In late 2021, as Moderna and the National Institutes for Health (NIH) sparred publicly over one of the patents key to the mRNA COVID-19 vaccine, activists began charging the NIH with getting “taken advantage of by pharma.” As co-inventor of the vaccine with Moderna, public health experts and advocates on drug pricing said, the U.S. government should better assert itself.

But more than a year later—and more than two since the vaccine’s initial rollout in the U.S.—the government has failed to clarify its role in developing the vaccine, and failed to exercise the power it has to shape the course of the drug’s future.

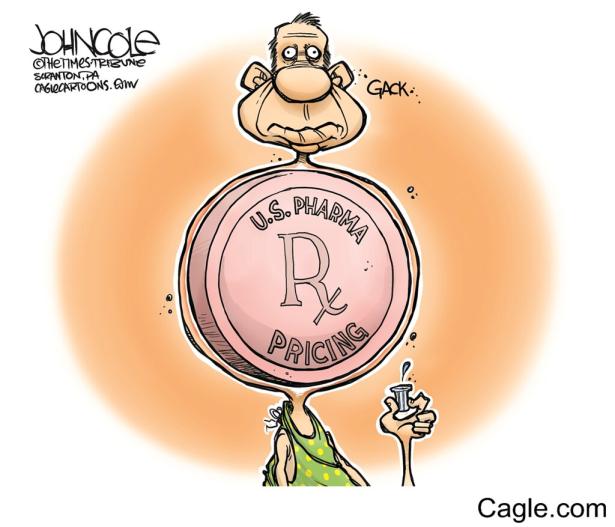

Given this history, Moderna’s announcement early this month that it would consider a price hike on the vaccine was inevitable. Pfizer and BioNTech had made a similar announcement last October. But Moderna’s proposed quadrupling of the price—from the current $26 per dose to between $110 and $130 per dose—is a stunning 4,000 percent increase from its manufacturing cost of $2.85 per dose. In earlier contracts, the government paid Moderna $15–$16 per dose, offering the vaccine to Americans for free.

On January 10, Senator Bernie Sanders (I-VT), incoming chair of the Senate Health, Education, Labor and Pensions (HELP) Committee, told Moderna’s CEO, Stéphane Bancel, that the “outrageous” price hike would raise private health insurance premiums and put the vaccine out of reach for “many millions of uninsured and underinsured Americans.” It would also have a “significantly negative impact on the budgets of Medicaid, Medicare and other government programs.” Moderna has not yet responded to Sen. Sanders’s letter, and did not respond to the Prospect’s request for comment.

That cost barrier makes the vaccines essentially worthless as a population-level public health tool, since vaccines work their magic through mass uptake. We can’t get anywhere “near herd immunity at $130 per dose,” said Alex Lawson, executive director of Social Security Works.

Pharmaceutical companies tend to shrug off price tags. “They go, ‘Oh, insurance will pay for it,’” said Peter Maybarduk, director of Public Citizen’s Access to Medicines program. But it’s impossible to predict what percentage insurers will pay for more expensive COVID vaccines. More likely, plans will “spread the extra cost… across all of its members in the form of increased premiums,” as Senator Sanders warned. For the uninsured, the results will be even more disastrous.

Few may remember that in June 2020, former NIH-director Francis Collins stated that pharma companies did not see the vaccine as a “money-maker… nobody sees this as a way to make billions of dollars.” But in Sanders’s letter, he pointed out that Moderna has made over $19 billion in profits in the past two years. Bancel’s personal wealth is estimated at $6.1 billion.

The government is partially to blame here as well, especially in this case, where they co-developed the drug. Christopher Morten, an intellectual property law specialist at Columbia Law School, explained that “HHS and the White House seem to be stepping back from active management—even from active leadership—of the COVID vaccines.” The administration’s withdrawal coincides with the long-awaited evaporation of public funding for coverage of COVID vaccines, testing, and treatment.

