How to Win Public Support for a Global Carbon Tax

Late last year, ‘yellow vest’ protests erupted across France. One trigger was a planned hike in the price of petrol. Fuel-tax rises, now on hold, are part of France’s strategy to reduce carbon emissions by 40% from 1990 levels by 2030 and phase out petrol and diesel vehicles by 2040. Clearly, public opposition might hinder these efforts.

Imposing a cost on carbon is the most economically efficient way to reduce greenhouse-gas emissions and keep global temperatures within the targets of the Paris climate agreement1. If heavy emitters must pay the most, they will shift to cleaner practices.

Many jurisdictions have introduced carbon taxes (including Chile, Finland, the Netherlands, Norway and Sweden) and emissions-trading schemes (such as those in California, the European Union, Quebec, Ontario and South Korea). About 20% of global greenhouse-gas emissions are covered, or soon will be2. But almost half of those are still priced below US$10 per tonne of carbon dioxide — too low to make a dent in global emissions.

A worldwide carbon-pricing system would speed up emissions cuts and prevent carbon-intensive industries from relocating to avoid charges. It would ensure that carbon pricing is effective and emissions are reduced at the lowest possible cost.

So why hasn’t it happened? Public support is currently the main obstacle. New taxes are rarely welcomed. For example, in 2015, 92% of Swiss voters rejected a tax on non-renewable energy. In 2016 and again in 2018, more than half of voters in Washington state opposed a carbon tax.

Opposition can dissipate once the benefits become clear. After British Columbia in Canada introduced a carbon tax in 2008, calls to ‘axe the tax’ faded once residents received rebates on income tax and greenhouse-gas emissions fell3. This year, Canadian Prime Minister Justin Trudeau will expand carbon taxes to other provinces. Revenues will be returned to people as per-capita dividends (see ‘People’s payout’).

Public attitudes to carbon taxes follow patterns4. Most people underestimate the benefits of lower emissions and overestimate drawbacks such as job losses. Acceptance increases once the policy is enacted, so implementing a tax gradually is more successful. And people tend to like ‘progressive’ policies under which costs are borne mainly by those most able to pay.

So the design of a carbon-pricing scheme is crucial. French President Emmanuel Macron’s fuel tax is seen as unfair. Price rises are sharp and the revenues are not given back to citizens, so the French petrol levy hits low-income and rural households hardest.

To learn more about public attitudes to a global carbon tax, we surveyed 4,997 citizens in 5 countries. We presented a range of tax designs and asked respondents whether they would support them if all other countries did. We also modelled the probable impacts.

The most feasible option? A global system of harmonized carbon taxes, in which countries retain control over the revenues. But one global tax might be accepted if the funds are distributed to all countries, rather than a few.

Tax designs

We considered three rates for a hypothetical global carbon tax to be introduced after 2020: US$40, $60 and $80 per tonne of CO2, in line with recommendations by the World Bank-supported High-Level Commission on Carbon Prices1. We identified six options for spending the money raised: supporting climate mitigation projects domestically, in developing countries or in all countries, paying out a per-capita dividend nationally or globally and using the money to lower domestic income taxes. (For details, see the Supplementary Information.)

Redistributing the revenues within a country would allow governments to keep the total tax burden steady. Taxing ‘bads’ such as pollution rather than ‘goods’ such as labour can reduce emissions while raising gross domestic product (GDP)5. However, many developing countries are lobbying for a pot of international funding, for example through the Green Climate Fund, to help them transition to cleaner economies. A global carbon tax could provide such funds.

Next, we simulated how each policy would affect the world economy by 2030. We found the following general trends.

First, higher tax rates would lead to larger reductions in greenhouse-gas emissions (by one-third at $80 per tonne or one-fifth at $40). Ploughing revenues into mitigation projects would accelerate emission reductions further.

Many South African households still lack electricity and currently rely on fossil fuels for cooking and heating.Credit: Kim Ludbrook/EPA/Shutterstock

Second, the extra cost borne by energy users is modest in countries with relatively clean supplies, such as the United Kingdom, where electricity prices would increase by 12% on average with a tax rate of $60 per tonne of CO2. It is greater for countries that rely on fossil fuels, especially coal. For example, the electricity price for South Africans would double with the same $60 tax.

