Anyone sounding the all-clear on tariffs, or Trump economic policy in general, should be kept away from sharp objects and banned from operating heavy machinery. We’re in a hardly better place than we were before Donald Trump announced a tariff pause (in a Truth Social post, of course.) In fact, we may be in a worse place.

Let me make four points about Trump’s post-pause tariff regime.

1. Even the post-pause tariff rates represent a huge protectionist shock

2. Destructive uncertainty about future policy has increased

3. We’re still at risk of a major financial crisis

4. The world now knows that Trump is weak as well as erratic

Still a huge protectionist shock

Yesterday Trump announced that he wasn’t going to impose all those tariffs he announced last week after all. Instead, he’s putting a 10 percent tariff on everyone, and 125 percent on China.

Question of the day: Does the 10 percent rate still apply to the penguins of the Heard and McDonald islands?

Anyway, this new announcement still sets tariffs at a much higher level than they were before Trump took office, indeed higher than he suggested during the campaign. For example, during the campaign researchers at the Peterson Institute for International Economics constructed a model assuming Trump implemented a 10 percent tariffs across the board and 60 percent on China. The researchers concluded that this regime would impose a nasty shock on the US economy. Now we are facing a tariffs of more than twice that level against China as well as 10 percent on all other countries.

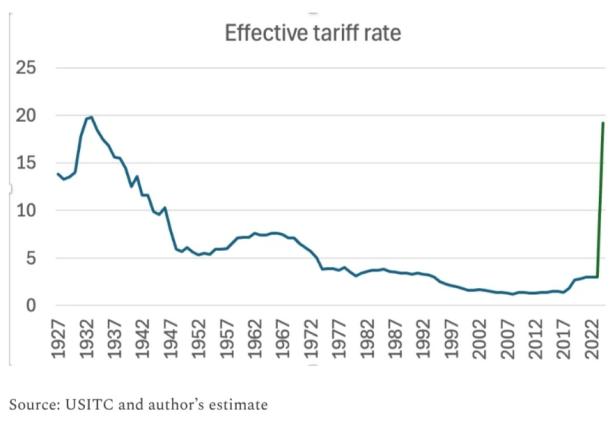

How high are overall tariffs after the “pause” was announced?

That’s actually a tricky question. China accounted for 13 percent of U.S. imports in 2024, and if you apply the newly announced rates to 2024 imports you come up with an average rate of 24.95 — higher than before the pause. Incredibly high tariff rates on China will, however, lead to lower imports from China, so a calculation based on 2024 trade is problematic.

However, not importing from China is also very costly: if we no longer import a good from China we must either shift to other, more expensive suppliers or the good simply disappears from the shelves. In the chart at the top of this post I’ve made an estimate of the “effective” tariff rate post-pause. The effective tariff takes into account both direct and indirect costs, and reflects the increase in the cost of living imposed by the tariff. With a 125% tariff on Chinese imports and a 10% tariff on all other imports, I arrive at an effective tariff rate that is slightly below the Smoot-Hawley level of 1930. But this still represents a huge jump in tariffs in a US economy that now imports three times as much as it did in 1930. Trump’s post-pause tariff regime remains the biggest trade shock in U.S., and I think world history.

It's the uncertainty, stupid

Like many other observers, I’ve been arguing that uncertainty about Trump’s policies is as big a drag on the economy as the policies themselves. Before the Rose Garden announcement, I warned that it wouldn’t be the end of the story:

Trump may impose further tariffs, or slash them as suddenly as he raised them, depending on who spoke to him last. L’Etat, c’est Trump.

This kind of uncertainty is paralyzing for businesses, who are realizing that any kind of long-term commitment can turn out to have been a disastrous mistake. Build a plant that depends on imported parts, and Trump may cut you off at the knees with new tariffs. Build a plant that’s only profitable if tariffs stay in place, and Trump may cut you off at the knees by backing down.

Again, the point is that there really isn’t a MAGA economic philosophy, just whatever suits Trump’s fragile ego.

