Food Commodities, Corporate Profiteeering and Crises, Revisiting the International Regulatory Agenda

[Portside Moderator: There are few areas of concensus in the aftermath of the 2024 Presidential elections. One area which does seem to exist is that a significant role in the election was played by impact of inflation, and in particular, with the cost of food in the World Capitalist System. However, the causes, responsiblity or blame for the rise in food costs remained murky in the election debate. Some answers may be found in this report. The following is Chapter III of the United NationsTrade and Development Report 2023 -- Growth, Debt, and Climate: Realigning the Global Financial Architecture. The full report is worthy of study. Chapter III addresses Food Commodities, Corporate Profiteering and Crises: Revisiting the International Regulatory Agenda. Wether the proposed methods in the report for controlling the oligopolies responsible for the massive rise in costs and profiteering laid bare in the report will be adequate, sufficient or effective will, most likely, be the subject of continuing debate.]

Profiteering in times of crisis

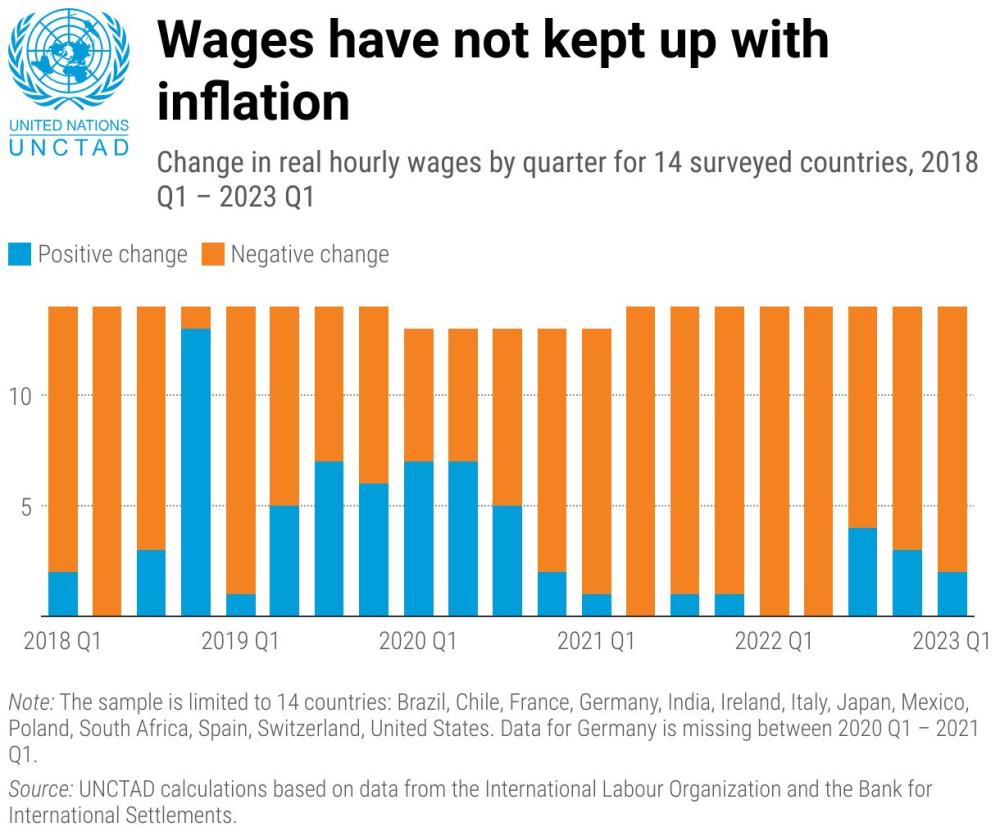

The report highlights how market concentration in key sectors, such as the trading of agriculture commodities, has grown since 2020, deepening the asymmetry between the profits of top multinational enterprises and declining labour share globally.

It finds that unregulated financial activity significantly contributed to the profits of global food traders in 2022.

Corporate profits from financial operations appear to be strongly linked to periods of excessive speculation in commodities markets and to the growth of shadow banking – an unregulated financial sector that operates outside traditional banking institutions.

During the period of heightened price volatility since 2020, certain major food trading companies have earned record profits in the financial markets, even as food prices have soared globally and millions of people faced a cost-of-living crisis.

Food trading companies take positions and function as key participants in financial markets, but this shadow banking function is not regulated in the current financial system.

Patterns of profiteering in the food trading industry reinforce the need to extend systemic financial oversight and consider corporate group behaviour within the framework of the global financial architecture.

From excess to equity

The stark contrast between the surging profits of commodity trading giants and the widespread food insecurity of millions underscores a troubling reality: unregulated activity within the commodities sector contributes to speculative price increases and market instability, exacerbating the global food crisis. This presents significant obstacles to effective policy measures. At the same time, an intricate web of crosssector connections and high volume of intragroup corporate activity in the industry complicates efforts to establish transparency and accountability. Profiteering from financial activities now drives profits in the global food trading sector. Yet commodity traders circumvent existing regulations: they are not regulated as financial institutions but are treated as manufacturing companies. This report calls for a fundamental revision of this regulatory approach. It is imperative to develop tools to enhance transparency and accountability in this opaque yet systemically vital global industry. Policymakers and regulators need to foster a future where equity replaces excess, and the global paradigm shifts from profiteering to purposeful sharing for the betterment of all.

Specifically

• Profiteering prompts the need to reevaluate corporate group membership and the behaviour of major players in food trading.

• Regulators should recognize the financial aspects of food traders’ activities as systemically important and extend relevant regulations. Measures proposed here at the corporate–finance nexus can enhance wider efforts to combat financial speculation and profiteering.

• A set of market-level, system-level and global governance reforms are needed to align the international financial architecture with recent developments in the opaque, underregulated yet strategically vital commodity trading industry

A. INTRODUCTION

The cost-of-living crisis has become the hallmark of the post-COVID-19 recovery and continues to cascade through the global political economy. In advanced economies, the crisis is manifesting as high inflation and growing financial fragilities (chapter I). In the developing world, import dependencies, extractive financial flows, boom–bust commodity cycles, trade disruptions, the war in Ukraine and climate-vulnerable food systems are combining to destabilize finances, bringing countries closer to a debt crisis (chapter II; IPES, 2023).

In the interplay of crisis transmission mechanisms, a vicious cycle has emerged between higher energy and food production costs, reduced farm yields and higher food prices, more inflation pressures and subsequent financial tightening. Stricter financial conditions are eroding the buying power of currencies in developing countries and increasing the import costs of food and energy, reducing financial capacity and increasing the costs of servicing debt (GCRG, 2022). In a fragile global economy on the verge of a recession, volatility in commodity markets endangers access to most basic needs and rights, such as food and energy security for millions, potentially threatening social and political stability in many parts of the world.

