A Greek Tragedy: Act III; Eurozone Talks Break Down

- A Greek Tragedy : Act III - Duane Campbell (Democratic Socialists of America)

- Eurogroup Talks to Resume on Saturday After Failure to Bridge Differences - Associated Press (ekathimerini.com)

- Lenders United Reject Greek Proposal, Ask for More - Theo Ioannou, Reuters (The TOC - Times of Change)

- What the Bankers are Now Demanding - Link to the Creditor Proposals

By Duane Campbell

June 24, 2015

DSA - Democratic Socialists of America

Left activists need to understand the crisis of austerity being imposed by European bankers on Greece, Spain, Italy and Portugal, among others. A catastrophe on the scale of the Great Depression has been forced upon Greece for over five years under the deceptive description of a "bailout."

Lets start with a few basics usually not considered in the corporate media descriptions of the crisis.

What happened ?

1. In 2010 and 2011, mainly German and French banks in pursuit of high profits made massive loans to Greek firms. When the banks recognized that this was a high risk, they were bailed out (not Greece) by transferring the debt from the banks to the public institutions like the European Central Bank and the IMF. Now the ECB and the IMF are trying to force the Greek government to cut pensions, education, salaries, and health care to pay for the bail out of the banks.

These funds were transferred from banks, the ECB, and the IMF to pay back banks, the ECB and the IMF. Few funds were used to assist the Greek people. That is loans are being used to refinance the debt. They are recycled back to Germany, France and other nations' banks. (Macropolis)

2. The German nation owes as much money to the Greek people as Greece owes to Germany and the European Central Bank combined.

But Greece can not collect from Germany. Germany has the political and economic power (and allies such as the U.S.) to enforce debt repayment by starving the Greek economy and forcing the Greek nation into a great depression. (Hallinan, "Greece, Memory and Debt."

3. The current policies are imposing a depression on Greece. Austerity policies have produced a decline in the Greek economy by over 25% since 2010. John Maynard Keynes explained this effect of imposed austerity during a depression way back in the 1930s, but the bankers and the governments they control choose to ignore this reality in part because it is not in their interest.

There are significant and complex economic issues here, but it is equally important to not allow narrow, technocratic, bankers' and economists' insiders views to go unchallenged. The problem is not that they are technocrats, but that their numeracy (number crunching) disguises a particular set of political assumptions that enriches and protects the wealthy at the expense of everyone else.

The domination of discussion in the media and in academia by a narrow and limited view of economics allows the neoliberal (pro- finance capital) assumptions to determine policy. To understand this process of wealth extraction, we need to recognize how debt has been transferred from banks to nominally "public" institutions such as the IMF and the European Central Bank.

The bankers' assumptions produce policy choices that make the rich richer and the poor poorer. They are not the product of a science of economics but of the well-financed pursuit of self interest and the promotion of profit by the financial oligarchy.

To begin to comprehend an alternative, you need to understand, along with Greek Finance Minister Yanis Varoufakes, that this is not a Greek crisis, it is a Eurozone crisis that is currently having its most devastating effects on the people of Greece, Spain, Portugal and Italy, and immigrant minorities in France, among others. See his explanation here:

The crisis is severe. These countries, and particularly young people, are going through a depression, similar in scope and magnitude to of the Great Depression of the 1930's which brought fascism to power in Germany, Italy and Spain.

The austerity demands of European bankers and politicians have shattered the economy of Greece, producing layoffs, wage and pension reductions, and huge cutbacks in health care. Some 44 percent of the Greek people are now living below the poverty line.

Pensions for retirees is currently one of the major sticking points preventing a compromise between Greece and the Eurozone bankers.

The Financial Times reports, "main pensions have been slashed 44 to 48 percent since 2010, reducing the average pension to 700 euros a month . About 45 percent of Greek pensioners receive less than 665 euros monthly - below the official poverty threshold." This is about $745 dollars per month. (Mark Weisbrot)

Many pensioners and their families have already been reduced to poverty, and currently the European Central Bank and the IMF insist on yet further cuts in pensions. For honest recording of the many and changing data points, I recommend the Center for Economic Policy and Research.

