Why Do Ivy League Schools Get Tax Breaks? How The Richest US Colleges Get Richer

International Business Times

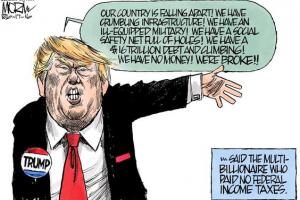

Why is Trump breaking his promise on carried interest? The White House is full of bankers and hedge fund managers who, over the last decade, have collectively dodged nearly $180 billion in taxes!

Donald Trump is hiding something, and we know where. He’s hiding it in his taxes. Elizabeth Warren explains.

This study isn’t the only one to show the positive impacts of sugary beverage taxes. This study on Berkeley’s soda tax found a whopping 21 percent decrease in sugary beverage consumption. At Harvard, researchers predicted that Philadelphia’s sugary beverage tax, which went into effect this year, could prevent 36,000 cases of obesity over 10 years, prevent more than 2,000 cases of diabetes in the first year after the tax reaches its full effect, and save $200 million.

This study isn’t the only one to show the positive impacts of sugary beverage taxes. This study on Berkeley’s soda tax found a whopping 21 percent decrease in sugary beverage consumption. At Harvard, researchers predicted that Philadelphia’s sugary beverage tax, which went into effect this year, could prevent 36,000 cases of obesity over 10 years, prevent more than 2,000 cases of diabetes in the first year after the tax reaches its full effect, and save $200 million.

Among the report’s key findings: 100 companies enjoyed at least one year in which their federal income tax was zero or less, 24 companies paid zero taxes in four out of eight years, 18 companies paid no federal income tax over the eight-year period, Collectively, the 258 corporations enjoyed $513 billion in tax breaks over the last eight years. More than half of those tax breaks, $277 billion, went to just 25 of the most profitable corporations.

Among the report’s key findings: 100 companies enjoyed at least one year in which their federal income tax was zero or less, 24 companies paid zero taxes in four out of eight years, 18 companies paid no federal income tax over the eight-year period, Collectively, the 258 corporations enjoyed $513 billion in tax breaks over the last eight years. More than half of those tax breaks, $277 billion, went to just 25 of the most profitable corporations.

Sanders calls out Trump for going back on his campaign promises, lying about corporate tax rates, and continues his push for a single-payer healthcare system.

Spread the word