How Foreign Private Equity Hooked New England’s Fishing

BEFORE DAWN, Jerry Leeman churned through inky black waters, clutching the wheel of the fishing vessel Harmony.

The 85-foot trawler, deep green and speckled with rust, was returning from a grueling fishing trip deep into the Atlantic swells. Leeman and his crew of four had worked 10 consecutive days, 20 hours a day, to haul in more than 50,000 pounds of fish: pollock, haddock and ocean perch, a trio known as groundfish in the industry and as whitefish in the freezer aisle.

As sunrise broke over New Bedford harbor, the fish were offloaded in plastic crates onto the asphalt dock of Blue Harvest Fisheries, one of the largest fishing companies on the East Coast. About 390 million pounds of seafood move each year through New Bedford’s waterfront, the top-earning commercial fishing port in the nation.

Leeman and his crew are barely sharing in the bounty. On deck, Leeman held a one-page “settlement sheet,” the fishing industry’s version of a pay stub. Blue Harvest charges Leeman and his crew for fuel, gear, leasing of fishing rights, and maintenance on the company-owned vessel. Across six trips in the past 14 months, Leeman netted about 14 cents a pound, and the crew, about 7 cents each — a small fraction of the $2.28 per pound that a species like haddock typically fetches at auction.

“It’s a nickel-and-dime game,” said the 40-year-old Leeman, who wore a flannel shirt beneath foul weather gear and a necklace strung with a compass, a cross, and three pieces of jade — one piece for each of his three children. “Tell me how I can catch 50,000 pounds of fish yet I don’t know what my kids are going to have for dinner.”

Leeman’s lament is a familiar one in New Bedford, an industrial city tucked below Cape Cod on the south coast of Massachusetts. In recent years, the port of New Bedford has thrived, generating $11.1 billion in business revenue, jobs, taxes, and personal income in 2018, according to one study. But a quiet shift is remaking the city and the industry that sustains it, realizing local fishermen’s deepest fears of losing control over their livelihood.

Blue Harvest and other companies linked to private equity firms and foreign investors have taken over much of New England’s fishing industry. As already harsh working conditions have deteriorated, the new group of owners has depressed income by pushing expenses onto fishermen, an investigation by ProPublica and The New Bedford Light has found. Blue Harvest has also benefited from lax antitrust rules governing how much fish it can catch.

Since it was founded in 2015, Blue Harvest has been acquiring vessels, fishing permits, and processing facilities up and down the East Coast. It started with the self-proclaimed goal of “dominance” over the scallop industry. It has expanded into groundfish, tuna, and swordfish, as well as becoming a government contractor, winning a $16.6 million contract from the US Department of Agriculture this past February to supply food assistance programs.