Third, a worldwide carbon tax would not disrupt the global economy. It would bring extra costs, which would slow economic growth. But GDP losses would be modest, especially if revenues were used to reduce labour taxes and stimulate the economy. Carbon-intensive economies, such as India and South Africa, would face the highest losses (of 2% and 5% of GDP, respectively, for a tax rate of $40 per tonne of CO2).

The impacts of distributing revenues internally depend on the nature of the economy and size of population. Per-citizen dividends range from $89 in India to $838 in Australia, at $40 per tonne of CO2. If pooled globally, the average payout would be $189 per person. Populous countries such as India would be net beneficiaries of hundreds of billions of dollars per year. Many developed countries would lose out.

Public support

We polled citizens in Australia, India, South Africa, the United Kingdom and the United States. We chose these populations because they all speak English yet reflect a variety of development levels, fuel mixes and climate policies. Around 1,000 people in each country completed an online survey. Each person was assigned one policy, chosen at random. We asked whether they would support such a carbon tax in their country if it were also implemented in all other countries. They were given background information on national and global greenhouse-gas emissions, fuel and electricity costs, income and employment, as well as on climate dividends, if any.

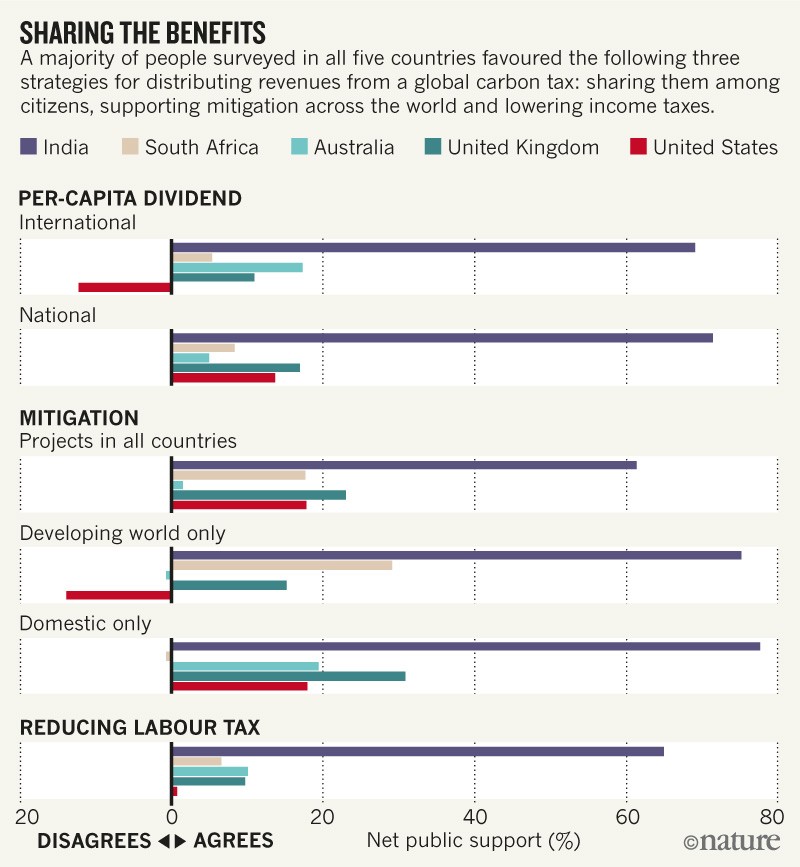

Three designs received majority (>50%) support in all five countries, when averaged across tax rates (see ‘Sharing the benefits’). These were: lowering income taxes, redistributing revenues domestically to each citizen, and earmarking funds for mitigation projects in all countries. The first two could be achieved through harmonized carbon taxes; the third would require a global carbon tax.

Source: S. Carattini, S. Kallbekken & A. Orlov

Funding mitigation projects worldwide received the highest support (65%), on average. Sharing out funds per capita globally also appealed in Australia (59%), India (85%), South Africa (53%) and the United Kingdom (56%), but not in the United States (44%).

