This Years Mass. Graduates Are 400 Million in Debt

GRADUATING FROM COLLEGE is a wonderful accomplishment reflecting your unwavering dedication and commitment both inside and outside the classroom. Throughout your academic journey, you have not only acquired a diverse range of skills and knowledge but also fostered a heightened sense of awareness, encompassing technical expertise, analytical prowess, and much more. Many of you have overcome barriers and hardships to get here, and you should be proud of yourselves. As you embark on this next chapter, you are better equipped with the essential tools to function as an analytical and contributing member in a democratic and hopefully an economically thriving society.

Unfortunately, many of you have likely also accumulated significant debt that will take years if not decades to repay. This debt will make it challenging to buy a house, to afford to have kids or provide for your family, and to get the job you want. This debt can also crush your credit score, or worse, if you default (a likely scenario), will undermine your future in multiple ways. This debt has a macro-level impact on the racial wealth gap in the United States, as historical racism has been intertwined with generational wealth. This translates into students of color and particularly Black students having to take on significantly more debt than their white peers in order to attend college. This disparity is exacerbated by persistent obstacles stemming from institutional racism in the job market and discriminatory lending practices by banks.

Moreover, an increasing number of students are also parents, adding further financial burdens while pursuing higher education. These include additional expenses such as childcare and supporting their families. Notably, Black student parents are disproportionately burdened with higher amounts of student debt compared to parents from other racial or ethnic groups, with an average borrowing amount of $18,100 for college. Addressing today’s racial justice issues necessitates the imperative of canceling student debt, as it is an essential step towards rectifying these disparities.

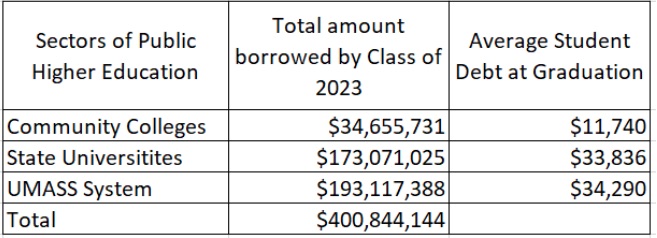

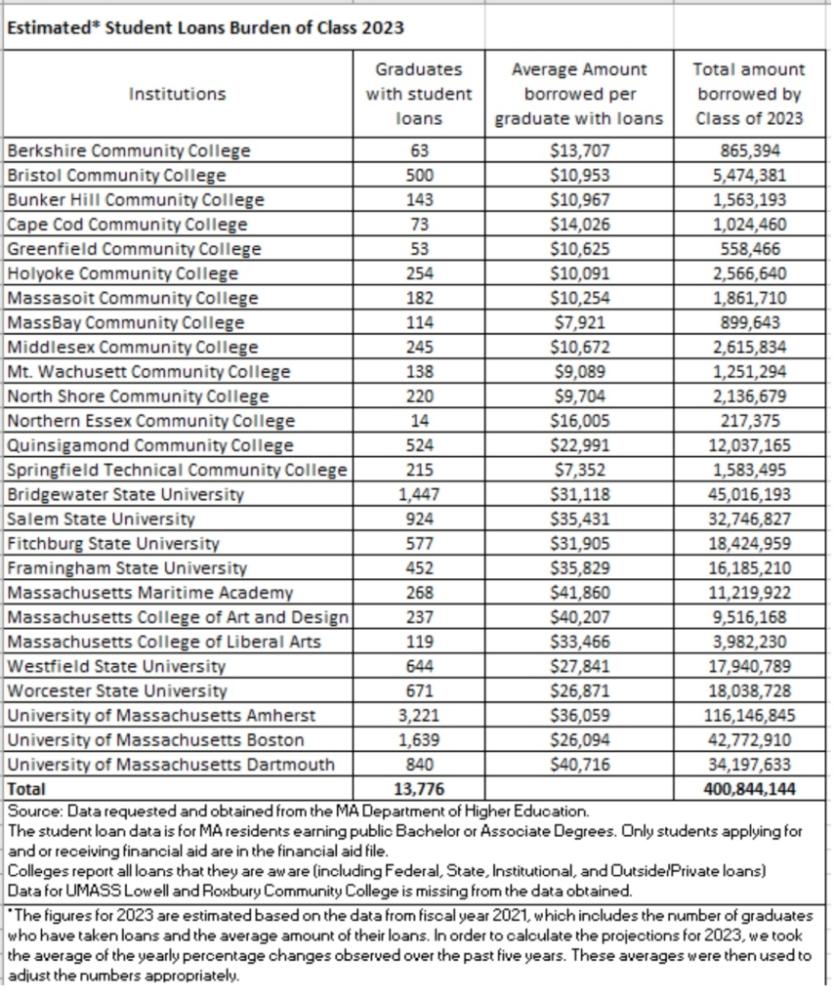

This spring, the graduating class of 2023 from our Massachusetts public institutions alone, which comprises both community college graduates and individuals receiving bachelor’s degrees from public higher education institutions, collectively carries a staggering debt of approximately $400 million.

