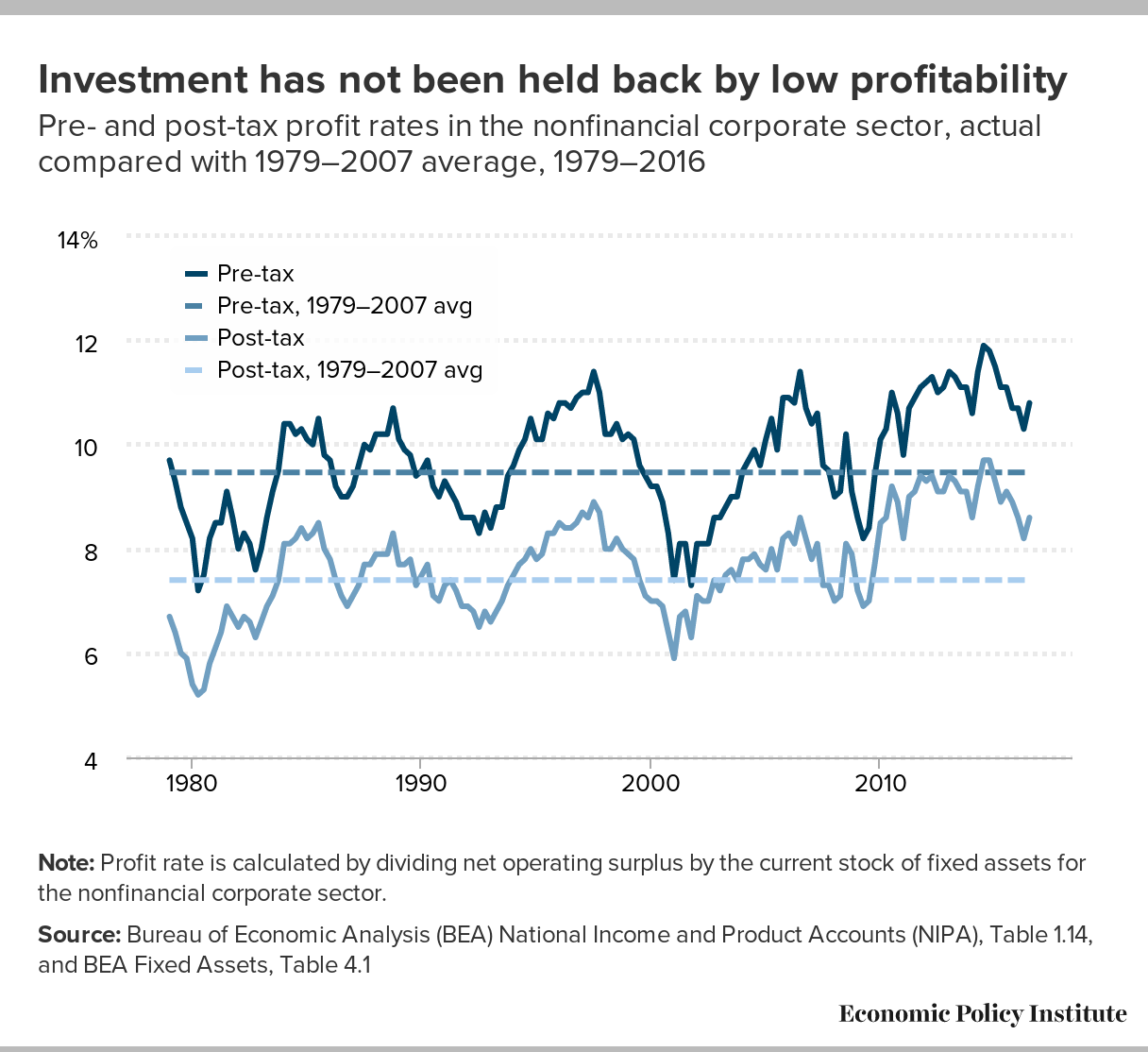

The decision of whether to invest in the U.S. depends overwhelmingly upon the expected profitability of this investment. And after-tax corporate profits in the U.S. are extraordinarily high in historic terms. As Figure D shows, the recovery since the Great Recession has been the most profitable time to invest in the U.S. economy in decades, and even seven-plus years into this recovery, post-tax profit rates are high by historical standards.

