The Agricultural Act of 2014, signed into law by President Obama last Friday, includes $8 billion in cuts to the Supplemental Nutrition Assistance Program (SNAP) over the next decade. One way the bill proposes to accomplish these savings is by reducing food stamp fraud. When the new farm bill is enacted, many of America’s hardest working families will experience cuts in services and have trouble putting food on their family’s table. But there will be major gains for an industry that most Americans might not expect: banking.

Banks reap hefty profits helping governments make payments to individuals, business that only got better when agencies switch from making payments on paper—checks and vouchers—to electronic benefits transfer (EBT) cards. EBT cards look and work like debit cards, and by 2002, had entirely replaced the stamp booklets that gave the food stamp program its name. SNAP is the most well-known program delivered via EBT, but they also carry payments for Temporary Aid to Needy Families (TANF); Women, Infants and Children (WIC); childcare subsidies; state general assistance; and many other programs. EBT use is widespread, from the corner store to the supercenter. According to a 2012 USDA report, SNAP funds, averaging $133 per family member per month, can be spent at more than 246,000 authorized stores, farmers' markets, farms, and meal providers nationwide.

Not only are the operating costs of delivering benefits by EBT lower—no paper checks to cut, envelopes to stuff, or postage to pay—but electronic forms of payment allow banks to multiply opportunities for revenue generation. Banks hold contracts with federal, state, and municipal agencies to provide EBT cards and services, collect interest on federal reserve money held for government programs (though not on SNAP funds), charge transaction fees for merchant use of bank technology and infrastructure, and levy penalties on users for EBT card loss, out-of-network use, and balance inquiries. Banks make money distributing government benefits if the economy is bad, because more people sign up for assistance; they make money if the economy is good, because rising interest rates mean more profit on the money they hold to distribute to beneficiaries.

Distributing government benefits is a lucrative industry. According to the Government Accountability Institute, J.P. Morgan Chase, which currently controls EBT contracts in 21 states, Guam, and the Virgin Islands, made more than half a billion dollars between 2004 and 2012 providing government benefits to U.S. citizens. In New York alone, J.P. Morgan Electronic Financial Services (EFS) holds a nine-year, $177 million EBT services contract with the State Office of Temporary and Disability Services (OTDA). New York currently pays $0.95 per month for each its 1.7 million SNAP cases. In addition, J.P. Morgan EFS collects penalties and fees from benefit recipients: $5 to replace a lost EBT card, $0.40 for each balance inquiry, $0.50 each time their cards are declined for insufficient funds, and $1.50 per withdrawal if they use ATMs to get cash more than once a month. While information about profit margins on EBT contracts is neither collected at the national level nor released by banks, EBT is a significant growth area for big banks. Last year, the Federal Reserve Payments Study reported that the number of EBT transactions more than doubled since 2006.

Electronic benefits delivery is such a rewarding business that banks seem to fear only two things: policy changes and bad publicity. The publicity problems of EBT programs became obvious over the last three months of 2103 when three major EBT system failure scandals erupted. The threat of policy change is perhaps less visible. New regulations could take distribution of these benefits out of the hands of for-profit banks, limit the fees they are able to collect, or mandate a switch from EBT cards to different kinds of electronic funds transfer with fewer opportunities for generating revenue, such as direct deposit. But banks have nothing to fear in the new Agricultural Act; it’s only good news for the finance sector.

The new farm bill lowers benefit levels somewhat, exempts new categories of people—college students, ex-felons, and lottery winners—from SNAP eligibility, and prohibits advertising to increase enrollment of eligible individuals, like radio and television campaign launched by the USDA in 2004. But the bill's sponsor, Representative Frank Lucas (R-OK), and other members of the House Committee on Agriculture seem to trust that detecting and preventing fraud will accomplish much of the hoped-for savings. The new Act includes numerous fraud-fighting provisions, including those that:

- Require merchants to maintain unique terminal identification numbers for point of sale machines, further restrict the kinds of food that can be bought with SNAP, and bar manual sales of food items without bar codes;

- Improve procedures and technologies to facilitate state-to-state and state-to-federal information sharing;

- Invite federal-state collaborative pilot projects to “identify, investigate, and reduce fraud” by merchants; and

- Set aside $40 million to help the USDA store information, such as food purchase data from chain stores and loyalty card companies, and data-mine it, by linking store sales and EBT transaction data at the household level to uncover purchasing patterns, for example.

