- The Sanders "Economic Plan" Controversy - Dave Johnson (Campaign for America's Future)

- More Links on Kerfuffle about Friedman's Sanders Analysis - Chris Sturr (Dollars&Sense)

By Dave Johnson

February 23, 2016

When you dare to do big things, big results should be expected. The Sanders program is big, and when you run it through a standard model, you get a big result. - James K. Galbraith

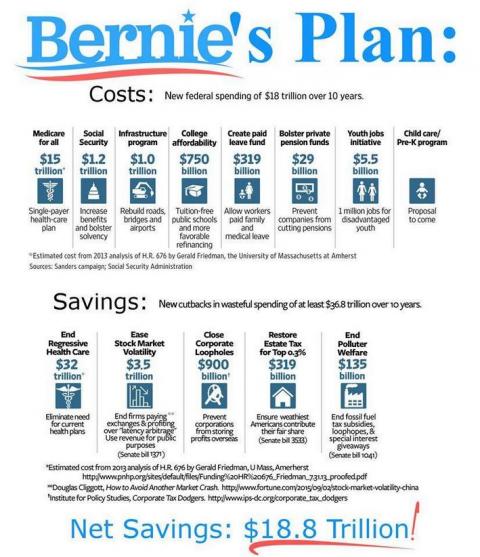

Democratic presidential candidate Bernie Sanders says he wants the American people to join him and "fight for a progressive economic agenda that creates jobs, raises wages, protects the environment and provides health care for all." His website outlines a number of proposals toward this end, including increasing taxation of corporations and the wealthy and using the money to repair the country's infrastructure, extending public education four years to cover college, extending Medicare to everyone, expanding Social Security and addressing climate change.

Gerald Friedman, a respected economist (and Clinton supporter by the way) took a look at Sanders' proposals, ran the revenue and spending numbers through a standard economic model, and suggested that the very high level of spending would provide a "significant stimulus to an economy that continues to underperform, with national income and employment at levels well below capacity." This stimulus could lead to several positive economic outcomes, including increasing gross domestic product growth to 5.3 percent a year, cutting unemployment to 3.8 percent and increasing wages by 2.5 percent per year. This, combining with the revenue proposals, would bring a budget surplus. Friedman wrote:

Like the New Deal of the 1930s, Senator Sanders' program is designed to do more than merely increase economic activity: the expenditure, regulatory, and tax programs will increase economic activity and employment and promote a more just prosperity, "broadly-based" with a narrowing of economic inequality.

On balance, the Sanders program will lead to a dramatic acceleration in economic growth and employment. It will raise wages, especially for the lowest-paid Americans, and narrow the gap between rich and poor. With these gains, economic conditions will return to the prosperity of the late-1990s, or even the mid-1960s.

Friedman's analysis went largely under the radar of the mainstream press.

White House Economists Stoke Opposition

Then, four ex-chairs of the White House's Council of Economic Advisers (CEA), all Democrats, wrote an open letter using Friedman's projections as a way to attack the Sanders campaign. The letter called the projections "fantastical," "extreme" and "claims that cannot be supported by the economic evidence." They compared the projections to the "grandiose" predictions Republicans make about the effects of tax cuts. They wrote that the Sanders campaign (not Friedman) was making "promises" of high job and income growth, writing, "Making such promises runs against our party's best traditions of evidence-based policy making and undermines our reputation as the party of responsible arithmetic."

The New York Times amplified the attack on Sanders in "Left-Leaning Economists Question Cost of Bernie Sanders's Plans," written from the premise that Friedman's projections came from the Sanders campaign itself, writing that even "liberal-leaning economists who share his goals but question his numbers and political realism." The Times piece quoted Austan Goolsbee saying Sanders is offering "magic flying puppies with winning Lotto tickets tied to their collars."

This was picked up widely and amplified further. Paul Krugman, in Varieties of Voodoo wrote that the former CEA chairs' letter matters because "fuzzy math from the left would make it impossible to effectively criticize conservative voodoo." Krugman said all of this "is an indication of a campaign, and perhaps a candidate, not ready for prime time."

Many others piled on, including Kevin Drum at Mother Jones, who wrote in "Bernie Sanders' Campaign Has Crossed Into Neverland," ". this is insane. If anything, it's worse than the endless magic asterisks that Republicans use to pretend their tax plans will supercharge the economy and pay for themselves. It's not even remotely in the realm of reality." (Note: Drum later takes it back. Read on to learn how.)

