Momentum for New and Expanded State Child Tax Credits, Earned Income Tax Credits Continued in 2023

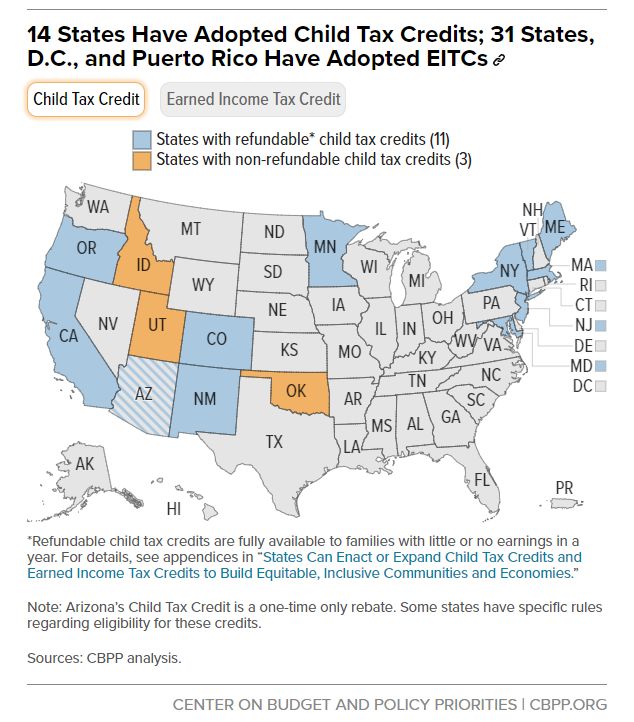

2023 legislative sessions saw strong momentum toward creating and expanding child tax credits. Three states created a new permanent child tax credit, one created a one-time child tax credit payment, and seven states improved existing child tax credits. These efforts build on the success of the federal Child Tax Credit in reducing child poverty and improving outcomes for children in the near and long term.

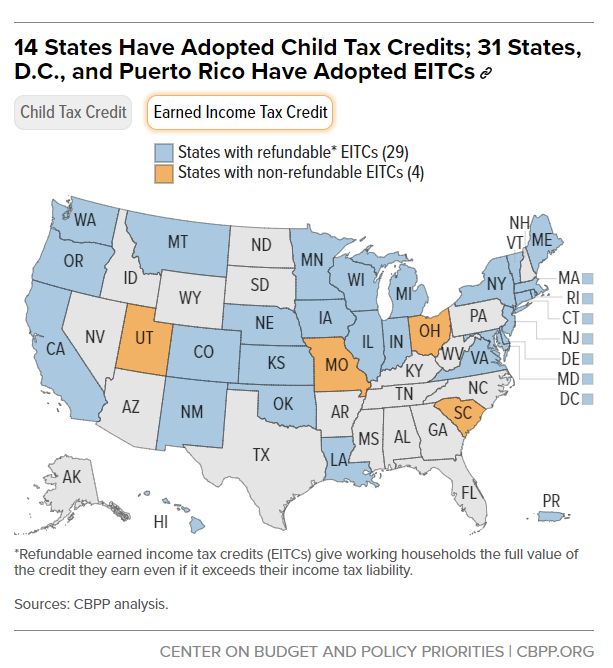

Many states this year have also improved their earned income tax credits (EITCs). State EITCs, like the federal EITC, boost incomes for people paid low wages and provide greater support for people caring for children, helping them better make ends meet and thrive in the long run, research has found.

Because people of color, women, and people who immigrated to the U.S. are overrepresented in low-paid work and in families with little to no earnings, these two state credits are important tools for advancing equity.

In total, 18 states established or improved either a child tax credit or EITC this year. Those states include:

- Colorado, which made its child tax credit fully available to families earning little to no income. The child tax credit is now worth up to $1,200 per child under age 6. The state also expanded its state EITC from 25 to 38 percent of the federal EITC.

- Maryland, which increased the income limit for families to receive the child tax credit and made all children under age 6 eligible. The state also made previous EITC expansions permanent and enabled people not claiming children on a tax return to receive the full credit value.

- Minnesota, which established a permanent, refundable child tax credit and increased the size of its Working Family Credit, as its state EITC is known. The new child tax credit will be worth up to $1,750 for each qualifying dependent under age 18, the highest of any state’s child credit to date.

- New Jersey, which expanded its existing child tax credit by doubling the credit available for families with incomes of up to $80,000 to a maximum credit of $1,000 per child.

- Oregon, whose legislature passed a new refundable child tax credit worth up to $1,000 per dependent under age 6. Governor Tina Kotek is expected to sign the bill.