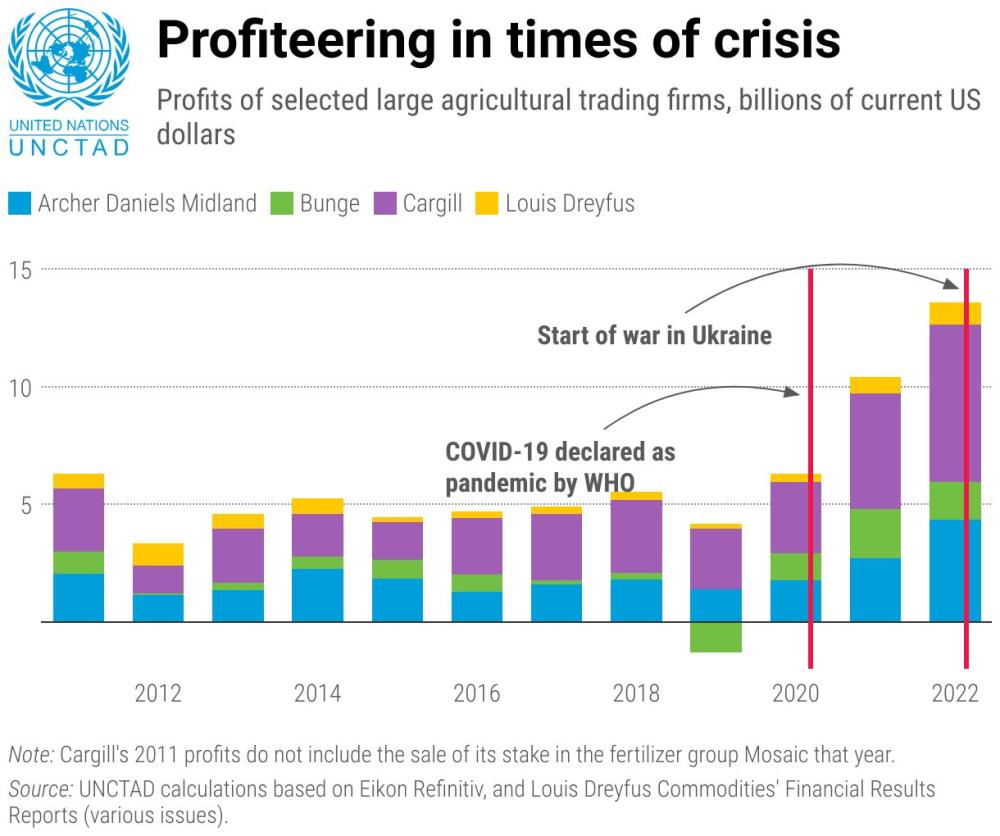

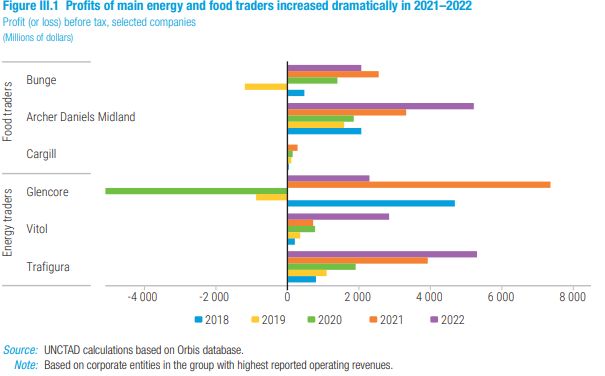

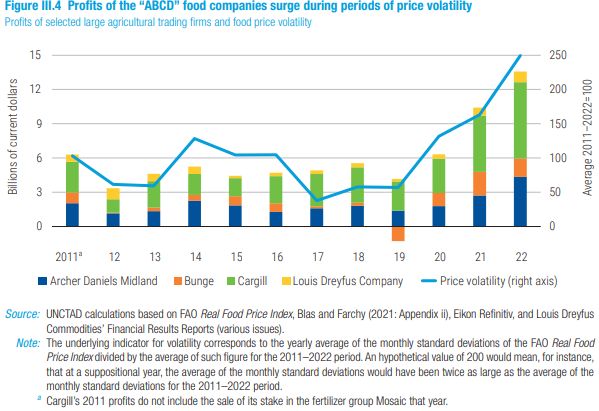

But crises always present opportunities, at least for some. The last few years of commodity price volatility have coincided with a period of record profit growth by global energy and food traders. In the area of food trading, the four companies that conservatively account for about 70 per cent of the global food market share registered a dramatic rise in profits during 2021–2022. As figure III.1 shows, growth in profits of some of the largest food traders in 2021–2022 is at par with the profitability profiles of leading firms in the energy sector. Meanwhile, total profits of the nine big fertilizer companies over the past five years grew from an average of around $14 billion before the pandemic to $28 billion in 2021 and then to an astounding $49 billion in 2022 (IATP and GRAIN, 2023).

This chapter analyses some key dynamics of corporate profiteering through crisis, with a focus on the global food trading sector. The analysis presented below aims to identify and help address some of the destabilizing impacts of concentrated corporate control in the strategically vital, highly interconnected yet opaque and poorly regulated food commodity trading industry

Corporate profiteering in times of crisis is not a new challenge. At the very first United Nations conference, which took place 80 years ago in Hot Springs, Virginia, United States, 43 countries gathered to discuss the food and agricultural challenges faced by the post-war international order.1 With many agricultural economies still suffering from the price collapses of the inter-war years and against a backdrop of famine conditions in parts of Europe and Asia, a central issue at the time was the problem of volatile prices, for both producers and consumers. But while there was broad agreement that the food question could not be left solely to market forces, there was less agreement about the best way to establish a more secure and stable global food system.

Today, in the context of systemic crises, the contrast between growing risks to food security of millions around the world and profiteering by the few corporations that control global food systems during times of volatility and shocks, is particularly stark. In the highly concentrated commodity trading industry, the super profits enjoyed by “agripolies” trickle down very slowly, if at all, to local farming communities.

In July 2023, Oxfam estimated that 18 food and beverage corporations made on average about $14 billion a year in windfall profits in 2021 and 2022, enough to cover the $6.4 billion funding gap needed to deliver life-saving food assistance in East Africa more than twice over (Oxfam, 2023). A recent study found that in Europe, up to 20 per cent of food inflation can be attributed to profiteering (Allianz, 2023). Some reports suggest that the ten leading “momentumdriven” hedge funds made an estimated $1.9 billion by trading on the food price spike at the start of the war in Ukraine (Ross and Gibbs, 2023).

However, according to two leading scholars, the issue is more enduring and rooted in structural factors. Growing cross-sectoral control over the food system by major agri-corporations raises the risk that extreme food-price swings will become the norm. Through decades of mergers and acquisitions, such firms have been able to expand their influence up and down the supply chain, while amassing huge amounts of market data. If a handful of companies continue to hold inordinate power over the world’s food systems, any policy effort to mitigate the short-term effects of food price spikes will be futile in the long term (Clapp and Howard, 2023). Similar warnings are increasingly echoed by market analysts, civil society, regulators and international organizations concerned with the lack of regulatory oversight of commodity trading (FSB, 2023; Schmidt, 2022; Tarbert, 2023; Tett, 2023).

The analytical and policy challenges of regulating commodity trading cannot be overestimated. Opacity, lack of regulatory oversight – especially at the systemic level – cross-sector interconnections and intragroup corporate activity all pose major hurdles in efforts to scope the problem and identify risks and workable solutions. This can explain why, despite growing public attention on the issue of market concentration and profiteering, current policy debate on possible multilateral solutions to the food systems crisis has not addressed this question in depth.

This chapter is a step forward in this endeavour and its aim is two-fold. First, to examine the factors that enable corporate profiteering in food trading in times of crises and thus play a role in the current dysfunction of global food systems. Second, to put forward a set of regulatory measures that can help address the destabilizing impacts of concentrated corporate control in a strategically vital, highly interconnected yet opaque and poorly regulated industry.

The analysis reveals that unregulated financial activity significantly contributes to the profits of global food traders. It also shows that corporate profits from financial operations appear to be strongly linked to periods of excessive speculation in commodities markets and to the growth of shadow banking – an unregulated financial sector that operates outside traditional banking institutions.

Specifically, during periods of heightened price volatility, certain major food trading companies gain amplified profits in the financial markets. Like a non-bank financial institution, food trading companies take positions and function as key participants in financial markets. This shadow banking function is not regulated in the current financial system. As a result, these companies are motivated to increase their already significant role in profiting from price differences in food markets. To help combat the problem of profiteering, arbitrage and unearned profits, a set of regulatory measures have been identified that can help address market dysfunction and risks of shadow financial trading.

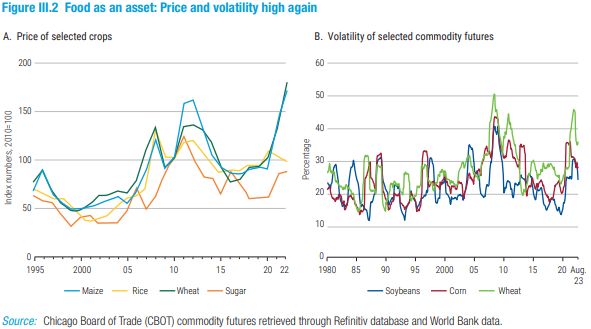

The analysis does not necessarily establish that financial speculation is driving food prices up. Rather, it suggests a strong link between corporate profiteering through the use of financial instruments and the current period of market volatility. As figure III.2 shows, the past two years have been marked by high volatility in crop prices and in the financial markets for food, but correlation does not mean causation. Much more research needs to be carried out to establish the relationship between excessive speculation and price dynamics. Food prices are determined by an interplay of supply and demand conditions, including in retail sectors, food processing industries and conditions in labour markets (Scott et al., 2023). Therefore, while financial speculation, and excessive speculation specifically, may accentuate price swings, agriculture prices are highly affected by market conditions, geopolitical tensions, climate risks and trade measures.

In February 2022, threats to global food systems were amplified with the start of the war in Ukraine. Since 24 February 2022, 62 per cent of 667 export-related non-tariff measures recorded affected agricultural products or fertilizers. Of these, 267 are restrictive measures such as bans on the export of fertilizers and certain food products.2

Early in 2023, food prices came down from their 2021 peaks, yet the suspension of the Black Sea Initiative and the subsequent withdrawal of the Russian Federation from the deal has again sparked market volatility (figure III.2.B). In early August 2023, wheat remains more than twice as expensive as it was before the pandemic. In most developing economies, food price inflation is above 5 per cent, and as high as 30 per cent in Egypt and Rwanda (Clapp and Howard, 2023). And while it may seem straightforward that high agriculture prices benefit food producers, such assumptions ignore the major role played by the international agrobusiness firms that control many of the links in the global agrivalue chains and the dynamics of price formation in global food systems (Akyüz and Gursoy, 2020; Baines, 2017; Clapp and Howard, 2023; Staritz et al., 2018; UNCTAD, 2023).