Despite these high profit rates, U.S. companies in general are not currently making new investments. Some may argue that firms see high expected profits but do not have access to the liquid funds they need to actually make the investments that could earn them these profits. Perhaps having profits held overseas come back to the U.S. could relieve this liquidity constraint? This seems unlikely in today’s economy. Besides its large offshore holdings, the U.S. corporate sector has enormous amounts of domestic liquidity in its balance sheets as well—meaning that there is plenty of capital simply from its own retained earnings that could be invested.

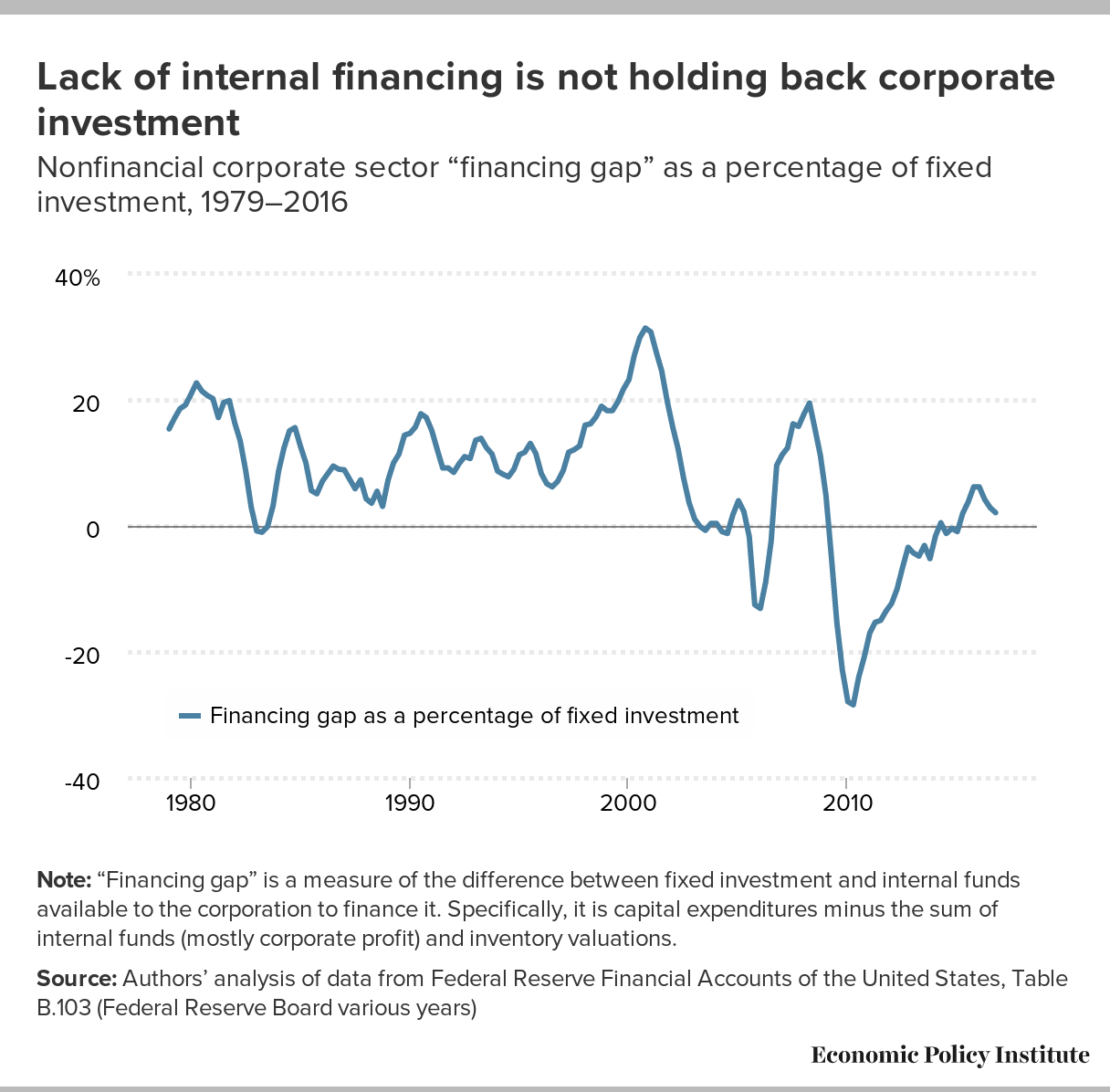

Figure E shows the “financing gap” in the nonfinancial corporate sector as a share of fixed investment. This financing gap measures the difference between capital expenditures and the firm’s internal funds to finance it (profits, essentially). When internal funds are almost sufficient to finance all planned investment, the financing gap is small. During the Great Recession and early recovery, this gap went negative for an extended period as firms radically reduced their investment. Even by the end of 2016, however, this gap was extremely small by historical standards, as investment remained weak and profitability quite high.

Further, firms can borrow to invest, and the cost of borrowing (interest rates) is also at a historic low. In short, there is no evidence that firms would benefit at all from a repatriation of corporate profits. The reluctance of corporations to invest in the United States is not attributable to lack of available savings; instead, it is due to continued weak demand growth. In this context, the return of offshore profits to the U.S. would most likely just add to a savings glut.

To support this conclusion, we have direct evidence on what has actually happened when multinational corporations were given tax breaks to repatriate offshore profits. In 2004, Congress offered multinational corporations a tax rate of 5.25 percent on their offshore profits if they repatriated them in that year. Multinational corporations and other proponents of the holiday claimed that repatriated offshore profits would be used to invest in the U.S. But in a review of the evidence, Marr and Huang (2014) point out that the Congressional Research Service, the Treasury Department, and other outside analysts have found virtually no evidence this investment occurred. On the other hand, these analysts did find strong evidence that firms used repatriated profits to benefit owners and shareholders. Further, there is little doubt that the 2004 holiday convinced firms to keep profits stashed offshore while their lobbyists work on convincing Congress to pass another holiday. This dynamic is not conducive to ending strategic tax avoidance.

