I’ve been watching with some dismay the wrestling match going on between the governor and the Maine Legislature over the opportunity offered by the federal Affordable Care Act to expand our MaineCare program.

Proponents of expansion of MaineCare make their argument on both moral and economic grounds. Such expansion would provide health care coverage for almost 70,000 low-income Mainers who will otherwise receive no assistance from the ACA. More coverage would result in better management of our burgeoning level of chronic illness as our population ages. That will drive down the use of expensive crisis-oriented emergency services as well as the illness-inducing stress produced by out-of-control health care bills in low-income patients already afflicted by poor health.

Since 100 percent of the costs of the proposed expansion would be borne by the federal government for at least the first three years of the program (gradually reduced to 90 percent by 2020), MaineCare expansion under the ACA would also provide significant economic benefits to Maine in the form of federal dollars and the jobs they will create in every county in the state. According to a new study released last week by the Maine Center for Economic Policy and Maine Equal Justice Partners, if MaineCare were expanded under the terms of the ACA it would stimulate more than $350 million in economic activity, lead to the creation of 3,100 new jobs, and result in the generation of up to $18 million in state and local taxes.

Since the Legislature has now refused to override the governor’s veto of the expansion, those federal dollars (including those originating from Maine taxpayers) and their associated benefits will go to other states that accept the deal.

Some opponents of expansion claim that they don’t trust the feds to keep their word (even though it’s now written into law) and that we won’t be able to get rid of the extra costs should they renege on their commitment. Others are simply philosophically opposed to bigger government. It seems as though some are opposing MaineCare expansion simply out of spite.

This fight could be avoided, and is just a symptom of a more fundamental underlying disease — the way we pay for health care in the U.S. Our insurance-based system requires that we slice and dice our population into “risk categories.”

This phenomenon was made worse by PL 90, the “pro-competition” health insurance reform law passed by the Republican legislature in 2011. Now we’re seeing older, rural Mainers pitted against younger, urban ones. This type of discrimination is the very basis of the insurance business.

Many conservatives still characterize Medicaid as “welfare,” and many think of it as such. Presumably other types of health care coverage have been “earned” (think veterans and the military, highly paid executives, union members and congressional staff). We resent our tax dollars going to “freeloaders.” Until the slicing and dicing is ended, the finger pointing, blame shifting and their attendant political wars will continue.

In sharp contrast, our Canadian neighbors feel much differently. Asked if they resent their tax dollars being spent to provide health care to those who can’t afford it on their own, they say they can’t think of a better way to spend them. “Isn’t that what democracy is all about?” I’ve heard Canadian physicians say, “Our universal health care is the highest expression of Canadians caring for each other.”

Here in Maine, the response tends to be much different. Canadians seem to think health care is a human right. We don’t — yet.

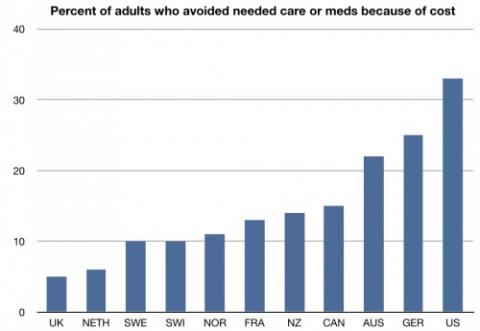

If everybody was in the same health care system in the U.S., as is the norm in most wealthy nations, we would be having a much different and more civil conversation than what we are now witnessing in Augusta. No other wealthy country relies on the exorbitantly expensive and divisive practice of insurance underwriting to finance their health care system. They finance their publicly administered systems through broad-based taxes or a simplified system of tax-like, highly regulated premiums. Participation is mandatory and universal.

Taxation gets a bad rap in the U.S. and consequently is politically radioactive. Yet it is the most efficient, most enforceable and fairest way to finance a universal health care system.

In her excellent New Yorker essay called “Tax Time,” Jill LePore points out that taxes are what we pay for civilized society, for modernity and for prosperity. Taxes insure domestic tranquility, provide for the common defense, promote the general welfare, and take some of the edge off of extreme poverty. Taxes protect property and the environment, make business possible and pay for roads, schools, bridges, police, teachers, doctors, nursing homes and medicine.

Oliver Wendell Holmes once said, “Taxes are what we pay for a civilized society.” The wealthy pay more because they have benefited more.

Canada’s tax-financed health care system covers everybody, gets better results, costs about two-thirds of what ours does and is far more popular than ours with both their public and their politicians. There is no opposition to it in the Canadian Parliament.

What’s not to like about that?

Oh yes, and the average Canadian is now wealthier than the average American. Their far more efficient and effective tax-based health care system is part of the reason.

Physician Philip Caper of Brooklin is a founding board member of Maine AllCare, a nonpartisan, nonprofit group committed to making health care in Maine universal, accessible and affordable for all. He can be reached at pcpcaper21@gmail.com.

Spread the word