Friday Nite Videos | Sept 17, 2021

Portside

Ten years ago, Occupy Wall Street transformed American politics.

Lean-in feminism and other variants of corporate feminism have failed the overwhelming majority of us, who do not have access to individual self-promotion and advancement and whose conditions of life can be improved only through policies that defend social reproduction, secure reproductive justice, and guarantee labor rights.

Lean-in feminism and other variants of corporate feminism have failed the overwhelming majority of us, who do not have access to individual self-promotion and advancement and whose conditions of life can be improved only through policies that defend social reproduction, secure reproductive justice, and guarantee labor rights.

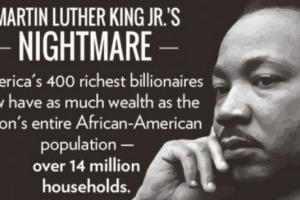

The typical millionaire receives about $145,000 in public tax benefits, while working families get a grand total of $174 on average. In 2043, minorities will be the majority and the will have doubled. The lingering effects of generations of discriminatory and wealth-stripping practices have left black and Latino households far behind white families, and may impact their economic trajectories in the decades to come.

The typical millionaire receives about $145,000 in public tax benefits, while working families get a grand total of $174 on average. In 2043, minorities will be the majority and the will have doubled. The lingering effects of generations of discriminatory and wealth-stripping practices have left black and Latino households far behind white families, and may impact their economic trajectories in the decades to come.

Four out of every five - or more - have said the government makes them feel either angry or frustrated. These frustrated Americans may not fully realize it, but there's a strong case for more government - not less - as the most promising way to improve the nation's standard of living. The American government pretty much stopped growing when the civil rights movement forced whites to share public space with African Americans, then Latinos, Asians and Native Americans.

Four out of every five - or more - have said the government makes them feel either angry or frustrated. These frustrated Americans may not fully realize it, but there's a strong case for more government - not less - as the most promising way to improve the nation's standard of living. The American government pretty much stopped growing when the civil rights movement forced whites to share public space with African Americans, then Latinos, Asians and Native Americans.

Using policy to shift economic power and make U.S. incomes grow fairer and faster. Boosting income growth for the bottom 90 percent requires a policy agenda that explicitly aims to halt or reverse the rise in inequality. Finding no relationship between rising inequality and faster growth means raising living standards for the bottom 90 percent can likely be better for overall growth.

Using policy to shift economic power and make U.S. incomes grow fairer and faster. Boosting income growth for the bottom 90 percent requires a policy agenda that explicitly aims to halt or reverse the rise in inequality. Finding no relationship between rising inequality and faster growth means raising living standards for the bottom 90 percent can likely be better for overall growth.

Portside is proud to bring our readers a full chapter from the book Imagine: Living in a Socialist USA. Periodically Portside will be sharing with our readers chapters and excerpts from books we feel are noteworthy. What better way to launch, than a book about socialism-in the USA. Ron Reosti's chapter - A Democratically Run Economy Can Replace the Oligarchy - argues we can democratically design and control an economy that satisfies the needs and desires of the people.

Portside is proud to bring our readers a full chapter from the book Imagine: Living in a Socialist USA. Periodically Portside will be sharing with our readers chapters and excerpts from books we feel are noteworthy. What better way to launch, than a book about socialism-in the USA. Ron Reosti's chapter - A Democratically Run Economy Can Replace the Oligarchy - argues we can democratically design and control an economy that satisfies the needs and desires of the people.

A large majority of Americans, 68 percent, in a recent ABC/Washington Post poll said our economic system favors the rich rather than the majority. About half of those who said they were Republicans agreed. Economist Joseph Stiglitz has been following opinion research and consistently found that the percentages of those who see too much wealth inequality were high among men and women, Democrats and Republicans, people with lower incomes, even those with higher incomes.

A large majority of Americans, 68 percent, in a recent ABC/Washington Post poll said our economic system favors the rich rather than the majority. About half of those who said they were Republicans agreed. Economist Joseph Stiglitz has been following opinion research and consistently found that the percentages of those who see too much wealth inequality were high among men and women, Democrats and Republicans, people with lower incomes, even those with higher incomes.

Bernie Sanders is campaigning on behalf of the 99 percent against the 1 percent. And, he is getting lots of supports, drawing thousands to his campaign rallies. Sanders is not running an explicit socialist campaign for public or worker ownership of major firms. Sanders's socialist values underpin his argument that the economy should serve the needs of the people and be governed not by corporate oligarchs, but by democratic means.

Bernie Sanders is campaigning on behalf of the 99 percent against the 1 percent. And, he is getting lots of supports, drawing thousands to his campaign rallies. Sanders is not running an explicit socialist campaign for public or worker ownership of major firms. Sanders's socialist values underpin his argument that the economy should serve the needs of the people and be governed not by corporate oligarchs, but by democratic means.

The wealthiest Congress in history, the first in which a majority of members are millionaires, we have a one-sided discussion demanding cuts only in public assistance to the poor, while ignoring public assistance to the rich. And a one-sided discussion leads to a one-sided and myopic policy. We're cutting one kind of subsidized food - food stamps - at a time when Gallup finds that almost one-fifth of American families struggled in 2013 to afford food.

The wealthiest Congress in history, the first in which a majority of members are millionaires, we have a one-sided discussion demanding cuts only in public assistance to the poor, while ignoring public assistance to the rich. And a one-sided discussion leads to a one-sided and myopic policy. We're cutting one kind of subsidized food - food stamps - at a time when Gallup finds that almost one-fifth of American families struggled in 2013 to afford food.

Spread the word