Newly available data from the Bureau of Labor Statistics’ Employer Costs for Employee Compensation data allows an update of the trends of worker bonuses through September 2018, to gauge the impact of the GOP’s Tax Cuts and Jobs Act of 2017. The tax cutters claimed that their bill would raise the wages of rank-and-file workers, with congressional Republicans and members of the Trump administration promising raises of many thousands of dollars within ten years. The Trump administration’s chair of the Council of Economic Advisers argued in April that we were already seeing the positive wage impact of the tax cuts:

A flurry of corporate announcements provide further evidence of tax reform’s positive impact on wages. As of April 8, nearly 500 American employers have announced bonuses or pay increases, affecting more than 5.5 million American workers.

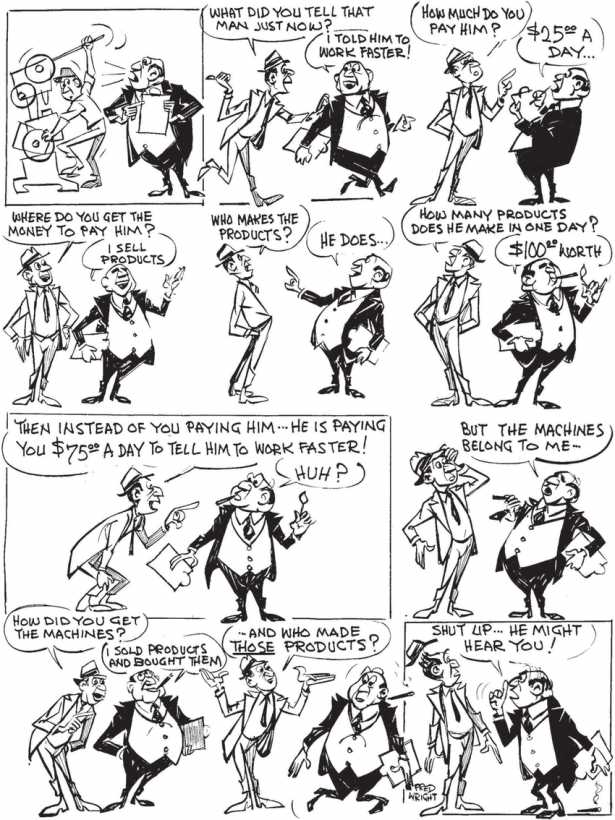

Following the bill’s passage, a number of corporations made conveniently-timed announcements that their workers would be getting raises or bonuses (some of which were in the works well before the tax cuts passed). But as Josh Bivens and Hunter Blair have shown there are many reasons to be skeptical of the claim that the TCJA, particularly corporate tax cuts, will produce significant wage gains.

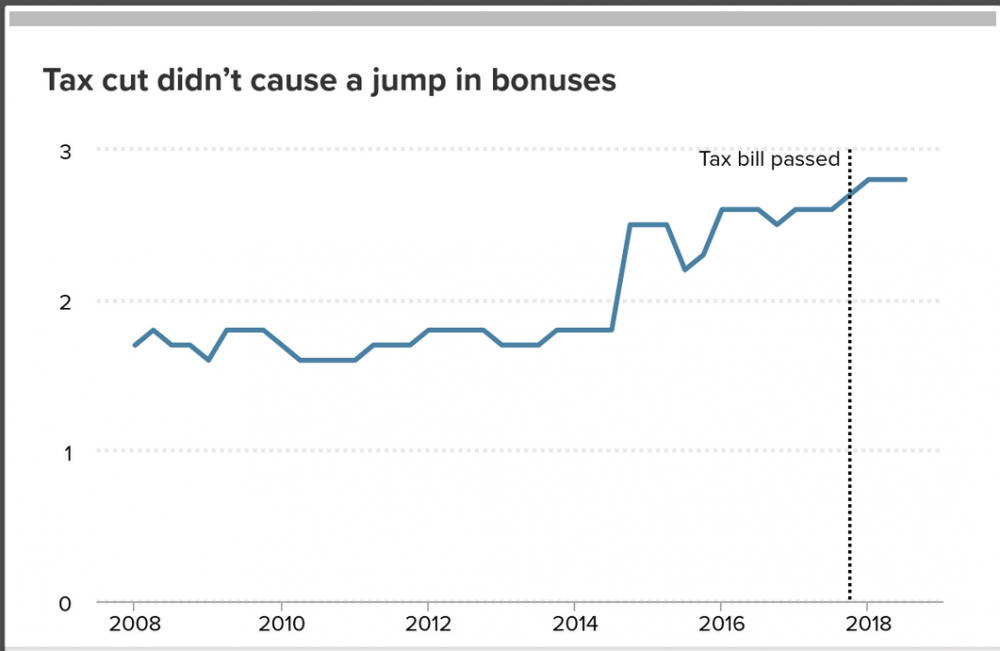

The new data allows us to examine nonproduction bonuses in the first three quarters of 2018 to assess the trends in bonuses in absolute dollars and as a share of compensation. The bottom line is that there has been very little increase in private sector compensation or W-2 wages since the end of 2017. The $0.02 per hour (inflation-adjusted) bump in bonuses between December 2017 and September 2018 is very small. Nonproduction bonuses as a share of total compensation grew from 2.73 percent in December 2017 to 2.78 percent in September 2018, an imperceptible growth. Moreover, whatever growth in bonuses has taken place is not necessarily attributable to the tax cuts, rather than employer efforts to recruit workers in a continued low unemployment environment.

As a June 2018 Wall Street Journal article noted:

Bonuses started taking off four years ago. Businesses have been electing to give workers short-term payouts for retention and morale, rather than longer-term wage increases the economy had experienced in previous decades. Anecdotally, the trend of bonuses rather than permanent wage increases continues. A recent report by the Federal Reserve showed employers in the Atlanta Fed district were “increasing the proportion of employee compensation that is not permanent and can be withdrawn, if needed.”

The figure below shows the share of total compensation represented by nonproduction bonuses for private sector workers since 2008.

There was a sharp jump up in the share of compensation going to bonuses between the second and third quarters of 2014, rising from 1.8 to 2.5 percent, but a fairly mild drift upwards since then. The increase from the fourth quarter of 2017 to the first quarter of 2018 was from 2.7 to 2.8 percent of compensation, an increase from $0.92 to $0.96 an hour. The third quarter, measured as of September 2018, shows the same share and level of nonproduction bonuses, $0.96 an hour and 2.8 percent of compensation. The inflation-adjusted increase (all inflation-adjusted data adjusted to September 2018 dollars) in bonuses was just $0.02 an hour between the fourth quarter 2017 and the third quarter of 2018.

An examination of overall wage and compensation growth does not provide much in the way of bragging rights for tax cutters, especially given the expectation of rising wages and compensation amidst low unemployment.

The $0.02 increase in inflation-adjusted bonuses per hour over the last three quarters came as W-2 wages (defined as direct wages plus wages for paid leave and supplementary pay) actually fell $0.07, a 0.3 percent decline.

The White House contention that corporate tax cut-inspired widespread provision of bonuses that led to greater paychecks through bonuses or wage increases for workers is not supported by the BLS Employer Costs for Employee Compensation data. This is not surprising. Press releases—“a flurry of corporate announcements”—by a small group of administration-supporting firms do not create widespread bonuses or wage growth for workers. Neither do tax cuts, at least within the first nine months.

EPI is an independent, nonprofit think tank that researches the impact of economic trends and policies on working people in the United States. EPI’s research helps policymakers, opinion leaders, advocates, journalists, and the public understand the bread-and-butter issues affecting ordinary Americans.

Spread the word