Every fan of the market knows the importance of exit. If your breakfast cereal is too bland, you can buy a different brand of cereal. If your barber charges too much, you can look for a new barber who will charge less. The option to leave is crucial, since it forces the cereal producer and the barber to try to please their customers in order to keep them.

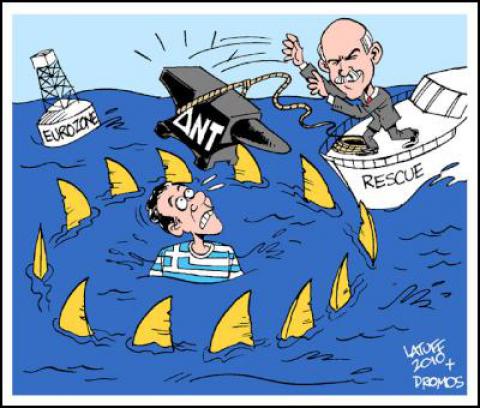

The same logic applies to Greece’s position in the eurozone. The country’s newly elected Syriza-led government intends to press other eurozone nations for concessions that will allow it to restart its economy. The policies that the troika — the European Commission, the European Central Bank and the International Monetary Fund — has imposed on Greece since the crisis could win a Nobel Prize for economic mismanagement.

Since the prerecession peak in 2007, the Greek economy has contracted by more than 23 percent. By comparison, in the Great Depression the U.S. economy bottomed out in 1933 at 26 percent below the 1929 GDP level. However the next year the economy grew by 10 percent, and by 1936 it had already made back all the ground it lost. If Greece sustains its 2014 growth rate, it will return to its 2007 level of output just before 2050. If the United States had taken the same hit as Greece, U.S. GDP would be lower by more than $4 trillion, implying a loss of annual output of more than $13,000 per person.

The plunge in output corresponds to a plunge in employment. The overall unemployment rate is more than 25 percent, with the youth unemployment rate above 50 percent. If the United States saw a decline in employment comparable to what Greece has endured, nearly 30 million fewer people would be working.

This economic collapse has had predictable consequences for the Greek population. Formerly middle-class people can no longer afford basic health care. Many are facing the loss of their house or apartment or are already homeless. Some scavenge garbage cans for food.

This is the backdrop of Syriza’s election victory. The party promised an end to the disastrous policies being imposed by the troika and a return to economic growth. However the other eurozone nations, led by Germany, is not likely to reverse course. As far as they are concerned, everything is fine. Their first priority is forcing Greece to run large primary budget surpluses in order to meet interest payments on its debt. The consequences of this policy for the Greek people is of little concern; the troika wants the Greeks to pay their bills.

This is where the exit option becomes important. As one of the smaller, less powerful countries in the eurozone, Greece stands little chance of being able to force a change in policy on its own. This means that it has to have a viable exit option, both because it may actually want to go this route and also because it needs greater bargaining power with the troika.

The EU has damaged Greece’s economy and society so severely that the disruptions caused by leaving the euro are likely to seem minor by comparison.

There is no doubt that an exit from the eurozone would initially lead to enormous disruption to Greece’s economy. Not only would returning to the drachma be associated with a default on government debt, but also many private businesses and individuals would be unable to meet debt payments denominated in euros. But other countries have worked through a similar adjustment, often with remarkable results.

Argentina, for example, broke a tie between its currency and the dollar in 2001. Although there was an immediate period of chaos and sharp economic decline, three years later, its economy was 17.2 percent larger than before the devaluation. East Asian countries had similar sharp turnarounds after the 1997 East Asian financial crisis, as have several other nations.

There is no guarantee that Greece will be as successful with a return to the drachma, but there are reasons for optimism. First and foremost, the country now has both a primary budget surplus and a trade surplus. The primary budget refers to the national budget without counting interest payments. Greece is running a primary budget surplus of more than 3 percent of GDP (the equivalent of $500 billion a year in U.S. GDP). This means that if it didn’t have to pay interest on its debt, it would not need to borrow to make ends meet.

Since Greece has a trade surplus, it doesn’t need to borrow to finance essential imports. (The recent plunge in oil prices could save Greece $9 billion a year, or close to 4 percent of GDP.) The drop in the drachma relative to the euro will further improve its trade position, leading to a boost in net exports and a sharp upturn in employment. It is certainly plausible that Greece’s economy would in very short order make up the ground lost to an initial period of instability and then continue on a path of robust growth.

This is where the troika has inadvertently done Greece a favor. It has damaged Greece’s economy and society so severely that if the country leaves the euro the resulting disruptions will likely seem minor by comparison.

Of course Greece would be far better off retaining the euro and negotiating a budget that allows it to resume growth, but it is far more likely to get the necessary concessions if it also has an exit strategy. Germany and other northern countries are concerned that a successful Greek exit could set an example for other countries facing crisis, such as Spain, Portugal and Italy. The result would be a rump euro of Germany and a few small neighbors.

But this outcome can be avoided if Greece has a good exit strategy on the table. Just as the threat of changing brands can lead cereal producers to offer a better breakfast cereal, the threat of Greek exit can force the troika’s leaders to become better policymakers.

Dean Baker is co-director of the Center for Economic and Policy Research and author, most recently, of The End of Loser Liberalism: Making Markets Progressive.

The views expressed in this article are the author's own and do not necessarily reflect Al Jazeera America's editorial policy.

Spread the word