With these qualifications, the findings presented in this chapter are indicative, and not definitive. More research is needed, and the challenge of incomplete data and non-transparency of the commodity trading industry is a major hurdle in this endeavour.

However, what is clear is that the fragmented and compromised set of regulatory norms governing the financial dimension of the global food trading industry has played a key role in enabling financial speculation, corporate arbitrage and profiteering in the global food industry since 2010. This problem was accentuated in the global context of compounding crises post-2020. Financial speculation in commodity markets, as well as the increasing role of financial assets under the control of large corporations that dominate the sector, point to the issue of unearned profits and the need to strategically regulate important modes of corporate control.

The chapter is structured as follows:

• Section B analyses the role of financial trades and speculation in food trading, finding a strong parallel between the period of high profits of major food traders and the wave of financial speculation in over-the-counter (OTC) markets.

• Section C investigates the conditions for corporate arbitrage in commodity trading created, in part, by the regulatory distinction between commercial and financial institutions. Findings show that this distinction is being eroded by the process of regulatory loopholing, corporate arbitrage and financialization of food trading.

• Analysing some of the concerns related to this process flagged by the Financial Stability Board in 2023, an indicator was developed (the asset dominance ratio, or ADR) to help locate and estimate the risks to financial stability in commodity trading.

• Section D concludes by charting policy solutions that aim to limit the systemic and distributional effects of unregulated financial activities in commodity food trading, at different regulatory levels.

B. FOOD AS AN ASSET: HEDGING, SPECULATION AND PROFITING FROM CRISES

Financial instruments and insurance products, known as commercial hedging tools, play a crucial role in risk management across all industries. Particularly vital in sectors such as agriculture, commodities, trade and investments, these tools contribute to market liquidity. They become even more significant due to their role in maintaining stable commodity prices, which in turn, rely on a stable commodity derivatives market. A notable aspect of this market are deferred settlements, a concept where transactions are settled at a later date. Derivatives are based on the principle of deferred settlements, and on the basis of being “a contract whose value depends on the price of underlying assets, but which does not require any investment of principal in those assets. As a contract between two counterparts to exchange payments based on underlying prices or yields, any transfer of ownership of the underlying asset and cash flows becomes unnecessary” (BIS, 1995:6–7).

Commodity futures markets bring together commercial operators who either produce, store or process commodities, and speculators, i.e., non-commercial operators who buy and sell futures contracts but have no specific interest in the use of the commodity; rather, they aim to make a profit exclusively from price fluctuations (Kornher et al., 2022; IPES, 2023).

A degree of speculation, and speculative liquidity, is essential for the stable operation of any financial market, as it helps price discovery and hedging. However, excessive speculation makes price swings larger than would have been the case based on supply and demand conditions alone. Under certain conditions, excessive speculation can become an independent driver of those price fluctuations. Excessive speculation, including in commodity markets, is intimately linked to the use of financial derivatives. These instruments mushroomed following the heightened uncertainty and unstable expectations that followed the end of the Bretton Woods system in 1973.

Speculation on food futures markets dates back to the mid-nineteenth century, when farm production expanded in the United States. At the time, small-scale farmers, being directly indebted to the banks which sold land, had to seek opportunities in markets much further afield. As international channels for trade in cereals had only just started to develop, control over the food chain became concentrated in the hands of a few powerful intermediaries, who are the ancestors of today’s food multinationals (Vargas and Chantry, 2011). These markets came under federal oversight in the late 1930s, with stricter regulation introduced following the farming crisis and the Great Depression.

Over the past few decades, the structure of food speculation has become more complex. Two parallel forces have driven this shift: the maturing of speculation in financial markets on the one hand, including through the use of derivatives; and the liberalization of agriculture markets, on the other (Vargas and Chantry, 2011). This process has seen private equity funds, asset management companies, institutional investors, banks, and other financial institutions invest in “alternative assets” such as commodity futures, agricultural land and the crops it produces, which had hitherto been avoided by most investors as too high-risk (Murphy et al., 2012). Partly as a result of this process, the financial activities of non-commercial hedgers in commodity markets have become associated with excessive speculation and its impact on price levels, most dramatically seen during the commodity price crisis of 2008–2010 (Bicchetti and Maystre, 2013).

The current crisis accentuates two major effects of these developments. First, there is ample evidence that banks, asset managers, hedge funds and other financial institutions continue to profit from the most recent bout of commodity market volatility (Schmidt, 2022; Oliver Wyman, 2023; Ross and Gibbs, 2023). Second, by actively managing risk, commodity trading firms have assumed many financing, insurance and investment functions typically associated with the activity of banks. In this context, very large international trading firms, or ABCD-type companies3 have come to occupy a privileged position in terms of setting prices, accessing funding, and participating directly in the financial markets. This not only enables speculative trades in organized market platforms, but a growing volume of transactions between individuals, or over-the-counter trades, over which most governments in the advanced countries have no authority or control (Suppan, 2010; Vargas and Chantry, 2011; Murphy et al., 2012).

Continuous lack of systemic regulatory oversight over the emergent segments of commodities trading reinforces this position. Market-based speculation, and operations in exchange-traded derivatives represent only a fraction of derivatives traded globally. Financial derivatives on agricultural commodities are mostly traded over the counter, which makes monitoring market trends and regulating risks in this sector a challenge (Schmidt, 2022).

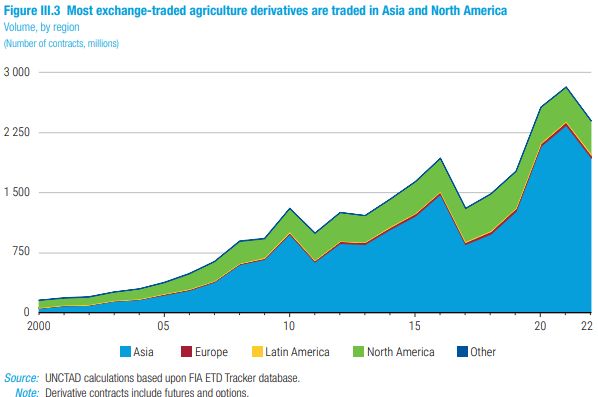

In this instance, the geographical structure of global commodity derivatives trade is instructive (figure III.3). Many market-based instruments are traded in North America and Asia, reflecting major trading zones for key commodities, while Europe accommodates mainly OTC trading.

Data from the Bank of International Settlements (BIS, 2023) shows that outstanding over-the-counter commodity derivatives relating to energy, food and non-precious metals experienced a sharp increase after 2020, with their gross market value increasing from less than $200 billion to $386 billion at the end of 2021 and peaking at $886 billion by mid-2022. This represents more than a fourfold increase compared to their 2015–2020 average. During the second half of 2022, this indicator declined by 45 per cent. Yet it still yielded a year-end value of $486 billion in 2022.

Notional principal values of these outstanding derivatives remained above $1.5 trillion at the end of 2022, its second highest since records began, after reaching an all-time-high of more than $2 trillion in mid-2022 (BIS, 2023). These trends reflect the uncertainty triggered by the war in Ukraine and other geopolitical tensions affecting commodities markets.

The central role of OTC operations in commodities trading points to one of the major challenges of regulating this notoriously inscrutable industry. The opacity of the global food trading sector has implications for the availability of data and therefore, definitive conclusions: only eight out of 15 main food trading companies examined in this chapter are publicly traded and required to publish consolidated accounts.4 The lack of transparency within this sector means that generalizations about profit trends for individual companies, and a conclusive verdict on the exact impact of corporate profits on the overall price dynamics, are difficult to draw at this stage.

What does appear to be clear from analysing sector-wide profit trends is the relationship between companies’ profits and price volatility. Figure III.4 presents the relationship between the (net) profits of the “ABCD” companies and food price volatility during the last decade

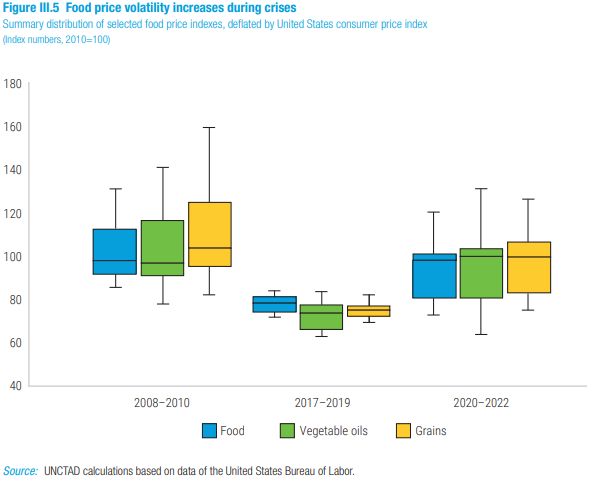

As figure III.5 shows below, global food price volatility during the crisis of 2020–2022 is close to the levels of the commodity price crisis period of 2008–2010.

