The collective wealth of all U.S. billionaires has increased over $1.1 trillion since mid-March 2020, a nearly 40% leap during the past 10 months of national emergency.

This wealth windfall could pay for all the relief for working families contained in the $1.9 trillion coronavirus relief package proposed by President Biden, while leaving the nation’s richest households no worse off than they were before COVID-19 hit.

The combined fortune of the nation’s 660 billionaires as of Monday, January 18, 2021 was $4.1 trillion, up 38.6% from their collective net worth of just under $3 trillion on March 18, 2020, the rough start of the pandemic, based on Forbes data compiled in this report by the Americans for Tax Fairness (ATF) and the Institute for Policy Studies (IPS). There have been 46 newly minted billionaires since the beginning of the pandemic, when there were 614.

At $4.1 trillion, the total wealth of America’s 660 billionaires is two-thirds higher than the $2.4 trillion in total wealth held by the bottom half of the population, 165 million Americans.

March 18 is used as the unofficial beginning of the pandemic because by then most federal and state economic restrictions responding to the virus were in place. Moreover, March 18 was also the publication date of Forbes’ annual billionaires report in 2020. It provided a detailed baseline that ATF and IPS have been comparing periodically with real-time data from the Forbes website. This methodology has been favorably reviewed by PolitiFact.

The $1.1 trillion wealth gain by 660 U.S. billionaires since March 2020 could pay for:

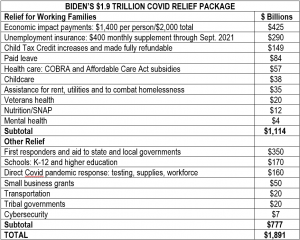

- All of the relief for working families contained in President Biden’s proposed $1.9 trillion pandemic rescue package, which includes $1,400 in direct payments to individuals, $400-a-week supplements to unemployment benefits, and an expanded child tax credit. (See table below)

- A stimulus check of more than $3,400 for every one of the roughly 331 million people in the United States. A family of four would receive over $13,000. Republicans in Congress resisted sending families stimulus checks most of last year, claiming we couldn’t afford them.

Source: Moody’s Analytics, “The Biden Fiscal Rescue Package,” Jan. 15, 2021

Sources: All data in table is from Forbes and available here. March 18, 2020 data: Forbes, “Forbes Publishes 34th Annual List Of Global Billionaires,” March 18, 2020. Jan. 15, 2021 data: Forbes, “The World’s Real-Time Billionaires, Today’s Winners and Losers,” accessed Jan. 18, 2021

Ordinary Americans have not fared as well as billionaires during the pandemic:

- Over 25 million have fallen ill with the virus and more than 420,000 have died from it. [Johns Hopkins Coronavirus Resource Center]

- Collective work income of rank-and-file private-sector employees—all hours worked times the hourly wages of the entire bottom 82% of the workforce—declined by 1% in real terms from mid-March to mid-December, according to Bureau of Labor Statistics data.

- Over 73 million lost work between Mar. 21 and Dec. 26, 2020. [S. Department of Labor]

- 16 million were collecting unemployment on Jan. 2, 2021. [S. Department of Labor]

- Nearly 100,000 businesses have permanently closed. [Yelp/CNBC]

- 12 million workers have likely lost employer-sponsored health insurance during the pandemic as of August 26, 2020. [Economic Policy Institute]

- Some 29 million adults reported between Dec. 9-21 that their household had not had enough food in the past week. From Nov. 25-Dec. 7, between 8 and 12 million children lived in a household where kids did not eat enough because the household could not afford to fully feed them. [Center on Budget & Policy Priorities (CBPP)]

- 14 million adults—1 in 5 renters—reported in December being behind in their rent. [CBPP]

Because of long-standing racial and gender disparities, low-wage workers, people of color and women have suffered disproportionately in the combined medical and economic crises of 2020. Latinos are more likely to become infected with Covid-19 and Blacks to die from the disease than are white people. Billionaires are overwhelmingly white men.

The stock market surge and lock-down economy have been a boon to tech monopolies and helped create multiple U.S. “centi-billionaires.” Jeff Bezos, Elon Musk, and Bill Gates were each worth more than $100 billion on Jan. 18. Prior to this year, Bezos had been the only U.S. centi-billionaire, reaching that peak in 2018. Bezos and other billionaires have seen particularly astonishing increases in wealth over the past 10 months:

- Elon Musk’s wealth grew by over $154 billion, from $24.6 billion on March 18 to $179.2 billion on Jan. 18, a nearly eight-fold increase, boosted by his Tesla The boost in wealth of the SpaceX founder over the past 10 months is more than twice that of any other billionaire. That $154 billion growth in wealth is also about seven times NASA’s $22.6 billion budget in FY2020, the federal agency Musk has credited with saving his company with a big federal contract when the firm’s rockets were failing and it faced bankruptcy.

- Jeff Bezos’s wealth grew from $113 billion on March 18 to $182 billion, an increase of 61%. Adding in his ex-wife MacKenzie Scott’s wealth of $55 billion on Jan. 18, the two had a combined wealth of almost a quarter of a trillion dollars thanks to their Amazon If Bezos’s $68.6 billion growth in wealth was distributed to all his 810,000 U.S. employees, each would get a windfall bonus of almost $85,000 and Bezos would not be any “poorer” than he was 10 months ago.

- Mark Zuckerberg’s wealth grew from $54.7 billion on March 18 to $92 billion, an increase of over two-thirds fueled by his Facebook

Tax reform that ensures the wealthy pay their fair share—the principle the Biden tax plan is built on—would transform a good chunk of those huge billionaire gains into public revenue to help heal a hurting nation. But getting at that big boost in billionaire fortunes is not as simple as raising tax rates: tax rules let the rich delay, diminish and even ultimately avoid any tax on the growth in their wealth. What’s needed is structural change to how wealth is taxed.

The most direct approach is an annual wealth tax on the biggest fortunes, proposed by Senators Elizabeth Warren and Bernie Sanders, among others. Another option is the annual taxation of investment gains on stocks and other tradable assets, an idea advanced by the new Senate Finance Committee chair, Ron Wyden. Even under the current discounted tax rates for investment income, if Wyden’s plan had been in effect in 2020, America’s billionaires would be paying hundreds of billions of dollars in extra taxes this spring thanks to their gargantuan pandemic profits last year.

Spread the word