This evidence surrounding the 2004 tax holiday comes as no real surprise. Proponents claim that U.S. multinationals would invest in the U.S. if only they could access their offshore profits. But U.S. investment is weak today, even as it is clearly true that U.S. multinationals are able to access their offshore profits through a variety of creative accounting practices.

Consider recent accounting maneuvers by Apple and Microsoft, who CTJ (2016) has found pay 3 and 5 percent tax rates, respectively, on their offshore profits. Both companies have recently used their offshore profits as collateral for financing debt. But rather than using this financing to boost plant and equipment investment in the U.S., Apple used this debt to finance stock buybacks, and Microsoft has used such collateralized debt to finance the purchases of Skype and LinkedIn.

Anticipation of further tax holidays (including the largest tax holiday of them all, a territorial tax system, discussed below) and the ease with which such profits are clearly accessible tax-free today for measures that return money to shareholders make it unsurprising that profit-shifting abroad has exploded since 2004. Such profit-shifting cost the U.S. as much as $111 billion in 2012 alone (Clausing 2016).

Claim: American corporations are double-taxed on their offshore profits when they bring them home.

Response: This is false. U.S. corporations receive a dollar-for-dollar credit for any foreign taxes paid. There is no double-taxation.

U.S. multinational corporations, like the average worker and like domestic corporations, are expected to immediately pay taxes on their U.S. income each year. However, unlike the average worker, corporations are given a loophole on any income earned offshore, with tax payments deferred until they are repatriated to the parent company in the form of dividends.

This means that by funneling profits into an offshore subsidiary located in a tax haven, multinational corporations can defer paying their taxes indefinitely. When a company decides to pay its taxes, by repatriating those profits, it pay the U.S. rate less foreign tax credits. As a rough example, say the corporation’s profits are located in a country that has a 35 percent tax rate. If it then repatriated these profits, it would face a U.S. tax bill of 35 percent—but would receive a tax credit for the 35 percent it paid abroad. This means that on net it would owe nothing. So no double-taxation has happened. In the far more realistic example where the multinational corporation has located its profits in a tax haven and pays nothing in taxes abroad, that corporation will owe the full U.S. rate of 35 percent upon repatriation.

