CEOs Made Nearly 200 Times What Their Workers Got Paid Last Year

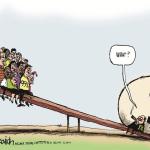

The typical compensation package for chief executives who run companies in the S&P 500 jumped nearly 13% last year, easily surpassing the gains for workers at a time when inflation was putting considerable pressure on Americans’ budgets.

The median pay package for CEOs rose to $16.3 million, up 12.6%, according to data analyzed for The Associated Press by Equilar. Meanwhile, wages and benefits netted by private-sector workers rose 4.1% through 2023. At half the companies in this year’s pay survey, it would take the worker at the middle of the company’s pay scale almost 200 years to make what their CEO did.

“In this post-pandemic market, the desire is for boards to reward and retain CEOs when they feel like they have a good leader in place,” said Kelly Malafis, founding partner of Compensation Advisory Partners in New York. “That all combined kind of leads to increased compensation.”

But Sarah Anderson, who directs the Global Economy Project at the progressive Institute for Policy Studies, believes the gap in earnings between top executives and workers plays into the overall dissatisfaction among Americans about the economy.

“Most of the focus here is on inflation, which people are really feeling, but they’re feeling the pain of inflation more because they’re not seeing their wages go up enough,” she said.

Many companies have heeded calls from shareholders to tie CEO compensation more closely to performance. As a result, a large proportion of pay packages consist of stock awards, which the CEO often can’t cash in for years, if at all, unless the company meets certain targets, typically a higher stock price or market value or improved operating profits. The median stock award rose almost 11% last year compared to a 2.7% increase in bonuses.

The AP’s CEO compensation study included pay data for 341 executives at S&P 500 companies who have served at least two full consecutive fiscal years at their companies, which filed proxy statements between Jan. 1 and April 30.

Top Earners

Hock Tan, the CEO of Broadcom Inc., topped the AP survey with a pay package valued at about $162 million.

Broadcom granted Tan stock awards valued at $160.5 million on Oct. 31, 2022, for the company’s 2023 fiscal year. Tan was given the opportunity to earn up to 1 million shares starting in fiscal 2025, according to a securities filing, provided that Broadcom’s stock meets certain targets – and he remains CEO for five years.

At the time of the award, Broadcom’s stock was trading at $470. Tan would receive portions of the stock awards if the stock hit $825 and $950 and the the full award if the average closing price is at or above $1,125 for 20 consecutive days between October 2025 and October 2027. The targets seemed ambitious when set, but the stock has skyrocketed since, and reached an all-time closing high of $1,436.17 on May 28.

Like rival Nvidia Inc., Broadcom is riding the current artificial intelligence frenzy among tech companies. Its chips are used by businesses and public entities ranging from major banks, retailers, telecom operators and government bodies.

In granting the stock award, Broadcom noted that under Tan its market value has increased from $3.8 billion in 2009 to $645 billion (as of May 23) and that its total shareholder return during that time easily surpassed that of the S&P 500. It also said Tan will not receive additional stock awards during the remainder of the five-year period.

Other CEOs at the top of AP’s survey are William Lansing of Fair Isaac Corp, ($66.3 million); Tim Cook of Apple Inc. ($63.2 million); Hamid Moghadam of Prologis Inc. ($50.9 million); and Ted Sarandos, co-CEO of Netflix ($49.8 million).

At Apple, Cook’s compensation represented a 36% decline from the year prior. Cook requested a pay cut for 2023, in response to the vote at Apple’s 2022 annual meeting, where just 64% of shareholders approved of his pay package.

The survey’s methodology excluded CEOs such as Nikesh Arora at Palo Alto Networks ($151.4 million) and Christopher Winfrey at Charter Communications ($89 million).

Although securities filings show Elon Musk received no compensation as CEO of Tesla Inc., his pay is currently front and center at the electric car company. Musk is asking shareholders to restore a pay package that was struck down by a judge in Delaware, who said the approval process for the package was “deeply flawed.”

Companies are required to assign a value to stock awards at the time they’re granted. The award given to Musk in 2018 was valued at $2.3 billion. Even if Musk were to cash out portions of those awards — he hasn’t yet — that wouldn’t count as compensation. Musk’s pay package is now estimated to be worth around $45 billion.

