We, the Plutocrats vs. We, the People - Saving the Soul of Democracy

TomDispatch

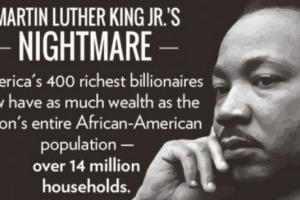

Our country's greatest failing, the true disaster, of our time: the scourge of growing inequality, economic and political. It is despicable as the very wealthy convert their financial might into political power to guard that wealth while exacerbating inequality further. This is the vast difference between a society whose arrangements serve all its citizens or one whose institutions have been converted into a stupendous fraud - democracy in name only.

Our country's greatest failing, the true disaster, of our time: the scourge of growing inequality, economic and political. It is despicable as the very wealthy convert their financial might into political power to guard that wealth while exacerbating inequality further. This is the vast difference between a society whose arrangements serve all its citizens or one whose institutions have been converted into a stupendous fraud - democracy in name only.

Spread the word