Most recently Ezra Klein amplified Krugman's "not ready for prime-time" comment in "Why Bernie Sanders's campaign makes me worry about how he'll manage the White House" implying that voters are looking for a manager, not a visionary, and this all shows that Sanders.

".isn't very interested in learning the weak points in his ideas, that he hasn't surrounded himself with people who police the limits between what they wish were true and what the best evidence says is true, that he doesn't seek out counterarguments to his instincts, that he's attracted to strategies that align with his hopes for American politics rather than what we know about American politics. And these tendencies, if they persist, can turn good values into bad policies and an inspiring candidate into a bad president."

Apparently, though, none of the critics actually ran Sanders' proposals through their own economic models to see if the results differed from Friedman's. They just followed the White House advisers' letter and went ballistic.

"Tribalism And Intellectual Dishonesty"

William K. Black looks at this attack on Sanders, through Friedman, at New Economic Perspectives in "Krugman and the Gang of 4 Need to Apologize for Smearing Gerald Friedman":

If you depend for your news on the New York Times you have been subjected to a drumbeat of articles attacking Bernie Sanders - and the conclusion of everyone "serious" that his economics are daft.

[. . .] Orthodox economists just hate the results of Friedman's model, for the results support Bernie, rather than Hillary. Worse, they show that orthodox economists' claims that the government can do little good is a myth. They set out to kill the messenger, Friedman, even though Friedman shares their support for Hillary.

[. . .] Friedman's modeling of Bernie's plan is so terrifying . because it shows - under the orthodox economic models - that the government can be a powerful engine of producing "huge beneficial impacts." What is required is that our President has the nerve to junk the orthodox economic myths. .

Notice that they do not claim that Friedman's "arithmetic" is inaccurate in the sense of making a computational or data input error. Nor do they attack his use of the conventional models they embrace. No, their criticism is that they hate the results of Friedman's accurate arithmetic. They point out no errors in Friedman's arithmetic. There is no indication that they ever checked out the accuracy of how he modeled the impacts of Bernie's plans.

Yves Smith also takes on this attack at Naked Capitalism, in "Krugman and His Gang's Libeling of Economist Gerald Friedman for Finding That Conventional Models Show That Sanders Plan Could Work":

Let us be clear about the vehemence of the salvos aimed at Friedman: this isn't just a bad case of tribalism and intellectual dishonesty. This is purveyors of a failed orthodoxy refusing to indulge any consideration of plans that would show how badly they've mismanaged the economy.

The original sin of Friedman's model of Sanders' plan is that it projects GDP increases in excess of 5 percent for several years running before growth levels moderate. Mind you, Friedman did this using a completely standard model.

Sanders Proposals Close The Output Gap

There is an "output gap" in the GDP trend from 2007 to now. This is the gap between where economic growth would have been without the Great Recession and where it is after austerity policies insisted on by Republican lawmakers restrained the "Obama stimulus," preventing a full normal recovery.

David Dayen points out that Friedman is saying Sanders' stimulus merely makes up that gap, in "The Pious Attacks on Bernie Sanders's `Fuzzy' Economics" at The New Republic:

I don't feel it necessary to defend Friedman, though it's worth pointing out that his economic growth numbers would simply eliminate the GDP gap that was created by the Great Recession and was never filled in the subsequent years of slow growth-which should be the goal of public policy, however "extreme" it sounds.

Mike Konczal at Next New Deal, also takes up the output gap argument in, "In Praise of the Wonk: Dissecting the CEA Letter and Sanders's Other Proposals":

I would have done Gerald Friedman's paper backwards. He gives a giant headline number and then you have to work into the text and the footnotes to gather all the details. But a core assumption within the paper is that we are capable of getting back to the 2007 trend GDP through demand. We can get the recovery we should have gotten in 2009.

...I'd recommend reading JW Mason's excellent analysis about why this is an important and reasonable argument to have: "In other contexts, it's taken for granted that more expansionary policy could deliver substantially higher growth" when there's still an output gap, and if the output gap has shrunk understanding why is essential.

Wonks can identify this as an essential disagreement and demand clarity. To reject Friedman's analysis, as the former CEA chairs do, seems to involve rejecting that component of the analysis. If so, they have an obligation to explain what happened to that potential output trend from 2007. I'm not sure where that trend went, and given the stakes we should look for it.

J.W. Mason takes up some of the same points in "Can Sanders Do It?" This is worth skimming; there's a lot and it's good.

The people who are saying that Jerry's growth numbers are impossible on their face are implicitly saying that we should expect all output losses in recessions to be permanent. This is not orthodox economic theory, at all. Orthodoxy says that the exceptionally deep recession should be followed by a period of exceptionally strong growth - and if it hasn't been, that suggests some ongoing demand problem which policy can reasonably be expected to solve.