The U.S. can trace its predicament back to Operation Warp Speed (OWS). Though OWS succeeded in bringing vaccines to market quickly, early contractual agreements for the vaccines failed to include two provisions in particular: non-exclusive licensing and reasonable pricing. Non-exclusive licensing is common, including for other NIH-funded technologies, Maybarduk told me. And until the 1990s, “reasonable pricing for government-funded medicines was the norm… without those clauses, we have few public health policy tools to ensure a reasonable price.”

The situation may be aggravated by patent disputes between the NIH and Moderna. Though the two entities collaborated on the vaccine’s research, they have not necessarily operated as equals, let alone partners.

In July 2021, in what was perhaps the most highly-publicized conflict between the two parties, Moderna filed for a patent application that did not list federal scientists as co-inventors of the vaccine. The patent covered a genetic sequence that instructs the body to build a harmless version of the virus’s spike proteins, which trigger an immune response. That acquired immunity protects the body when the real virus comes knocking, making the patent key to the vaccine.

Because a co-inventorship designation presumes co-ownership, inventor status would have allowed the NIH to collect royalties or license the patent to foreign manufacturers. For Moderna, owning the patent by itself could help it “justify its prices and rebuff pressure to make its vaccine available to poorer countries.”

Many scientists saw Moderna’s omission as a “betrayal” by the company, given that it received $1.4 billion to develop and test the vaccine and over $8 billion more to provide the nation with its first doses. After a few weeks, Moderna dropped its pursuance of the patent application, citing the disagreement with the NIH. It also offered to share co-ownership of the patent to “avoid any distraction.” Meanwhile, the company filed a continuance application that would allow it to secure the IP claim in the future. Its other pending and granted COVID vaccine patents remained unaffected.

This defused tensions, but also didn’t resolve them; to the Prospect’s knowledge, no settlement has been reached. And it didn’t lead the NIH to make the kind of decisions its co-ownership should allow; as Maybarduk pointed out, the government does not seem to have “exercised much leverage on price” in the intervening months.

Experts disagree on just how much power the government has over the vaccine’s price. But it’s clear that not much pressure it being exerted now, making pressure from advocates hollow. Jason Silverstein, a lecturer in the department of global health and social medicine at Harvard Medical School and editor-in-chief of PESTE Magazine, said: “What does Moderna care? They’re winning.” After Moderna’s announcement, PESTE disseminated graphics calling on shareholders to divest from Moderna’s stock––because that’s “something Moderna might care about.”

Silverstein has a point. A recent study by economists William Lazonick and Öner Tulum found that Moderna spent $3.8 billion “on buybacks to manipulate its stock price” during 2021 and 2022––a figure that represents 20.2 percent of its total pandemic profits for the period. They predict that Moderna “will remain addicted to doing buybacks to manipulate its stock price in the years to come.”

Moderna is not alone. Lazonick and Tulum found that in the last decade, the 14 largest publicly-traded pharmaceutical companies spent more on stock buybacks and dividends alone than on R&D. This contradicts pharma’s insistence that companies must keep drug prices high as a “necessary cost” to reinvest in new discoveries. Research shows that most companies spend profits on marketing, lobbying, and political contributions, not innovation. Large companies are “nowhere near as important to real drug innovation” as they say they are, with the majority of the patents they do file going toward “me-too” drugs––modified versions of existing medications that are used to extend patent protections. “Breakthrough” products, like the mRNA vaccines, more often originate through NIH-funded research efforts.

Lazonick put it bluntly: The NIH “in effect gave Moderna the vaccine. Decades of research, much of it publicly funded, ended up in that vaccine.” Operation Warp Speed funding also went toward advanced purchase commitments, which helped create the vaccine’s market. And Lawson reminded me that the company was created “whole cloth by U.S. taxpayer-funded efforts.” (Moderna was founded in 2010, but the mRNA vaccine was its first commercial product.)