The crisis was initially created by the general crisis of capitalism in 2008/2009.

During this period, Europeans, especially in Greece, Spain and Italy, suffered a recession similar to our own, including use of tax dollars to save major banks. The looting of the U.S. economy crashed the world economy and caused the massive cutbacks Greeks and others continue to suffer. The situation is not improving.

In Europe, as in the U.S., the banks were bailed out at public expense while the working people were required to pay the bailout costs. Bankers raised their profits by imposing policies of severe loan paybacks as a part of the program known as austerity. Austerity policies are ruining the Greek economy - and you and I should care, in part because similar policies and programs are at work in the U.S. and are advocated by most of the Republican candidates for President.

Bankers imposed their plan for austerity through their influence on government power, and quasi-governmental institutions such as the International Monetary Fund, the World Bank and the European Union Central Bank. In the poorer countries of Europe, the imposition of austerity has made the economic situation worse year by year while maintaining a very profitable system for finance capital and capitalists. This is class war of the rich against the poor and impoverished.

Why is this devastation austerity policy being imposed? Austerity is imposed by coordinated economic power because, in the short term, it serves the interests of finance oligarchs in Europe and the U.S. If we misunderstand the nature of the crisis being imposed upon the people of Greece, Spain, etc, then we are likely to misunderstand the crisis being imposed upon working people and pensioners and college students ( among others) here in the U.S.

Under the current system of political economic advantage and ideological domination in the European Union, the working people, the 99%, cannot win. They are being forced into increasing desperation, at times with the support of working people in Germany, for example, who support their government's harsh economic extractions from Greece due to nationalists' myth making rather than an analysis of economic reality. See the excellent essay on Greece: "Memory and Debt".

A government responding to the needs of the 99% of its own people, as has the Syriza government of Greece, would need to seek alternatives to the continuing economic despoliation. If a democratic government is elected in Spain this fall, they will face similar demands from the bankers and creditors.

The European Monetary Union is not going to change, because the current system is very profitable for the financial oligarchy.

There are alternatives. Leading economists recognize the failure of the austerity approach and have proposed alternatives, but the banking sector will not consider reform. See "A Modest Proposal": A significant number of mainstream economists have proposed reasonable if moderate alternatives ( Joseph Stiglitz, Thomas Piketty, and others: "Economists Demand End to Greek Austerity"). A Greek exit from the Eurozone may be the best of several bad options. They could leave the 19-member Eurozone (European Monetary Union) but remain in the 28-nation European Union. As an example, Great Britain is in the European Union but not in the European Monetary Union known as the Eurozone.

Another alternative supported by a left wing in Syriza would be for Greece to follow the example of Iceland and nationalize the banks rather than bail them out with further bank and IMF loans that must be repaid by further cutting of pensions, schools, health care and social services. Certainly, a new policy direction is needed.

So, what do we do as a left in the U.S.?

First, we need to comprehend the reality of the oligarchy using the governments to impose austerity in Europe and in the U.S. To do this, we need to turn to alternative media and economic institutions, since the oligarchy funds and promotes its views and claims a consensus on the "Greek crisis." I recommend the several papers at the Center for Economic Policy and Research site.

The bankers and the governments that they control argue that Greece is just being irresponsible. This blaming the victim is the same argument that U.S. finance used to blame the poor and people of color home owners in the U.S. for the real estate crisis that the banks caused in 2008/2009. The oligarchy has a significant infrastructure and well endowed economists to promote their neoliberal economic viewpoints.

Study and analysis and acts of solidarity beyond the dominant paradigms will help us to develop policies and practices for the needed battle in our own society against corporate greed and the neoliberal finance oligarchy. These forces control a growing number of state governments, including Kansas, Wisconsin, Ohio, Louisiana, Texas and most of the South. The corporate forces provide the resources for the Republican Party victories in the U.S. Congress, which consistently promotes austerity policies at the federal level as well as providing the economic and media advisors of most of the Republican candidates for the U.S. presidency.

We need to break the stranglehold on what passes for economic thinking here in the U.S. as well as in Europe.

