The Trump Administration and Republican majorities in both houses of Congress are advancing a policy agenda that deeply threatens millions of families’ ability to afford the basics by making it harder for them to secure health coverage, buy groceries, or afford everyday goods — all while pursuing expensive tax cuts that are skewed toward the wealthy.

The centerpiece of that agenda is far-reaching tax and budget legislation intended to be passed through the fast-track budget “reconciliation” process. But that legislation works hand-in-hand with other Administration policies, both accelerating and deepening the damage to families with modest incomes. It includes an executive action agenda that unlawfully stops funding for public services and investments, hollows out and politicizes the civil service, and undermines basic governance. It also includes sweeping tariffs — the highest in more than a century and eight times higher than they were last year — that will cost low- and moderate-income families hundreds if not thousands of dollars, more than offsetting whatever modest tax cuts they may receive from tax legislation.

This three-part agenda — legislation, executive action, and tariffs — the Trump Administration and congressional Republicans are pursuing will reduce the living standards and raise costs for millions of families with modest incomes while helping pave the way for tax cuts skewed to the wealthy. And it’s important to understand that the justification for this upward income redistribution — faster economic growth — is unlikely to materialize. In fact, the sweeping tariffs that Trump has imposed have heightened the risks of a recession — and low-paid workers will bear the brunt.

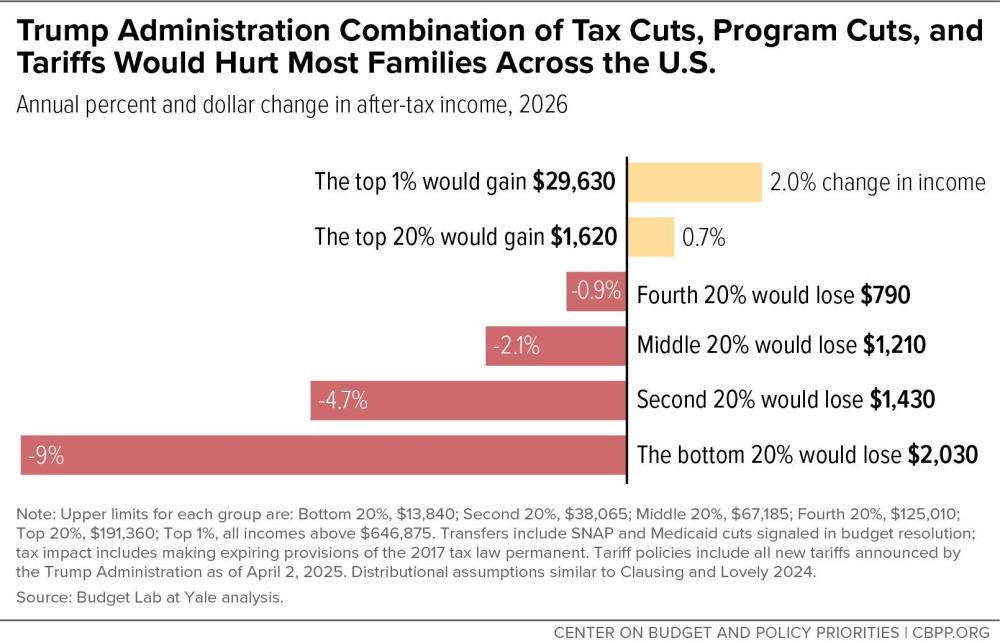

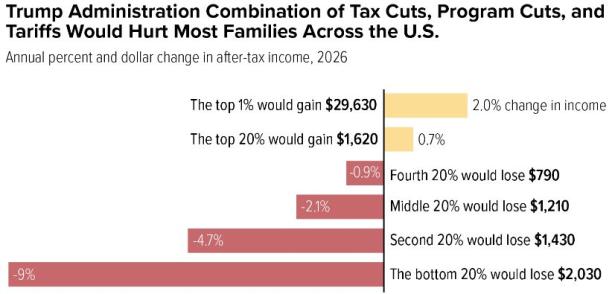

To illustrate the distributional consequences of this triple threat policy agenda, we show in Figure 1 below that the combination of extending the 2017 tax law, deep cuts to Medicaid and SNAP consistent with the House budget, and the tariffs announced in 2025 would reduce the income of households in the bottom 60 percent of the income distribution by an average of $1,550, or the equivalent of about three months of groceries. Meanwhile, the package would increase the income of households with incomes in the top 1 percent by an average of $29,630. The chart in some ways understates the potential harms for families because it does not include the effects of the Administration’s extraordinary executive actions.

These policies would affect families of all races by reducing assistance or access to assistance while raising costs, but would particularly affect communities of color given their lower incomes due to past and ongoing discrimination in areas like housing and hiring.

Far from shared sacrifice, this fiscal policy agenda hurts the people, families, and communities the President pledged to serve during the campaign. It reduces the living standards of low- and moderate-income people across the U.S., who need more support, to finance unnecessary tax cuts for the wealthiest people.

The Trump Administration’s Main Goal: Tax Cuts for the Wealthy Financed by Cutting Health Coverage and Food Assistance That Millions of Families Need

The centerpiece of the Trump Administration’s economic agenda is legislation enacting large tax cuts skewed to the wealthy and corporations while making deep cuts to programs low- and moderate-income people rely on and a wide range of public services.