Two major issues are notable here. First, the profits of four major food traders rise during periods of market volatility and during crises, and this trend has been particularly pronounced during the pandemic. Second, in the context of compounding crises, the sources of the super-profits in the food trading industry warrant closer attention.

As noted in the seminal study by Oxfam (Murphy et al., 2012), prices in volatile commodity markets are as much about anticipated supply and demand as they are about existing conditions and potential risks. The level of risk and volatility in the trading of standardized and generic products pushes companies to look for strategies that will increase their stability and predictability. To achieve this, a range of financial techniques designated for commercial hedging can be used, such as futures and options. Commodity exchanges can also serve this purpose if traders, in addition to using publicly available information, trade using independent information derived from an intimate knowledge of specific events and their own plans to supply or demand commodities. However, in an inadequately regulated system, instruments officially designed (and regulated) as hedging tools are being used for speculating in food prices.

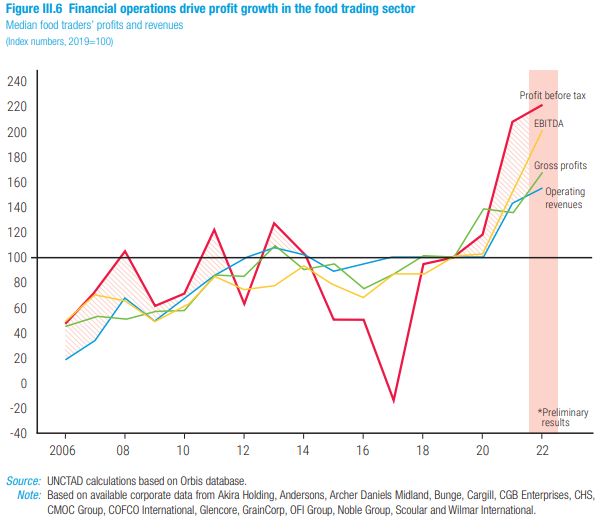

Figure III.6 gives an indication of this phenomenon in the food commodities trading industry. It shows that profit indicators reflecting the dynamics of the core business of companies in the sector have followed a common trend since 2006. Yet in 2020, pre-tax profits, which can serve as an indicator of the profits (and losses) from purely financial operations (i.e., non-core business operations) became extreme, greatly exceeding profits/ losses from their core business operations. These are: operating revenues, gross profits and earnings before interest, taxes, depreciation and amortization (EBITDA).

This contrast in profit indicators leads to three key observations.

First, food trading companies have come to rely on the use of financial instruments and markets not simply to hedge their commercial positions, but to strategically ride the wave of market volatility (in other words, to speculate) using techniques of financial engineering. Second, market and price volatility appear to have a much more pronounced role in the sector’s financial operations, in contrast to their core commercial activities. Third, financial instruments and techniques designed for hedging a range of commercial risks are being used by the sector for speculative purposes. This is enabled by the current regulatory architecture of commodity trading as a whole, which remains diluted and fragmented.

Hedging activity, regardless of whether it is officially a hedge under the existing rules, or a hedge to bypass onerous regulations, should have a negligible impact on financial performance because, if done properly, that is the objective of the hedge. Most derivatives trading takes place in OTC markets, which are largely unregulated. Major commodity traders classify the bulk of their derivatives assets as normal speculative investments that contribute to the profit of the group as a financial gain (or loss). However, the unique nature of derivatives trading means it does not consistently deliver predictable results. Financial gains from derivatives activities are not equivalent to “financial income”, but instead, are manifested as “fair value adjustments” based upon the difference of the original face value of the contract, and whether, over time, value differences generate gains or losses to be accounted for. Depending on how companies present their accounts, these “adjustments” can materialize in different places in the income statement present in annual reports. For some companies in the sample, the magnitude of these adjustments is consistent across time, except during periods of excessive derivatives speculation (discussed below). During such times, company accounts report unusually large adjustments, which boost overall profit levels and drive the observations detected in figure III.6. This attests to the disproportionate role that non-operating activities (speculation) play in the current era of super profits. This aligns with the timeframe during which excessive speculation in the OTC markets surged, as shown below.

Over time, large commodity trading companies have become major financiers. They act as creditors to governments and private entities, carry out proprietary trading (i.e., speculating on the future direction of prices, leveraging their large informational advantage), issuing financial instruments such as “secured amortizing notes” to third party investors such as pension funds, etc. (Blas and Farchy, 2021). Driven by the need to hedge their business transactions, and with the resources and opportunities to speculate, commodity traders today are key participants in derivatives trading. In 2017, the European Central Bank (ECB) found that 11 commodity dealers cover more than 25 per cent of the Euro area market in commodity derivatives, with more than 95 per cent of derivative contracts being non-centrally cleared OTC derivatives.5

There is mounting evidence that speculative activity in financialized food markets increases dramatically during crises, including the current period of 2020– 2022/2023. Kornher et al. (2022) examine the drivers of excess price volatility of commodity futures markets and find that, following the period of extreme market volatility between 2007 and 2011, markets stabilized until the onset of the pandemic in 2020. Since the end of 2021, excessive price volatility surrounding commodity futures trades has grown significantly. The share of speculators (non-commercial traders) in hard wheat and maize corresponds to price spikes and has risen sharply since the end of 2020 (Kornher et al., 2022). In 2022, the share of long positions held by non-commercial traders was estimated at around 50 per cent, a figure similar to the period of high speculative pressure in 2007–2008 (Kornher et al., 2022).

More recently, data compiled by French commercial bank, Société Générale, suggests that a group of 10 leading “momentum-driven” hedge funds made an estimated $1.9 billion trading on the food price spike at the start of the war in Ukraine in wheat, corn and soybean trades, after a period of years in which they had largely made losses on these food commodities in the same three-month period (Ross and Gibbs, 2023). Their activity contributed to speculative price rises and exacerbated the food crisis for millions around the world. Researchers have found that in the Paris Milling Wheat market – the benchmark for Europe – the proportion of buy-side wheat futures contracts held by financial speculators increased from 35 per cent of open interest in May 2018 to 67 per cent in April 2022 (Agarwal et al., 2022).

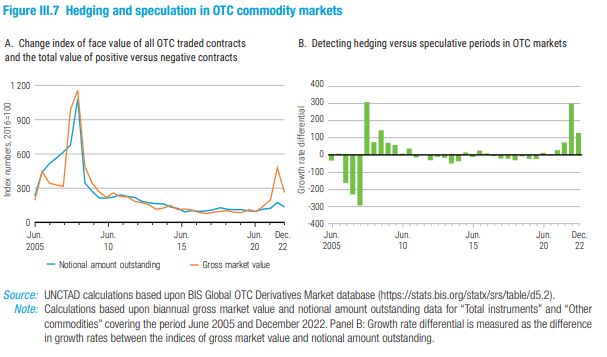

These findings are confirmed by the analysis of speculation in OTC derivatives presented in figure III.7. The available current data from the Bank of International Settlements indicates that financial speculation in commodities, including food, has risen dramatically during the two recent crises, 2008–2010 and 2020–2022.

The Bank of International Settlements offers two metrics which provide two ways of understanding the key dynamics in these markets. The first measure is “notional value of outstanding” OTC derivatives (blue line in figure III.7.A). It is a metric of value that aggregates the total “face value” of an underlying set of contracts. The second measure is the “gross market value of outstanding derivatives” (orange line in panel figure III.7.A). This differentiates the pool of contracts into those that are currently generating a profit, versus those that are generating a loss. The latter metric is particularly important for evaluating when speculation pursuits “overtake” break-even risk management hedge interests. Put simply, the blue curve in figure III.7.A shows the volume of bets taken in OTC commodities. Major increases in the orange curve indicate periods when there were more profit-making bets in the market.

Taken together, the panels in figure III.7 present the evolution in the structure of speculative trades in OTC markets during the past two financial cycles. The data suggests that the OTC commodity markets have evolved through four phases. The first is the lead up to the global financial crisis, when the rapid growth of OTC markets coincided with a predominance of loss-making contracts (orange line in III.7.A), with a notable correction and growth in contracts that were profit-making immediately after the onset of the crisis in late 2007. This period of excessive profit making contracts gave way to a long period of stability with little volatility in the composition of profit versus loss-making contracts in the OTC markets from, roughly, 2010 until the end of 2020. Between 2021 and December 2022, the underlying composition of the OTC markets, compared to 2007–2009, has been marked by a disproportionately large number of profit-making contracts.

These metrics distinctly show when there are shifts towards excessive speculation in the OTC markets. They also show how this measure more effectively correlates with the timing of systemic shifts when profits are generated from financial activities, as reflected in corporate accounts. Together, the two measures indicate the timing of excessive speculation. The determining feature in when this happens appears to be external to the companies themselves. This reflects differences in how market investors estimate prices, compared to industry insiders’ more precise knowledge of actual prices.

