What this report finds: Progressive tax increases should be a top policy priority. If the economy returns to and stays at full employment, they can finance current federal commitments to social insurance and public investments as well as future commitments that could stop the rise in income inequality that has stymied living standards growth for the vast majority of Americans over the last generation. Finally, even if enacted right away, progressive tax increases would provide only a minimal drag on economic recovery, and if combined with near-term public investments would allow fiscal stimulus to lock in full employment.

Why it matters: Deficit hawks insist that policymakers plan now for closing projected long-run deficits that could emerge when the economy reaches full employment. Full employment hawks insist that closing deficits too rapidly in the short run could put excessive drag on economic recovery. Progressive revenue increases are the only policy change that threads this needle. They provide long-run financing for projected deficits, but impose only minimal short-run fiscal drag. All other deficit-reduction measures would do clear economic damage if imposed in the short run.

What we can do about it: There are a menu of progressive tax policies we can choose from to take care of today’s challenges and commitments and move us toward a more equal economy, from raising top tax rates to closing loopholes such as the provision allowing heirs to avoid paying capital gains taxes on inherited wealth.

Introduction and key findings

Since the start of the Great Recession, discussions among economists regarding the nation’s fiscal policy stance have become more pragmatic and sensible. At the same time, too many policymakers have remained stuck in destructive orthodoxy, preaching that policies that increase federal budget deficits are bad always and everywhere, and that only spending cuts constitute a sustainable strategy for reducing deficits.

What has become clear over the past decade is that closing budget deficits is not always the optimal fiscal policy in the short term (one to two years) or the medium term. Instead, the federal budget balance should simply be seen as a tool with which to boost living standards. Sometimes policy needs to move the budget toward a deficit to achieve this; at other times, the budget needs to be moved closer to a balance or surplus.

This paper highlights the key policy challenges facing the U.S. economy and fiscal policy over the coming years and decades. It finds that a key plank in any sensible platform to address these challenges is a commitment to progressive tax increases, and it provides a menu of progressive tax policies that would broaden the tax base and raise top tax rates. Some specific findings include:

- The most immediate fiscal policy challenge is to avoid crippling a still-incomplete recovery from the Great Recession. This means minimizing fiscal drag and avoiding unnecessary austerity measures (particularly on spending) in the short and even medium term.

-

If the economy returns to and stays at full employment:

- the clearest long-term fiscal challenge is simply paying for commitments the federal government has made to financing health care.

- cutting non-health spending to maintain fiscal sustainability in the face of rising health care costs will not boost living standards for the vast majority. American commitments to social insurance (Social Security, Medicare, Medicaid), income support (unemployment insurance, food stamps) and public investment are extraordinarily valuable to American living standards yet quite modest by international standards.

- If the economy returns to and stays at full employment in the long run, then expanded federal spending commitments are likely necessary to stop the rise in income inequality that has characterized the last generation of American life.

-

Progressive revenue increases help meet all three of these challenges:

- They impose less fiscal drag than any other deficit-reducing measures.

- They could provide financing for current spending commitments in the long term.

- They provide financing for new commitments and would likely slow the rise of income inequality.

- Recent research strongly indicates that higher top marginal tax rates could well provide a powerful check against rising income inequality, through the bargaining channel.

The key fiscal policy challenges: locking in full employment, paying for health care, and stopping the rise in inequality

The key fiscal policy challenge is too often presented as reducing the federal budget deficit, period. Defining it this way in the present economic environment, however, is simply bad economic analysis. Instead, the most pressing economic task should be viewed as finally securing a durable return to genuine full employment. This means the first fiscal challenge is precisely to avoid too-rapid policy moves toward smaller budget deficits.

However, if a return to full employment is attained and the economy manages to stay anchored there in decades to come, then long-run trends do indicate that more revenue will be needed to honor existing federal commitments to provide social insurance, income supports, and public investments. This means that the second fiscal challenge is finding long-run revenue sources to cover existing federal spending commitments. Crucially, all projected increases in long-run federal spending can be accounted for by rising health care costs. As we argue later in this paper, this fact argues strongly for closing long-run projected fiscal gaps with increased revenue rather than spending cuts.

Finally, besides the effects of the Great Recession, the greatest damage to low- and moderate-income Americans’ living standards over the past generation has been done by the large rise in inequality. Fiscal policy is extremely well-targeted to address this. Hence, the final fiscal challenge is using taxes and transfers to ensure that future increases in overall economic growth translate more seamlessly into growth of living standards for the vast majority.

Below, we will flesh out these challenges and then explain why each is well-addressed by finding new, progressive revenue sources for the federal budget.

