Sen. Elizabeth Warren and Rep. Elijah Cummings, who co-chair an initiative called the Middle Class Prosperity Project, are holding a forum today at the University of Massachusetts in Boston on Tackling the Student Debt Crisis (more info here).

If the word “crisis” seems dramatic to you, you haven’t been paying attention. The Federal Reserve recently released new data on student debt, and it shows that the situation is even worse than many people realized. There’s a lot of new information available, but here are four things every American needs to know:

1. Student debt is soaring in this country.

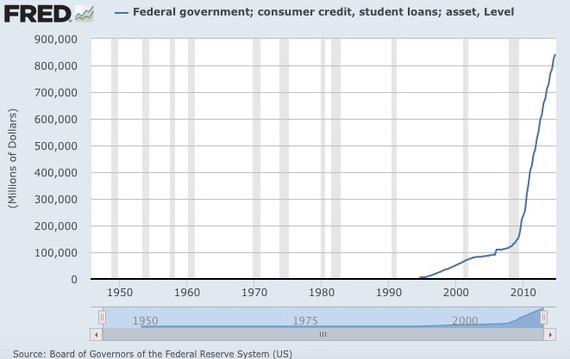

This chart from the Federal Reserve database tracks the amount of government-backed debt, the largest category of student debt:

Private loans, an additional form of debt burden, are not reflected in this chart.

The total amount of student debt in this country is currently estimated at $1.3 trillion. There are many reasons for this surge in debt, including soaring college tuitions and an increase in the number of people attending college. The growing number of for-profit corporations in the education business, as illustrated by the struggle of the Corinthian 100, is another major factor in the rise of this debt.

Federally backed student loans have been available in this country, in one form or another, since the 1950s. But, as this chart dramatizes, student debt has only reached crisis proportions in recent decades.

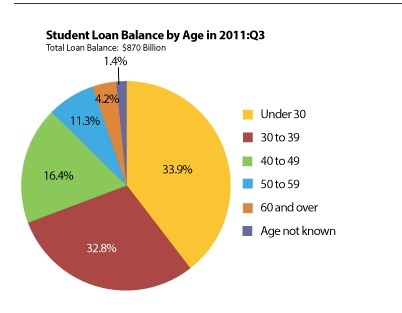

2. The debt burden is disproportionately falling on younger Americans.

Unsurprisingly, given the steep angle in the chart above, millennials are bearing the brunt of the student debt crisis. As this pie chart (based on an earlier Fed report) illustrates, more than two-thirds of all student debt is held by people under 40:

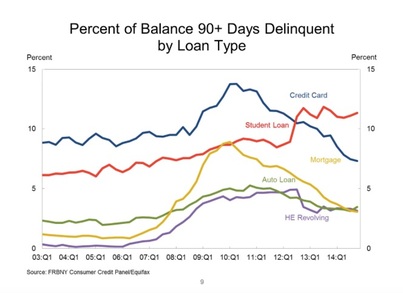

3. An alarming number of student loans are delinquent.

As Mark Huelsman of Demos explains, the Fed’s new reporting indicates that student loan default rates are much higher than previously thought. Student loans have a much higher rate of delinquency than other forms of borrowing:

Here, too, the problem is much greater for people under 40:

(Note: This chart is also based on earlier Fed reporting. The ratios should be similar with both sets of data, but this particular analysis has not yet been released for the new data.)

The Fed’s new reporting shows that the delinquency rate for mortgages is 3.2 percent. The student loan delinquency rate is 11.1 percent, nearly three and a half times as high. (The rate is 7.5 percent for credit cards, which is the second-highest.)

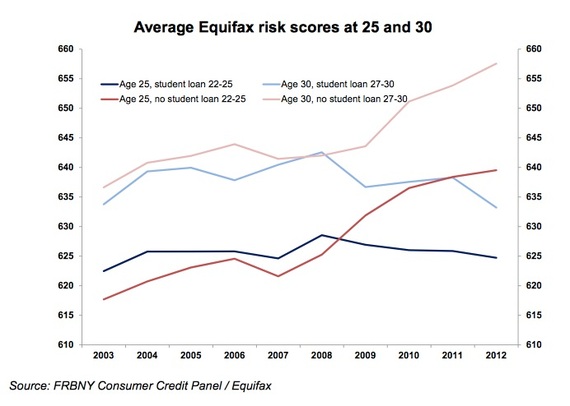

4. Student debt is ruining credit scores – and keeping young people out of the consumer economy.

As the New York Fed’s analysis of Equifax data shows, student debt is having a negative impact on young borrowers’ credit scores. That can affect their ability to finance a home or car, the cost of borrowing, and even their employability. (Prospective employers often check credit scores before hiring.)

This is holding young people back from the consumer economy. As the New York Fed noted, “thirty-year-olds with no history of student debt saw their homeownership rates decline by 5 percentage points.” In recent years, student debt holders have also been less likely to obtain an auto loan than other college-educated people in their age group.

Excessive consumer debt is another economic problem, of course. But these figures are an indication that student debt is keeping young Americans from forming households and purchasing homes, from buying cars, and presumably from other types of purchases as well.

If large numbers of young people are prevented from fully participating in the consumer economy – if they’re not able to buy things – that doesn’t just harm them personally. It hurts the entire economy – which means it affects almost everyone.

Spread the word