Moreover, as can be seen from figure III.7.A, while the speculative bout of 2007–2010 was driven by new entrants into the commodity markets supplying new liquidity (banks and other financial institutions), the current peak is mainly associated with the activity of the incumbent market players (see the much less dramatic rise of the blue curve in figure III.7.A reflecting the more limited injection of new liquidity).

It is instructive in this instance that in the documentation presented by one of the ABCD giants, a listed company under strict obligation to disclose to the public the exact nature of its activities, it is made clear that:

The majority of the Company’s derivative instruments have not been designated as hedging instruments. The Company uses exchange-traded futures and exchange-traded and OTC options contracts to manage its net position of merchandisable agricultural product inventories and forward cash purchase and sales contracts to reduce price risk caused by market fluctuations in agricultural commodities and foreign currencies. The Company also uses exchange-traded futures and exchange-traded and OTC options contracts as components of merchandising strategies designed to enhance margins (Archer Daniels Midland, 2022:67, emphasis added)

The transformation of food trading companies into financial institutions is a problem long noted by analysts (Murphy et al., 2012; Gibbon, 2013). The blurred distinction between hedging operations by commercial traders and financial speculation poses not only a financial contagion risk but is also a factor in price inflation. This warrants a revision to the existing regulatory architecture of commodity trading. While the phenomenon of excessive speculation in commodities is linked to deregulation policies (de Schutter, 2010; Oxfam, 2011; Winders, 2011), there are growing concerns that financial activities within today’s food trading industry give rise to unnoticed financial stability risks and strengthen corporate influence over strategically significant markets (FSB, 2023). Not only does this add to the challenges of detecting and curbing excessive market speculation in commodity and food trading; it also further complicates regulation of the shadow banking system and imperils financial stability. It also conceals risks and exposures in the poorly regulated yet highly interconnected and systemically important industry. These issues are addressed in the next section.

C. OF LOOPHOLES AND LOOPHOLING

“What might happen under legislation that would allow most OTC derivatives to remain in dark markets, thus preventing regulators from having timely access to all trading information, a prerequisite for effective regulation?”, asked one contributor from the Institute for Agriculture and Trade Policy, to a 2010 UNCTAD symposium on commodity market regulatory pathways (Suppan, 2010).

More than a decade after the use of OTC derivatives in food markets raised concerns among regulators, some clear lessons can be drawn. They point to the incomplete, fragmented and diluted approach to regulating commodity trading. Increasingly, these concerns relate to heightened financial stability and opacity risks in the industry, where regulatory gaps have widened further since 2010. These gaps are being exploited by the corporate groups that dominate commodity trading. Moreover, commodity traders have not only circumvented existing regulations but also consistently avoided further attempts to regulate the financial dimension of their activities.

Regulatory competition, unique industry characteristics and efficiencies, as well as economies of scale, are typical arguments used by the industry to advocate the merits of the fragmented regulatory approach which has prevailed until today. Despite efforts to increase oversight, the food markets sector has resisted, arguing that it is indirectly supervised by banks.

To a large extent, current gaps are the outcome of regulatory loopholing in the post-2010 financial architecture. These include caveats and exemptions to market-level regulations introduced in the wake of the global financial crisis; company-level techniques of financial and regulatory arbitrage; a persistent lack of a harmonized approach to regulating commodity traders generally, and of food companies more specifically.

There is also a more fundamental reason for the lack of appropriate regulatory treatment: the majority of food trading companies are not regulated as financial institutions but are treated as manufacturing companies. The ongoing crisis in the global food system underscores the need to rethink the regulation of food and commodity traders at a more coherent and systemic level.

1. Dodd-Frank: an opportunity missed

Historically, the most important source of the public regulation and monitoring of futures exchanges has been the government of the United States, driven by farmer and consumer interests. Until the financial crisis of 2007–2009, futures exchanges in other jurisdictions, except for some developing countries, were typically subject only to light forms of self-regulation and little or no public monitoring. In the European Union, regulation of commodity derivative markets centred on the behaviour of market participants – in terms of capital requirements, organizational requirements and requirements to follow conduct-of-business rules, and even here with wide exemptions – rather than of markets (Gibbon, 2013).

Following the commodity price boom of the 2000s, financial market regulation concerns began to feature in the regulatory agenda of the United States and the European Union. Signed in 2010, the Dodd-Frank Act aimed to roll back the preceding liberalization of OTC and exchange-based trading. The Act prioritized measures and requirements for better (re)-capitalization of banks, and more discipline in the credit operations of commercial banks (Kornher et al., 2022). In the area of commodity trading, the main provisions in the Act were usefully summarized by Gibbon (2013):

(i) OTC swaps “taking a standard form”, when traded by financial entities with portfolios with a notional value of more than $8 billion, will have to be cleared through centralized clearing houses and subject to reporting and margin requirements. The United States Securities and Exchange Commission (SEC) has announced a margin requirement equivalent to 15 per cent of the notional value of the acquired position. Crucially, “non-financial entities” hedging risk will be exempted from the central clearing requirement but will be subject to a requirement for central notification. Additional margin requirements were considered for non-cleared swaps.

(ii) Banks shall spin off their commodity swap activities to independent entities excluded from Federal Reserve Insurance arrangements and not engage in derivatives trading not directly related to the trading they do for customers (the so-called “Volcker rule”).

(iii) Federal position limits shall be extended to all exchange-traded commodity contracts, and the aggregation of individual positions on a commodity for position limit purposes shall occur across all exchanges and trading venues, including non-United States exchanges and swap venues. The eligibility for hedgers’ exemptions from position limits shall be narrowed to entities with positions exclusively in cash-settled contracts.

(iv) Spot month position limits shall normally be set at 25 per cent of the estimated deliverable supply

(v) These rules shall also apply to activities on foreign exchanges and other trading.

(vi) Venues by “United States persons”, foreign-registered subsidiaries of firms and foreign firms whose activities are likely to impact on the economy of the United States, except where foreign exchanges set rules that are deemed to be identical to domestic ones.

(vii) In early 2012, additional Presidential authority was granted for the Commodities Futures Trading Commission (CFTC) to increase margin requirements for oil futures and options contracts (Gibbon, 2013).

Not long after the initial adoption of the Act, its key principles started to be diluted, under the influence of industry interests, inter-agency competition, technical difficulties of implementation and opportunities of international arbitrage.

The coalition of companies using derivatives includes companies such as Bunge, John Deere and Cargill, which engage in both commercial hedging and financial speculation. The coalition has argued that OTC trades between financial institutions and non-financial institutions (such as the coalition members), should be exempt from requirements to clear those trades on public exchanges. At least three reasons are typically given to justify the exemption.

• First, non-financial firms pose no systemic financial risk and hence they should not be prevented from “customizing” their interest rate, currency rate, balance sheets and credit risk in bilateral deals with financial institutions;

• Second, the higher margin requirements of trading on exchanges will pose huge cash-flow problems for coalition members and imperil market liquidity;

• Third, if bilateral trades are pushed from the dark OTC market to exchanges or derivatives clearing platforms, trade risks will be concentrated in such quantity that these centralized clearing platforms will be unable to confirm and verify trades operationally (Suppan, 2010).

Some of the key effects resulting from regulatory loopholing in financial derivatives that ensued soon after the inception of the 2010–2011 regulatory norms are examined in box III.1. The overall outcome of diluting the set of financial reforms was the creation of an important regulatory loophole that is being used by financial institutions to speculate in commodity derivatives to this day.

Box III.1 It’s all in the footnote: Dodd-Frank and financial regulatory arbitrage

With the adoption of Dodd-Frank, OTC trading for financial derivatives was supposed to be formalized and moved to central clearing platforms to boost market transparency. The measure was aimed primarily at swaps and security-based swaps (Kornher et al., 2022). Other important regulatory reforms included new position limits and restrictions on the use of swaps. However, although at the time the Commodity Futures Trading Commission (CFTC) issued comprehensive rules on position limits, the authorities failed to enforce them fully. Some funds, such as the commodity index and similar funds, were left unregulated. Regulation of swaps in particular became the centre of the regulatory loopholing that would soon ensue.

To understand its origins and the impact on the sector, a critical distinction needs to be drawn between “branches” and “affiliates” or “subsidiaries” in the structure of banking and corporate operations. The distinction is legally important and impacts the identification of the persons subject to legislation; it also defines how to potentially avoid (arbitrage) the application of legislation.

A branch is merely an office of a legal person; transactions concluded by personnel out of this office are transactions of the legal person owning the branch. An affiliate, or subsidiary, as opposed to a branch, is a separate legal person having its own legal personality, assets, and personnel. This separate legal person is an affiliate or subsidiary because its equity capital is owned by a parent company, which is itself also a separate and autonomous legal person. But legally speaking, as a matter of principle, it is an autonomous legal person. The activities conducted in the office can be exactly the same under both legal configurations. In the first case, they are attributed to the owner of the branch; in the second they are those of a separate legal person (the subsidiary), although 100 per cent of the share capital of the subsidiary may be owned by the “parent” company.