CEO pay vs workers

Workers across the country have been winning higher pay since the pandemic, with wages and benefits for private-sector employees rising 4.1% in 2023 after a 5.1% increase in 2022, according to the Labor Department.

Even with those gains, the gap between the person in the corner office and everyone else keeps getting wider. Half the CEOs in this year’s pay survey made at least 196 times what their median employee earned. That’s up from 185 times in last year’s survey.

The gap is particularly wide at companies where employees typically earn lower wages, such as retailers. At Ross Stores, for example, the company says its employee at the very middle of the pay scale was a part-time retail store associate who made $8,618. It would take 2,100 years earning that much to equal CEO Barbara Rentler’s compensation from 2023, valued at $18.1 million. A year earlier, it would have taken the median worker 1,137 years to match the CEO’s pay.

Corporate boards often feel pressure to keep upping the pay for well-performing CEOs out of fear that they’ll walk out the door and make more at a rival. They focus on paying compensation that is competitive within their industry or marketplace and not on the pay ratio, Malafis said. The better an executive performs, the more the board is willing to pay.

The disparity between what the chief executive makes and the workers earn wasn’t always so wide.

After World War II and up until the 1980s, CEOs of large publicly traded companies made about 40 to 50 times the average worker’s pay, said Brandon Rees, deputy director of corporations and capital markets for the AFL-CIO, which runs an Executive Paywatch website that tracks CEO pay.

“The (current) pay ratio signals a sort of a winner take all culture, that companies are treating their CEOs as, you know, as superstars as opposed to, team players,” Rees said.

Say on pay

Despite the criticism, shareholders tend to give overwhelming support to pay packages for company leaders. From 2019 to 2023, companies typically received just under 90% of the vote for their executive compensation plans, according to data from Equilar.

Shareholders do, however, occasionally reject a compensation plan, although the votes are non-binding. In 2023, shareholders at 13 companies in the S&P 500 gave the executive pay packages less than 50% support.

After its investors gave another resounding thumbs down to the pay packages for its top executives, Netflix met with many of its biggest shareholders last year to discuss their concerns. It also talked with major proxy-advisory firms, which are influential because they recommend how investors should vote at companies’ annual meetings.

Following the talks, Netflix announced several changes to redesign its pay policies. For one, it eliminated executives’ option to allocate their compensation between cash and options. It will no longer give out stock options, which can give executives a payday as long as the stock price stays above a certain level. Instead, the company will give restricted stock that executives can profit from only after a certain amount of time or after certain performance measures are met.

The changes will take effect in 2024. For last year, co-CEO Ted Sarandos received options valued at $28.3 million and a cash bonus of $16.5 million. Co-CEO Greg Peters received options valued at $22.7 million and a cash bonus of $13.9 million.

Anderson, of the Institute for Policy Studies, said Say on Pay votes are important because they “shine a spotlight on some of the most egregious cases of executive access, and it can lead to negotiations over pay and other issues that shareholders might want to raise with corporate leadership.”

“But I think the impact, certainly on the overall size of CEO packages has not had much effect in some cases,” she said.

Female CEOs

More women made the AP survey than in previous years, but their numbers in the corner office are still minuscule compared to their male counterparts. Of the 341 CEOs included in Equilar’s data, 25 were women.

Lisa Su, CEO and chair of the board of chip maker Advanced Micro Devices, was the highest paid female CEO in the AP survey for the fifth year in a row in fiscal 2023, bringing in compensation valued at $30.3 million — flat with her compensation package in 2022. Her overall rank rose to 21 from 25.

The other top paid female CEOs include Mary Barra of automaker General Motors ($27.8 million); Jane Fraser of banking giant Citigroup ($25.5 million); Kathy Warden of aerospace and defense company Northrop Grumman Corp. ($23.5 million); and Carol Tome of package deliverer UPS Inc. ($23.4 million).

The median pay package for female CEOs rose 21% to $17.6 million. That’s better than their male counterparts fared: Their median pay package rose 12.2% to $16.3 million.

Reporters Stan Choe and Ken Sweet contributed.