...If increased government spending could boost output in 2008, then why couldn't it today? And if the right answer to "how big?" then was "enough to close the output gap," why isn't that the right answer today? Yes, it would be a big number. (Again, it's a lucky coincidence - if correct - that it happens to be close to what Sanders is proposing.)

In "Why are big-shot liberal economists hippie-punching Bernie Sanders?" at The Week, Ryan Cooper has an idea:

Let's do what the Very Serious Wonks did not, and actually look closely at the paper. Friedman's analysis is certainly far outside the mainstream, and from my informed amateur perspective, the amounts by which he predicts Sanders' program will exceed the CBO baseline are mighty implausible. But the basic shape of his analysis - a sharp initial growth spike driven by massive fiscal stimulus, falling rapidly to a lower but still-strong rate - is not at all ridiculous.

[. . .] In short, the whole debate is about how much extra economic capacity there is in the economy, and some fairly strong evidence suggests that the answer is "a lot," provided the government is willing to try really hard. As Matthew Klein writes, "This supposedly `extreme' and `unsupportable' forecast implies American output will return to its previous trend just as Sanders would be finishing up his second term."

[. . .] This is classic hippie-punching. It's policing the leftward edge of the discourse, and in a way that is deeply unfair to Professor Friedman. Even if his analysis turns out to have some errors, he's not remotely comparable to the Republican hacks who cynically stamp out argle-bargle claiming whatever handout to the rich is on deck will create one bazillion percent growth.

James K. Galbraith's Ultimate Takedown Of The Critics

Economist James K. Galbraith wrote a letter responding to the CEA criticisms, saying:

I respond here as a former Executive Director of the Joint Economic Committee - the congressional counterpart to the CEA.

You write that you have applied rigor to your analyses of economic proposals by Democrats and Republicans. On reading this sentence I looked to the bottom of the page, to find a reference or link to your rigorous review of Professor Friedman's study. I found nothing there.

[. . .] et's first ask whether an economic growth rate, as projected, of 5.3 percent per year is, as you claim, "grandiose." There are not many ambitious experiments in economic policy with which to compare it, so let's go back to the Reagan years. What was the actual average real growth rate in 1983, 1984, and 1985, following the enactment of the Reagan tax cuts in 1981? Just under 5.4 percent. That's a point of history, like it or not.

You write that "no credible economic research supports economic impacts of these magnitudes." But how did Professor Friedman make his estimates? The answer is in his paper. What Professor Friedman did, was to use the standard impact assumptions and forecasting methods of the mainstream economists and institutions. For example, Professor Friedman starts with a fiscal multiplier of 1.25, and shades it down to the range of 0.8 by the mid 2020s. Is this "not credible"? If that's your claim, it's an indictment of the methods of (for instance) the CBO, the OMB, and the CEA.

[. . .] It is not fair or honest to claim that Professor Friedman's methods are extreme. On the contrary, with respect to forecasting method, they are largely mainstream. Nor is it fair or honest to imply that you have given Professor Friedman's paper a rigorous review. You have not.

[. . .] What does the Friedman paper really show? The answer is quite simple, and the exercise is - while not perfect - almost entirely ordinary.

What the Friedman paper shows, is that under conventional assumptions, the projected impact of Senator Sanders' proposals stems from their scale and ambition. When you dare to do big things, big results should be expected. The Sanders program is big, and when you run it through a standard model, you get a big result.

That, by the way, is the lesson of the Reagan era - like it or not. It is a lesson that, among today's political leaders, only Senator Sanders has learned.

Again, "When you dare to do big things, big results should be expected. The Sanders program is big, and when you run it through a standard model, you get a big result."

Galbraith drops the mic.

90s-Style Attack Politics

There is a style of politics where you win by creating a lasting "first impression" before your opponent has a chance to respond. When people are first looking at a candidate there is an information gap, so early information can fill the void and "set the narrative" about them. This was common in old-style politics of the past. But the overuse and negativity of it turned people off to politics in general, not knowing who to trust anymore.

This was such an attack. In this case the attack was meant to give an impression that Sanders "makes promises he can't keep," Sanders "doesn't know what he is talking about," and Sanders' "numbers don't add up." Of course people can't be expected to dive into complicated economic models themselves.

