At this moment, at the White House as well as the Departments of Treasury and Justice, officials are debating a legal theory that previous presidents and any number of legal experts — including me — ruled out in 2011, when the Obama administration confronted a default.

The theory builds on Section 4 of the 14th Amendment to argue that Congress, without realizing it, set itself on a path that would violate the Constitution when, in 1917, it capped the size of the federal debt. Over the years, Congress has raised the debt ceiling scores of times, most recently two years ago, when it set the cap at $31.4 trillion. We hit that amount on Jan. 19 and are being told that the “extraordinary measures” Treasury has available to get around it are about to run out. When that happens, all hell will break loose.

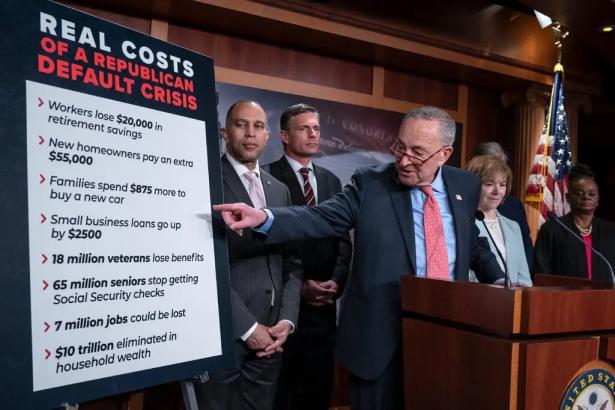

Taking advantage of that prospect, congressional Republicans are threatening to do nothing unless the administration agrees to slash lots of government programs that their party has had in its sights. If the president caves in to their demands, they will agree to raise the cap — until this crisis occurs again. Then, they will surely pursue the same game of chicken or, maybe more accurately, Russian roulette. It’s a complicated situation, but a solution is staring us in the face.

Section 4 of the 14th Amendment says the “validity” of the public debt “shall not be questioned” — ever. Proponents of the unconstitutionality argument say that when Congress enacted the debt limit, effectively forcing the United States to stop borrowing to honor its debts when that limit was reached, it built a violation of that constitutional command into our fiscal structure, and that as a result, that limit and all that followed are invalid.

I’ve never agreed with that argument. It raises thorny questions about the appropriate way to interpret the text: Does Section 4, read properly, prohibit anything beyond putting the federal government into default? If so, which actions does it forbid? And, most important, could this interpretation open the door for dangerous presidential overreach, if Section 4 empowers the president single-handedly to declare laws he dislikes unconstitutional?

I still worry about those questions. But I’ve come to believe that they are the wrong ones for us to be asking. While teaching constitutional law, I often explored the problem of bloated presidential power, the puzzle of preserving the rule of law in the face of unprecedented pressures, and the paradox of having to choose among a set of indisputably bad options. During my last semester teaching, with Covid forcing my seminars from the classroom to the video screen, I studied the most insightful literature on the debt ceiling and concluded that we need to reframe the argument.

The question isn’t whether the president can tear up the debt limit statute to ensure that the Treasury Department can continue paying bills submitted by veterans’ hospitals or military contractors or even pension funds that purchased government bonds.

The question isn’t whether the president can in effect become a one-person Supreme Court, striking down laws passed by Congress.

The right question is whether Congress — after passing the spending bills that created these debts in the first place — can invoke an arbitrary dollar limit to force the president and his administration to do its bidding.

There is only one right answer to that question, and it is no.

And there is only one person with the power to give Congress that answer: the president of the United States. As a practical matter, what that means is this: Mr. Biden must tell Congress in no uncertain terms — and as soon as possible, before it’s too late to avert a financial crisis — that the United States will pay all its bills as they come due, even if the Treasury Department must borrow more than Congress has said it can.

The president should remind Congress and the nation, “I’m bound by my oath to preserve and protect the Constitution to prevent the country from defaulting on its debts for the first time in our entire history.” Above all, the president should say with clarity, “My duty faithfully to execute the laws extends to all the spending laws Congress has enacted, laws that bind whoever sits in this office — laws that Congress enacted without worrying about the statute capping the amount we can borrow.”

By taking that position, the president would not be usurping Congress’s lawmaking power or its power of the purse. Nor would he be usurping the Supreme Court’s power to “say what the law is,” as Chief Justice John Marshall once put it. Mr. Biden would simply be doing his duty to “take care that the laws be faithfully executed” even if doing so leaves one law — the borrowing limit first enacted in 1917 — temporarily on the cutting room floor.

Ignoring one law in order to uphold every other has compelling historical precedent. It’s precisely what Abraham Lincoln did when he briefly overrode the habeas corpus law in 1861 to save the Union, later saying to Congress, “Are all the laws, but one, to go unexecuted, and the government itself go to pieces, lest that one be violated?”

For a president to pick the lesser of two evils when no other option exists is the essence of constitutional leadership, not the action of a tyrant. And there is no doubt that ignoring the debt ceiling until Congress either raises or abolishes it is a lesser evil than leaving those with lawful claims against the Treasury out in the cold.

Of course, my solution might roil the bond markets and cause lenders to demand a premium for extending credit to the United States. But no path out of the dilemma is without risk.

Some will say that letting the president ignore the statutory limit on borrowing would give him too much power and represent a dangerous step in a tyrannical direction. Wrong. What I propose would in truth give the president a lot less power than entrusting him to decide which of the government’s promises to honor and which creditors to stiff — a power that the Supreme Court denied him when it handed down a 1998 decision that prevented him from vetoing line items within a budget.

In any event, Section 4 prohibits the president from permanently stiffing our creditors — even those required to wait their turn after the Treasury runs dry. So even if Speaker Kevin McCarthy and those pulling his strings succeed in making some of those creditors wait, it wouldn’t eliminate our debts; it would merely replace them with i.o.u.s. And that’s just debt in another form.

All Congress would have done is create economic catastrophe on top of constitutional crisis — and without securing compliance with the debt ceiling that Republican claim to want. The only way out of this forest is through the trees.

==

Laurence H. Tribe (@tribelaw) is a university professor emeritus at Harvard and an author, most recently, of “To End a Presidency: The Power of Impeachment.”

Spread the word