Thus, an international climate fund could succeed if its revenues were allocated to all countries. Transferring wealth from developed to only emerging countries might trigger opposition in the former.

A system of harmonized taxes would be easier to achieve than one global tax because countries would not have to agree on the use of revenues. Governments could also adjust how proceeds are used. Respondents from Australia, India, the United Kingdom and the United States supported harmonized taxes, especially if the funds went to environmental projects. South Africans preferred the revenues to be shared as a dividend, because this would do more to relieve the economic burden of a carbon tax there.

Caveats apply to our study. We did not simulate or communicate to respondents the economic costs of climate-change damages without a global carbon price, or the value of health and environmental benefits that would follow from emissions reductions. Arguably, these would increase public support. The people we interviewed (see Supplementary Information for sampling details) might not represent those who turn out to vote. Also, every country has its own political dynamics and vested interests. Energy-intensive industries might campaign against carbon taxes. Politicians might not enact carbon taxes even if they are popular with the public. Finally, our ballot question presumes that a country could make a commitment conditional on other nations doing the same. In other words, it presumes that a framework, similar to the Paris climate agreement, can be agreed.

Next steps

Carbon taxes should take centre stage in international climate discussions before 2020. That is when countries will submit the next round of nationally determined contributions to the Paris climate agreement and increase the ambition of their climate policies. Policymakers worldwide should analyse the factors underpinning public support for different schemes and identify compromises between efficiency and acceptability for various rates and revenue uses.

Climate-policy and negotiations experts should design agreements that can leverage existing carbon-tax schemes with an international system of harmonized taxes. Many developed countries with carbon pricing have tax rates above $30 per tonne of CO2. With the help of the World Economic Forum or the Organisation for Economic Co-operation and Development, they could form a club, and expand to include developing countries6. The club could suggest amended World Trade Organization rules to facilitate tariffs on countries that oppose the system, and gradually increase the tax to mitigate global emissions7.

Researchers should evaluate the best uses of revenues and ways to distribute them. For example, is it better to earmark funds for environmental purposes through national schemes, a global climate fund or a market for carbon credits? And what is the best way to implement payments to citizens in different national contexts? Modellers should explore how emissions reductions, economic effects, distributional impacts and other factors vary with global carbon-tax designs8,9.

Public support for carbon taxes needs more study, especially in developing countries. This will involve many disciplines, including economics, political science and psychology. And researchers need to determine the most-effective ways to communicate information about carbon taxes and their economic, social and environmental effects to voters.

Knowing what the public will and won’t support is essential for designing policies to set a global carbon price that is high enough to drive emissions down as much as is necessary to tackle climate change.

Nature 565, 289-291 (2019)

doi: 10.1038/d41586-019-00124-x

Stefano Carattini is an assistant professor in economics at Georgia State University, Atlanta, Georgia, USA. Contact

Steffen Kallbekken is research director at the CICERO Center for International Climate Research, University of Oslo, Norway.

Anton Orlov is a senior researcher at the CICERO Center for International Climate Research, University of Oslo, Norway.

References

-

Stiglitz, J. E. et al. Report of the High-Level Commission on Carbon Prices (Carbon Pricing Leadership Coalition, 2017).

-

-

World Bank & Ecofys. State and Trends of Carbon Pricing 2018(World Bank, 2018).

-

-

Murray, B. & Rivers, N. Energy Policy 86, 674–683 (2015).

-

Carattini, S., Carvalho, M. & Fankhauser, S. Wiley Interdisc. Rev. Clim. Change 9, e531 (2018).

-

Goulder, L. H. Int. Tax Public Finan. 2, 157–183 (1995).

-

Cramton, P., MacKay, D. J. C., Ockenfels, A. & Stoft, S. (eds) Global Carbon Pricing: The Path to Climate Cooperation (MIT Press, 2017).

-

-

Nordhaus, W. Am. Econ. Rev. 105, 1339–1370 (2015).

-

Tavoni, M. et al. Nature Clim. Change 5, 119–126 (2015).

-

Bauer, N. et al. Technol. Forecast. Soc. Change 90, 243–256 (2015).