In states like Alabama, almost every interaction a person has with the criminal justice system comes with a financial cost. If you’re assigned to a pretrial program to reduce your sentence, each class attended incurs a fee. If you’re on probation, you’ll pay a fee to take your mandatory urine test. If you appear in drug court, you will face more fees, sometimes dozens of times a year. Often, you don’t even have to break the law; you’ll pay fees to pull a public record or apply for a permit. For poor people, this system is a trap, sucking them into a cycle of sometimes unpayable debt that constrains their lives and almost guarantees financial hardship.

While almost every state in the country, both red and blue, levies fines and fees that fall disproportionately on the bottom rung of the income ladder, the situation in Alabama is far more dramatic, thanks to the peculiarities of its Constitution. Over a century ago, wealthy landowners and businessmen rewrote the Constitution to cap taxes permanently. As a result, today, Alabama has one of the cruelest tax systems in the country.

Taxes on most property, for example, are exceptionally low. In 2019, property taxes accounted for just 7 percent of state and local revenue, the lowest among the states. (Even Mississippi, which also has low property taxes, got roughly 12 percent from property taxes. New Jersey, by contrast, got 29 percent.) Strapped for cash, all levels of government look for money anywhere they can get it. And often, that means creating revenue from fines and fees. A 2016 study showed that the median assessment for a felony in Alabama doubled between 1995 and 2005, to $2,000.

Cities like Selma, Ala., cannot pass laws or raise taxes without going through the State Legislature.Credit...Trent Bozeman for The New York Times

In most of the country, if residents of a school district or county want to raise taxes to pay for a new library or electrical systems, they are free to impose a new tax on themselves. Not so in Alabama. Its cities and counties do not have home rule, so they have to go through the State Legislature, which often has to initiate a constitutional amendment allowing them to pass a law. It’s an astonishingly backward system, and it’s why Alabama has the longest Constitution on the planet, with an absurd 977 amendments. (The U.S. Constitution has only 27, even though it has been around almost twice as long.) “Alabama wants totalitarianism,” said Leah Nelson of Alabama Appleseed Center for Law and Justice, “but they just don’t want to pay for it.”

As I traveled through Alabama in April, I asked almost everyone I met — gas station attendants, Starbucks baristas and grocery store clerks of all races — if they knew anyone who had been affected by court fines and fees. Many told me stories of family and friends who had. Some had themselves.

Lane Norris told me she left prison after serving 14 years (nine of them in solitary), only to be hauled before a judge five times for fines and fees she accrued during her incarceration. A legal service found that the state had mistakenly charged her more than $20,000 in fees for, among other things, crimes she did not commit. Many of those fines were later erased, but she doesn’t believe she’ll ever pay off her remaining balance.

The state mistakenly charged Lane Norris roughly $20,000 for crimes she did not commit.Credit...Trent Bozeman for The New York Times

Marquita Johnson fell behind on her court debt and spent 10 months in jail. Martez Files, who lives outside the Black Belt, has a degree from Brown University and a new tenure-track job at the University of Pittsburgh, and yet he said he cannot crawl out from under the debt resulting from a series of tickets he got in Alabama. Teon Smith told me about how police ticketed her multiple times in a county just north of Montgomery on her way to work at a casino. It got so bad, she quit the job and moved to Montgomery. She always taught her six children to do the right thing, to follow the law, but even in Montgomery she couldn’t seem to avoid or pay off her tickets. (She has since paid off the debt incurred from them.)

Niaya Williams, a mother of three, received a series of tickets for traffic infractions, ended up with a mountain of debt and, because she missed her court dates, spent roughly three weeks in jail. In much of Alabama, wherever you see working people, you’re bound to find a story like hers.

Mrs. Williams and millions of others in the state live in the wreckage of a system starved of funding: The state has chronically underfunded schools, bad public transit, a dearth of well-paying jobs, little affordable child care and a diminishing health care system. During the 20th century, some public schools began asking students for recommended donations, or what might amount to tuition. They also asked parents to donate books, toilet paper and other supplies. Many school districts had no school buses. Most places have a simple and effective method for quickly ameliorating these problems: They raise property or income taxes. But Alabama often refuses to do so or makes it exceptionally difficult, dooming many to living standards unthinkable for a country as rich as the United States.