To see how proponents of lower corporate income taxes are able to reinterpret this latter example as “double-taxation,” consider an example in which a company pays 10 percent on taxes overseas and then repatriates its profits to the U.S. The company is taxed once, at 10 percent abroad. However, when repatriating it faces the 35 percent rate less the 10 percent it already paid. The repatriated income faces a 25 percent tax rate. Since the profits are technically taxed in both countries, some try to argue that this is “double-taxation,” but the total tax bill is exactly the same as it would be if the company were taxed once in the U.S.

Claim: The United States should adopt a territorial tax system—only taxing company profits made in this country—so that American corporations can use the tax savings on foreign profits to invest and create jobs.

Response: A territorial system of taxation is likely the worst policy prescription to come from proponents of “competition,” when considering its effects on employment, productivity, and income distribution. This is because a territorial tax system is likely to have negative effects on all three of these determinants of the living standards of the vast majority.

A territorial tax system basically makes the deferral loophole permanent rather than indefinite, as offshore profits would no longer be subject to U.S. taxes. The incentives for tax avoidance this creates are obvious.

Armed only with the deferral loophole (and well-paid lawyers and accountants), multinational corporations managed to book profits offshore that accumulated to an amount equal to 13 percent of total U.S. GDP by 2016 (CTJ 2016). If these firms knew with certainty that they could avoid taxes forever so long as profits appeared to have been earned offshore, multinational corporations would surely further flood the offshore world with U.S. profits. This would drain the U.S. of needed tax revenues, and there is nothing economically efficient or productivity-enhancing in advantaging multinational corporations over domestic ones.

Aside from the incentives for tax avoidance, a territorial tax system would incentivize moving investment offshore. The logic is clear for a U.S. multinational deciding where to invest—it will face lower rates of taxation if that investment is offshore. In today’s corporate tax system, deferral, not high rates, is what nudges companies to move production offshore. Under a territorial system, this nudge becomes a hard shove. In the long run, this shove could result in less capital investment in the U.S., weakening labor productivity. In the short run, incentivizing multinational firms to invest abroad reduces aggregate demand, therefore weakening employment generation.

Finally, by allowing multinational corporations to easily avoid taxation, territorial taxation would be a boon to the highest-income households, who pay the lion’s share of corporate income taxation. Further, the territorial shift is one that would not help purely domestic firms at all; it would only provide tax advantages for large multinational corporations, likely deepening the regressivity of this shift.

Arguments claiming that corporate rate cuts would be good for the U.S. economy and fairer to corporations

Claim: Cutting corporate tax rates would spur enough growth—and therefore increased tax collections—that the rate cuts would lead to only small revenue losses, or even no revenue losses at all.

Response: Recent history shows that, in general, tax rates and total revenue move in tandem up and down, as would be expected. The argument that somehow rate cuts will not lead to significant revenue losses is a variant of the “Laffer curve” argument. We analyze this argument below and show why empirically there is very little evidence that this argument applies in the current U.S. economy.

Recent decades show that, in general, tax rates and total revenue move in tandem up and down, as would be expected. The argument that somehow rate cuts will not lead to significant revenue losses is a variant of the “Laffer curve” argument, which posits that as rates increase, eventually the economic activity displaced becomes large enough that the total revenue collected actually begins falling. The logic follows that if one were on this portion of the Laffer curve (that is, if rates started at very high levels) then rate cuts could actually boost revenue.

Logically, there is a grain of truth in this. At the extreme, a tax rate of 100 percent really would likely lead to very small tax collections (the incentive to earn income is small when 100 percent is taxed away); there is a theoretical tipping point at which very high tax rates would lead to decreased revenues as described by the Laffer curve. Empirically, however, there is very little evidence that the U.S. economy is anywhere near such a tipping point. In the most recent deep examination of this issue, Diamond and Saez (2011) estimate that the revenue-maximizing top marginal income tax rate is 73 percent. This finding is not out of line with a broader view of the literature. As the entry for “Laffer curve” in the New Palgrave Dictionary of Economics points out, the mid-range estimate for the elasticity of taxable income with respect to the after-tax share is around 0.4—consistent with a revenue peak of about 70 percent (Fullerton 2008). These revenue-maximizing top rates are substantially higher than the top statutory rates in the United States today.