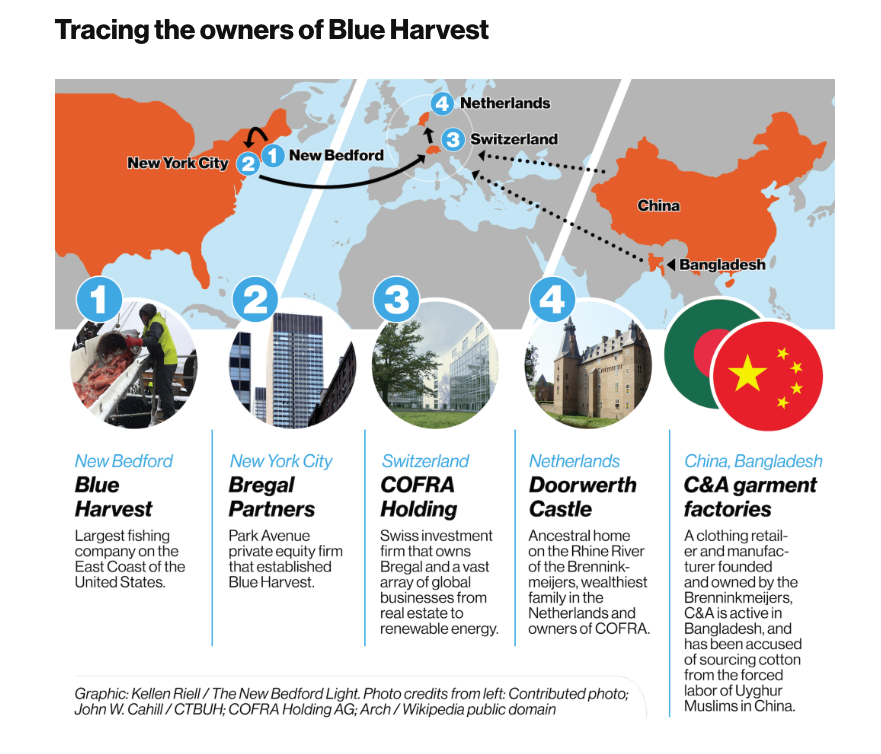

The acquisitions are backed by $600 million in capital from Bregal Partners, a Manhattan-based private equity firm. Bregal is an arm of a firm owned by a Dutch billionaire family, who are best known for their multinational clothing company, which maintains a steady track record of environmental philanthropy and low-wage labor around the globe.

Bregal, its parent company, and Blue Harvest president Chip Wilson did not respond to questions. Wilson said in an email that he has been “fighting a handful of fires” and that “speaking with the press has been low on my priority list of late.” He is more concerned “about moving our strategy forward so that the 200+ folks who work for Blue Harvest can be confident about their future,” he said.

“New Bedford is an interesting community, particularly in this ‘colorful’ sector, and the rumor mill is particularly vicious,” he added. “I cannot tell you how many times I have listened to employees scared to the core for themselves and their families due to unsubstantiated rumors about our company.”

In the first half of 2021, private equity firms, which often invest in privately held companies with the goal of ultimately selling them for a profit, accounted for 34 percent of mergers and acquisitions in the fishing industry, nearly double the 2017 percentage, according to trade publication Undercurrent News. Last fall, one such firm, ACON Investments, purchased three seafood processing companies, including one with a 38,000-square-foot plant in New Bedford. Another private equity company — Solamere Capital, which boasts as partners former Speaker of the House Paul Ryan and Taggart Romney, son of former Massachusetts governor and current Utah Sen. Mitt Romney — also acquired processing plants.

To be sure, private equity can inject capital to buy new equipment or renovate a processing facility. Boosters say that consolidation can improve efficiency and make US seafood more competitive against cheaper fish imported from foreign countries that subsidize their fleets.

Still, private equity’s gain has largely been small fishermen’s loss. Known for seeking profits by slashing costs in retail sectors such as toys and shoes, private equity investors have taken a similar approach to the fishing industry, which offered an opportunity to make a significant return on investment through economies of scale.

The number of employers in New Bedford’s fishing industry has dropped by more than 30 percent in the past decade, according to Bureau of Labor Statistics data. Fishermen are working much longer hours — 45 percent of fishermen reported working 18 hours or more per day in a federal survey published last year, up from 32 percent in 2012.

Leeman’s crew hauls fish from below deck. (Photo by Tony Luong for ProPublica)

Almost all fishermen in New Bedford are paid a share of the earnings from their catch. It’s an arrangement with origins in the 19th century, when whale oil made New Bedford the Dubai of its day. Whaling captains built the city’s historic mansions; the whale ships’ investors built churches and hospitals.

But today, companies like Blue Harvest take advantage of this pay structure to shift costs onto fishermen, reducing their income. Under the private equity takeover, regional economies like New Bedford’s are keeping less of the industry’s profits while a cut of the owners’ share is shuttled to skyscrapers in Manhattan and, in some cases, overseas. Despite rising consumer prices for New Bedford’s fish, the poverty rate in the city has been double the state average for the past decade.

“Without question, there is an increase in costs that are being passed down to crew,” said Matthew Cutler, who studies socioeconomic trends among fishermen for the regional arm of the National Oceanic and Atmospheric Administration. NOAA, which is part of the Department of Commerce, governs the fishing industry.

So far, private equity mainly dominates New England’s groundfish, which constitutes roughly 11 percent of all seafood caught off the region’s coast by weight. But a proposal being considered by federal regulators could expand private equity’s control over scallops — the most lucrative seafood for New Bedford fishermen. The proposal has roiled New Bedford, where more than 100 fishermen signed a petition against it. It also worries New Bedford Mayor Jon Mitchell.

“Private equity owns a piece of the waterfront now,” he said. “Remote ownership is always going to be driven by dollars and cents. Without any loyalty to the place, business decisions can become cold and harsh.”