After a series of tickets for traffic infractions, Niaya Williams spent roughly three weeks in jail.Credit...Trent Bozeman for The New York Times

To understand how Alabama came to be so underdeveloped, you need only look to the Black Belt, a large region originally named for its rich black dirt that sweeps across the lower midsection of the state. The earth is full of crushed limestone left behind by the sea that once covered the land. Montgomery, Alabama’s capital, is in the heart of the region. It’s an agriculturally rich area that was once blanketed by cotton plantations worked by enslaved people. Much of the area is still rural and agricultural, but the product isn’t cotton; it is, among other things, timber. Drive just a few minutes outside Montgomery and you’re flanked by forest. Rows of loblolly pine stand sentinel along the roads, waiting to be turned into America’s paper. Much of the land is owned by multinational corporations, international investors, hedge funds, some families that live outside the Black Belt and some whose ancestors cultivated the land before the Civil War.

Many of those families’ agricultural interests were top of mind when state lawmakers rewrote Alabama’s Constitution. In 1874, less than a decade into Reconstruction, the Democratic Party, representing the landowning, formerly slave-owning class, took over the state government in a rigged election and quickly passed a new Constitution that mandated taxes on property would remain permanently low.

In the next couple of decades, as cotton prices crashed, poor sharecroppers, both white and Black, banded together in a populist movement to unseat the elites who controlled the state. In response, in another set of contested elections, the elites called another constitutional convention to further consolidate their power over the state. “What is it that we want to do?” the convention president, John B. Knox, asked. “Establish white supremacy in this state.” But this time, he said, they wanted to “establish it by law — not by force or fraud.”

Even today, pockets of the Black Belt — a region that includes this intersection in Selma — are extremely impoverished.Credit...Trent Bozeman for The New York Times

People like Knox weren’t just racist; they were virulently classist, too, and hoped to exclude all poor people from the political process. The result of the 1901 Constitution was the mass disenfranchisement and subjugation of poor people — white and Black. The Constitution established the basis for a literacy test, a poll tax and stringent residency requirements. By 1943, according to the Alabama Policy Institute, an estimated 520,000 Black people and 600,000 white people had been disqualified from voting by different aspects of the 1901 Constitution. “In most counties more whites were disenfranchised than registered,” the historian Wayne Flynt writes in his authoritative book “Alabama in the Twentieth Century,” “limiting the vote to a select elite.”

This system of minority rule starved public administration in the name of small government. The result was a “government of, by and for special interests,” writes Mr. Flynt. “The citizens of Alabama did not control their government. Trial lawyers, the Business Council of Alabama, ALFA, A.E.A. and their cohorts did.” And this government went about protecting the property owned by some of the wealthiest families and businesses in the state from any meaningful taxation. In 1920, property taxes accounted for 63 percent of state revenue, but by 1978, it was down to a measly 3.6 percent. In 1992, it was below 2 percent, he writes.

As a result, according to Conner Bailey, a professor emeritus of rural sociology at Auburn University, the social structure in Alabama is highly unequal, even today. Over 60 percent of the land in the Black Belt is owned by people who don’t live there. A few wealthy families and corporations own the land, pay little tax and profit off agriculture, all while roughly a quarter of residents live below the poverty line. This social and economic structure is one reason Mr. Bailey calls Alabama an “internal colony,” a place where wealth and resources are continually extracted by people elsewhere.

Teon Smith quit her job at a casino because of how frequently she was ticketed by police on her way to work.Credit...Trent Bozeman for The New York Times

The Black Belt contains some of the worst living conditions and attendant health outcomes in the United States. Famously, there are homes in Lowndes County, just a few miles southwest of Montgomery, without septic systems. Some residents pump their sewage into open pits in their backyards. A strikingly high number of women die of cervical cancer in the Black Belt, and the Annie E. Casey Foundation ranked Alabama 47th among the states for children’s health in 2021. Throughout the region, hospitals have shuttered regularly over the past couple of decades, leaving many people without adequate medical care. Black Belt counties like Lowndes, Wilcox and Montgomery are some of the poorest in the country. There simply is not a tax base to support the municipal infrastructure most Americans take for granted.