[Duane Campbell is a professor emeritus of bilingual multicultural education at California State University Sacramento, a union activist for over 40 years, and former chair of Sacramento DSA. He blogs on politics, education and labor at www.choosingdemocracy.blogspot.com and www.talkingunion.wordpress.com . He recently returned from Greece.]

Thanks to the author for sending this to Portside.

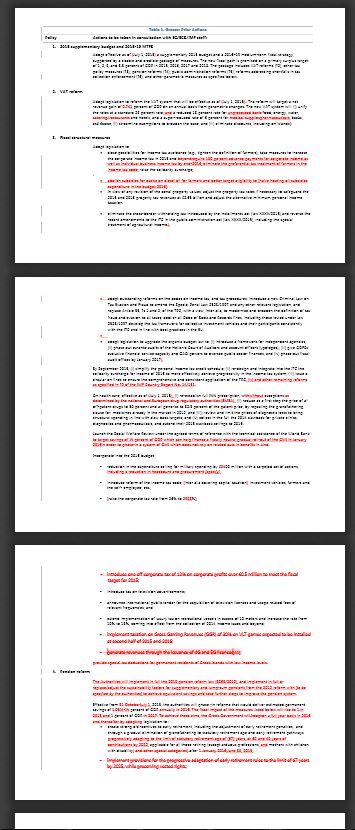

Eurogroup talks in Brussells, June 25.

credit: ekathimerini.com

Eurogroup Talks to Resume on Saturday After Failure to Bridge Differences

By Associated Press - Lorne Cook in Brussels, Elena Becatoros in Athens and David McHugh in Frankfurt, Germany, contributed to this report

June 25, 2015

ekathimerini.com (Greece)

Talks between Greece and its eurozone partners broke up Thursday without agreement, intensifying doubts about whether Athens can make a crucial debt payment due in just a few days. The negotiations will resume Saturday.

Finance ministers from the 19 nations using the euro currency failed to bridge differences over the kinds of reforms that Greeces radical left government must implement to qualify for billions in new loans.

It was the latest in a series of negotiating road blocks, and a major setback since there had been hopes to reach a deal in time for European leaders to approve it at a summit later in the day.

"Eurogroup back later, but not today," Finland's finance minister, Alexander Stubb, tweeted as the talks broke up. Two EU officials, who declined to be named while deliberations were ongoing, said that the ministers would meet again on Saturday.

The blockage happened after leaders from the International Monetary Fund, the European Central Bank and the European Commission raised the stakes by putting forward their joint position on the reforms they would accept to offer Greece a financial lifeline.

But Greece was still not on board, and wanted to stick to a previous plan it has offered.

A Greek government official said that Athens remains "steadfast in support of the proposals" the country had made earlier in the week.

Greeces most influential creditor, Germany, had never been optimistic about a breakthrough Thursday.

The Greek government so far has "not moved, rather moved backward, and so I am not very confident for our meeting today," said German Finance Minister Wolfgang Schaeuble as he arrived for the eurozone meeting.

He said nothing new is on the table and added that "there is a bigger difference rather than a coming together."

Schaeuble insisted that "the decision lies exclusively with those responsible in Greece."

Greek Prime Minister Alexis Tsipras was under pressure to seal a deal before facing other European Union leaders at the summit.

But he is also under massive pressure from Greeks themselves as the compromises suggested so far will mean fresh hardship for citizens already suffering the impact of past austerity measures to bring public spending into line.

According to Greek officials at the talks, creditors are seeking a different mix of austerity measures than those proposed by Athens, making the cuts more immediate.

They include broad pension cuts, higher revenue from sales tax, and a faster elimination of tax exemptions - demands that are likely to fuel dissent within the government if accepted.

Representatives from almost every Greek party were in Brussels, following developments blow by blow, to see whether they would be able to back any new deal in the Greek parliament, where a vote must pass by Monday.

"We are at a critical moment," Greek Labor Minister Panos Skourletis warned on private Antenna television.

"There are issues that for us are paramount - that must be included in an agreement. These are tackling the debt so that it can go on a sustainable course, and the financing of the economy," he said.