Under the International Swaps and Derivatives Association (ISDA) documentation applicable at the time, a legally separate subsidiary would in effect benefit from an unlimited parent guarantee. In the context of financial trading, for counterparties, this meant that the situation was almost “as if” they traded with the parent company, or a branch. The trade could be subject to local rules, but with a United States bank holding guarantee. This opened the possibility to enjoy the best of many different worlds: for instance, to trade under a more relaxed regime while benefiting from the parent’s guarantee and the backing of the United States federal government in case of a bailout.

Dodd-Frank purportedly closed this possibility with Section 722(i). But the CFTC introduced a loophole in its own legislation making it possible to adapt the form of past practices and keep the substance. The July 2013 Guidance made “[United States] persons” in swaps trades subject to all Dodd-Frank’s swap rules, regardless of the physical location of the swap execution.

However, footnote 563 of the Guidance stated: “The Commission agrees with commenters who stated that Transaction-Level Requirements should not apply if a non-[United States] swap dealer or non-[United States] major swap participant (MSP) relies on a written representation by a non-[United States] counterparty that its obligations under the swap are not guaranteed with recourse by a [United States] person.”

Consequently, newly (officially) “de-guaranteed” foreign subsidiaries were no longer subject to Dodd-Frank. It has been reported and understood among swaps industry experts that a large portion of the United States swaps market shifted from the largest United States bank holding companies and their United States affiliates, to their newly de-guaranteed “foreign” affiliates, even though those swaps remained on the consolidated balance sheets of these United States institutions (Greenberger, 2018). Also, these huge United States bank holding company swaps dealers were often “arranging, negotiating, and executing” these purported “foreign” swaps in the United States, through United States personnel but then “assigning” those fully executed swaps to their newly “de-guaranteed” foreign subsidiaries, asserting that these swaps were not covered by Dodd-Frank even though completed in the United States.

By arranging, negotiating, and executing swaps in the United States, with United States personnel and then “assigning” them to their “foreign” newly “de-guaranteed” subsidiaries, these swaps dealers once again have the best of both worlds: swaps execution in the United States under the parent bank holding companies’ direct control, but the ability to move the swaps abroad out from Dodd-Frank (Greenberger, 2018:126).

The 2013 Guidance and Policy Statement was superseded on 23 July 2020 by the CFTC which issued its Final Rules regarding the cross-border application of various requirements under the United States Commodity Exchange Act. Importantly, however, the definition of a “[United States] person” has been further narrowed. For example, a collective investment vehicle owned by [United States] persons was considered a “[United States] person” in the Guidance (although such a legal vehicle does not have legal personality). In the Final Rules, it is not a “[United States] person” anymore (CFTC, 2020).

Although a fully accurate estimate of the extent to which swaps have moved abroad from the United States is not available, it is estimated that up to 95 per cent of certain lines of swaps trading had moved outside the United States under the de-guaranteed loophole and thus were considered not to be subject to Dodd-Frank swaps regulations. An international race-to-the-bottom of swaps regulation ensued (Greenberger, 2018). Partly as a result of this regulatory loopholing, Greenberger estimated that, in the United States, the ratio of speculators versus hedgers, historically around 30 per cent speculators to 70 per cent commercial hedgers, has inversed: 70 per cent speculators to 30 per cent hedgers (Greenberger, 2013).

In the European Union, the European Commission broadly modelled its approach to OTC trading on DoddFrank. Yet its key regulatory issues, such as the regulation of OTC derivatives and the enforcement of aggregate positions limits for all market participants, have been controversial and divisive (Suppan, 2010). After the G20 meeting in Pittsburgh in 2009, position limits became a cornerstone of the regulatory approach.

Position limits imposed on market actors are supposed to ensure that derivatives markets work for the commercial producers, and not for purely financial operators with no intrinsic interest in the commodities themselves. Importantly, this means that industrial and financial market participants are to be treated differently. The classical method used is to set position limits and provide bona fide exemptions for commercial producers as in the Dodd-Frank Act. In the European Union, the Markets in Financial Instruments Directive (MiFID), notably MiFID I and II, apply to commodity derivatives, but include a number of key exemptions. Under MiFID II, a specific “ancillary activity exemption” is available where a firm’s activities relating to commodity derivatives are “ancillary” to its main business.

2. Global food traders: Commercial hedgers or financial institutions?

At its core, the problem of regulatory gaps centres on the dichotomy between the regulatory treatment of commodity traders as manufacturing corporations on the one hand, and their increasingly more profitable (yet unregulated) activities in financial markets, on the other. The concept behind this distinction between commercial and financial market participants is that an industrial business should only look for security in prices; not betting for the sake of it. However, large grain processors with access to a wealth of information regarding food markets have a clear interest in using their hedging activities as a profit centre. In the process, they tend to change their business model and start operating like a financial actor, with the benefit of exemptions designed for purely commercial hedgers.

“Large grain processors with access to a wealth of information regarding food markets have a clear interest in using their hedging activities as a profit centre.”

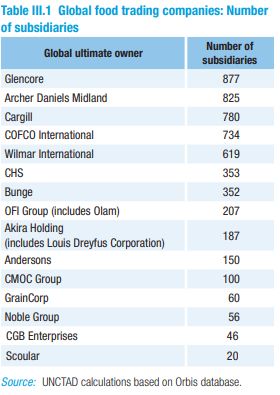

By using a series of subsidiaries located in appropriate jurisdictions, food monopolies have found a way to combine several advantages:

– A superior knowledge of the agricultural commodities markets (real-time supply and demand and prospective knowledge of their evolution);

– An ability to store agricultural commodities to harness price surges when they occur, ABCD have invested heavily in infrastructure for storage and built significant grain reserves; but with no obligation to disclose their grain stocks;

– Secrecy of their operations and the benefit from derogations to the rules applicable to pure financial actors. ABCD have all legally structured their operations using hundreds of subsidiaries incorporated to take advantage of the various menus of regulations (or lack thereof) offered by the different jurisdictions, including secrecy jurisdictions, around the world (table III.1).

Although some of the challenges of implementing regulatory reforms are due to the operational complexity and opacity of the global food trading industry (indicated in table III.1), many key arguments against closer regulatory attention are constructed by group politics

The core of regulatory arbitrage opportunities lies in the use of the concept of legal personality and subsidiaries. As the investigation shows below, in the case of major food giants, using hedging for purely speculative purposes appears to take place at the level of subsidiaries, often not being reported at a consolidated (GUO, Global Ultimate Owner) level.

Increasingly, however, in the context of 2020–2023 crises, there is growing recognition that such regulatory dichotomy poses a range of potentially systemic risks to financial stability (FSB, 2023), price stability and economic security (UNCTAD, 2022) and corporate governance, including through risks of illicit financial flows (OECD, 2023; Public Eye, 2023).

In 2012–2013, the Financial Stability Board (FSB) considered classifying large physical commodity trading houses (which are without exception major participants in derivatives markets) either as shadow banks or as “systemically important non-bank financial institutions” or both. This would have made them subject to greater regulation.6 The industry pushed back, insisting that commodity trading is a highly complex, globally interconnected manufacturing sector managing a range of specialized risks on a large scale (Baines, 2017). In the event, the FSB concluded there was insufficient evidence to consider trading houses as shadow banks but left the door open for future revision of this stance (Gibbon, 2013).

In the absence of close regulatory oversight, the transformation of commodity trading houses into shadow financial institutions continued unabated. Following the implosion of the 2008–2010 commodity bubble, many of the world’s largest banks have scaled down their commodity trading operations. Some institutions (e.g., Barclays, Deutsche Bank) have exited the business. These departures opened the space for less regulated entities such as commodity trading firms. As a result, “large trading companies have gained access to increasingly sophisticated instruments that offer them greater financial flexibility and enable them to avoid any controls by banks” (Public Eye, undated).

At the global level, large commercial groups (“ABCD”-type) with real commercial hedging needs have been developing additional financial strategies designed to enhance profit margins, further challenging the regulatory framework of the industry and posing potential threats to financial stability (FSB, 2023). Some of these risks came to the fore during the energy crisis in 2020 when commodity companies faced severe liquidity difficulties (Longley and Chin, 2022). Lévy-Garboua (2022) has called such traders “semi-financial” players, with one foot in finance (their liabilities, which make greater use of leverage than a company, albeit much less than a bank) and one foot in the real world (the raw materials they hold). Yet this real world is close to the financial markets, due to the extreme volatility of prices (Lévy-Garboua, 2022). Implications for financial stability arise from the fact that central banks are helpless when addressing such entities. They require intermediary institutions to take on the functions typically carried out by banks when dealing with commodity traders. From the perspective of central banks, only banks and, to a greater extent, central clearing platforms, are well-suited to this role.

Academics have long suggested that global food trading corporations have expanded the scope of control over the industry to become not simply oligopolies, but cross-sectoral value chain managers (Clapp, 2015). Crucially, this includes control over the financial assets. Yet methodologies or monitoring tools that would help capture the scale and impacts of this transformation at a systemic level were, up to now, lacking. The idea that the commodity trading industry will self-regulate means there is an absence of established regulatory guidelines in the industry, making it challenging to differentiate between commercial and financial institutions.

