As we celebrate the 78th birthday of Social Security today, it’s worth noting the vital role the program continues to play in Americans’ retirement security. Though Americans are increasingly turning to savings in 401(k)-type accounts, Social Security remains the most reliable and equitable system of retirement savings. The expected stream of Social Security benefits for a household at the median is not very much less than for a household in the top 10 percent—in 2008, the median household age 65-69 had $315,300 of Social Security wealth, while a household at the 90th percentile had $643,100, a little more than twice as much.1

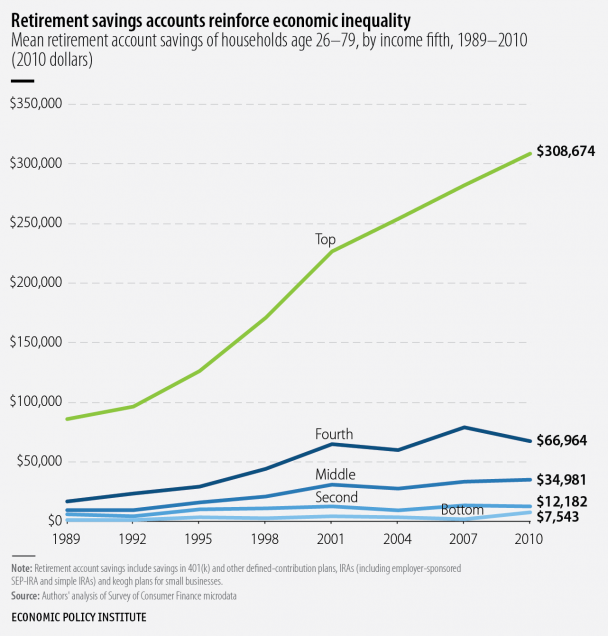

By contrast, the savings in IRAs, 401(k)s and similar retirement accounts are strikingly unequal. The amount of private retirement savings in individual accounts is nine times greater at the 90th percentile than at the 50th. In 2010, households whose income was in the middle fifth percentile of incomes had, on average, only $34,981 in individual retirement savings, while households in the top fifth of incomes averaged $308,674. Other than high-income households, who receive most of the federal subsidies for IRAs and 401(k)s, virtually no one has enough savings to generate substantial retirement income. Social Security wealth and retirement income, on the other hand, are broadly shared.

This chart comes from an upcoming EPI report, Retirement Disparities Chartbook: How the 401(k) Revolution Created A Few Big Winners and Many Losers, by economist Monique Morrissey and research assistant Natalie Sabadish, scheduled to be released on Tuesday, August 27. The report assesses the impact of the shift from pensions to individual savings by examining disparities in retirement preparedness and outcomes by income, race and ethnicity, education, gender, and marital status.

1. Poterba, James, The Composition and Drawdown of Wealth in Retirement, Journal of Economic Perspectives,Volume 25, Number 4, Fall 2011,pages 95–118, Table 2. http://pubs.aeaweb.org/doi/pdfplus/10.1257/jep.25.4.95

Spread the word