CAUGHT IN THE CATCH-SHARE NET

Owning his own vessel was Jerry Leeman’s goal when he first started fishing with his grandfather at the age of 12. He climbed the ranks from deckhand to mate and finally to captain. He hoped to go into business for himself.

But an overhaul of federal rules adopted in 2010 halted Leeman’s ascent and that of thousands of other fishermen in the northeast. Promoted by an alliance of conservation groups and some of the largest seafood distributors, the new framework sought to end decades of overfishing that had devastated species like the Atlantic cod while also helping American businesses compete with cheaper, imported fish by making the domestic supply more predictable.

Under “catch shares,” as the system is called, regulators cap how much of each species can be fished and require permits to catch them. Federal scientists set a “total allowable catch,” determining the amount of each kind of fish that can be sustainably hauled from regional waters each year. Based on a decade of their catch history, individual fishermen and companies were granted rights to a percentage of the annual total allowable catch — in perpetuity — free to fish it, sell it, or lease it to others.

The catch shares system has proven to be an effective tool to reduce overfishing. Overall, New England waters have “shown slow recovery since the major declines,” a 2021 study noted. But the change hurt small fishermen. Their shares were based on their historical percentages of the catch for a given species. As the total allowable catch for some species was reduced to avoid overfishing, the same percentages translated into fewer pounds of those fish. Many fishermen sold their permits to bigger companies that had been granted larger shares and rushed to expand. New England’s fleet of vessels actively catching groundfish was reduced from 596 in 2007 to 269 in 2015, according to a NOAA study.

“This is the door closing on an entire generation of fishermen,” said Brett Tolley, who comes from a family of Cape Cod fishermen. After a series of reductions, he said the catch allocated to his family — about one-third of 1 percent of pollock and haddock — was too small to make a living. They sold their permit a year ago to a midsize local company.

While consolidation started before catch shares, the new system accelerated the process. It “turned the privilege to catch a pound of fish into a commodity that could be bought or sold without owning a boat,” Macinko said. “It opened the door to private equity.”

Recognizing the potential for consolidation, the Pacific Coast branch of NOAA built in controls prohibiting any individual from owning more than 2.7 percent of groundfish permits, limiting the inroads that private equity could make. Accommodating business interests, the New England office initially set a much higher cap of 20 percent before reducing it to 15.5 percent in 2017.

“You have to limit entry in order to have a profitable fishery,” said Chad Demarest, an economist with the Northeast Fisheries Science Center under NOAA. “The goal is to create some profit in the industry that is shared by the owners.”

Because Leeman was a hired hand when catch shares were adopted, he wasn’t allocated any permits. And as the price of a single permit climbed to as much as $500,000 for groundfish, he couldn’t afford to buy in. His dream of captaining a fishing boat that he owned was dashed.

Rights to fish “were free 30 years ago,” he said. “But then came the conservation groups. Then there was consolidation. Then there was big money.”

GOING DUTCH

In the early years of catch shares, many smaller fishermen sold out to the same New Bedford fishing magnate: Carlos Rafael, often referred to as “the Codfather.” A first-generation immigrant from the Azores, a chain of Portuguese islands, Rafael arrived in New Bedford as a teenager. He started as a fish cutter, and over four decades he built one of the largest groundfish operations in the country, running more than 40 vessels.

A charismatic rogue who liked to describe himself as a modern-day pirate, Rafael was openly opposed to the catch shares system at first, believing it would eventually mean only one company would be left fishing on the East Coast. Yet as New England transitioned to the system, he was granted about 9 percent of the region’s total groundfish permits, one of the largest initial allocations. He decided that if only one company would be left standing, it would be his.

“So he [a smaller fisherman] doesn’t have the money to buy a fucking quota,” he said. “So he’s fucked either way. He’s hanging by his shoestrings. So this is a matter of fucking time for me to pick the rest of these fuckers and just get them all out of the picture….I always had the ambition to get fucking control of the whole fucking thing.”

According to court documents, Rafael made that statement to undercover IRS agents posing as Russian mobsters. He also divulged to them an illegal scheme he called “the dance.” On a February morning in 2016, the green-and-white panels of the Carlos Seafood building were reflecting red and blue as a team of federal agents raided the waterfront facility. He pleaded guilty in 2017 to 27 counts of fraud and tax evasion related to mislabeling almost 800,000 pounds of fish; he was sentenced to 46 months in prison.