With this task becoming more urgent in light of recent volatility and crises, a new method is proposed below to advance this discussion.

3. How to differentiate between financial and commercial companies, using the “asset dominance” ratio

Analysis of the food trading sector’s profitability presented in section B above established that non-operating activities were the main source of heightened profit growth in the food trading sector during 2020–2022. But what is the best way to gauge the level and impact of the financial activity undertaken by a global non-financial corporation?

The answer to this question presented below has its origins in corporate accounting methods.7 In corporate accounting, financial instruments used in intrafirm financing are typically described on the balance sheet of entity filings. The method used here is based on examining the corporate filings of 13 of the major global food commodity traders and comparing the accounts of the corporate parent with the accounts of group subsidiaries. The result is measured by an indicator called the asset dominance ratio (ADR), which aims to capture financial (as opposed to “real”) economic activity carried out inside a corporate structure. This is achieved by comparing information presented in the balance sheet with income statements in corporate filings. More specifically, ADR points to heightened use of intragroup transfers within private corporate groups. Intragroup transfers are financial transactions between legally independent entities within a corporate group.

As table III.1 shows, large companies such as food traders consist of a parent company and tens, in some cases, hundreds of subsidiaries. A great deal of intrafirm transfers take place among the parent and subsidiaries, and between subsidiaries themselves. There are two main types of such intragroup transfers: (a) transfer pricing, which involves trading activities between group members; and (b) intragroup financing, which involves using financial instruments to create debt or equity relationships between group members.

In corporate accounting, balance sheet items represent an approximation of all forms of financial investments by the reporting entity (e.g., a subsidiary or the corporate parent); while income statements document the amount of revenue harvested from those investments during the reporting period. Due to the known problem of tax avoidance through transfer pricing, corporate intrafirm trading is subject to considerable regulation. The regulation of intragroup financing, however, is less developed than transfer pricing, and is a concern for regulators. The study presented here is predicated on the assumption that tracking intragroup financing requires comparing balance sheets and income statements because financial instruments are accounted for on the balance sheet. This helps simplify the complexity of financial reporting within multinational corporations.

More precisely, ADR is computed as the mean average of all reported balance sheet items compared to the mean average of all income statement items presented by the corporate entities under examination. Note that:

• An ADR figure at or below 1 describes an industrial corporation in this sector;

• An ADR of more than 1 indicates that financial investment activity outweighs the earnings activities from core business and investments.

This metric focuses on the use of financial instruments in intragroup financing and gives weight to certain reporting patterns. Findings show that the use of intragroup financing is significant in generating excess profits.

It is commonly performed by select members of a corporate group whose primary role is corporate financing and treasury functions. The use of financial instruments is often reported in multiple places within accounting categories, and the magnitude of assets and liabilities involved is much larger than the values reported on the income statement.

For governance purposes, it is important to compare not only the subsidiaries within a group but also the consolidated parent company’s reporting. Consolidated reporting, oriented towards shareholders, excludes intragroup transfers. Thus, analysing changes in excess values produced by subsidiaries excluded from consolidated reporting is crucial from the point of view of: (a) financial stability, (b) tax avoidance and fiscal revenues; (c) risks of illicit financial flows (IFF).

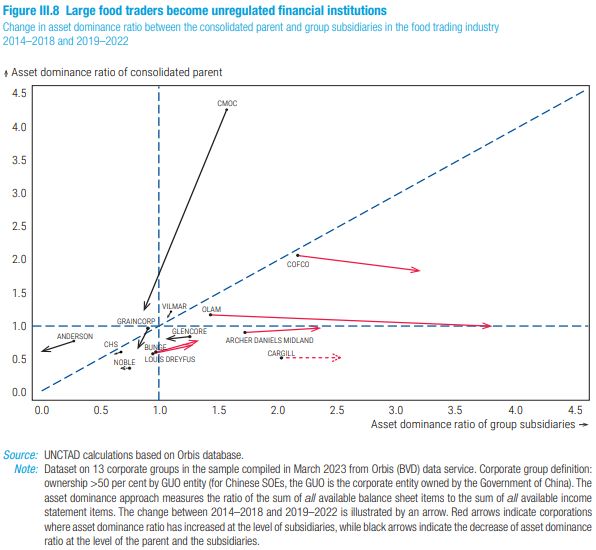

Figure III.8 illustrates the change in asset dominance ratio between the consolidated parent (GUO in most cases) and group subsidiaries for the 13 companies in the sample. It presents an analysis of the corporate activity, including at the level of subsidiaries, between two time periods:

• the period when hedging predominates in the OTC markets (2014–2018);

• the period of speculation on OTC markets and excessive corporate profits (2019–2022).

This analysis pinpoints shifts in the reports of these corporate groups, which indicate these entities are taking advantage of the profit opportunities that have arisen in recent years. The distinction between data presented by the consolidated parent group (y axis) and data presented by the group’s subsidiaries (x axis) is key. The diagonal in the graph depicts the points where subsidiary reports match the information presented in the consolidated public reporting. As positioned in figure III.8, being at or below 1 (e.g., GrainCorp in the sample) depicts an accounting profile of a typical industrial corporation. The diagonal differentiating the two halves of the graphic where there is a difference in the information presented by the financial reporting: one which is “hidden” (subsidiary level) and one which is “already public” (consolidated parent).

In figure III.8, the ADR is the ratio of the sum of all available balance sheet items to the sum of all available income statement items. The change in the ratio is illustrated by an arrow, where the starting point is the period of 2014–2018, and the endpoint of the arrow is the period of 2019–2022. Red arrows indicate corporations where asset dominance ratio has increased at the subsidiary level, while black arrows indicate the decrease of asset dominance ratio at the level of the parent.

Three key conclusions can be drawn from these findings:

• First, the cases showing growth in asset dominance are observed primarily at the subsidiary level within the group, indicating increased use of intragroup transfers.

• Second, this suggests that the amount of excess profits being made could be underestimated when only looking at public profit and loss reporting.

• Third, profiteering is not limited to a specific sector but is specific to individual firms. There are concerns that excess profits may be linked to market concentration, benefiting only a few global players in the commodity trading community. This reinforces the need to consider group membership and the evolving behaviour of major international players in the sector. It is pertinent that these three issues crystallized in the commodities sector at the peak of the energy crisis in 2020–2021, when market volatility threatened the financial stability of clearing houses and required the support of public liquidity injections. The financial crisis of utility companies highlighted the risks of liabilities on hidden balance sheets and underscored banks’ exposure to commodity firms facing sharp market volatility (Petrou, 2022; Foroohar, 2020).

As monetary tightening continues in advanced economies, there are growing market fears that similar financial structures may arise and threaten the stability of individual companies, as well as the international financial system (FSB, 2023). Therefore, it is necessary to adopt rules to the effect that commodity derivatives play their useful social function while preventing excessive speculation in the financial markets for food and dysfunction of food systems globally (Thomas, 2023; OECD, 2023).

D. REGULATORY LESSONS

When asked who is monitoring the food system globally, beyond the prism of antitrust, a former senior economist at the United Nations Food and Agriculture Organization replied: “Nobody” (Thomas, 2023).

The absence of harmonized global rules provides ample opportunities for regulatory arbitrage, which is exploited differently by different market participants. As noted above in section C, large United States banks use “de-guaranteed” subsidiaries to evade Dodd-Frank. Other actors use exemptions available thanks to their commercial activities in order to conduct what amounts to financial speculation. The United Kingdom Financial Services Authority (which oversees the world’s second largest agricultural commodities market outside the United States) does not even distinguish between commercial and financial traders (de Schutter, 2010). As a result, the commodities sector is lightly supervised, much of it is opaque, and regulation of key actors is close to non-existent (Jones, 2022).

The current fragmented and outdated approach to regulating the global food industry has many causes. But with new types of risks and shocks confronting an already complex, opaque yet strategically important system, it is time to revisit the menu of available regulatory pathways. Such a challenge is vast. Below, measures are outlined relating to what are considered the root causes of the current regulatory gaps: the flawed distinction between commercial and financial operators, and an outdated set of systemic regulations that have not kept pace with financial, technical and legal innovation available to corporate groups. Possible solutions centre on three interrelated levels of policy reform that capture the connection between market practices and financial activities:

1. Market-level reform: close loopholes, facilitate transparency;

2. Systemic-level reform: recognize aspects of food traders’ activities as financial institutions and extend relevant regulations;

3. Global governance-level reform: extend monitoring and regulations to the level of corporate subsidiaries in the sector to address the problem of unearned profits, enhance transparency and curb the risks of illicit financial flows.

