Trumponomics, Taxes, and the American Worker

Washington Spectator

Sanders calls out Trump for going back on his campaign promises, lying about corporate tax rates, and continues his push for a single-payer healthcare system.

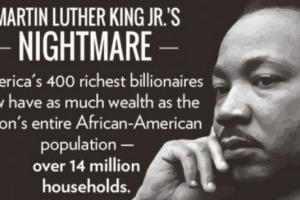

The typical millionaire receives about $145,000 in public tax benefits, while working families get a grand total of $174 on average. In 2043, minorities will be the majority and the will have doubled. The lingering effects of generations of discriminatory and wealth-stripping practices have left black and Latino households far behind white families, and may impact their economic trajectories in the decades to come.

The typical millionaire receives about $145,000 in public tax benefits, while working families get a grand total of $174 on average. In 2043, minorities will be the majority and the will have doubled. The lingering effects of generations of discriminatory and wealth-stripping practices have left black and Latino households far behind white families, and may impact their economic trajectories in the decades to come.

Spread the word