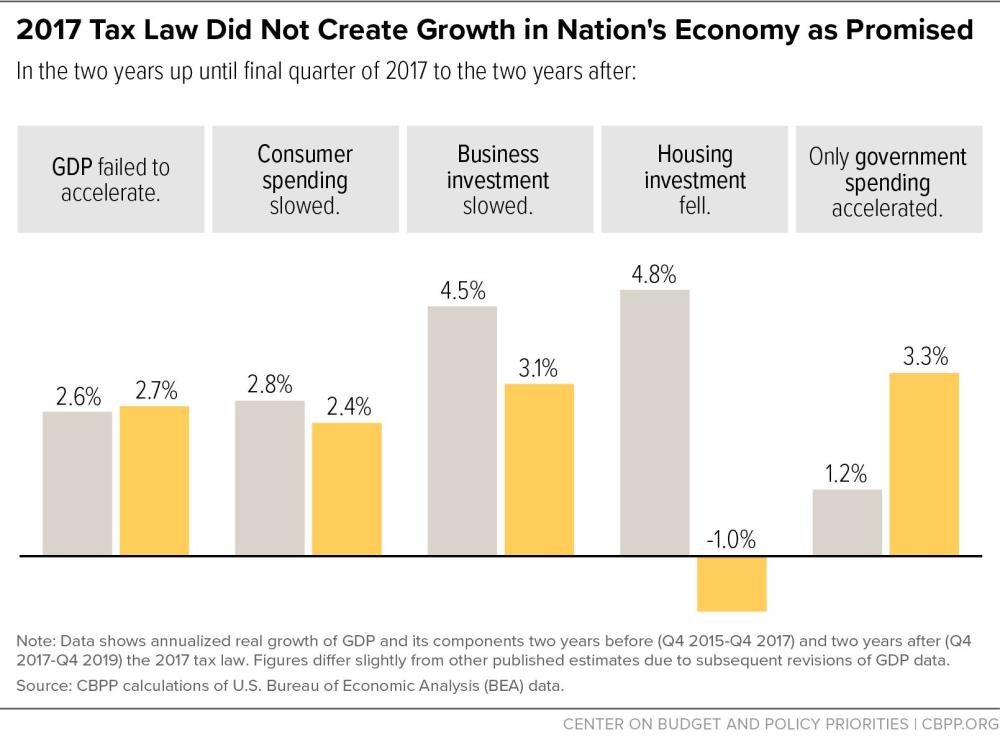

The Trump Administration’s main policy priority is extending the expiring provisions of the 2017 tax cuts as part of a party-line bill using the fast-track reconciliation process. The annual cost of extending the individual and estate tax provisions of the 2017 tax law is about $400 billion, which would severely erode the revenue base. The economic benefits of the law fell far short of the proponents’ claims, failing to significantly boost economic growth, investment, or workers’ earnings.

Extending the expiring tax cuts would, however, deliver large benefits for the wealthy: millionaire households would get tax cuts averaging $54,190 and a 2.9 percent increase in their after-tax incomes according to the Tax Policy Center. Indeed, roughly half the cost of extending the expiring tax cuts would flow to households with incomes in the top 5 percent.

The House-passed budget resolution calls for $4.5 trillion of tax cuts over the fiscal year 2025-2034 budget window, more than enough to cover the cost of extending the expiring individual and estate tax cuts over that period. As a result, the House budget creates room for additional tax cuts. Several leading House Republicans have signaled that enacting a series of business-related tax cuts related to the 2017 tax law as well as increasing the amount of state and local taxes high earners can deduct are priorities that could be added to take up that extra room. These policy changes would increase both the size of the tax cuts received by high earners and the regressivity of the package, likely exceeding the generosity of any populist-sounding tax breaks like “no tax on tips” that are included.

