Recent passage of President Trump’s economic agenda has dominated news coverage. However, in our already complex health care system it can feel impossible to understand how the law will impact your health care, especially if you are not directly insured by one of the programs that is being cut. Below is a guide that describes what changes you may encounter and examples of what these changes will look like to you and your loved ones. In future pieces we will explore how you can protect yourself from the sweeping reductions in funding and other changes to the system.

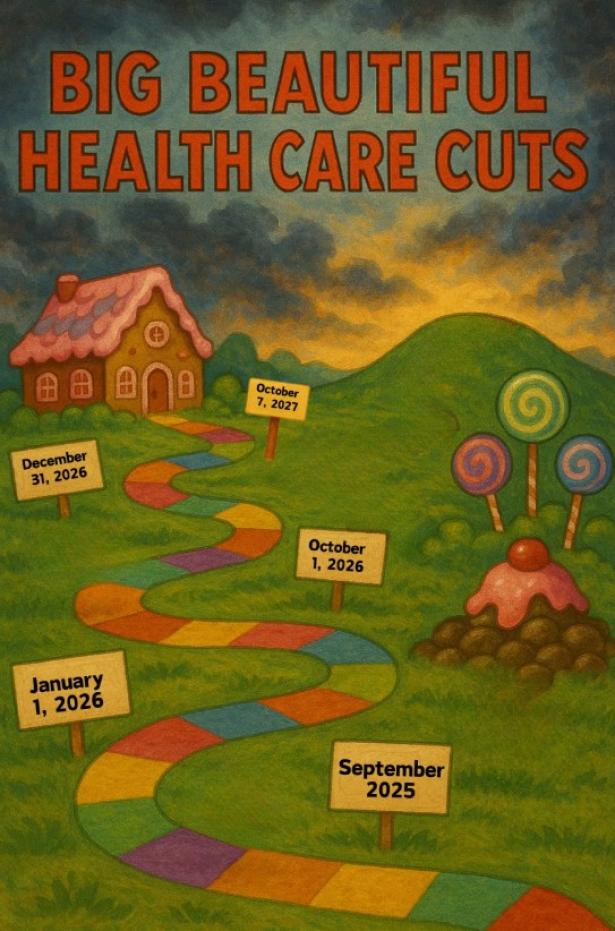

As you will see, there are a lot of changes, some not happening for a few years, but some will affect you sooner than you might expect, regardless of where you currently get your coverage. The cuts to Medicaid and the new work requirements have been the focus of most stories, but the law and the reaction of insurers and health care providers will impact all of us.

For example, as insurers release their proposed rates for 2026, enrollees could see their premium increase by an average of 75% compared to what they are currently paying. On top of that, Curtis Medical Center in rural Nebraska has announced that it will be closing due to coming Medicaid cuts and other strains, the first of many hospitals expected to close, leaving an untold number of patients without convenient access to care. In addition:

Immediate changes to the Medicare Savings Programs will make it harder for people to enroll in this Medicaid program, which pays Medicare premiums and cost sharing for low income seniors. Currently, 31 states automatically enroll people in the Medicare Savings Programs if they receive Supplemental Security Income (SSI), easing the application burden for these patients. The bill prohibits states from doing this until 2034, which will lead to more obstacles for seniors trying to enroll in this program. The bill also changes the process for determining eligibility, meaning low-income seniors could be forced to travel to an interview to prove they need help paying their medical costs.

Real world example: You apply for and begin receiving Supplemental Security Income because you are over the age of 65 and have a low income. You do not know about the Medicare Savings Programs so you never apply and have to pay 20% of your monthly SSI benefits to Medicare Part B premiums, and a large portion of your benefits go toward out-of-pocket costs for your medical care. If this bill had not prohibited states from enrolling you in the Medicare Savings Programs when you got approved for SSI, you would have little to no out-of-pocket medical costs and would be better able to afford other necessities.