And so it has proved. So are things settled now? Hardly. The pause is for 90 days. Then what happens? Nobody, Trump included, has the faintest idea. If you imagine that the U.S. can negotiate “tailored” tariff deals with the more than 75 countries Trump claims are seeking a deal in just three months, ask yourself, who’s supposed to be sorting out the details?

So if you were a business owner or executive, would you make any major investments or long-term commitments over the next few months? I wouldn’t.

Still a risk of financial crisis

Yesterday I noted that financial markets were showing the telltale signs of an incipient financial crisis. I looked mainly at the breakeven inflation rate, but many other indicators were also flashing yellow. Even yields on long-term federal bonds, normally a safe haven in troubled times, were sounding a warning.

The inimitable Nathan Tankus has a new post explaining why we were and continue to be vulnerable to a new crisis. He explains why the Rose Garden announcement may have been a new tariff-induced “Lehman moment” for the financial system. He explains a lot of stuff that I didn’t know or had grasped only vaguely — in particular, how hedge funds have become key providers of liquidity, even in the Treasury market (via the “basis trade.”) So when hedge funds’ portfolios take a hit from erratic policy, this quickly creates system-wide stress.

I’m planning to write a primer about financial crises and how they happen this weekend.

The level of financial market stress declined somewhat yesterday, but the situation remains fraught. Trump’s next stupid policy move — and there will be more stupid moves — could quite easily tip us over the edge.

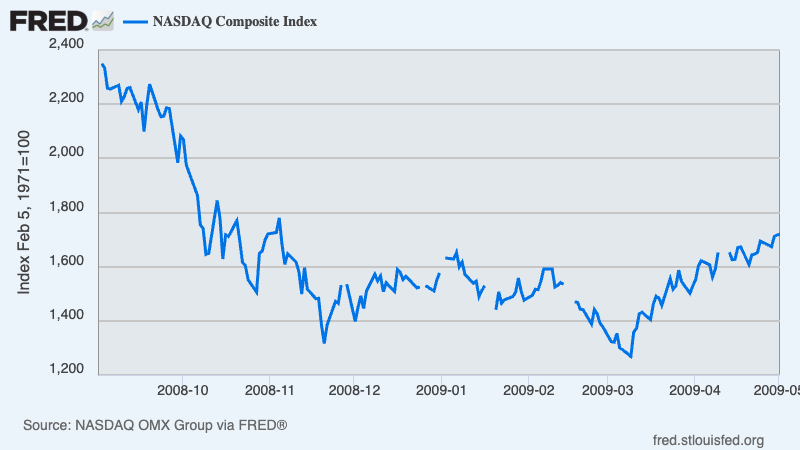

Above all, don’t take yesterday’s relief rally as a sign that the danger is behind us. Look at how the NASDAQ behaved after the original Lehman moment:

There were several big but short-lived stock rallies along the way to a huge decline. Assuming that yesterday’s surge was the end of the story requires ignoring both the fundamentals of erratic policy and the lessons of history.

Bullies are weak

The story of the tariffs so far — at least as other countries will see it — is that Trump announced extreme policies, insisted that he would persist with those policies no matter what, then beat an ignominious retreat. In other words, Trump is a typical bully, full of swagger and tough talk, who runs away at the first sign of adversity.

On tariffs, Trump’s cowardice and weakness may be a good thing. But what about everything else?

I [Paul Krugman) am an economist by training, and still a college professor; my major appointments, with some interim breaks, were at MIT from 1980 to 2000, Princeton from 2000 to 2015, and since 2015 at the City University of New York’s Graduate Center. I won 3rd prize in the local Optimist’s club oratorical contest when in high school; also a Nobel Prize in 2008 for my research on international trade and economic geography.

However, most people probably know me for my side gig as a New York Times opinion writer from 2000 to 2024. I left the Times in December 2024, and have mostly been writing here since.

Subscribe or upgrade subscription to Paul Krugman's Substack column.

Spread the word