What government can do

Even now, Maybarduk asserts, Moderna relies on the largesse of the government to “help protect its interests abroad, including enforcing patent protections.” This should give the administration the ability to push back on a unilateral price proposal, since an expensive vaccine undermines the country’s fight against the virus. The companies, Maybarduk said, “aren’t shy about asking the U.S. government to weigh in in defense of their interests against other governments. So the U.S. government shouldn’t be shy about asking for what it needs either.”

The NIH has not tapped all of the resources it could use to enforce its patents. For instance, the NIH already owns a number of mRNA spike protein patents (including technology that the U.S. licensed to the World Health Organization and United Nations’ Medicines Patent Pool last May). One of the NIH patents, U.S. 10,960,070, has been used by several vaccine manufacturers. Moderna seems to be using it in every dose of the vaccine it produces without a license from the NIH. Morten said that if the U.S. government agrees that there is a credible claim that Moderna is infringing on its patent, lawyers could use the threat of patent infringement litigation to push Moderna to apply for a license in exchange for other voluntary agreements, like a potential price cut.

More broadly, the White House could “compel Moderna to be a better corporate citizen,” Morten said. On a global scale, that might mean pushing or forcing Moderna to openly share its technologies with other countries.

But the U.S. government has “a reputation for not aggressively enforcing its patent rights.” It tends to focus on early-stage research, as with this vaccine. Then it leaves “private industry to manage intellectual property on later stages of an invention.” For final development, pharma companies will often invest hundreds of millions of dollars, just a portion of the overall financing of a new drug.

In Moderna’s case, Lazonick and Tulum believe that by retaining control of the vaccine’s marketing, the company was able to “keep the lion’s share of the profits” after the FDA issued an emergency use authorization. Moderna’s 10-year contract with Lonza (a Switzerland-based contract development and manufacturing firm) also gave it the capacity to produce vaccines without investing in manufacturing infrastructure.

Lawson said that arrangement has become de rigueur. It’s “just accepted that we need a private company to do the last mile in bringing something to market.”

A public option

Fortunately, alternatives are beginning to emerge. In July, Alex Sammon wrote for the Prospect that the government could create its own manufacturing capabilities. This would be tailor-made for products like vaccines, which companies often see as low-margin and not worth producing.

Last December, researchers Dana Brown and Tom Latkowski published a state policy kit on public pharmaceuticals. Brown and Latkowski argue that to date, drug pricing reform has fallen short through its failure to change the fundamental “design” of the wider industry. We need a “public option,” they write, with state-owned enterprises manufacturing generic medications to be distributed via state or regional mechanisms. That infrastructure already exists, in small pockets around the country. (Larger pockets, of course, exist across the globe. In Sweden, most of the pharmaceutical sector was nationalized in 1970; in Cuba, the sector has been public since 1960.)

Massachusetts, for example, has housed a public biopharmaceutical R&D and manufacturing enterprise for over a century. The facility, MassBiologics, manufactures a tetanus and diphtheria vaccine and distributes products nationwide. It is the “only non-profit, FDA-licensed manufacturer of vaccines” in the country.

Efforts are picking up in other states. In 2020, California passed legislation to create a public generic drug label, called CalRx. That apparatus moved forward in 2022, when the passage of a second bill required the development of an insulin manufacturing facility in the state. Maine, meanwhile, passed legislation in 2022 to assess the feasibility of the state producing insulin. And though Michigan doesn’t currently have public drug manufacturing, the state produced and freely distributed several of its own vaccines—including ones for typhoid, diphtheria, pertussis, tetanus, rabies, and anthrax—up until 1998.

A publicly manufactured and distributed COVID vaccine is, realistically, many years away. But these state-based models are promising, especially considering the vaccines for other illnesses like RSV and cancer that could be developed soon. With price disputes likely, a substantial intervention is necessary. Without one, Moderna’s story may be a harbinger, Morten told me, of all of the “crises of inequitable access to come.”

Spread the word