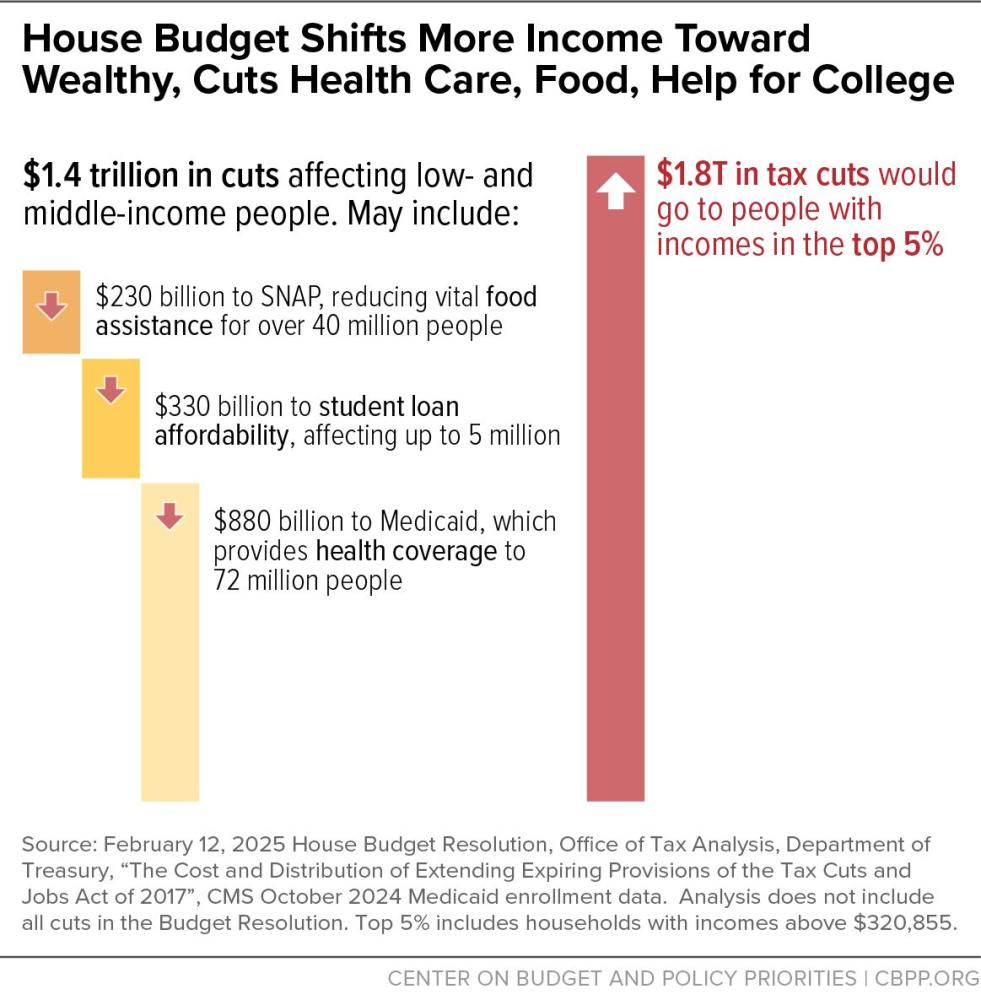

The House budget then instructs several House committees to achieve various levels of savings to help offset the cost of the tax cuts. (See Figure 2.) It requires the Energy and Commerce Committee to cut at least $880 billion; the Agriculture Committee to cut at least $230 billion; the Education and Workforce Committee to cut at least $330 billion; and other committees to also cut programs to reach a cumulative target of at least $1.5 trillion in cuts through 2034. Moreover, these committee targets are minimums or “floors” — meaning the committees must cut at least that amount and may cut more. In fact, a provision in the House budget pushes the committees to cut more, by requiring the overall level of program cuts to reach $2 trillion to retain the full $4.5 trillion in tax cuts.

Given the magnitude of these reductions and the programs within the jurisdiction of these committees, these congressional committees would have no alternative but to make enormous cuts in Medicaid, the Supplemental Nutrition Assistance Program (SNAP), student loan assistance and other vital sources of support to make their math work as they develop the reconciliation spending and tax bill that follows the budget resolution. Congressional Republicans have, at times, denied the budget resolution means cuts to Medicaid and SNAP despite assigning significant deficit reduction to the committees overseeing those programs. Yet, it would be impossible for the Energy and Commerce Committee to reach its deficit reduction target while avoiding cuts to Medicaid without cutting Medicare, or for the Agriculture Committee to avoid cuts to SNAP without cutting farm aid by 75 percent (something House Republicans have not even floated).

These massive cuts in health coverage and food assistance cannot be achieved through efficiency; they would require taking food assistance and health coverage away or cutting benefits significantly. Some 72 million people get their health coverage through Medicaid or the Children’s Health Insurance Program and 40 million people help each month buying food through SNAP.

The Budget Lab at Yale recently illustrated the potential harm of the tax and spending policies inherent in the House budget by calculating the net effects for different income groups of extending the 2017 tax law and making the cuts to Medicaid and SNAP suggested in the House budget. The Budget Lab found that this would reduce the incomes of families with incomes in the bottom 40 percent while leaving the tax cuts for the top 1 percent of families essentially unchanged.

The new Senate budget retains the instructions to House committees analyzed above but, in an extraordinary sleight of hand, its instructions to Senate committees do not match the House instructions. The Senate committees with jurisdiction over SNAP and student loans are directed to cut at least $1 billion over ten years, rather than the far higher levels in the House instructions. The instruction to the Finance Committee, which is responsible both for the tax provisions and Medicaid, does not explicitly assume large Medicaid cuts either.

While the Senate could in theory craft a reconciliation bill that only hits the de minimis program cut targets assigned to the Senate committees, nothing in the Senate resolution would prevent the same large cuts to health, food assistance, and student aid that the very same resolution directs House committees to achieve. And given that some conservative Senators have called for enacting program cuts that are deeper than those assigned in the House, and the budget resolution and congressional budget rules allow for that outcome, the threat that the ultimate reconciliation bill will deepen poverty, raise costs, and leave more people uninsured is extremely high.

Aggressive Executive Actions Aim to Cut Critical Services and Reduce Benefit Access While Undermining Basic Governance

At the same time the Trump Administration and congressional Republicans are pursuing enormous cuts to programs through the legislative process, the Administration (with the support of congressional Republicans) is using executive actions to attack a range of public services that low- and moderate-income families need. Moreover, their actions are undermining basic governance, which will have wide-reaching effects on the economy and likely increase the deficit, despite the Administration’s claims to the contrary.

