‘I Hope I Can Quit Working in a Few Years’: A Preview of the U.S. Without Pensions

The Washington Post

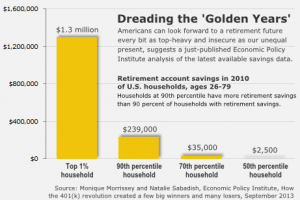

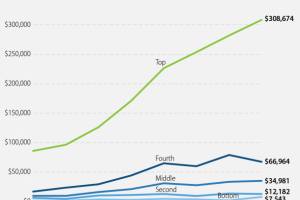

The way major U.S. companies provide for retiring workers has been shifting for about three decades, with more dropping traditional pensions every year. The first full generation of workers to retire since this turn offers a sobering preview of a labor force more and more dependent on their own savings for retirement.

The way major U.S. companies provide for retiring workers has been shifting for about three decades, with more dropping traditional pensions every year. The first full generation of workers to retire since this turn offers a sobering preview of a labor force more and more dependent on their own savings for retirement.

Spread the word