(Another example of this kind of attack politics is the idea that Sanders somehow is "against" African Americans and women. For example, recently Clinton campaign ally David Brock said, "black lives don't matter much to Bernie Sanders," in an attempt to reinforce that narrative. But then the New Hampshire primary showed that Sanders actually does get votes from women, and Nevada showed he can get votes from Latinos - erasing the myth of a supposed demographic disadvantage and restoring issues to the forefront of the campaign.)

This "attack politics" used to be very effective. Back then there were few ways a candidate could break through a set narrative. Channels for getting information to voters were limited, as was mindshare. But times have changed. Now there is the Internet. People are connected. Information gets passed around. Memories are longer - because Internet search engines let you look into the past. So the 90s-style attack might set an opening narrative, but people have the capacity to analyze the attack and might see that what they first heard is not the story at all. And then they are as likely to turn on the attacker as believe the attack.

This is happening to the story about Sander's proposals, and Friedman's analysis of their effect on the economy. For example, Kevin Drum, who originally wrote, "Bernie Sanders' Campaign Has Crossed Into Neverland" is taking it back. In "On Second Thought, Maybe Bernie Sanders' Growth Claims Aren't As Crazy As I Thought," Drum actually puts Sanders' proposals through some actual analysis - none of the other critics had done this - and writes, "t turns out that.Friedman isn't projecting anything wildly out of the ordinary after all. . I set out to take another whack at these projections, and I didn't really get what I expected. So I figured I should share."

Unfortunately Drum still says these are Sanders' claims instead of Friedman's. But you take what you can get.

So the turnaround is beginning. In the 90's the "establishment" may have gotten away with this and established a "truthiness" to the claim that Sanders' numbers don't add up (even though they are actually Friedman's numbers). Spending on fixing our infrastructure actually would "create jobs" and raise wages. Shifting health care costs off of people's and business' backs though a Medicare-for-All plan actually would help the economy. Increasing Social Security benefits and the minimum wage actually would enable people to spend more at local stores, boosting the economy.

We don't have to accept slow growth, resulting from austerity policies, as the "new normal." Our economy is currently resisting treacherous global economic conditions and those conditions, if anything, could plausibly argue for the U.S. to accelerate against the global headwinds to prevent us from joining other countries in an economic spiral downward. In fact, it is in the interest of the rest of the world for the U.S. to play this role. And that is exactly what Sanders' proposals do.

[Dave Johnson is a contributing blogger for the Campaign for America's Future.]

By Chris Sturr

February 22, 2016

Here are more links related to the kerfuffle surrounding our columnist Gerald Friedman's research paper on the likely macroeconomic effects if Bernie Sanders economic policies were implemented. (Find the full 53-page paper here.)

David Dayen, The New Republic, The Pious Attacks on Bernie Sanders's "Fuzzy" Economics. "I don't feel it necessary to defend Friedman, though it's worth pointing out that his economic growth numbers would simply eliminate the GDP gap [links to the FT Alphaville piece we linked to the other day] that was created by the Great Recession and was never filled in the subsequent years of slow growth-which should be the goal of public policy, however "extreme" it sounds. What I do want to challenge is the idea that there's one serious, evidence-based way to perform economic forecasting. The truth is that most economic forecasts that look several years into the future are flawed, almost by definition."

Dean Baker, HuffPo, The Four Economists' Big Letter. Dean says he agrees with the substance of the CEA ex-chair's critique (he's skeptical of Friedman's growth projections), but not their "tone" of authority. "I respect all four of these people as economists, but I want to hear their argument, not their credentials. How about just giving the evidence? It might not be as dramatic, but it could have considerably more impact." More recently at his CEPR blog Beat the Press, there's this from Dean: President Obama's Council of Economic Advisers Confirms Sanders' Growth Projections, in which he discusses a section of the 2016 Economic Report of the President and a section "an that provides insight into the question of how fast the economy can grow, and more importantly how low the unemployment rate can go" and the non-accelerating inflation rate of unemployment (NAIRU). Obama's CEA report "is hardly an endorsement of the specifics or the even the size of the Sanders agenda (and certainly not the now famous growth projections from Gerald Friedman), but it does argue for pushing the envelope in terms of bringing down the unemployment rate." (Why Dean is engaged in line-drawing here, subtly suggesting that Jerry's not credible, is beyond me.)

Gerald Friedman, Response to Krugman. A response to a really condescending blog post by Krugman, Lack of Power Corrupts. Krugman really smears Friedman.

Bill Black, New Economic Perspectives blog, Krugman and the Gang of 4 Need to Apologize for Smearing Gerald Friedman. Excellent skewering of the "Gang of 4" CEA ex-chairs. See also Yves Smith's introduction to her reposting of Bill's post at Naked Capitalism, Krugman and His Gang's Libeling of Economist Gerald Friedman for Finding That Conventional Models Show That Sanders Plan Could Work.