In short, the SNAP fraud provisions will increase the ability of state and federal agencies to track who bought what food, where, and for how much. A vast amount of information on the purchases of millions of U.S. citizens will be collected by state agencies and private entities, stored by the USDA, and data-mined for patterns of EBT use that indicate fraud.

Why will this intensified focus on fraud work out so well for banks? First, banks innovate and control the most cutting-edge technologies that detect and prevent fraud in electronic funds transfer. The financial sector employs armies of computer programmers, IT specialists, and software engineers, and banks hold dozens of patents on biometric technology, data-mining systems, and payment tracking software. State and federal agencies can develop fraud-fighting code and procedures themselves, but many lack sufficient capacity and choose instead to contract with banks. Florida, for example, piloted an eight-month EBT abuse detection project in 2012 that was staffed by both J.P. Morgan and state employees, as Peter Schweizer reported in The Daily Beast. The anti-fraud provisions of the farm bill, thus, provide a significant opportunity for more, and more lucrative, contracts for banks.

Second, fraud in food stamps, despite public perceptions, is already low, and getting from very little fraud to zero fraud is prohibitively expensive. This is especially true for trafficking—the trading of SNAP benefits for cash—the most common form of SNAP fraud. Merchants and recipients must work together to traffic SNAP benefits. Recipients approach a merchant, who might offer 50 cents on the dollar to convert food stamps to cash. The merchant runs the EBT card, hands over cash, and then reports sales for reimbursement by the Treasury. Current fraud detection and prevention focuses on suspicious patterns—merchants who claim lots of even-dollar sales, recipients who spend all of their SNAP benefits in the first week of the month—but traffickers have adjusted quickly, learning to input odd dollar amounts and to spread requests for reimbursement over time.

The USDA estimates that the amount of SNAP benefits being trafficked has been reduced by 145 percent since 1993. According to a March 2011 Food and Nutrition Service (FNS) report, for the period of 2006-2008, trafficking diverted about 1 cent of each benefit dollar. Trafficking is difficult to detect and prevent, because retailers and recipients who commit fraud adapt as fast as banks, states, and the USDA can develop new data-mining and investigative procedures. This fraud-detection arms race is expensive and time-consuming for government agencies and contractors, and adds cumbersome limits and procedures for users—both merchants and recipients—most of whom aren’t committing fraud.

What cost are we willing to bear to reduce SNAP fraud to less than a penny per dollar? Federal and state government agencies invest astronomical sums in high-tech tools to address a financially negligible problem. For comparison's sake, while we lose $330 million a year to SNAP trafficking, Ashlea Ebeling of Forbes estimates that the U.S. government loses $40 to $70 billion a year to offshore tax evasion. Nevertheless, in 2012, the FNS conducted 4,396 undercover investigations of retail grocers suspected of fraud, at an undisclosed cost to taxpayers, identifying violations in about 40 percent of cases. In 2011, Alabama's RFP for EBT services strongly encouraged potential vendors to “recommend the use of new and innovative technologies” to “improve detection and prevention of fraud” and integrate biometrics in their proposals for the state’s SNAP program. The five-year Alabama contract, worth $51 million, went to Xerox, the same company that denied SNAP users in 17 states access to food for several hours when they shut down their EBT system without any warning last October.

