This Website IDs Corporations Profiting From the Abuse of Communities of Color

Colorlines

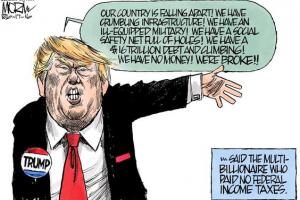

Among the report’s key findings: 100 companies enjoyed at least one year in which their federal income tax was zero or less, 24 companies paid zero taxes in four out of eight years, 18 companies paid no federal income tax over the eight-year period, Collectively, the 258 corporations enjoyed $513 billion in tax breaks over the last eight years. More than half of those tax breaks, $277 billion, went to just 25 of the most profitable corporations.

Among the report’s key findings: 100 companies enjoyed at least one year in which their federal income tax was zero or less, 24 companies paid zero taxes in four out of eight years, 18 companies paid no federal income tax over the eight-year period, Collectively, the 258 corporations enjoyed $513 billion in tax breaks over the last eight years. More than half of those tax breaks, $277 billion, went to just 25 of the most profitable corporations.

Promises that a free lunch can be had by relying heavily on private investors for infrastructure should be viewed skeptically. Tax credits dangled to entice private financiers and developers to provide infrastructure provide no compelling efficiency gains and mostly just open up possibilities for corruption and crony capitalism.

Promises that a free lunch can be had by relying heavily on private investors for infrastructure should be viewed skeptically. Tax credits dangled to entice private financiers and developers to provide infrastructure provide no compelling efficiency gains and mostly just open up possibilities for corruption and crony capitalism.

On both sides of the Atlantic, citizens are seizing upon trade agreements as a source of their woes. While this is an over-simplification, it is understandable. Today's trade agreements are negotiated in secret, with corporate interests well represented, but ordinary citizens or workers completely shut out. Not surprisingly, the results have been one-sided: workers' bargaining position has been weakened further, compounding the effects of legislation undermining unions.

On both sides of the Atlantic, citizens are seizing upon trade agreements as a source of their woes. While this is an over-simplification, it is understandable. Today's trade agreements are negotiated in secret, with corporate interests well represented, but ordinary citizens or workers completely shut out. Not surprisingly, the results have been one-sided: workers' bargaining position has been weakened further, compounding the effects of legislation undermining unions.

Matthew Desmond is an academic who teaches at Harvard - a sociologist or, you could say, an ethnographer. But I would like to claim him as a journalist, and one who has set a new standard for reporting on poverty. In Milwaukee, he moved into a trailer park and then to a rooming house on the -poverty-stricken North Side and diligently took notes on the lives of people who pay 70 to 80 percent of their incomes for homes that are unfit for human habitation.

Matthew Desmond is an academic who teaches at Harvard - a sociologist or, you could say, an ethnographer. But I would like to claim him as a journalist, and one who has set a new standard for reporting on poverty. In Milwaukee, he moved into a trailer park and then to a rooming house on the -poverty-stricken North Side and diligently took notes on the lives of people who pay 70 to 80 percent of their incomes for homes that are unfit for human habitation.

While some communities are currently enjoying the fruits of the recovery, others have sunk further into poverty. According to the authors, this pattern of distress vs. prosperity not only “diverges between cities and states but even more starkly within cities at the neighborhood level." In the period of recovery following the Great Recession, the authors find, jobs in the median U.S. ZIP code grew at less than half the national rate.

While some communities are currently enjoying the fruits of the recovery, others have sunk further into poverty. According to the authors, this pattern of distress vs. prosperity not only “diverges between cities and states but even more starkly within cities at the neighborhood level." In the period of recovery following the Great Recession, the authors find, jobs in the median U.S. ZIP code grew at less than half the national rate.

Spread the word