Crucially, all three levels of necessary action require much more cooperation on data quality, disclosure and corporate transparency in the sector. The ongoing crises highlight that the historical approach, which distinguishes between commercial and financial operators in agricultural commodity derivatives, is ill-suited to the current economic and legal structures of global trade in certain agricultural products and their associated derivatives. While data transparency is necessary, it is insufficient for market participants to discover prices. What is required is a process in which all market participants contribute daily price information, and which is accessible to all participants and regulators on a daily basis.

Following the UNCTAD vision to reform the financial regulatory framework, scaling up could take place in a three-fold manner:

1. Market-level: close existing loopholes, facilitate market transparency and competition (Dodd-Frank, CFTC, MiFID, European Commission).

Consider applying several rules to all the exchanges around the world:

• Improve stock (public and private) information. Excessive speculation is made easier by a lack of transparency on stock levels. Information about one’s inventory can be made a pre-condition to act on the derivatives market. The information can also be used to evaluate whether combined positions correspond to a hedging strategy or to excessive speculation.

• Build a highly disaggregated dataset with volume/weight of commodity, import price value, source and destination countries, all company names obtained via customs declarations linked to each unit of commodity movements, and time stamps for shipment and receipt.

Both proposals can build on the experience of the Agricultural Market Information System (AMIS), an interagency platform to enhance food market transparency. It was launched in 2011 by the G20 Ministers of Agriculture following the global food price hikes in 2007, 2008 and 2010. By bringing together the principal agricultural commodity trading countries, AMIS assesses global food supplies (focusing on wheat, maize, rice and soybeans) and thus helps alleviate market uncertainty.8

Clearly distinguish between commercial hedging and financial speculation, with the understanding that the historical segregation between commercial/financial does not apply to today’s structure of the world agricultural commodities exchanges (de Schutter, 2010).

Current practices and unsupported assertions by market participants seeking minimal oversight of their trading activities cannot be the sole focus with respect to bona fide hedging recognitions. Legitimate hedging relating to physical commodities through derivatives markets must not be jeopardized by those seeking exposures for investment, speculative, or dealing reasons.

• Access to commodities derivatives markets could be restricted to traders and specialist brokers.

• The holdings of any single trader should be known to all. Strict position limits should be placed on individual holdings, such that they are not manipulative. UNCTAD (2011a) noted that determining appropriate levels of position limits is difficult, but as a first step, it might be useful to adopt position points at which traders would be required to provide additional information.

• The limits currently set in the United States and Europe are too high. For the same reason that the United States sets federal limits applying to all markets, this needs to be globally set. Position limits must address a proliferation of economically equivalent instruments trading in multiple trading venues. Position limits at the exchange level cannot suffice (Behnam, 2020).

• Improve market transparency in physical commodity markets, commodity futures exchanges and OTC markets. Require market participants to disclose their positions and trading activities (UNCTAD, 2011a, 2011b). There should be clearing to the maximum extent possible of OTC derivatives, so that there is real time reporting of all transactions made without information privileges for OTC traders. The small minority of OTC derivatives which cannot be cleared should nevertheless be reported within a short time lag.

• The unfair competitive advantage conferred by the OTC trade data reporting delay not only impedes price discovery but makes it harder for exporters and importers to manage price risks and investment, as UNCTAD has repeatedly noted. If developing countries continue to spend a high portion of hard currency reserves on food and energy imports, while the rate of return in commodity investments remains unpredictable, the “distortion of development” will intensify (Suppan, 2010; UNCTAD 2011a).

2. Systemic-level: Promote competition in commodity markets to curb the concentration of market power in the hands of a few large players.

Systemic reforms can include laws such as breaking up monopolies, promoting the entry of new market players, considering measures such as antitrust laws, adherence to modern international financing reporting standards (IFRS) in commodity trading, and supporting the participation of small farmers and producer organizations in commodity markets.

Regulation should support the development of physical markets to reduce the destabilizing impacts of unregulated financial instruments and promote price discovery based on physical supply and demand fundamentals. This could include measures such as supporting the development of commodity exchanges in developing countries and promoting the use of physical delivery contracts in commodity trading. Also, contingency plans need to be developed to deal with potential market disruptions.

More fundamentally, regulators should revisit the plans of 2010–2012 and recognize the financial aspects of food traders’ activities as systemically important and extend relevant regulations. Like the previous set of measures, these date back to policy discussions in the wake of the 2007–2009 financial and commodity price crises. At the time, lack of evidence was cited as a reason not to pursue a closer regulatory focus.

Notwithstanding the existing rules, there is widespread agreement that as of late, the dynamics and price signals of supply and demand have been overwhelmed by financial speculators, making price discovery, and hedging, challenging, if not impossible (Tarbert, 2023). There are also warning signs from the financial risks in the underregulated energy market, where amidst the uncertainty of 2022, utility companies did not have enough working capital to meet big collateral calls. It became apparent that government regulators and private sector risk managers had failed to prepare for the crisis (Tett, 2022).

Measures to help mobilize fiscal resources, curb regulatory arbitrage and enhance corporate transparency also need to be expanded and updated. Conservative estimates suggest that today, multinational enterprises (MNEs) avoid tax payments of at least $240 billion per year, due to outdated international taxation rules. These rules allow multinationals to treat each national subsidiary as a separate “arm’s-length” entity for tax purposes, and to move profits to low- or no-tax jurisdictions. The study presented above demonstrated some of the effects of this fragmentation for companies in the global food trading industry. Chapter VII of the 2022 Trade and Development Report analysed the problem of corporate arbitrage in the area of foreign direct investment (FDI).

There are mounting calls from academia and civil society to address the problem of corporate arbitrage at the regulatory level. For instance, tax and other forms of regulatory arbitrage can be prevented by recognizing that multinationals are global unitary businesses, and by abandoning the arm’s-length principle. Multinationals’ profits could then be divided among countries according to a formula based on the location of revenues, employees and so on (Ghosh, 2023).

3. Global economic governance: The evidence presented above underscores two dimensions of the regulatory impact of the financialization of food trading. At the level of companies themselves, their transformation into shadow banks poses systemic, regulatory and stability challenges. Additionally, there is a link that needs to be examined between the speculative activity of food traders in the financial markets, and price instability.

More and more evidence is emerging not only about profiteering in food and commodity trading, but of the role of unregulated financial activities and institutions inside commodity trading giants. An estimate of the scale of the phenomenon was provided above, but more research is needed. In addition to system-wide measures to strengthen regulation in food commodities and enhance food security – such as harmonized and clearer rules, enforceable controls to limit the destabilizing influence of high-frequency trading and position limits (Kornher, 2022) – regulators and policymakers should apply some of the financial stability measures developed for the banking system in 2011–2012 to large food trading giants.

This requires further work on the nature of systemic risk in the highly financialized industry. This can only effectively be done as part of the reform to the global financial ecosystem, an idea strongly endorsed by the first Financing for Development Conference organized by the United Nations in 2001. Since then, efforts at global reforms have been slow and often non-inclusive, while the unresolved problems of financial and resource asymmetries only continued to deepen (Ryding and Rangaprasad, 2022). In light of recent crises, such efforts should include regulation of corporate behaviour including at the subsidiary level, to address the problem of unearned profits, opacity and risks of illicit financial flows. This direction of work could capitalize on the plans for a United Nations Tax Convention (see Tax Justice Network, 2022) and be usefully supported by the work of the Independent Commission for the Reform of International Corporate Taxation established in November 2022 (ICRICT, 2023).

Some lessons from the recent attempts to increase transparency and regulate super profits in the energy sector are relevant here. Several countries have levied windfall taxes on the oil industry, following the dramatic rise in profits in the sector amidst the energy and inflation crisis of 2022. A similar strategy could be imagined with regards to the profits derived from speculation on the food commodities derivatives markets. At the same time, levying windfall taxes does not address the main issue for developmental purposes, which is to have commodities derivatives markets fulfilling their role: providing hedging solutions for producers and processors.

There are, moreover, numerous issues with the retroactive taxation of speculative profits. The first is that the profits have often been booked in tax havens whose cooperation is unlikely. Second, retroactive taxation creates constitutional issues in many jurisdictions. In some countries, it is unconstitutional, and, in many others, courts accept retroactive taxes only in limited circumstances, such as closing a blatantly abused loophole. A windfall tax would most likely be litigated in many forums with substantial chances of success. A windfall tax does not deliver on the opportunity created by illuminating that there are serious issues with the rules applying to the world food commodities derivatives markets. Although States may need to address their constituents’ desire for the correction of what they perceive as an unfair outcome, the structural issue needs to be addressed via other means.

In this respect, a 15 per cent global minimum tax rate agreed to in 2021 by 136 countries, further to a plan by the OECD, is often seen as a major step towards countering tax avoidance and artificial arbitrage strategies by multinational groups of companies generally. Yet this is a compromise measure agreed after fraught international negotiations. Alternative measures, such as a median global tax rate of 21 per cent, as proposed by ICRICT, would serve to offset the potential revenue lost, making a significant difference to developing countries (Ghosh, 2023).