But those levels are focused on the individual income tax side—what about for the corporate income tax? Proponents of corporate tax cuts argue that the peak of the Laffer curve (i.e., the maximum revenue-generating tax rate) is much lower for corporate income taxes than for individual income taxes, citing studies such as Devereux (2006), Clausing (2007), Brill and Hassett (2007), and Mintz (2007). These papers mostly find revenue-maximizing rates around 30 percent (though under certain specifications Clausing’s estimates range up to 57 percent). Gravelle and Hungerford (2012), however, respond to these studies, providing a detailed rebuttal of their findings and estimating much higher revenue-maximizing rates.

At the level of theory, Gravelle and Hungerford (2012) show that even with models based on extreme and implausible assumptions specifically intended to find large effects of tax rates on investment, revenue-maximizing rates for corporate taxes should hover close to the labor share of income in the economy.11 For the United States, this labor share is roughly 75 percent in the corporate sector. At the statistical level, Gravelle and Hungerford (2008) show that empirical estimates of very high responsiveness of investment to tax rates are not robust to even minor changes in specifications. Given this, there is very little evidence that economic activity would increase enough in response to cuts in corporate taxes to neutralize the revenue loss.

Finally, Clausing’s (2007) concluding remarks on the policy implications of such estimates are crucially important. She notes that low revenue-maximizing rates could be driven by firms that are shifting their profits into low-tax jurisdictions or engaging in general tax avoidance. This highlights again that economic decisions may not be much affected by corporate tax rates, but accounting decisions may. But accounting rules can be changed and loopholes closed. In short, low revenue-maximizing tax rates may well simply be a signal that we have allowed corporations and their lobbyists to poke far too many holes in our corporate tax base. This argues for closing the loopholes, not lowering rates.

Claim: U.S. corporations are double-taxed—once at the corporate tax level and a second time at the individual level on dividends and capital gains.

Response: Double-taxation is not a phenomenon that is special to corporations; labor income is also double-taxed. Further, the extent to which this double-taxation inflates average taxes paid on capital income is often wildly overstated. Overall, there has in fact been a massive erosion of taxation on capital income.

The alleged unfairness of double-taxation is often invoked by proponents of cutting corporate income taxes. It is largely a red herring. It is true that capital owners’ income can be taxed twice—once at the corporate level, then again on individual tax returns when it is distributed to them as dividends or capital gains. But labor income is double-taxed as well—facing both payroll taxes and income taxes.

And the extent to which this double-taxation inflates average taxes paid on capital income is often wildly overstated. In a recent paper, Rosenthal and Austin (2016) show that the percentage of corporate stock that is taxable at the individual level (and hence subject to this double-taxation) fell from 83.6 percent in 1965 to 24.2 percent in 2015, largely due to the growth of tax-preferred savings vehicles like 401(k)s and individualized retirement accounts (IRAs).

In fact, combining the decline of taxable corporate stock with the pervasiveness of corporate tax avoidance implies massive erosion of taxation on capital income. Since capital income is heavily concentrated at the top of the income distribution, this has significant consequences for the progressivity of the tax code.

Finally, we should note that many proponents of corporate tax rate cuts have taken to arguing that its real incidence is on labor, pointing to a number of recent studies. These studies have been found to be flawed,12 but if they were taken at face value, this would necessarily imply that corporate profits were not being taxed twice. Yet proponents of these cuts often argue both that cutting corporate taxes will benefit workers, not capital owners, and that cutting corporate taxes is only fair because capital incomes are being taxed twice. These are not compatible arguments.

Claim: If corporations were allowed to immediately expense all costs, rather than having to depreciate certain big-ticket purchases over time, they would invest more in the economy.