At the time of Rafael’s downfall, Bregal Partners was rapidly tightening its grip on the fishing industry. It took its first plunges in 2015. It invested in Seattle-based American Seafoods, which Bregal has described as “the largest harvester of fish for human consumption in the US.” It also founded Blue Harvest, which quickly acquired four fishing operations on the East Coast.

Hundreds of vessels line the harbor in New Bedford, the top-earning commercial fishing port in the US. (Photo by Tony Luong for ProPublica)

It first bought a large scallop fleet in Virginia, then a midsize company in New Bedford. In 2018, it added Maine-based Atlantic Trawlers. (Leeman, who had been working for Atlantic Trawlers, stayed on the same boat, now owned by Blue Harvest.) It capped off its buying spree with its biggest prize.

As part of a settlement with NOAA, Rafael had agreed to sell his empire, estimated to encompass a quarter of New England’s groundfish industry, to the highest bidder. Rafael had tried to sell his company to the undercover agents for $175 million. In 2020, Blue Harvest acquired a portion of Rafael’s holdings — 12 groundfishing vessels and 27 permits — for $25 million.

Along the way, Blue Harvest bought and expanded processing facilities off Herman Melville Boulevard, named after the Moby-Dick author, who sailed out of New Bedford on a whaling voyage in 1841. The goal, the then-chief executive said in 2020, was to establish the “first vertically integrated groundfish company on the East Coast” — folding a large slice of the waterfront into one streamlined operation: vessels, permits, processing and distribution.

Crates of haddock await processing in Blue Harvest’s facility. (Photo by Tony Luong for ProPublica)

Controlling the supply chain enables Blue Harvest to reduce costs and compete with imports shipped frozen into the US from Icelandic or Norwegian companies fishing in the North Atlantic. It also means that the company doesn’t have to pay its fishermen the market price for their catch.

Independent fishermen sell their catch at public auctions or to whichever wholesaler offers the best price. But Blue Harvest fishermen generally don’t have that opportunity. They must sell their fish to the company — sometimes at prices lower than they could get otherwise. Blue Harvest did not respond to questions about its payments to fishermen.

As it cast an ever-larger shadow over the port, Blue Harvest set a lofty goal: “transforming commercial fishing into an industry that is defined by sustainability, governed by transparency, and bound to the promise of delivering excellence to every plate.”

Leeman has never heard of the billionaire Brenninkmeijer family, but he’s working for them. Blue Harvest’s trail of global ownership winds from New Bedford’s industrial waterfront to Bregal Partners’ office in a sleek, 50-story skyscraper on Manhattan’s Park Avenue and then on to a Swiss company, Cofra Holding AG. Cofra, in turn, is wholly owned by the Brenninkmeijers, a Dutch family described by a former retail analyst at Morgan Stanley as both “highly secretive” and a “global powerhouse” in the retail industry. One member married into the Dutch royal family. Several have lived in a moated, five-story medieval castle on the River Rhine.

The family’s holding company has a wide-ranging portfolio. It has focused on renewable energies like solar and offshore wind, as well as on fossil fuel projects such as natural gas drilling and exploration in Appalachia’s Marcellus Shale. Its investments include shopping plazas in Spain, Belgium and the UK and commodities such as dairy, coffee, timber and, now, fish. Its sprawling supply chains encompass more than one million workers, from New Bedford to Bangladesh.

The family’s vast wealth originated in clothing. In 1841, brothers Clemens and August Brenninkmeijer began peddling textiles in a small region that now spans Germany and the Netherlands. In an era when most European clothing manufacturers catered mainly to affluent families, the brothers’ company, now called C&A, specialized in ready-to-wear clothing for the middle and working classes.

Under the Nazi regime, the company took advantage of opportunities afforded by “Aryanization” to take over stores owned by Jews fleeing persecution, according to a 2016 book by Mark Spoerer, an economic historian at the University of Regensburg, who was commissioned by the family to examine the company’s past. The German branch of C&A used forced labor in the Lodz Ghetto to manufacture clothing, Spoerer found. Soon after the war, C&A retail locations expanded around the world.