Hospitals and nursing facilities will immediately have their payments from Medicaid cut because the bill prohibits states from instituting new payment levels to these facilities more than the Medicare rate in states that expanded Medicaid, and 110% of the Medicaid rate in other states. The bill also requires a 10% decrease in payments currently in place that exceed these caps each year until reaching the cap January 1, 2028. Without additional policy changes to address how hospitals are paid, this will reduce hospital revenue. This almost certainly will affect access to hospitals and nursing facilities and the quality of care they provide.

Real world example: You receive care at a nursing facility in Michigan that serves a large population of Medicaid patients. The facility previously received payments higher than the Medicare payment rate, which enabled them to care for those patients. Now that payments will decrease, and it might have to close, leaving you without nearby care.

Medicaid reimbursement for services such as cancer screenings and birth control provided by Planned Parenthood and related organizations have been immediately stopped.

Real world example: You are a young woman in college and on Medicaid who receives her annual exam at Planned Parenthood. Now that this bill has passed, Planned Parenthood cannot participate in Medicaid so you must find a new doctor who is accepting new patients, takes Medicaid, and is close to your college campus. Due to decreases in Medicaid funding nationwide, these providers undoubtedly will be difficult to find.

Beginning in September 2025, there will be $50 billion in grants available to states for payments to rural health care providers, a tenth of what Sen. Susan Collins (R-Maine) had sought. The $50 billion is just 5% of the $1 trillion in funding the new law will cut from Medicaid and is almost certainly not enough to prevent more rural hospitals from closing.

Real world example: You live in a rural area and your community hospital receives a grant from this funding. Unfortunately, the grant is very small compared to the funding your hospital stands to lose from changes to Medicaid eligibility, provider taxes, and state payments, so your hospital might not be able to stay open.

On January 1, 2026, ACA insurance plan premiums will increase by a median of 15%, and there will be a 75% increase in out-of-pocket premium payments each month for the average ACA enrollee.

Real world example: You and your family of three earn $110,000 and are enrolled in an ACA silver plan in 2025 and pay $779 in premiums per month. You receive your expected premium notice for 2026 and see that your monthly premium payments will jump to $1,662, an increase of $883 per month. You decide you cannot afford that increase and will have to go without health insurance in the future.

Beginning October 1, 2026, lawfully present immigrants including refugees, individuals granted asylum or parole for at least one year, and certain survivors of domestic violence or trafficking will no longer be eligible for Medicaid.

Real world example: You are an immigrant granted asylum and are in the U.S. legally and on Medicaid. You will lose your Medicaid coverage on October 1, 2026.

Eligibility redeterminations, including meeting work and other requirements for Medicaid, will now be required at least every six months rather than once a year if you are 19-64 years old and make $15,060-$20,779 (for a one-person household). Increased redeterminations will begin December 31, 2026.

Real world example: You are on Medicaid and make $20,000. You completed your annual Medicaid redetermination at the beginning of 2027 then moved to a new apartment. You are sent a Medicaid eligibility redetermination letter in June 2027 but it does not get to you at your new address. You are disenrolled from Medicaid and no longer have health insurance. You try to call your state Medicaid office but the wait times are longer than they had been because of the increased call volume, which has historically plagued Medicaid offices because of existing eligibility redeterminations requirements.

Funding for Medicare will be cut by $490 billion from 2027-2034, which will result in decreased payments to medical providers. This likely will lead to fewer providers accepting Medicare and physicians and more hospital closures, especially in rural areas, due to the financial strain.

Real word example: You are a senior on Medicare who has been seeing the same primary care doctor for more than 20 years. Due to the cuts to Medicare payments to providers for their services, your physician might not be able financially to continue treating patients on Medicare. You are forced to find a new doctor.

Starting on October 7, 2027, federal funding to states that expanded Medicaid will decrease due to changes to a wonky provision called a provider tax. For example, in New York funding will decrease by $3.3 billion by 2032. This funding decrease will put more than 300 rural hospitals nationwide at risk of closure. It will also leave states with billions of dollars in funding gaps for their Medicaid program, which will force them to decrease provider payment rates or enroll fewer people in their Medicaid programs.