Executive Actions Are Taking Aim at Critical Retirement and Health Care Programs

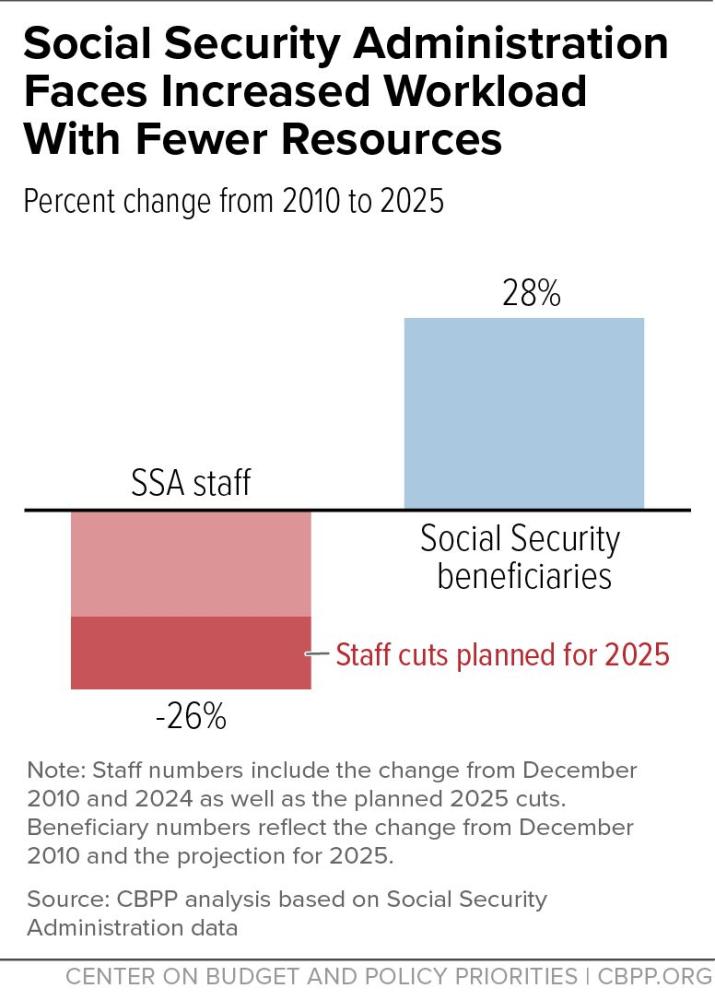

The Administration and its “Department of Government Efficiency” (DOGE) headed by Elon Musk have targeted the Social Security Administration (SSA) for staffing and service cuts. (See Figure 3.) The agency was already experiencing serious customer service challenges, including long hold times on the phone, long waits for in-person appointments, and record-long waits for disability determinations — fueled by long-time inadequate funding and understaffing.

Yet Musk and DOGE are pushing deep cuts to SSA staff, placing new restrictions on phone-based services, and shuttering SSA field offices — further degrading services for millions of people who receive or apply for Social Security benefits each year. (See Figure 3.) These moves, along with actions threatening the security of people’s personal information, are placing the operational reliability of SSA’s systems at risk, prompting former SSA leaders and high-ranking career staff who have served Presidents of both parties to raise alarms.

In another example, the Centers for Medicare & Medicaid Services (CMS) has issued a proposed Affordable Care Act marketplace regulation that would reduce marketplace enrollment by between 750,000 and 2 million people and raise premium costs for millions more people, CMS estimates.

Executive Actions Undermining Governance Will Negatively Impact Everyone

The Administration is also implementing large-scale staffing reductions across the government through buy-outs, terminations of probationary employees, and now through layoffs being executed through a “reductions in force” (RIFs) process. The firings are occurring despite fiscal year 2025 funding levels for most annually appropriated (or discretionary) programs being held at last year’s levels and there being sufficient funding to staff these agencies without staffing reductions.

The effects of the Administration’s proposed staffing cuts put a wide range of core government services — in addition to those delivered by SSA and HHS, as we described above — at risk. For example:

- layoffs at the National Weather Service could reduce the country’s capacity to collect, analyze, and disseminate data on drought, flood, and extreme heat emergencies. These data are particularly important for farmers who make decisions based on these data;

- layoffs at the Department of Agriculture’s Forest Service could mean less access to expertise to manage forests to decrease fire risk and fewer personnel to fight increasingly large and deadly fires, endangering millions of people;

- layoffs at the National Institutes of Health could mean less research on preventing and curing diseases; and

- layoffs at the Office of Civil Rights at the Department of Education — the office that parents can turn to when their schools are not meeting their obligations — may hobble its capacity to investigate discrimination against students, including discrimination based on race and disability status.

The Administration has justified many of these staffing reductions as helping reduce the deficit — despite total employee costs making up a small fraction of the federal budget. Perhaps most perversely, it has also proposed a 20 percent cut in IRS staff heavily targeted at the enforcement functions that ensure tax cheats pay their taxes. This would increase the deficit by about $160 billion over ten years, an analysis by the Budget Lab at Yale found.

The large-scale staffing reductions are just one way the Administration has tried to circumvent enacted funding laws. It’s also withheld funding broadly for entire agencies such as USAID and has terminated grants and contracts for services that nonprofits and businesses would provide on behalf of government. However, both statutes and the Constitution prohibit the Administration from unilaterally withholding funding provided by Congress, and various legal actions have been brought to stop many of the Administration’s actions.

These actions will make it harder for the government to effectively serve people and communities. Households with low and moderate incomes could be particularly impacted by degraded public services, since they can’t afford to simply shift from public to private resources to meet their basic needs, nor do they have the resources to seek legal recourse when their rights are trampled.

Tariff Plans Are Part of Scheme of Distributing Wealth From Low- and Moderate-Income Families to the Wealthy

The Administration has proposed and implemented sweeping taxes on imported goods, known as tariffs, through executive actions, justifying them in part on the need to raise revenues to offset the extension of the 2017 tax cuts. Prior to the April 2 announcement of broad-based tariffs, the Administration imposed a 20 percent tariff on Chinese imports and a 25 percent tariff on steel, aluminum, car, and car part imports from across the globe. It also put in place 25 percent tariffs on imports from Canada and Mexico, though these tariffs exempt imports covered under our free trade agreement with those countries.