“It was opportunism,” acknowledged Maurice Brenninkmeijer, then chairman of Cofra Holding, in a 2016 interview with German newspaper Die Zeit. “I suspect that my relatives were solely focused on business, and in doing so they lost sight of our values.” He added, “I wish it had been different.”

Leeman’s crew sorts haddock on deck. (Photo by Tony Luong for ProPublica)

In rare interviews, family members portray themselves as major donors to environmental initiatives. Their philanthropic arm, the Laudes Foundation, promotes sustainable usage of raw materials used in C&A clothing to address what it calls “the dual crisis of inequality and climate change.”

Yet C&A has come under fire for contracting with companies that have allegedly exploited workers. While it produces its own line of clothes, it also acts as an intermediary between Western companies and hundreds of garment factories in East Asia and South America. It’s most active in Bangladesh, where labor costs are among the lowest in the world.

In 2012, a fire swept through a Bangladesh factory producing clothes for C&A, killing at least 112 workers. The company agreed to pay compensation to victims and to assess safety conditions. Last year, a German human-rights organization filed a criminal complaint against C&A, among others, for sourcing cotton made with the forced labor of Uyghur Muslims in China. Cofra and C&A did not respond to requests for comment.

“Given the scale at which C&A operates, they could literally lift millions of garment workers out of abject poverty,” said Ben Vanpeperstraete, senior legal adviser with the European Center for Constitutional and Human Rights, who helped negotiate compensation for victims of the 2012 Bangladesh factory fire. “In the end, they put profits first.”

WORKING THE SYSTEM

One July day in 2017, Joseph Drago woke up in a loud, dark cabin below deck of a scallop vessel owned by Blue Harvest. He had a splitting headache and couldn’t catch his breath. He stumbled onto the deck and asked the crew what was happening.

It was fumes, one replied in Spanish. An exhaust leak from the engine had been pouring into the sleeping quarters. Soon after, the engine blew out, leaving the vessel bobbing in swells 80 miles off the coast. It had to be towed into port.

Blue Harvest boats have had a number of mishaps. Last year, one Blue Harvest vessel burned at sea; another ran aground, which can be attributable to human error or weather conditions. Leeman had to cut a fishing trip short in January when the boat’s engine malfunctioned.

Current and former workers said that several vessels that Blue Harvest regularly operates were already past their prime when the company bought them. “Their next stop should have been the scrapyard,” said the former Blue Harvest mechanic, who requested anonymity out of concern for his career. “The boats had been worked like dogs.” Blue Harvest did not respond to questions about the condition of its fleet.

The Blue Harvest processing facility on Herman Melville Boulevard in New Bedford. (Photo by Tony Luong for ProPublica)

Captains and crew on Blue Harvest boats pay for maintenance, according to settlement sheets and fishermen. The company has also imposed other charges that fishermen say they haven’t encountered elsewhere in the industry, including a 3 percent “electronics fee” and a $400 “wharfage fee” for pulling up at the company dock to unload fish.

“The price stays the same but all our expenses just keep going up,” said Drago. “Every trip they’re taking more and more out of the crew’s share.”

Drago, like Leeman, aspired to buy his own boat. But with nerve damage in his hand from years working at sea, the 35-year-old plans to leave the industry as soon as he can find another job.

“You can no longer work your way up from the deck, become a captain and buy your own boat and permit. That was always the arrangement,” he said. “You’ll never make enough. They made it unattainable to do anything but work for them.”