Richard Wolff, via email: "As a colleague of Jerry Friedman for decades, I know directly of his consistently careful work in economic history and applied economics, his exceptional commitment to teaching, and the immense time and effort he has committed to doing detailed explorations of the economics of health insurance-explorations his detractors might have learned from had their commitments not been otherwise. Shame on them."

J.W. Mason, at his blog (The Slack Wire), Plausibility. A follow up to the earlier post of his we linked to, Can Sanders Do It?. He gives two scatter-plot graphs, one showing "the initial deviation of real per-capita GDP from its long run trend, and the average growth rate over the following ten years, for 1925 through 2005," the other showing the same thing for just 1947-2005 (so it eliminates the Depression and WWII years). He argues that for either, Friedman's GDP growth projections don't look so implausible; even less so if you take out "the seven points well below the line in the middle are 1999-2005, whose 10-year growth windows include the Great Recession." His upshot: "Should the exceptionally poor performance of this period make us more pessimistic about medium-term growth prospects (it's sign of supply-side exhaustion) or more optimistic (it's a sign of a demand gap that can be filled)? This is not an easy question to answer. But just counting up previous growth rates won't help answer it." His earlier blog post has been republished under a new title at the Jacobin website: When Wonks Attack. Subtitle/teaser: "Beltway wonks are dismissing Bernie Sanders's economic plan as unserious and unrealistic. Here's why they're wrong."

Brad DeLong, at his blog (Grasping Reality.) No: We Can't Wave a Magic Demand Wand Now and Get the Recovery We Threw Away in 2009. Responding to the Mike Konczal post we linked to. I wish people would stop the talk of magic wands and unicorns and fantasy and voodoo and puppies and unicorns. It's just uncharitable and undignified. It reminds me of the infantilizing language Republicans and Clintonites use about Sanders' proposals (e.g., saying that he's promising people "free stuff" including "free ponies"). It's that grown-up stance, talking down to the rest of us.

Kevin Drum, Mother Jones blog, On Second Thought, Maybe Bernie Sanders' Growth Claims Aren't As Crazy As I Thought. Back-pedaling, in light (it seems) of Jamie Galbraith's full-throated defense of the plausibility of Friedman's analysis. No apology for calling his GDP growth projections "insane" without having examined the analysis. (I asked for an apology on Twitter. But that never works.)

Jasper Craven, VTDigger.org, Economist, Others, Defend Sanders `Stimulus' Plans as Realistic. A local Vermont summary of the kerfuffle. Hat-tip Nancy B. A nice piece (though he identifies the D&S Economy in Numbers columns as Jerry's reports, but again, Jerry's main Sanders report is "yuge"-some 53 pages long, including appendices and sources).

Andrew Perez and David Sirota, International Business Times` Political Capital blog, Bernie Sanders Economic Plans Questioned By Critics With Ties To Wall Street, Hillary Clinton.

Ron Baiman, Postscript (Feb 21) to his earlier D&S blog post (Feb 19), The Poverty of Neoclassical Analysis: "Unfortunately, even, politically liberal, mainstream or `Neoclassical', economists do not believe that massive increases in effective demand, or other large scale public spending and policy measures, can produce lasting major and fundamental structural changes in the economy (in spite of the examples of the New Deal, WWII, etc. ). They also don't accept Verdoorn's law (which Friedman employs) in spite of numerous empirical studies and common sense validation: long-term growth in demand leads to increased investment and thus increases in productivity and by implication structural changes in the economy. NC `Keynesians' believe only in short-term Keynesianism - not in a long term principle of effective demand. To the extent that Friedman (rightly) employs a long-term `Post Keynesian' principle like Verdoorn's law (in addition to all of the other standard techniques that he uses) he crosses a line that NC economists will not cross. I belatedly remembered after writing and posting this piece, that Friedman had employed Verdoorn's Law in his study of the long-term economic impact of Bernienomics."

And in case you missed it two weeks ago:

Tami Luhby, CNN Money (Feb. 8), Under Sanders, income and jobs would soar, economist says. The article that likely ignited the kerfuffle (rather than our two columns by Friedman based on his research); this is where a large audience saw Friedman's big GDP growth estimates. And this is where the Sanders campaign appeared to endorse Friedman's findings. "Sanders' policy director, Warren Gunnels, also defended the estimates, noting the candidate is thinking big."

That's it for now. I'm sure there will be another follow-up to this post.

Spread the word