Response: Evidence from “bonus depreciation” policies—which allow businesses to depreciate a larger amount in the first year—shows that such a policy is not likely to boost aggregate demand by very much, making it a poor stimulus measure.

American corporations are already seeing historically high after-tax profits. If investment is lagging, it reflects a lack of demand in the market, not profitability that has been sabotaged by tax law.

Immediate expensing is a bit of a technical point, but it relates to how corporations are taxed based on the costs of durable capital investments. Business costs for assets that will depreciate over time are not immediately deducted; instead, they are written off on a depreciation schedule spanning a number of years depending on the type of the asset. Immediate expensing would allow such assets to be written off the year they are bought, even though the assets continue to provide useful services (and usually are paid for) over a long period of time.

Immediate expensing is aimed at reducing the marginal effective tax rate on certain types of new investments. We note in previous sections the problems with such a focus on savings and investment as solutions to the current challenges facing the economy.

In addition, we can get more specific about what to expect from immediate expensing by looking at the evidence from previous bonus depreciation policies. Bonus depreciation resembles a move toward immediate expensing. With bonus depreciation, businesses are allowed a bonus amount of deductible depreciation in the first year above what is normally available. Bonus depreciation has been in and out of effect since 2001, and typically the bonus has been around 50 percent of the cost of the asset. The available evidence indicates that bonus depreciation, like a corporate income tax cut, does not boost aggregate demand by much, making it a poor stimulus measure. As shown in Table 1, Mark Zandi of Moody’s Analytics estimates a fiscal multiplier of 0.25 for accelerated depreciation (Zandi 2010). This is far from shocking—corporate rate cuts through any means are simply not a very valuable stimulus measure, as the benefits accrue to high-income households that will save a large portion of any extra dollar coming their way.

The effects on productivity from an effective rate cut are likely to be quite modest even in the long run and even if the economy reaches and stays at full employment. And, in this full-employment long run, these rate cuts will provide no boost at all to productivity unless they are somehow paid for.

Conclusion: Corporate taxes should not be cut

Corporate income taxes have been taking up less and less of the overall tax burden over the past generation, even as owners of corporations have done extraordinarily well in the era of ever-rising inequality. As Figure F shows, while corporate profits as a share of GDP rose from 5.5 percent to 8.5 percent between 1952 and 2015, corporate tax revenues as a share of GDP plummeted—from 5.9 percent to 1.9 percent—during the same period.

Despite this, many continue to call for the corporate tax burden to be further reduced by cutting the tax rates these businesses face. These calls are often dressed up with claims that rate cuts will somehow boost the economy and help low- and middle-income American families who have seen such slow growth in their living standards over the past generation. These claims are clearly wrong. The idea that corporate rate cuts are a good strategy for boosting the incomes of low and middle-income families is misguided if not outright deceptive.

Rate cuts would not just fail to boost incomes for the vast majority; they would also deprive the federal government of the revenue it will need in coming years both to honor the commitments it has made to provide social insurance and a safety net and to maintain (let alone expand) needed public investments. If rate cuts were proposed as part of a policy package that also included strategies to stem the erosion of the corporate tax base and result in at least revenue neutrality, a fruitful discussion might be possible. But in tax policy proposals, too often the rate cuts are specified and immediate and concerns about how to broaden the tax base are largely ignored.

Corporate tax reform needs instead to restore the severely eroded corporate income tax base by closing huge loopholes. The age of allowing “do-it-yourself” tax cuts for corporations that hire clever-enough tax attorneys should end.

About the authors

Josh Bivens joined the Economic Policy Institute in 2002 and is currently the director of research. His primary areas of research include macroeconomics, social insurance, and globalization. He has authored or co-authored three books (including The State of Working America, 12th Edition) while working at EPI, edited another, and has written numerous research papers, including for academic journals. He often appears in media outlets to offer economic commentary and has testified several times before the U.S. Congress. He earned his Ph.D. from The New School for Social Research.

Hunter Blair joined EPI in 2016 as a budget analyst, in which capacity he researches tax, budget, and infrastructure policy. He attended New York University, where he majored in math and economics. Blair received his master’s in economics from Cornell University.