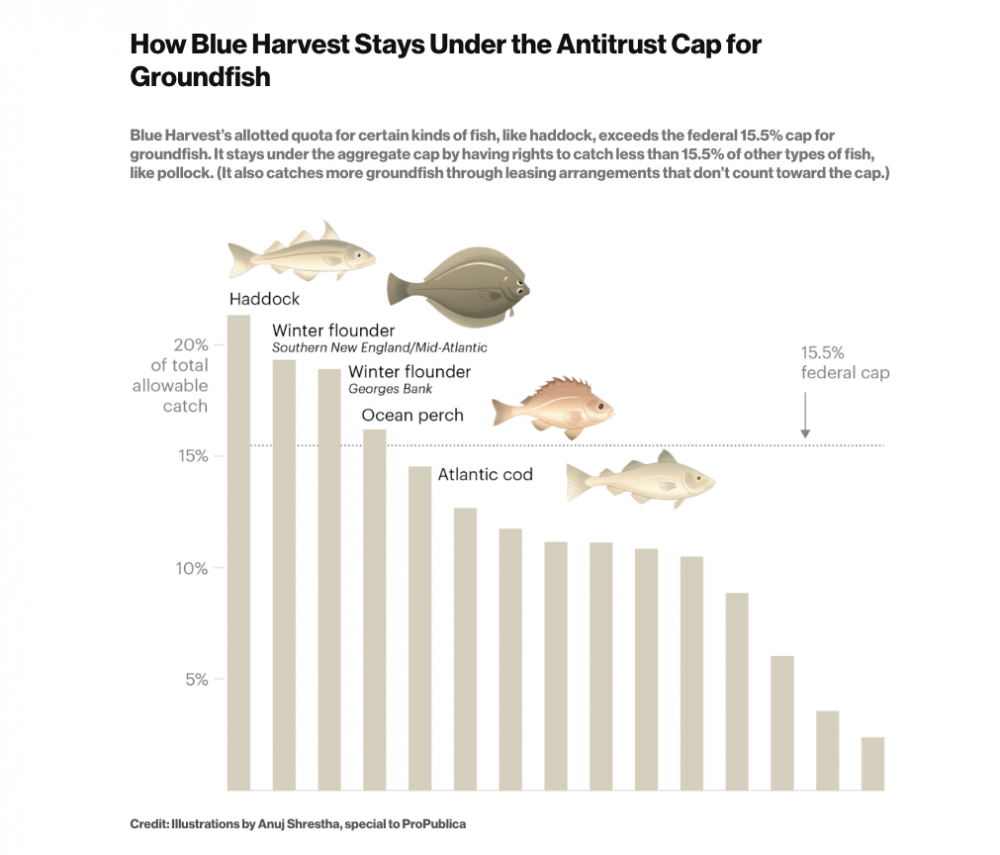

As Blue Harvest snapped up fleets, it also acquired their permits. Today, it is approaching the antitrust limit of 15.5 percent ownership of permits for groundfish caught off New England.

Blue Harvest owns 12 percent of the permitted catch overall, including 21 percent of haddock, 19 percent of winter flounder, 16 percent of ocean perch and 15 percent of cod. It stays below the aggregate cap by owning smaller shares of other species, like 2 percent of a certain northern flounder. The company’s groundfish permit holdings total about 46 million pounds.

But those figures underestimate Blue Harvest’s market share. In addition to owning permits, it also leases fishing rights from other permit owners. At the beginning of the year, the company will lease a “bucket of fish,” one Blue Harvest manager said. “If we’re short on something, we’ll buy it” for the year. The manager said that this practice addresses a weakness in the catch shares system, which allows individuals and organizations to hold permits and passively earn a profit through leasing rather than fishing themselves. About 40 percent of all groundfish permits are not used by their owners and are available only on the leasing market, records show.

Leasing provides a small but steady revenue stream for those owners, and it helps to ensure that enough seafood reaches the market to satisfy demand. The practice also enables the expansion of larger companies. That’s because NOAA’s antitrust rules apply only to ownership. “There is no restriction on leasing,” said NOAA’s Demarest. “It would be a very illiberal idea to try to cap the amount that each corporation can land.”

Theoretically, Blue Harvest or any other major player can legally circumvent the 15.5 percent cap by leasing the rights to catch more fish. Because of leasing, the cap “does not really prevent consolidation at all,” said Mary Hudson, a manager at a Maine cooperative that makes permits available to independent fishermen at discount prices. “Private equity backing can come in, set prices and still buy it all.” Instead of fishing, some small fishermen have taken to leasing out their rights, she added: “They just don’t have the capital to compete.”

The news organizations’ analysis could not determine how much quota — the industry term for the number of pounds of fish someone is allowed to catch — Blue Harvest is leasing, or from whom. That’s because groundfish permits belonging to individual fishermen, organizations and large corporations are generally pooled and managed in groups known as sectors. The sectors act as a black box — fish quotas can be seen flowing in and out, but who exactly is leasing them is hidden. NOAA tracks and publishes the weight of fish leased between sectors, but those transactions do not identify the specific lessor or lessee. Even the US government doesn’t track that information.

“It’s not legally traceable,” Demarest said. “The government can’t get involved in what happens within sectors.”