Meanwhile, across the state in wealthy Shelby County, schoolchildren play on freshly mowed lawns of the American Village in Montevallo, an interpretive historical site that includes a number of reconstructions of important buildings in American history. There’s a replica of Mount Vernon, in which a historical re-enactor playing Alexander Hamilton’s wife, Elizabeth, recounts her husband’s successes and failures to a small audience. Down a well-trimmed walkway is a newly constructed building that houses a striking multimedia display that sweeps the viewer back to Revolution-era Boston.

It is hard, if not impossible, to find any mention of the fact that the grounds are funded in part by a fee imposed on every court filing in Alabama, which comes to well over $300,000 a year. And while the grounds surely have value for students who can’t afford to visit our nation’s capital, it is not clear why the poorest Alabamians should shoulder the burden of paying for it. But this is the perverse logic of court fees and fines in Alabama.

The American Village in Montevallo is funded, in part, by a fee imposed on every court filing in Alabama.Credit...Trent Bozeman for The New York Times

Niaya Williams’s story shows how the lack of municipal services combines with the weight of fines and fees to trap people in a kind of penury from which they never escape. In 2007, when she turned 16, Mrs. Williams wanted to enroll in driver’s education at her public high school in Montgomery. But before she could begin the course, she recalled, the school eliminated it. The easy way for her to learn to drive vanished in an instant.

Montgomery is not a walkable city, especially in the punishing summer heat. It sprawls out south and east from a sleepy downtown, with neighborhoods bisected by wide thoroughfares and highways. Public transportation service is spotty, slow and impractical (a painful irony, lost on no one, considering the significance of the 1955 and 1956 Montgomery bus boycott). For most of the people who live there, driving is a fact of life.

When Mrs. Williams became pregnant with her first son, in late 2008, driving became a necessity. School was chaotic. Without anyone to care for her son, Mercury, she dropped out of high school the next year and began driving hours each day back and forth from her job at McDonald’s and his day care. “I was always on the road,” she told me of this time in her life. She tried to get a license, but she failed the written portion of the test. She really had needed driver’s ed to teach her the rules of the road.

Then, all of a sudden, she started getting ticketed quite frequently. She remembers that one day, she got her first set of tickets for, among other things, not stopping long enough at a stop sign. Then, while driving Mercury to a clinic, she got pulled over. A ticket for not having a license, a ticket about switched tags that she didn’t fully understand and a ticket because the officer said Mercury was buckled incorrectly. She recalled being given at least three tickets every time she was pulled over. She wasn’t aware of how much these tickets added up to, but she figured it couldn’t be much. They were just traffic tickets.

Montgomery is not a walkable city, especially in the punishing summer heat. For Niaya Williams, who grew up there, driving was a necessity.Credit...Trent Bozeman for The New York Times

Then, on her way to her mother’s house in 2013, she was stopped at a police checkpoint, as she was several times before. The officer told her there was a warrant out for her arrest because she had failed to show up to court for her unpaid tickets. He let her off with two more tickets and suggested she schedule a court date. Mrs. Williams was in shock, surprised that she was being made to feel like a criminal.

In 2014 she was driving herself to church when she heard police sirens. She had unknowingly made an illegal right on red. The officer pulled her over, took her information and walked back to his car. When he called for a backup car — and took a longer time than usual to return — she got worried.

Several minutes passed, and she was sure the worst was in store. Increasingly frantic, she called her mother over and over, knowing that her mother was in church. She remembers saying, “Mom, I’m going to jail,” when her mother answered. Her mom and dad made it to Mrs. Williams quickly. “You’re sending her to jail for tickets?” she recalled her mother yelling at the officer. She was being arrested because of just traffic infractions and missed court dates, Mrs. Williams said. She was, in essence, guilty of little else than being too poor to pay off her fines.

When she got to jail, she said, she learned that she had about eight outstanding tickets, with fines totaling about $2,500. She had not gone to court to pay them off, she told me, in large part because she had heard from a cousin and other friends that people would sometimes be arrested at court if they were unable to pay off their debts all at once.

A jail in Montgomery County. For every day people spend in most Alabama jails, they can earn credit toward their fines, but they also have to pay fees to do things like send letters and make phone calls.Credit...Trent Bozeman for The New York Times

People earn credit toward their fines for every day spent in jail, but while Mrs. Williams was there, she said, she was charged fees for almost everything she wanted to do, such as send letters and make phone calls. There were various fees if someone wanted to put money on her books, processing fees for other services and, she said, because she was fed just enough to get by, she had to buy food at the commissary. (A representative of Montgomery’s municipal jail did not reply to the Times’s questions by publication time.) She was surrounded by fees. (While Mrs. Williams was incarcerated, Alabama budgeted $1.75 to feed each inmate per day; the sheriffs overseeing the jails could pocket any leftover funds, incentivizing low quality and volume of food. The law was changed in 2019.)