Real world example: You are a patient at Lincoln Community Hospital and Care Center in Hugo, Colorado. The CEO just announced he may have to start cutting services for patients because of impending cuts to federal funding through changes to provider taxes. You are uncertain if you will have a hospital you can get to for needed care. On top of this, you do not know if your state will be forced to decrease enrollment in Medicaid, which could leave you without health insurance.

If you are on Medicaid, your out-of-pocket medical expenses could go up. The bill requires states to impose cost sharing, often called co-pays, for medical services received by adults on Medicaid because of the expansion. This means that if you are over 18 and make $15,060-$20,779 (one person household) you will have co-pays, sometimes up to $35 when you go to the doctor. Of note, primary care, mental health, substance use disorder services, services from FQHCs and rural health clinics are exempt. These co-pay requirements will start October 1, 2028.

Real world example: You go to your endocrinologist in New Jersey for treatment of diabetes and your income is $17,000 and you are on Medicaid. Starting in the fall of 2028 you will be required to pay up to $35 for this visit, which previously did not require a copayment. This could make it financially difficult, maybe impossible, to keep up with your diabetes care.

Work reporting requirements will be instituted for Medicaid enrollment and continuity by December 31, 2028. However, states can choose to implement them earlier. This means that if you are applying for or on Medicaid, between the ages of 19 and 64 and have an income 100-138% of the federal poverty line ($15,060-$20,779 for a one-person household) you are required to work or participate in “qualifying activities” for at least 80 hours per month and report those activities through your state. This also means you must fulfill the work requirement for at least one month before applying for Medicaid. If your Medicaid application is denied or you are disenrolled for not meeting the work requirements, you are prohibited from purchasing subsidized health plans on the Marketplace. Parents with children under the age of 13 and those who are medically frail are exempt from these requirements.

Real world example: You are in your 30s and make $20,000 and you are on Medicaid. You are not successfully contacted by your state to report your work status because, as history has shown, states fail to successfully contact many Medicaid recipients when instituting work requirements. You are then disenrolled from Medicaid because of the complex work reporting system your state set up and wind up uninsured. You try to enroll in a subsidized Marketplace plan but are ineligible because you were disenrolled from Medicaid due to the work reporting requirements. This will start happening in every state in 2029.

The staggered implementation of these health care cuts and targeting of Medicaid and Medicare may make it seem like a lot of small changes to our health care system that will not affect you. But they will unless Congress acts soon to change the law, regardless of the type of coverage you have, especially if your local hospital closes, your doctor stops seeing patients on Medicare and Medicaid and even other types of insurance, or a family member or friend loses coverage and can’t get the care they need. Emergency rooms of hospitals that are able to stay open likely will become more crowded, potentially leaving you without the rapid care needed in a true emergency. The amount of uncompensated care at those hospitals will go up, which in turn will mean your private health insurance premiums likely will also go up, along with your own out-of-pocket costs. Finally, none of the changes in this bill address the growing power that Big Insurance has over our health care, meaning that insurers will continue their abusive practices of delaying and denying care causing more obstacles for you. And states likely will contract with private insurers to administer the new work requirements, which will be new revenue for them but higher administrative costs we all will pay for.

A shock to our entire health care system is coming and the dominos are about to fall.

[Rachel Madley is Director of Policy and Advocacy at the Center for Health & Democracy. She previously worked for Congresswoman Pramila Jayapal. She received her PhD from Columbia University and has written for publications including The New York Times.]

HEALTH CARE un-covered is a reader-supported publication. To receive new posts and support our work, consider becoming a free or paid subscriber.

Subscribe to HEALTH CARE un-covered

Pulling back the curtains on how Big Health is hurting Americans and how we got to this point.

Spread the word