In Blue Harvest’s case, most of the company’s permits are held in two sectors that have leased the rights to catch more than 14 million pounds of groundfish since 2018. But there are other permit owners in those sectors as well. “This sector acquires quota from just about every sector out there,” said Hank Soule, who manages both sectors where Blue Harvest operates. He declined to say which owners within the sector were leasing the most quota.

Blue Harvest boats “are the ones that are fishing, day and night,” said John Pappalardo, a member of NOAA’s regional council. “Nobody else is fishing at the level they are. Obviously, they are going to be the ones setting the price and moving the market.”

The Cape Cod Commercial Fishermen’s Alliance, a cooperative headed by Pappalardo, originally opposed catch shares, fearing the system would gut the local industry. But when he realized that the new system was inevitable, he voted to adopt it. Today, he’s stoic about the entry of private equity into the fishing industry. “If not them, then who?” he said. “I don’t think you’re going to see a lot of independent vessels or communities get into the fishery again.”

Since Leeman doesn’t own permits, he isn’t eligible to lease them himself — that’s a perk afforded only to permit holders. But he ends up paying for it anyway. Blue Harvest passes the cost of leasing permits on to its fishermen, the same way it does for fuel, fishing gear or vessel maintenance, the manager and workers said. In November 2021, a settlement sheet shows, Blue Harvest deducted a $3,329.90 leasing charge from the pay for Leeman and his crew.

‘A BIG GRAY AREA’

There’s a long history of foreign fishing in US waters. In the 1970s, trawlers from Russia and elsewhere depleted East Coast fish populations, spurring a 1976 federal law pushing foreign fleets at least 200 miles offshore. In 1998, a cap was added, limiting a foreign entity to owning 25 percent of a US fishing vessel.

In recent years, foreign companies have reentered US fishing grounds through a different route: investing in local operations. They include Canada-based Cooke Seafood, which recently acquired a one-fourth interest in scallop fleets in New Bedford and North Carolina, and Profand, a Spanish company that did the same with Seafreeze Ltd., the largest squid and mackerel operation on the East Coast. According to Undercurrent News, Profand’s majority shareholder is Enrique García Chillón, who is known in his home country as “el emperador del pulpo,” or the emperor of octopus.

A member of Leeman’s crew works below deck. (Photo by Tony Luong, for ProPublica)

Federal enforcement of the 25 percent cap largely relies on companies’ own assurances that they are in compliance. The Coast Guard lacks the resources to vet businesses’ paperwork, a former official said, and is required by law to “minimize the administrative burden” on owners and operators of vessels.

“There should be more transparency in ownership. But there isn’t. It’s basically an honor system,” said Charlie Papavizas, a Washington, DC, attorney specializing in maritime law. “As a result, there is a big gray area in what is permissible.”

In a 2015 press release, Bregal Partners acknowledged that, “as an arm of German-Dutch Brenninkmeijer Group,” it was limited by law to “a 25 percent ownership in any quota-holding fishing company.” Ownership forms for four of Blue Harvest’s vessels from 2018 and 2019 — submitted to NOAA and obtained through a public records request — listed four owners for each of the boats. One was Jeff Davis, who served as Blue Harvest’s CEO before retiring from the company in 2018. Another was Chris Lischewski, who was then chief executive of Bumble Bee Seafoods, known for its canned tuna. The others were Mark Thierfelder, a lawyer who has represented Bregal Partners, and Michael Arougheti, chief executive of a finance company that has advised Bregal on acquisitions in the fishing industry.

Davis and Thierfelder could not be reached for comment. A spokesperson for Arougheti declined to comment. Lischewski stepped down as CEO of Bumble Bee after he was indicted for conspiring to fix canned tuna prices. He was found guilty in 2019 and sentenced to 40 months in prison.

NOAA lacks the regulatory authority to require investors to disclose the percentage of their stake in a vessel or permit, said Ted Hawes, chief of NOAA’s regional permitting office.

Blue Harvest said in a statement that the Coast Guard had approved its “capital and ownership structure” in advance and that the company has “continued to submit all required notices and reporting materials” to regulatory authorities. “At no time has Blue Harvest been owned 100 percent by Bregal,” it added.

