When it became clear that Social Security recipients would not receive a cost-of-living adjustment in 2016, Sen. Elizabeth Warren came up with an ingenious remedy, which she introduced in the Senate last week: End the taxpayer subsidy for CEO bonuses and use the proceeds to give seniors and veterans a one-time boost in their benefits.

What we do not know yet is whether frontrunner Democratic presidential candidate Hillary Clinton supports that idea. Where she stands on this bill would say a lot about where she stands on the larger question of expanding instead of cutting Social Security.

We do know where her chief competitor, Sen. Bernie Sanders, stands. He is one of 18 original co-sponsors of a bill that would give seniors, veterans and people with disabilities a one-time benefit adjustment of 3.9 percent, which would amount to a $581 payment to the average beneficiary.

The 3.9 percent represents the average increase in compensation received by the CEOs of the top 350 corporations last year. These increases are taxpayer-subsidized: Corporations can deduct “performance pay” for top executives as a business expense, and many of these executives enjoy tax-deferred compensation packages.

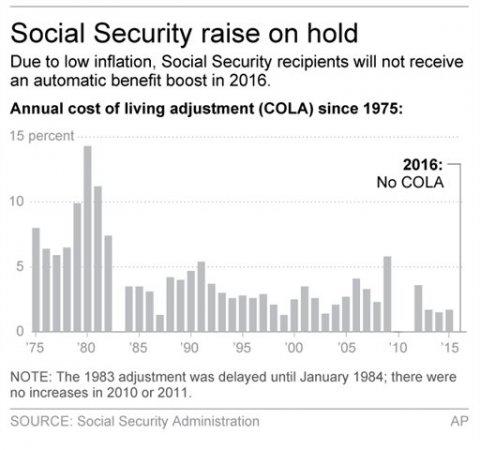

While these executives were enjoying pay increases averaging 4 percent or higher, seniors face having no cost-of-living increase for the third year since 2009. Only one year did seniors see a cost-of-living increase greater than 2 percent; that was 2012, which followed two consecutive years of no increase at all.

The decision to not grant a cost-of-living increase on Social Security, disability and veterans benefits was based on the federal government’s Consumer Price Index for All Urban Consumers (CPI-U), which last month had registered no overall increase in prices over the past year.

But while a prototypical “average” consumer may not be experiencing any increases in their living expenses over the past year, seniors aren’t average. Seniors spend more than the average household on health care, and prices in that sector are expected to increase 6.5 percent in 2016, according to a recent PriceWaterhouseCooper report. Housing costs have been increasing at a rate of more than 3 percent in the past year, and one survey has rents rising by an average of 8 percent in 2016.

Even the cost of groceries, according to government data, have increased nearly 1 percent over the past year, and the cost of eating out has increased more than three times that.

So the denial of cost-of-living benefits for these beneficiaries is going to amount to a cut in their day-to-day ability to keep up with expenses.

According to Rep. Alan Grayson (D-Fla.), basing Social Security payment increases on the CPI-U has shortchanged Social Security recipients to tune of $388 billion since 1976. His “Seniors Deserve a Raise Act” would give Social Security recipients a 2.9 percent increase in 2016, and base future increases on a now-experimental Consumer Price Index for the Elderly, which is designed to mirror the unique spending patterns of older consumers.

“At a time when senior poverty is going up and more than two-thirds of the elderly population rely on Social Security for more than half of their income, our job must be to expand, not cut, Social Security,” Sanders said in a statement at the time Warren introduced her bill. “At the very least, we must do everything we can to make sure that every senior citizen and disabled veteran in this country receives a fair cost-of-living adjustment to keep up with the skyrocketing cost of prescription drugs and health care.”

A MoveOn petition in support of the Warren bill had by midday Tuesday been signed by more than 222,000 people since launching late last week; MoveOn says it is one of its fastest-growing petitions this year. A letter endorsing the Warren bill has received the endorsements of 41 major organizations, including several large labor unions, the Alliance for Retired Americans, B’nai B’rith International, Credo, the National Organization for Women, Vote Vets and Campaign for America’s Future.

Meanwhile, Clinton has received some heat for what have been interpreted as equivocal statements regarding Social Security. She raised concerns in last month’s Democratic presidential debate when she said she would “fully support Social Security” against efforts to “privatize it” but would only “enhance” benefits “for the poorest recipients of Social Security.” Critics have warned that such an approach would violate Social Security’s status as an “earned benefit” program and make it more akin to a welfare entitlement program vulnerable to political manipulation. Plus, there are already measures that give Social Security benefits a more progressive benefit structure, such as benefit deductions for people still working while earning Social Security.

Clinton has also yet to endorse a key measure that would help ensure Social Security’s long-term solvency and make the payroll tax that funds Social Security more fair: Lift the cap (now about $118,000) on the portion of wages that are subject to Social Security taxes. Without that change, the Social Security trust fund will be able to pay full benefits to all recipients into the 2030s. If high earners paid into Social Security at the same rate as middle- and low-income earners, that single policy change would enable the trust fund to pay full benefits far into the future.

Clinton will have another opportunity at Saturday’s Democratic debate to be clear about where she stands on expanding, and not cutting Social Security. Standing with Warren on the cost-of-living bill would make a powerful statement about her priorities for improving this income security pillar for seniors and people with disabilities. Moderators at Saturday’s debate should probe this question, but more importantly, so should citizens who encounter Clinton on the campaign trail.

Spread the word