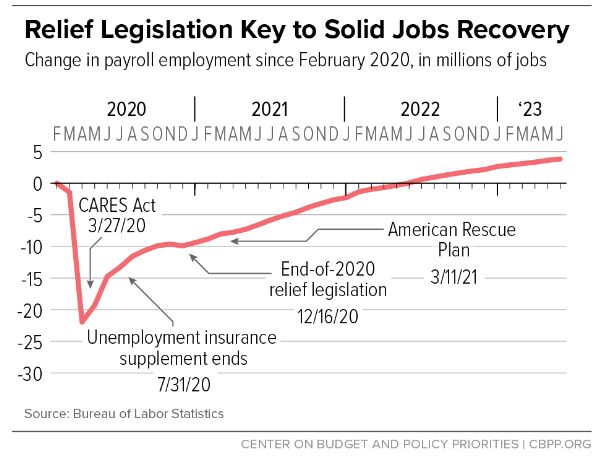

States are also thoughtfully implementing measures that move toward providing people tax credit payments throughout the year, rather than in one lump sum at tax time. The American Rescue Plan recognized this need for flexibility by temporarily authorizing monthly payments of its expanded federal Child Tax Credit, which reduced financial stress and boosted families’ ability to meet their monthly budgets.

At the state level, more frequent tax credit payments could affect recipients’ eligibility for other types of public assistance. For example, in the past the U.S. Department of Agriculture has counted state periodic payments of refundable tax credits as income for the Supplemental Nutrition Assistance Program (SNAP), which could reduce the amount of support people receive from that program.

States offering multiple payments should plan carefully to avoid this outcome and should create a comprehensive outreach plan to notify credit recipients of potential impacts. For example, Vermont’s child tax credit and Oregon’s (when enacted) will both give recipients an option to receive the credit over multiple payments, though the states won’t begin disbursing on that schedule unless the federal government clarifies that these payments won’t affect other types of public assistance people receive. Minnesota’s new child tax credit law gives the state Department of Revenue an option to design an advance payment process. All three states provide the flexibility for people to choose to receive one or multiple payments, a necessary element.

Most state tax systems ask the most as a share of income from families earning the least. Strong and well-designed child tax credits and earned income tax credits can make state tax codes fairer and more equitable while helping families afford the basics and address everyday financial challenges.

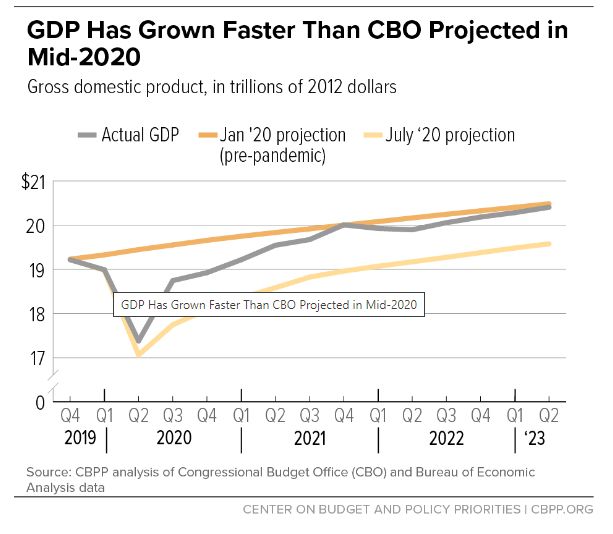

Moderator -- Read more: Economy Remains Resilient at Mid-Year by Chad Stone, Center on Budget and Policy Priorities, August 3, 2023

Samantha Waxman is Deputy Director of State Policy Research on the State Fiscal Policy team. In this role, she leads a team of analysts and conducts research on a range of tax policies designed to make state tax codes more equitable and fairer, including refundable credits and wealth taxes.

Prior to joining the Center, she served as a policy fellow in a congressional office. She holds a master’s degree in Social Policy from the University of Pennsylvania’s School of Social Policy & Practice and a bachelor’s degree in English and Classics from Bowdoin College.

Amelia Minkin is a State Fiscal Policy Intern

About The Center on Budget and Policy Priorities:

We are a nonpartisan research and policy institute that advances federal and state policies to help build a nation where everyone — regardless of income, race, ethnicity, sexual orientation, gender identity, ZIP code, immigration status, or disability status — has the resources they need to thrive and share in the nation’s prosperity.

We combine rigorous research and analysis, strategic communications, and effective advocacy to shape debates and affect policy, both nationally and in states.

We work closely with a broad set of national, state, and community organizations to design and advance policies that promote economic justice; improve health; broaden opportunity in areas like housing, health care, employment, and education; and lower structural barriers for people of color and others in communities that continue to face systemic barriers to opportunity.

We promote federal and state policies that will build a stronger, more equitable nation and fair tax policies that can support these gains over the long term. We also show the harmful impacts of policies and proposals that would deepen poverty, widen disparities, and worsen health outcomes.

We work on policy implementation at the federal, state, and local levels to maximize the positive impact of policies and bring the lessons learned on the ground back to the policymaking process in Washington, D.C. and state capitals.

Our work — rooted in sound research and original data analysis, informed by our extensive knowledge of policy and how programs operate on the ground, and strengthened by our collaboration with a broad range of partners — is trusted by a wide range of researchers, policymakers, and media.