- Collectively, community college students graduated with a total of $34 million in student debt, averaging $11,740 per student.

- State university students graduated with a total of $174 million in debt, averaging with $33,836 per student

- UMASS students graduated with a total $193 million in debt, averaging with $34,290 per student

Due to the chronic underfunding of our public higher education system, students are now forced to rely heavily on loans to finance their degrees. Not only have appropriations to institutions decreased, leading to increased tuition and fees, but state financial aid per student has also consistently declined over the past two decades. As a result, the purchasing power of state grants and scholarships has diminished, leaving many students with significant unmet financial need. Startlingly, 8 out of 10 students attending four-year public institutions in the state face an annual unmet financial need of $12,000, while 9 out of 10 community college students have an unmet need of $8,557 per year. Given these circumstances, it is unsurprising that they graduate burdened with the weighty loans depicted in the table above.

It doesn’t have to be this way, either nationally or in Massachusetts. In fact, it hasn’t always been this way. In 1963 tuition and fees in 4-year public universities averaged $820 (in 2021 dollars) and by 2021 they were up to $9,580. For 2022-23 the Massachusetts average in-state tuition (in 2023 dollars) was $10,036. The primary reason for the vast increase is the long-term defunding of public higher education by the states – and Massachusetts is no exception.

In Massachusetts, there is a way to begin to reverse this trend and make public higher education, first, affordable, then debt-free and finally even free. Recent increases for public higher education to increase affordability and support services in Governor Healey’s and both the House’s and Senate’s proposed budget are good first steps in this direction. What is critical in the longer term is support for the Cherish Act, and the Debt-Free Public Higher Education bill, which would increase funding for all elements of public higher education, further reduce the costs for students and move towards fully providing the critical educational and support services that students need and deserve while also helping to address the racial and economic disparities in the state.

As discussions around higher education increasingly emphasize its individual-level investment aspect, focusing on the improvement of skills and income potential, it is crucial to acknowledge the extensive body of research that consistently demonstrates the profound societal benefits of a well-funded and high-quality higher education system. Such investment goes beyond individual gains and extends to wider societal benefits. Not only does it contribute to economic growth, innovation, and competitiveness, but it also plays a pivotal role in preserving democracy, fostering economic, racial, and gender justice, and creating opportunities for more meaningful and prosperous employment.

At the national level, many legal scholars have argued that President Biden has the ability to immediately issue an executive order canceling all federally held student debt, granted to him by the Higher Education Act of 1965. The argument is that he could do this no matter what the outcomes are in the Supreme Court cases related to debt relief – Biden v. Nebraska or US Department of Education v. Brown – that will be decided any week now. Meanwhile, Congressional Republicans certainly are not waiting on the Supreme Court in order to pass legislation that would actively harm student debt borrowers’ chances of future debt relief and force them to pay back some of the relief that they have already received. Additionally, there has been a student debt repayment pause for more than three years now – for much of your time in college – and we have seen that the government can in fact afford it, although Republicans have now included a detrimental provision in the debt ceiling deal that would codify an end to this repayment moratorium.

While it is crucial to address the pressing need for debt cancellation, it is important to recognize that this measure alone cannot fully resolve the underlying problem of the affordability crisis and the persistent cycle of student debt burden. These issues will continue to impact future generations of students unless comprehensive steps are taken to tackle the root causes.

Bahar Akman Imboden is the managing director of the Hildreth Institute, a Boston-based research and policy center dedicated to restoring the promise of higher education as an engine of upward mobility for all. Rich Levy is a professor of political science emeritus at Salem State University and is active in two of Massachusetts’ public higher education unions, the Massachusetts Teachers Association and the Massachusetts State College Associations. Ian Rhodewalt is the field organizer for the Western Massachusetts Area Labor Federation, a coalition of more than 60 public and private sector unions.