UNION TALK ON THE DOCKS

On May 11, more than 160 scallop fishermen, business owners, marine scientists, attorneys and vessel owners crowded into the New Bedford Whaling Museum for a rowdy meeting. Attendance was especially high because the seas were stormy and many fishermen stayed in port. To loud applause, more than a dozen people denounced a proposal, backed by Blue Harvest and other large companies, that independent local fishermen fear would enable private equity to storm their last stronghold — scallops.

Leasing scallop permits is currently prohibited, but the proposal would allow it. The biggest companies in the market, which are running up against a cap on permit ownership, are advocating for the change.

New Bedford fishermen object to allowing scallop permits to be leased. They say the proposal would accelerate consolidation in their industry. (Photo by Tony Luong for ProPublica)

Current scallop regulations allow one permit per boat, up to a total of 17 vessels. One local company, Eastern Fisheries, has reached the limit, according to a letter it sent to NOAA in 2021. In its own letter, Blue Harvest listed 15 scallop vessels.

“This is going to hurt the fishermen and the local economy,” said Tyler Miranda, a third-generation fisherman from New Bedford and captain of two scallop vessels who is leading the opposition. “The only people to benefit are the owners of the largest companies. How much do the biggest owners need to take out of our wages and bring into theirs? How much is enough?”

One of the few speakers in favor of the proposal was George LaPointe, a policy consultant to Blue Harvest and a former commissioner of Maine’s Department of Marine Resources. “We believe that we can improve flexibility,” said LaPointe, who was there to represent large scallopers, including Blue Harvest. As he returned to his seat, many fishermen booed.

New Bedford fishermen had a strong union until the mid-1980s, when the union was broken in the heat of a strike. Now, with private equity setting its sights on scallops as well as groundfish, talk of a union is beginning to stir again.

Leeman said he would welcome a union to fight for fair pay. On his own, he spends his days on land making calls to check how the rate that Blue Harvest paid compares to the market price.

Last year, after a 10-day fishing trip, he took a look at his settlement sheet and burst into the management office, demanding fair pay for him and his crew. “I said, ‘Until we get this straight, I’m not leaving the dock,’” he recalled.

And with the weight of a multibillion-dollar industry resting on the labor of a few hundred New Bedford fishermen, the company relented and paid him what he said was the market rate. “If I didn’t say anything, they’d still be paying us half of what that fish was worth.”

Will Sennott is a reporter with The New Bedford Light. This article was produced for ProPublica’s Local Reporting Network in partnership with The New Bedford Light.

About the Data: How We Tracked Blue Harvest’s Fishing Permits

After hearing from local fishermen that Blue Harvest Fisheries is dominating New Bedford’s fishing industry, we set out to document how much of the total allowable catch the company is pulling in.

A first step was to find out how many permits the company owns. The National Oceanic and Atmospheric Administration provided a database breaking down the permit holdings in the groundfish industry for the 2022 fishing year. Each permit has a unique identification number and represents a certain percentage of the total allowable catch of a species of groundfish. Blue Harvest holds permits in the names of limited liability companies. Most of these companies have “BHF” as part of their corporate name, and we confirmed that they were linked to Blue Harvest through their corporate filings, which list Blue Harvest’s executives. Our analysis was limited to permits that could be clearly linked to Blue Harvest through these records. It is possible that Blue Harvest holds additional permits.

We measured Blue Harvest’s share of permits as a percentage of the total quota by weight. When aggregating across different kinds of groundfish, these percentages were averaged, consistent with how NOAA calculates its 15.5 percent cap. We found that Blue Harvest owns permits for 12 percent of groundfish quota — the industry’s term for the total pounds a permit-holder is allowed to catch — in the current fishing year.

In addition to owning permits outright, companies can also lease permits. However, company-level lease agreements are not made public. Instead, NOAA posts leasing transactions at a more summary level.

Permits are managed in groups of permit holders known as “sectors.” If one permit holder leases to another in its own sector, NOAA does not publish the transaction. If a holder leases to a party in another sector, that transaction is recorded publicly, but only the sectors are identified, not the specific lessor or lessee.

Most of Blue Harvest’s permits are kept in two of the 18 sectors. NOAA’s leasing records through May of this year show that more than 14 million pounds’ worth of fishing quota have flowed from other sectors into those two sectors since 2018.

Interviews with individual fishermen and others in the industry indicate that Blue Harvest has a significant leasing operation; however, lack of precise data from NOAA makes it impossible to determine the exact extent of the company’s leasing.