The most significant tariffs to date were announced on April 2. The U.S. will now impose at least a 10 percent tax on all imports, and imports from about 60 additional countries will be taxed at a rate as high as 50 percent. Trading partners’ imports subject to extra tariffs include the European Union (20 percent), Japan (24 percent), South Korea (25 percent), and Vietnam (46 percent). The newly announced 34 percent tax on Chinese imports will stack on top of the previously announced 20 percent tax, for a cumulative tax of 54 percent. Imports from Canada and Mexico will be exempt from this specific tariff. Energy imports will also be exempt as will products the Trump Administration has imposed or plans to impose specific global tariffs on such as autos, steel, aluminum, and medicine.

These tariffs are highly significant: they raise the U.S.’s effective tariff rate — that is the tax rate on all imports — from 2.7 percent to 22.5 percent when combined with the other 2025 tariffs. This is the highest effective tariff rate since 1908, exceeding the infamous Smoot-Hawley tariffs enacted in 1930.

The revenue from these tariff actions totals $3 trillion over ten years before accounting for negative macroeconomic effects and retaliation, according to the Budget Lab at Yale. Both the Administration and congressional Republicans have said that the projected revenue from tariffs could be an informal offset for the legislation that will deeply cut taxes for wealthy taxpayers and corporations.

Because the tariffs stem from executive action, they will not be part of the tax bill and its final Congressional Budget Office and Joint Committee on Taxation scores. But the Administration could use the projected revenue to assuage members of Congress’s fears about the country’s growing deficit as a result of the tax cuts. If the tariff revenue is being used to justify the reconciliation bill’s fiscal implications, then it is fair to also include it in the analysis of the budget agenda’s distributional implications.

These tariffs will increase the prices of a wide range of imported goods, including products that the United States does not, nor cannot, produce in large quantities, such as bananas. Indeed, tariffs provide no protection to domestic producers of goods that compete against imported goods unless prices on the imported goods rise. A wide array of analysts including the Congressional Budget Office, the Budget Lab at Yale, and Goldman Sachs project that sweeping tariffs will result in an increase in prices that families would experience as a one-time burst of inflation and then permanently higher price levels for goods, even after incorporating mitigating effects like adjustments in exchange rates.

Some of the largest price increases U.S. consumers will experience from this year’s tariffs include clothing (16.9 percent), cars and car parts (8.4 percent), computers (4.5 percent), and vegetables and fruits (4.0 percent). Importantly, these estimates are for overall domestic prices — not just imported goods. These increases will make it more expensive for families to get to work, put food on the table, and buy new school clothes for their children.

Tariffs can play a useful role in trade policy as a way to remedy specific trade issues — like the need to ensure domestic production of goods related to national security — but are a flawed way to raise revenues because of the burden they place on low- and moderate-income families. They function similar to a sales tax and place a heavier immediate burden on families with low and moderate incomes since they spend a larger share of their income than higher income families.

Moreover, unlike the individual income tax, tariffs do not feature a progressive rate structure where high-income households by design pay higher tax rates than low- and moderate-income families. The Treasury Department finds that families with incomes in the bottom 80 percent of the income distribution pay 30 percent of tariffs and excise taxes and 7 percent of individual income taxes. The top 1 percent of households, on the other hand, pay 17 percent of tariffs and excise taxes and 44 percent of individual income taxes.

But the Republican agenda would make tariffs even more regressive, by using the revenue raised to help finance regressive tax cuts like extending the 2017 tax law, which gives low- and moderate-income families paltry tax cuts and high-income families large tax cuts. We illustrate how large tariffs can contribute to an extremely regressive fiscal policy package by adding the Budget Lab analysis of the House budget to a Budget Lab analysis of the tariffs Trump has enacted this year.

The combination of tariffs, the cuts to Medicaid and SNAP, and the extension of the expiring 2017 tax cuts will reduce the incomes of households with incomes in the bottom 80 percent of the distribution. The only group that will benefit is households with incomes in the top 20 percent, with those in the top 1 percent receiving a net 2.0 percent increase ($29,630) increase in their incomes. The result for households with incomes in the bottom 20 percent is especially striking: they would lose an average of $2,030, or a 9.0 percent reduction in their income, in service to extending tax cuts for the wealthy. Overall, households with incomes in the bottom 60 percent would lose an average of $1,550 in their incomes — the equivalent of about three months of grocery spending for the average household in this group.

Triple Threat Agenda Will Likely Result in Slower Economic Growth

Tax cuts for the wealthy paid for by cutting programs that help low- and middle-income families get needed health coverage and afford groceries, executive actions that undermine services and programs that communities and households count on, and enormous tariffs that will cost jobs and raise prices for consumers are going to damage the economy’s potential for growth.

Extending the 2017 tax cuts will not result in markedly faster economic growth. In fact, it would shrink the economy in the long run, a CBO analysis finds.

Despite the claims of the tax law’s proponents, the original legislation did little to spur economic growth during the pre-pandemic period. Economic growth barely changed in the two years after the law relative to the two years before the law. The rate of overall business investment slowed after the tax law’s enactment, as did consumption. Ironically, real GDP growth rose slightly because of increases in government spending following passage of the 2018 Bipartisan Budget Act, which boosted defense and non-defense appropriations funding. (See Figure 4.)

In addition, the tariffs will lead to higher prices, both for consumer purchases and business investments, ultimately lowering real spending by consumers and businesses. Given that consumer spending is nearly 70 percent of GDP, and business investment represents another 20 percent, a major negative shock to this spending is likely to lead to lower growth. For example, a CBO analysis finds that a combination of a 10 percent tariff on the value of goods from all countries plus an additional 50 percent tariff on goods imported from China would decrease real GDP by 0.6 percent. The Budget Lab analysis of Trump’s 2025 tariffs found similar negative growth effects.

