Innovations or Hucksterism? Three Little-Known Infrastructure Privatization Problems

On a recent Diane Rehm Show on the future of US Toll Roads, Robert Puentes, a senior fellow in the Brookings Institute's Metropolitan Policy Program, observed, "We had this program in the '50s that built out the interstates. That was a lot of federal money coming in." Those days, Puentes said, "are over."

Those days are indeed over - but this is no product of fate. The shift is due to the work of advocates for privatizing roads, who are undermining the legacy of President Eisenhower.

Today, these vocal privatization boosters have no real counterbalance; one of the most important and thoughtful advocates for high quality multimodal and interlinked transportation - Congressman Jim Oberstar (MN) - has left us with no advocate for public transportation infrastructure and no satisfactory form of transportation financing.

Oberstar should be memorialized with a serious discussion as to how we will pay for high-quality transportation infrastructure, including roads, trains, bicycles, planes and other multimodal forms of transportation. Do we prefer to finance our roads with funding that has the laser-like clarity of a fuel tax indexed for inflation? What about privatized toll roads? How do we develop a robust ecosystem that draws on many sources to create a balanced system for financing transportation? And how do we best mitigate climate change?

These are important questions, but not the only questions that matter, just as cars and roads are not the only infrastructure that matters. Similar issues affect other vital public infrastructure, water, in particular, and privatization is being advanced as the solution to all our infrastructure problems. The advocates of privatization speak more forcefully, but this "solution" puts us on the road to nowhere good.

Here are three under-reported infrastructure privatization issues we need to pay attention to. First, who actually benefits from and pays for infrastructure? Second, how are opinion makers talking about privatized infrastructure? Third, what is the quality of the process used to build large infrastructure projects?

1. Are There Really Innovative Ways to Pay for Highway Construction?

Some hope that leasing infrastructure to private contractors will be a painless solution for cash-strapped state and local governments. However, the record shows that privatization as a "solution" comes at a cost to the public.

For example, a recent report on global water privatization by the Public Services International Research Unit (PSIRU) "Troubled Waters: Misleading Industry PR and the Case for Public Water," found that the private "partners" fail to provide the promised quality and quantity of water. In fact, the PSIRU report found that no technological innovation was involved. In fact, the only "innovation" was providing up-front payments to the public "partner" that severely undervalued the public asset.

In the case of highways, the fuel tax that has long provided funding for roads has the nice feature of showing a connection between the tax we pay at the pump and the taxes paying for roads. The problematic funding issue for roads has been the failure to index the fuel tax for inflation.

More recently, the challenge has been tax fairness with the increase of high-mileage vehicles, hybrids, and other non-gasoline-powered cars. Many of these vehicles may avoid paying tax, or lower the amount of tax paid, compared to the damage done by driving.

The bankruptcy and sale of the road to a new buyer was not just an unfortunate situation. Rather . . . it is an integral part of a structure that makes money for the private investors.

Just linking the cost of an individual's driving and taxes misses key features of our transportation ecosystem. Almost everything we buy - and the raw materials for things we need - will get to us on a road at some point, and some level of fuel tax will have been paid.

Or, consider, that there are non-tax costs when our roads become so dangerous that they damage our cars or cause accidents and injuries.

2. Privatization Hype on Public Radio

On a recent Diane Rehm show, the question was, "What can we learn from innovative models for funding highway construction?" Unfortunately, that question missed the dynamics of the infrastructure privatization ecosystem.

Brookings Institution fellow Robert Puentes, saw the failed Indiana toll road as a positive: "They recently just went through a financial restructuring, and a new company is taking it over. But there's so much interest from the private sector in investing in this country . . ."

Research by highway expert Randy Salzman, finds that the magic of privatization has been highly exaggerated. According to Salzman:

In March, Fluor's senior vice president Richard Fierce bragged that his company was saving taxpayers $1.7 billion on the new bridge across the Hudson until one congressman offhandedly remarked that he'd heard the Tappan Zee project would cost $5 billion, not $3.1 billion as the contractor had claimed. . . .