A senior lawmaker in Tsipras' radical left governing party, Nikos Filis, denounced the international demands for new spending cuts as "blackmail."

Greece has a 1.6 billion-euro ($1.8 billion) debt to pay on Tuesday which it cannot afford unless the creditors unfreeze 7.2 billion euros (8.1 billion dollars) in bailout money.

A failure to reach agreement with its creditors and a default on its debts could force Greece out of the eurozone, which would be hugely painful for the country. Some experts say it could be manageable for Europe and the world economy, but that remains unclear and any failure would likely shake global markets.

Amid the uncertainty over Greeces future, bank deposit holders have been pulling money out of the banks. That has forced the European Central Bank to increase emergency credit to the Greek banks on a daily basis since last week.

Experts say that if Greece does not reach a deal, it could have to put limits on money withdrawals soon.

Miranda Xafa, senior fellow at the Center for International Governance Innovation and a former IMF official, said that the talks were now "more a matter of signing a deal, even a painful deal" that would cover Greece for three to nine months.

If no deal is struck quickly, she said, Greece could see "capital controls as early as next week."

Markets edged higher on news of the new proposals by creditors. Europes Stoxx 50 index was up 0.2 percent, while the Athens Stock Exchange was up 0.6 percent. Greeces sovereign borrowing rates eased, a sign of an easing in tensions among investors.

Lenders United Reject Greek Proposal, Ask for More

By Theo Ioannou, Reuters

June 25, 2015

The TOC - Times of Change (Greece)

**It's beginning to feel like Groundhog Day, with Greece rejecting the EU proposals, EU rejecting the Greek proposals and yet another Eurogroup meeting ending in vain.

After the end of yet another short (but certainly not sweet) Eurogroup meeting, EU officials sounded tired, angry and borderline frustrated with the Greek negotiating methods. Eurozone finance ministers suspended talks on a cash-for-reform deal to avert a looming Greek default next week and agreed to resume efforts on Saturday morning, a eurozone official said.

German Chancellor Angela Merkel told European centre-right party leaders there must be a debt deal with Greece before financial markets reopen next Monday, two participants in the meeting said.

She also told the closed-door meeting of leaders of the European People's Party before an EU summit in Brussels that Germany "will not be blackmailed" by Greece, they said. Other participants in the session declined to confirm what Merkel had said.

IMF spokesman Gerry Rice said discussions on debt sustainability and financing for Greece will have to wait until Athens agrees and implements key reforms.

We've been calling for a balanced approach, and for all sides to play their part," Rice told reporters in Washington. "First we need to see the reforms agreed and implemented. And on the other side, we need to have the requisite financing and debt sustainability addressed."

The IMF had insisted in the past that Greece will need some form of debt relief to make its finances sustainable. But on Thursday, the Fund appeared to be closer to position of euro zone officials, who say the creditors would not discuss any debt restructuring until after Greece implements the remainder of its bailout program.

"As a matter of longstanding policy, the Fund does not extend payment deadlines," Rice said, when asked about flexibility around this date. He also said IMF Managing Director Christine Lagarde would inform the board "promptly" of Greece's failure to pay, given the visibility of the issue.

Earlier Italian Prime Minister Matteo Renzi appeared semi-confident that an agreement between the EU and Greece will be found soon. "If you want my forecast there will not be a deal at the summit," Renzi said in Brussels before joining the start of the gathering, adding however that there would still be time for a solution to save Greece from default.

So it appears that an umpteenth extension to the Greek drama has been witnessed. The European and Greek bandwagon will be back in Brussels on Saturday, while low level officials from both sides will, once more, try to bridge the seemingly endless distance between the two sides. Perhaps during a break, they should all enjoy a screening of the hilarious "Groundhog Day". Or, alternatively, watch the 1980s fairytale film "Never-ending Story"

What the Bankers are Now Demanding - Link to the Creditor Proposals

Here is a link to the 5-page document containing the counter-proposals put forward by Greece's lenders on Wednesday.

The document, first revealed by The Wall Street Journal, was met with profound skepticism from Greek officials.

Read full document here.