Tariffs — particularly those with an unclear trajectory — also cause uncertainty in financial markets and make it difficult for businesses to plan. With the Trump Administration’s haphazard announcements on tariffs, businesses do not know whether tariffs will be imposed for a brief period, if there will be exemptions, or whether the tariff rates will stay constant. This uncertainty lowers investment spending and thereby decreases economic growth.

This uncertainty has driven consumer and business sentiment indices downward. The University of Michigan’s Consumer Sentiment fell by 10.5 percent between February and March 2025. The Conference Board’s consumer confidence measure fell seven points to its lowest reading since January 2021. Business confidence has fallen, too with the National Federation of Independent Business small business optimism index fell 2.1 points between February and March 2025.

The Federal Reserve Board is also factoring this uncertainty into its economic analysis. The Administration’s agenda led the Fed to revise down its forecast for economic growth even before the April 2 announcement, while raising its forecast for both unemployment and inflation. Many economists have expressed concern that the risk of higher unemployment and economic contraction has risen significantly.

This agenda will not only not boost economic growth but could lead to a recession. Treasury Secretary Scott Bessent called for the economy to “detox” from public spending. Recessions are not something to take lightly or to purposely foment. When a recession occurs, people lose jobs, businesses lose revenue and may end up shuttering, and state and local finances diminish.

While recessions hit broadly across an economy, specific groups tend to suffer more harm than others, including Black and Hispanic workers, youth, and those with lower educational attainment. Leisure and hospitality — the industry with the lowest wages — has been hard hit in the last few recessions as consumers saved money by pulling back on discretionary purchases like eating out.

And recessions can have long-lasting impacts on households. Wage losses persist after recessions for individuals who graduated in a recession. New job entrants struggle to progress up the job ladder if they enter the labor market during a recession. Incomes take longer to recover for those outside of the top 5 percent of earners. None of this bodes well for the U.S. economy in 2025 and beyond.

End Notes

Chuck Marr and Samantha Jacoby, “House Republican Budget’s $4.5 Trillion Tax Cut Doubles Down on Costly Failures of 2017 Tax Law,” CBPP, February 28, 2025, https://www.cbpp.org/research/federal-budget/house-republican-budgets-45-trillion-tax-cut-doubles-down-on-costly

Tax Policy Center, “T25-0040 – Extend Certain Individual Income Tax Provisions in the 2017 Tax Act, by ECI Level, 2026,” March 27, 2025, https://taxpolicycenter.org/model-estimates/t25-0040-extend-certain-individual-income-tax-provisions-2017-tax-act-eci-level.

United States House Committee on Ways and Means, “Chairman Smith: A Vote Against This Budget Is A Vote to Raise Taxes on Low-Income Americans,” February 25, 2025, https://waysandmeans.house.gov/2025/02/25/chairman-smith-a-vote-against-this-budget-is-a-vote-to-raise-taxes-on-low-income-americans/; Carolyn Gusoff, “SALT cap debate could delay GOP tax bill, New York Republican says,” CBS News, January 30, 2025, https://www.cbsnews.com/newyork/news/salt-cap-nick-lalota-andrew-garbarino-mike-lawler-us-house-of-representatives/ .

Chuck Marr, 10:50 a.m., March 12, 2025, https://x.com/ChuckCBPP/status/1899835459598983416.

Sharon Parrott, “House Budget Would Increase Costs and Hardship for Many While Providing Huge Tax Breaks for a Wealthy Few,” CBPP, February 25, 2025, https://www.cbpp.org/press/statements/house-budget-would-increase-costs-and-hardship-for-many-while-providing-huge-tax.

Office of Congressman Steve Scalise, “Scalise: Democrats Want Multi-Trillion Dollar Tax Increase,” February 25, 2025, https://scalise.house.gov/press-releases/Scalise%3A-Democrats-Want-Multi-Trillion-Dollar-Tax-Increase.

Jacob Bobage, “GOP must cut Medicaid or Medicare to achieve budget goals, CBO finds,” Washington Post, March 5, 2025, https://www.washingtonpost.com/business/2025/03/05/gop-budget-medicaid-cuts/; Bobby Kogan, “The GOP’s budget plan makes it hard to conceal its lies about Medicaid and SNAP,” March 4, 2025, https://www.msnbc.com/opinion/msnbc-opinion/house-republicans-budget-medicaid-snap-cuts-rcna194231.

Allison Orris and Gideon Lukens, “Medicaid Threats in the Upcoming Congress,” CBPP, December 13, 2024, https://www.cbpp.org/research/health/medicaid-threats-in-the-upcoming-congress; Katie Bergh, “Millions of Low-Income Households Would Lose Food Aid Under Proposed House Republican SNAP Cuts,” CBPP, February 24, 2025, https://www.cbpp.org/research/food-assistance/millions-of-low-income-households-would-lose-food-aid-under-proposed-house.

https://budgetlab.yale.edu/news/250319/illustrative-distributional-effects-policies-consistent-house-concurrent-budget-resolution-fiscal

The Budget Lab analysis does not account for the budget’s cuts to education or to how the Trump Administration would finance the budget’s increase to deficits since the enormous cuts to programs are still not enough to pay for its tax cuts. Brendan Duke, “New Analysis Quantifies Low- and Moderate-Income Families’ Losses Under House Budget Resolution,” CBPP, March 19, 2025, https://www.cbpp.org/blog/new-analysis-quantifies-low-and-moderate-income-families-losses-under-house-budget-resolution.