After roughly three weeks in jail, during which she told her young son she was away at school, her bill shrank to $1,500. Her parents contributed what they could, and Mrs. Williams used a bail bond to secure a release. While she was free, she was, in effect, using new debt to dig herself out of the consequences of an old debt. The cycle continues.

Alabama is far from the only state with an aggressive system of tax limits and caps. Caps on property taxes once again gained notoriety after California passed Proposition 13 in 1978; many other states started to rely heavily on user fees, sales taxes and other fees that disproportionately affect poor people. As the criminal justice system expanded to meet the needs of the war on drugs, increased policing and the rise of mass incarceration, this, too, strained state budgets. “No new taxes,” many cried, while demanding that the government get tough on crime.

Many states turned to court fees and fines to fund courts and the police. Another contributing factor to the rise of fines and fees was that in 1982 the federal government withdrew funding from the Law Enforcement Assistance Administration, a government agency that once helped fund law enforcement. States found fines and fees to be an expedient source of revenue, operating under the radar as what some scholars call nontax taxes. “The reliance of government on both is a relatively recent problem,” said Lisa Foster, a co-director of the Fines and Fees Justice Center, “and related directly to the question of how we fund the government.”

Florida, for instance, added 20 categories of financial obligations for defendants going through its court system from 1996 to 2010, according to a 2010 Brennan Center report. Additionally, the state eliminated most exemptions for those who could not pay its fees and fines. The state also increased the amount defendants were expected to pay: In 2000, the median defendant paid around $475, but by 2011, that figure had peaked at $935, then dropped to $700 to $800 by the end of the decade. California began increasing its fines in 1991, and New York made some court costs mandatory so judges could not waive them. A 2019 Governing magazine study of cities, towns and counties with significant revenue from fees and fines showed that nearly 600 jurisdictions relied on fines and forfeitures for more than 10 percent of their revenue and 80 relied on fines and forfeitures for over half their revenue. “It’s a problem happening everywhere in the country,” Ms. Foster said.

Martez Files, right, with his godson, Kerec Hill, will be a professor at the University of Pittsburgh this fall and is struggling to pay off a series of tickets he got in Alabama.Credit...Trent Bozeman for The New York Times

But as a source of revenue, fines and fees are incredibly inefficient — far less efficient than taxes collected by the I.R.S. and local and state tax agencies. A study by the Brennan Center found that governments in Texas and New Mexico collect only 41 cents on every dollar of revenue brought in by fees and fines. One county in New Mexico spent $1.17 to collect every dollar of court fees, largely because jailing people for unpaid court debt comes at a cost.

It is inefficient partly because of the type of person most likely to be fined. “The people involved in the court system,” said District Judge Adrian Johnson of Lowndes County, who frequently noticed that he was required to impose fees and fines on impoverished people, “are the people least able to afford the court costs and fines imposed on them.”

And while some law-and-order advocates may argue that fines are an important way to deter crime, a report by Alabama Appleseed Center for Law and Justice found that fines and fees may do the opposite: They might cause people to commit more of it. The report surveyed almost 1,000 people affected by court debt and learned that four in 10 had committed a crime — most frequently, selling illegal drugs — to pay off their debt. Around 80 percent gave up necessities like food or medical care. Those who committed crimes sometimes landed back in jail, and there they can’t escape fines and fees.

Some of the money they contribute goes directly to district attorneys and law enforcement, which, to defenders of the system, makes some sense: Shouldn’t people who broke the law have to underwrite the criminal justice system?

This is flawed for several reasons. Not only is it deeply undemocratic to have the public administration of justice paid for by those who are targeted by law enforcement (a group that tends to be Black or brown and poor), but the system actually perverts the course of justice. To raise money, officers have incentives to overpolice — to ticket more people, arrest more, to make more traffic stops, which can sometimes turn deadly. One small community in Alabama increased its funding from fines and fees 640 percent from 2018 to 2020 and was able to add nine police officers and numerous vehicles. (The town’s police chief resigned when the practice came to light last winter, and the town said it would give up its armored vehicle.)