"Design-build" is, in effect, "cost-plus," tailor-made for expensive change orders once construction is underway, when no politician can dare pull the plug on runaway spending. "P3s" are even more geared for lining the pockets of financiers; hence foreign money is flooding into US highway projects today. The costs and risks, it is consistently claimed, are dumped on the privates, but the reality is much more complex and, according to the Congressional Budget Office (CBO), at best delays taxpayer pain. There is little, if any, long-term savings for citizens, the CBO notes, and the tiny amounts of private equity serve primarily to get construction underway quicker. (Emphasis added).

None of the Diane Rehm Show's panelists seemed aware that the bankruptcy and sale of the road to a new buyer was not just an unfortunate situation. Rather, as Randy Salzman has shown, it is an integral part of a structure that makes money for the private investors.

Part of that structure has depended on IRS tax breaks for Lease-In/Lease-Out (LILO) and Sale-In/Sale-Out (SILO) transactions.

Right now fierce lobbying is pushing for tax breaks as part of the new water law - the Water Resources Reform and Development Act (WRRDA). If their lobbying is successful, these tax breaks will include tax-free Private Activity Bonds (PABs). Tax-free PABs would increase an investor's income while, of course, decreasing government revenues to spend on public needs, because "tax-free" means less tax money paid into the US Treasury.

And yet, the hype goes on.

Also on the same Diane Rehm Show on transportation was Cato Institute economist Chris Edwards. He claimed that, when the Indiana toll road went bankrupt, neither drivers nor taxpayers were hurt. Rather, he said, only the private company and the creditors were hurt. Said Edwards, "The companies - they didn't earn any profits. And I would say actually there's a benefit. If you have a liberal perspective, there's a benefit of private companies coming in and running roadways because those private companies will pay taxes on their profits, on their income tax. So it broadens the tax base to put some of these assets into the private sector."

However, that is not how the infrastructure privatization cookie actually crumbles.

According to highway expert, Randy Salzman, the international financiers play a deep game that most of us misread:

Beginning with the contracting stage, the evidence suggests toll operating public private partnerships are transportation shell companies for international financiers and contractors who blueprint future bankruptcies. Because Uncle Sam generally guarantees the bonds - by far the largest chunk of "private" money - if and when the private toll road or tunnel partner goes bankrupt, taxpayers are forced to pay off the bonds while absorbing all loans the state and federal governments gave the private shell company and any accumulated depreciation. Yet the shell company's parent firms get to keep years of actual toll income, on top of millions in design-build cost overruns.

US and state taxpayers are left paying off billions in debt to bondholders who have received amazing returns on their money, as much as 13 percent, as virtually all - if not all - of these private P3 toll operators go bankrupt within 15 years of what is usually a five-plus decade contract.

3. When Large Projects Fail

Edwards' Econ 101 analysis fails to take into account the reality of infrastructure privatization and the complexity and elegance of our tax code, which, as Salzman has explained, makes it possible for privatization investors to do very well indeed while doing bad for the rest of us.

While Salzman reveals how privateers make money using the tax and bankruptcy codes, University of Oxford Professor and Chair, Bent Flyvbjerg and his various coauthors have studied the processes that cause large construction projects to fail. Not all large building projects involve privatization, but all large infrastructure privatization projects are likely to be affected by similar problems.

Here is a small sample of published research by Flyvberg and his coauthors on infrastructure failure.

Their investigation into "Why the Worst Infrastructure Gets Built." draws on interviews and other information about the process of building large-scale projects. They find that the problem is one of incentives. The project managers' goal is getting projects funded and then built. The result of those incentives is that project managers and planners fail to get good quality project forecasts and fail to abide by the relevant codes of ethics.

In addition, the process depends on government officials with far less experience with big projects than the private contractors. In fact, the government officials are unlikely to know even what their interests are and what the pitfalls are. As this study observed:

If you do not know what your interests are, it is difficult to safeguard them. Contractors, on the other hand, who bid for and build such projects, do so all the time. Contractors, therefore, typically know much more than clients about the ins and outs of projects and contracts, including the many risks and pitfalls that apply, plus which lawyers, bankers and consultants to hire to safeguard their interests most effectively. This asymmetry has brought many a client to grief.

Is it any wonder, then, that outcomes for transportation projects that are given the green light have cost overruns of at least 45 percent and ridership 50-70 percent lower than forecast? Indeed, those who want to understand how transportation projects fail would be well advised to read the analyses of both Salzman and Flyvberg and his coauthors.