Burgess Everett, “Tea party’s champions agonize over spending cuts,” Semafor, March 27, 2025, https://www.semafor.com/article/03/27/2025/tea-partys-republican-champions-face-a-reckoning-over-spending-cuts.

Paul N. Van de Water, “SSA Budget Will Worsen Customer Service Crisis, But Investment in 2025 Could Fund Turnaround,” CBPP, April 12, 2024, https://www.cbpp.org/blog/ssa-budget-will-worsen-customer-service-crisis-but-investment-in-2025-could-fund-turnaround.

Lisa Rein and Hannah Natanson, “Long waits, waves of calls, website crashes: Social Security is breaking down,” Washington Post, March 25, 2025, https://www.washingtonpost.com/politics/2025/03/25/social-security-phones-doge-cuts/.

Jennifer Sullivan, “Proposed ACA Marketplace Rule Will Increase Costs, Reduce Enrollment,” CBPP, https://www.cbpp.org/research/federal-budget/executive-action-watch?item=29678.

David A. Super, “Many Trump Administration Personnel Actions Are Unlawful,” CBPP, February 14, 2025, https://www.cbpp.org/research/federal-budget/many-trump-administration-personnel-actions-are-unlawful.

The Budget Lab, “The Revenue and Distributional Effects of IRS Funding,” March 14, 2025, https://budgetlab.yale.edu/research/revenue-and-distributional-effects-irs-funding.

David Lawder, David Ljunggren, and Kylie Madry, “Trump triggers trade war, price hikes with tariffs on Canada, China and Mexico,” Reuters, March 5, 2025, https://www.reuters.com/world/trade-wars-erupt-trump-hits-canada-mexico-china-with-steep-tariffs-2025-03-04/; Abha Bhattarai, Mary Beth Sheridan and Amanda Coletta, “Trump grants one-month tariff reprieve to some goods from Mexico, Canada,” Washington Post, March 6, 2025, https://www.washingtonpost.com/world/2025/03/06/trump-mexico-tariffs; Ana Swanson and Jeanna Smialek, “Trump’s Tariffs on Steel and Aluminum Go Into Effect, Inciting Global Retaliation,” New York Times, March 13, 2025, https://www.nytimes.com/2025/03/12/us/politics/trump-tariffs-steel-aluminum.html.

The Budget Lab, “Where We Stand: The Fiscal, Economic, and Distributional Effects of All U.S. Tariffs Enacted in 2025 Through April 2,” April 2, 2025, https://budgetlab.yale.edu/research/where-we-stand-fiscal-economic-and-distributional-effects-all-us-tariffs-enacted-2025-through-april.

Aime Williams, “Donald Trump considers two-step tariff regime on April 2,” Financial Times, March 25, 2025, https://www.ft.com/content/114ceb19-86ef-43a0-9f45-7d45300c3ffd; Meredith Lee Hill, “Trump and GOP leaders discuss using tariffs to pay for agenda,” Politico, February 27, 2025, https://www.politico.com/live-updates/2025/02/27/congress/trump-tariffs-gop-agenda-budget-00206556.

The Budget Lab, April 2, 2025; Jan Hatzius et al., “USA: President Trump Announces ‘Reciprocal’ Tariffs,” Goldman Sachs, April 2, 2025. On file with author.

The Budget Lab, April 2, 2025.

Kimberly Clausing and Mary E. Lovely, “Why Trump’s tariff proposals would harm working Americans,” The Peterson Institute for International Economics, May 2024, https://www.piie.com/publications/policy-briefs/2024/why-trumps-tariff-proposals-would-harm-working-americans.

U.S. Treasury Department Office of Tax Analysis, “Distribution of Tax Burden, Current Law (2025),” https://home.treasury.gov/policy-issues/tax-policy/office-of-tax-analysis.

Analysis of 2023 Consumer Expenditure Survey data.

Congressional Budget Office, “Projections of Deficits and Debt Under Alternative Scenarios for the Budget and Interest Rates,” March 21, 2025, https://www.cbo.gov/publication/61255.

Jeffrey R. Campbell et al., “The Macroeconomic Effects of the 2018 Bipartisan Budget Act,” Federal Reserve Bank of Chicago, Economic Perspectives, Vol. 43, No. 2, July 2019, https://www.chicagofed.org/publications/economic-perspectives/2019/2?attredirects=0&d=1.

Congressional Budget Office, “Effects of Illustrative Policies That Would Increase Tariffs,” December 19, 2024, https://www.cbo.gov/publication/61112.

The Budget Lab, April 2, 2025.

David Lawder and Susan Heavey, “US Treasury’s Bessent says economy may slow in shift away from public spending,” Reuters, March 7, 2025, https://www.reuters.com/world/us/us-treasurys-bessent-says-economy-may-slow-shift-away-public-spending-2025-03-07/.

Hilary Hoynes et al., “Who Suffers during Recessions,” Journal of Economic Perspectives, Vol. 26, No. 3, Summer 2012, https://www.aeaweb.org/articles?id=10.1257/jep.26.3.27.

U.S. Bureau of Labor Statistics, “Table B-3. Average hourly and weekly earnings of all employees on private nonfarm payrolls by industry sector, seasonally adjusted,” https://www.bls.gov/news.release/empsit.t19.htm; Eliot Davila, “Employment in leisure and hospitality departs from historical trends during 2007–09 recession,” U.S. Bureau of Labor Statistics Monthly Labor Review, April 2011, https://www.bls.gov/opub/mlr/2011/04/art9full.pdf; Stefania Albanesi and Jiyeon Kim, “Effects of the COVID-19 Recession on the US Labor Market: Occupation, Family, and Gender,” Journal of Economic Perspectives, Vol. 35, No. 3, Summer 2021, https://www.aeaweb.org/articles?id=10.1257/jep.35.3.3.