What’s more, this hasn’t made communities any safer. One 2018 study found that jurisdictions that rely on fines and fees solve violent and property crimes at significantly lower rates. “Fees are not about public safety,” said Lauren-Brooke Eisen of the Brennan Center for Justice. “They’re about raising revenue.”

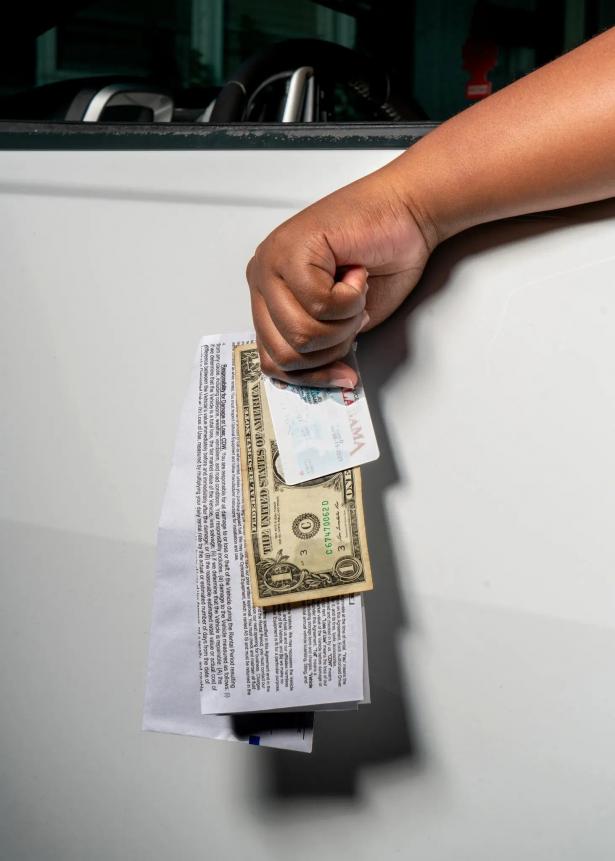

While the courthouse where Montgomery residents normally pay ticket fines is under construction, a temporary payment location is in a county law enforcement building downtown.Credit...Trent Bozeman for The New York Times

Paradoxically, little of the money collected by courts makes it back into the judicial system. The money from county courts goes to the state to pay for schools, hospitals and roads, as well as projects like the American Village. (Towns and cities can also use money from fines to fund municipal projects directly — like expanding their police forces.) It is a state whose leaders, from Knox to George Wallace to the current governor, Kay Ivey, often profess an aversion to a strong central government, and yet cities and counties have little power over their own destinies, at least not their own finances.

Several years after her release from jail, just before she turned 30, Mrs. Williams finally got her license. But even today, she said, if she has to drive, she instantly gets a migraine headache, loses her appetite and thirst, struggles to make conversation and feels a great deal of anxiety. “It’s just a stressful, heavy, brooding feeling,” she said. She’ll do almost anything to avoid it, even pulling her son out of an after-school football program he loved because it was 25 minutes from their house. “Anything more than 10 to 15 minutes away, and I’m thinking, ‘Do I really want to do this?’”

Often, she doesn’t have much of a choice. Since the state underfunds public transit, residents like Mrs. Williams are often burdened with moving their families around at their own expense and on their own time, limiting their children’s extracurricular activities, say, to what is feasible with their work schedules, dispositions and finances. Shouldering these duties comes with a cost — in gas and in traffic tickets, of course, and also in time. It is a system designed to ensnare people like Mrs. Williams, and in that way, they suffer a double indignity: the disadvantages of a deliberately tightfisted state and the further cost incurred from court fees and fines.

Fines and fees have turned driving, the quintessential emblem of American freedom, into a burden on Mrs. Williams’s life. “It’s jail on wheels,” she told me.

And while Mrs. Williams is trying to think of clever new ways to pick up groceries without driving, the fortunes of Alabama’s wealthiest and most powerful citizens continue to grow — untaxed, unregulated and larger by the day.

This article was supported by the Economic Hardship Reporting Project.

Personal information is obscured in the opening photograph for the privacy of the subject.

Robin Kaiser-Schatzlein, a journalist, writes frequently about economic policy, inequality and criminal justice. For this essay, he spent four months reporting on fines and fees in Alabama.

Spread the word