It is ironic that the authors of these studies will have undergone far more scrutiny of their articles than will be the case for multimillion-dollar projects.

"Why the Worst Infrastructure Gets Built" finds that forecasting errors are caused by "delusions or honest mistakes; deceptions or strategic manipulation of information or processes; or bad luck." Executives fall victim to the "planning fallacy," which causes managers to make decisions based on delusional optimism, which then causes them to "spin scenarios of success and overlook the potential for mistakes and miscalculations."

The authors do find that overreaching and other problems can be kept in check by safeguards, such as requiring all parties to share financial responsibility, to disclose information and to be rewarded for providing realistic estimates. In addition, forecasts should be critiqued by expert and independent peer review. It is ironic that the authors of these studies will have undergone far more scrutiny of their articles than will be the case for multimillion-dollar projects.

A second Flyvberg article asks, "Should We Build More Large Dams? The Actual Costs of Hydropower Megaproject Development."

Dams as infrastructure have long raised special issues. Their traditional purposes include providing flood control, diverting water for special uses and providing electrical power. However, each of these uses has had many problematic effects, including on fish and mammals, such as beavers. Some efforts to mitigate these constructed barriers include installing structures that allow the fish to travel to areas in which they can spawn.

The authors conclude that megaprojects result in an inverted Darwinism, i.e., the "survival of the unfittest."

This study found a number of problems associated with dams. For example, plans for one dam raised concerns over the site's "weak geology." Assurances were made that this problem could be dealt with. However, when the dam was built, the "weak geology" cost more than 96 percent of the dam's base cost.

The construction of another hydroelectric dam raised concerns about the exchange rate between the Colombian peso and the US dollar during the dam's seven-year construction. Many assurances were made that there would be no problem. As it turned out, the Colombian currency depreciated nearly 90 percent against the US dollar. This study found that "currency exposure consistently proves to be a fiscal hemorrhage for large projects." The study authors cautioned, "Although, following convention, our cost analysis excludes the effects of inflation; planners ought not to ignore the risks of 'unanticipated inflation,' " which can lead to cost overruns as high as 110 times the initial budget and lead to delay.

Flyvberg and his coauthors have also used their findings to create a rigorous process of review based on an examination of issues that have been shown to affect the success or failure of large infrastructure projects.

What You Should Know About Megaprojects and Why: An Overview

This study analyzed why people are attracted to specific types of megaprojects. Projects in the study included both public and private infrastructure. The study found that people connected with megaprojects fall into four groups:

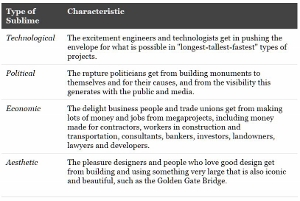

Table 1:The "four sublimes" that drive megaproject development.

The study also found that a special characteristic of megaprojects are that they seem to be recession-proof. For example, the 2008 recession saw growth in megaprojects because the focus on stimulus spending was creating jobs and getting the economy back on track.

Another finding was that cost overruns in megaprojects can run very high - for example, 200 percent (Denver International Airport), 220 percent (the Boston Big Dig), and 1,400 percent (the Sydney Opera House). The authors conclude that megaprojects result in an inverted Darwinism, i.e., the "survival of the unfittest."

Conclusion

The studies by Flyvberg and his research partners provide important details about the dynamics of constructing projects. Of most importance, these studies warn against superficial and overly optimistic, unfounded claims about the value and operation of infrastructure and privatized infrastructure.

The Flyvberg studies and the Salzman analysis of infrastructure and infrastructure privatization are based on reality and experience and deserve to be heard. All too often, those findings are drowned out by unfounded beliefs and claims. And who actually pays? The public pays.

[Ellen Dannin is the author of "Crumbling Infrastructure - Crumbling Democracy: Infrastructure Privatization Contracts and Their Effects on State and Local Governance," in winter 2011, Northwestern Journal of Law and Social Policy. She is a former National Labor Relations Board field attorney and the author of Taking Back the Workers' Law - How to Fight the Assault on Labor Rights (Cornell University Press).

[Thanks to the author for sending this to Portside.]

Copyright, Truthout. Reprinted with permission. May not be reprinted without permission.

Spread the word