Heather Boushey et al., “The Damage Done by Recessions and How to Respond,” May 16, 2019, The Hamilton Project, https://www.hamiltonproject.org/publication/paper/the-damage-done-by-recessions-and-how-to-respond/.

Kevin Rinz, “Did Timing Matter? Life Cycle Differences in Effects of Exposure to the Great Recession,” Journal of Labor Economics, Vol. 40, No. 3, July 2022, https://www.journals.uchicago.edu/doi/10.1086/716346.

Areas of Expertise

Recent Work:

-

Republican Agenda’s “Triple Threat” to Low- and Moderate-Income Family Well-Being

-

New Analysis Quantifies Low- and Moderate-Income Families’ Losses Under House Budget Resolution

-

CRS: 2017 Tax Law Proponents’ Trickle-Down Claims Haven’t Materialized

Areas of Expertise

Recent Work:

About the Center on Budget and Policy Priorities

Who We Are

We are a nonpartisan research and policy institute that advances federal and state policies to help build a nation where everyone — regardless of income, race, ethnicity, sexual orientation, gender identity, ZIP code, immigration status, or disability status — has the resources they need to thrive and share in the nation’s prosperity.

What We Do

We combine rigorous research and analysis, strategic communications, and effective advocacy to shape debates and affect policy, both nationally and in states.

We work closely with a broad set of national, state, and community organizations to design and advance policies that promote economic justice; improve health; broaden opportunity in areas like housing, health care, employment, and education; and lower structural barriers for people of color and others in communities that continue to face systemic barriers to opportunity.

We promote federal and state policies that will build a stronger, more equitable nation and fair tax policies that can support these gains over the long term. We also show the harmful impacts of policies and proposals that would deepen poverty, widen disparities, and worsen health outcomes.

We work on policy implementation at the federal, state, and local levels to maximize the positive impact of policies and bring the lessons learned on the ground back to the policymaking process in Washington, D.C. and state capitals.

Our work — rooted in sound research and original data analysis, informed by our extensive knowledge of policy and how programs operate on the ground, and strengthened by our collaboration with a broad range of partners — is trusted by a wide range of researchers, policymakers, and media.

Our History

In 1981, Robert Greenstein founded the Center on Budget and Policy Priorities (CBPP) to analyze federal budget priorities, with a particular focus on how budget choices affect people with low incomes. In the Center’s early years, we focused on federal budget and tax issues, nutrition programs, and income assistance. Our work has broadened considerably over time and now includes research and advocacy on a wide range of issues including health care, housing, and the economic and health security of people who immigrated to the U.S.

Recognizing the critical role that state policy plays in economic and health security, we began extensive work on state-level policies in the 1990s. We founded — and continue to coordinate and foster — the State Priorities Partnership, a network of high-impact policy and advocacy organizations that now stretches across more than 40 states, Puerto Rico, and the District of Columbia. Sharing with the Center a strong emphasis on designing and promoting policies that foster economic, health, and racial justice, these independent nonprofit organizations collaborate with a host of partners in their states to shape policy debates.

Our Impact

Over the last four decades, the Center has played a significant role, in collaboration with partners around the country, in major advances in economic and health security policies nationally and in states.

We have helped protect and expand health coverage for millions of people, extend and expand refundable tax credits that lift millions above the poverty line, and strengthen nutrition, housing assistance, and income support to help people afford basic needs. These policies improve people’s near-term well-being; promote equity across lines of race, ethnicity, immigration status, and gender; and have long-term payoffs for them and the country as a whole.

When the Center was founded in 1981, economic security programs lifted just 20 percent of people who would otherwise be poor above the poverty line. Prior to the pandemic in 2019, that figure had more than doubled to 46 percent; economic security programs lifted 34 million people above the poverty line that year, reducing the poverty rate from 22.8 percent to 12.2 percent. In 2020, during the pandemic and its economic fallout, economic security programs and temporary COVID-19 relief measures increased the number of people kept above the poverty line substantially to 53 million. Advances in economic security programs have reduced poverty across racial and ethnic groups while also narrowing disparities significantly, though large gaps remain.

Similarly, expansions we helped to drive in Medicaid and the Affordable Care Act’s (ACA) subsidized coverage through federal and state marketplaces have changed the landscape of health coverage. In the early 1980s, Medicaid was small, the Children’s Health Insurance Program (CHIP) didn’t exist, and most people in low-paid jobs had no access to affordable coverage unless their employer provided it. Prior to the pandemic, some 81 million people — 25 percent of the U.S. population — received coverage through Medicaid, CHIP, or the ACA marketplaces.

State Priorities Partnership groups have secured important policy advances across the country. Among other victories, over the past several years, Partnership groups have helped to raise or protect roughly $40 billion in state revenue to support a range of investments, such as in education, health care, and infrastructure; have contributed to adoption of the ACA’s Medicaid expansion in a number of states; and have worked toward new or expanded state refundable tax credits in more than a dozen states, Puerto Rico, and the District of Columbia, expanding state earned income tax credits by more than $1 billion and increasing their reach to millions more households.

The Center is also helping to build the next generation of state policy leaders through the State Policy Fellowship program. This program brings dynamic emerging leaders who know the challenges faced by communities of color, LGBTQ people, immigrants, tribal communities, and families with low incomes to Partnership groups and the Center by offering them two-year paid positions as policy analysts, as well as other supports, training, and networking opportunities.

Spread the word