Third, only three firms handle the majority of EBT contracts with states and U.S. territories: J.P. Morgan EFS (23 contracts); Xerox State and Local Solutions, Inc. (17 contracts); and eFunds Corporation, a subsidiary of FIS Global (11 contracts). On February 10, J.P. Morgan confirmed that it plans to sell its prepaid card business, including U.S. Public Sector and EBT programs, after suffering a serious data breach on debit cards used at Target stores and facing inquiries from Connecticut and New York about its lack of sufficient privacy safeguards and high card fees. This may leave even fewer players in the mix, and that’s a bad thing, according to Michele Simon, author of the report, "Food Stamps, Follow the Money: Are Corporations Profiting From Hungry Americans?", who provided a copy of the New York/J.P. Morgan EBT contract for this story. When so few firms control such significant market share, it implies limited competition and excessive market power. Simon suggests, in fact, that the recent changes to SNAP represent a large, mostly overlooked corporate subsidy. “The real policy challenge in SNAP is not fraud. It is the fact that we have an $80 billion a year program that does not solve hunger, and certainly does not provide good nutrition, but instead is a boon for banks, big box retailers, and junk food companies.”

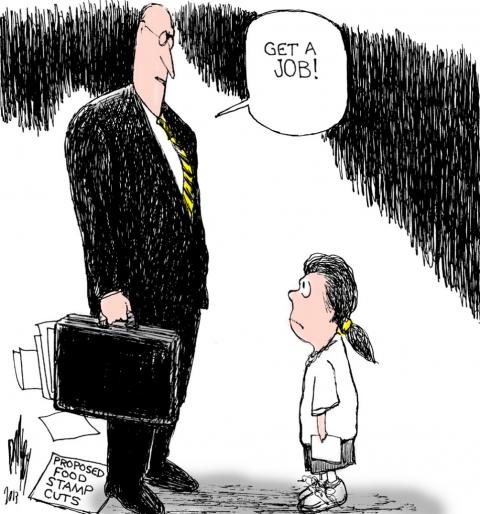

If banks are secret winners, the losers are pretty clear: taxpayers, particularly those who receive nutritional support through the SNAP program. That’s one in seven Americans at this moment, and 52 percent of all Americans at some point in their lifetimes, according to Mark Rank, author of One Nation, Underprivileged: Why American Poverty Affects Us All. Put simply, the Agricultural Act of 2014 takes money from a program that serves the majority of Americans and gives it to banks and high-tech companies.

But it does something else. These provisions improve a system meant to collect information on the food purchases of more than half of the U.S. population, and fund the development of increasingly sophisticated technology to sift and analyze it. In the same year that we expressed shock and outrage that the NSA is collecting meta-information on our cellphone calls and Google searches, why are we acquiescing, even welcoming, a sophisticated new program to collect American consumer information? Do we really want the federal and state governments data-mining our grocery lists?

We need a solution that contains bank profits and prevents this kind of mass surveillance. The answer’s simple: stop trying to predict fraud, eliminate complicated rules about what can and cannot be bought with food stamps, and switch to direct deposit.

A key challenge of this solution is connecting benefits recipients with affordable bank accounts, because for-profit banks are not particularly interested in low-balance, high-transaction customers. But, according to Aleta Sprague, policy analyst in the Asset Building Program at the New America Foundation, strategies that focus on eliminating barriers to bank accounts will provide significant benefits for poor and working Americans. Connecting benefits recipients to the financial mainstream poses real challenges to both the public assistance system and current financial practices, but there are intriguing experiments already underway. In Washington state, for example, a collaboration of the Department of Commerce and Burst for Prosperity is connecting households on public assistance with affordable banking services and requiring that no-fee accounts be included in future EBT provider contracts.

“Instead of seeking to monitor and regulate every purchase a low-income consumer makes,” says Sprague, “we should recognize and capitalize on the potential of the public assistance system to serve as a mechanism for financial inclusion. That way, rather than constructing the safety net around distrust of the poor, we would leverage the system to increase families’ financial autonomy and capabilities.”

Direct deposit is more efficient, cheaper, and requires less administrative oversight. That’s why the IRS, Social Security, and Unemployment Insurance encourage us to use it. What direct deposit would not allow is paternalistic rules about how public assistance beneficiaries choose to use their resources to best support their families. Treating SNAP recipients like the reasonable, hard-working adults they are is not only simpler and less expensive; it is most just.

Spread the word