Locking In full employment

At the moment, the U.S. budget deficit is relatively low in historical terms. It is projected to be less than 3 percent of GDP for the next three years, a level consistent with a stable debt-to-GDP ratio. The Congressional Budget Office (CBO 2016a) projects it to rise to 4.9 percent of GDP by 2026, a level that would start moving the debt-to-GDP ratio upward. It is this projected upward movement of the debt-to-GDP ratio even at a time of projected full employment that has revived calls to begin policy efforts to close budget deficits, a push that had been (correctly) put on the back-burner during the Great Recession and subsequent slow recovery. However, a close look at the CBO (2016a) projections show that all of the projected rise in budget deficits between 2016 and 2026 are accounted for by a projected increase in interest rates. That is, there are no tax cuts, no new spending programs, and no explosion in the costs of current spending programs that drive these larger projected budget deficits. Instead, the projection is driven by an assumption that the U.S. economy will quickly converge back to full employment and this convergence will drive upward pressure on long-term interest rates.

But this projected near-term return to full employment has been a recurring feature of CBO forecasts for years now, and has yet to happen (see Figure A). It is certainly true that the U.S. economy is closer to full employment today than it has been in years, but the fact that full employment remains relatively far away is demonstrated by the complete failure of long-term interest rates to rise. Given the huge benefits to restoring the economy to full employment, all levers of macroeconomic policy—including fiscal policy—should be oriented to spurring demand growth and finally cementing the long-awaited recovery.

Another development presents yet another reason to avoid a hair-trigger action on deficit reduction: a pronounced decline in the growth rate of health care costs (Furman and Fiedler 2015). Because the increase in health care costs is the primary driver of projected budget deficits (and by a long shot), this slowdown is incredibly important. For example, the latest CBO Budget Outlook (CBO 2016a) indicates that Medicare costs in 2017 will be $143 billion less than what these costs were projected to be in 2017 in CBO’s 2007 report. This is one year’s cost. Over the entire 2007–2017 period, cumulative savings because of Medicare’s cost slowdown has been a staggering $399 billion (Figure B shows the changing projections of Medicare costs as a percentage of GDP).

It is hard to attribute this slowdown purely to policy, so there is always some concern that it may prove transitory. But the savings are undeniable; and the introduction of the Affordable Care Act (ACA) and its numerous cost-control measures provides further insurance that downward policy puts pressure on health care costs. To put it more plainly, the combination of the still-slack economy and the very rapid reduction in health care cost growth combine to give policymakers a long window of time before significant policy-driven deficit reduction is needed.

Paying for health care

The data in the last section indicate that our current federal spending trajectory does not require any near-term (and maybe not even any medium-term) new revenue sources. However, if the economy does finally get to full employment and stays there for an extended period of time, then most projections show that a “fiscal gap” will require some combination of revenue increases or spending cuts to close.

It is important to note, however, that almost the entire fiscal gap can be explained by the excess cost growth of federal health spending (excess cost growth is the difference between health care cost growth and overall economic growth rates. While federal health costs have grown significantly slower than equivalent private-sector insurance costs in recent decades, both sets of health costs are projected to grow significantly faster than overall economic growth, as explained below.) In the 2016 edition of the CBO Long-Term Budget Outlook (CBO 2016b), all noninterest spending by the federal government rises by 2.7 percent of GDP over the next 30 years. But the combined cost of federal health programs rises by 3.3 percent of GDP over this time.1

Since the rest of the federal budget looks to be on a sustainable path over the long run, the question of how best to close the nation’s “fiscal gap” (if the economy settles into full employment in the long run) really boils down to whether federal health spending is a good deal for American households, and whether living standards would be raised by cutting this spending to keep taxes from rising, or whether they would be raised by raising taxes to pay for health care costs.

If federal spending on health programs was cut, this would obviously not lead to a healthier population that no longer needed medical care. Instead, it would simply shift the costs for health spending off of the federal budget and onto the budgets of American households. A crucial question that arises is whether this shift of costs from federal to household budgets would change the overall burden of paying for health care. The evidence is clear that this shift would lead over time to a significantly higher health care burden for most American families, as epitomized most clearly by Medicare.

Medicare provides health insurance coverage to essentially all Americans over the age of 65. Importantly, while Medicare per capita costs have been forecast to grow significantly faster than overall economic growth and put upward pressure on federal spending, they have grown significantly slower than equivalent private-sector insurance costs in recent decades.2 By 2012, the cumulative difference was well over 40 percent. One way to see the importance of this is to realize that if private insurance costs had followed the trajectory of Medicare costs since 1970, a family health insurance policy that today costs employees and employers roughly $15,000 would cost just $10,000, leaving room for employees to have substantially higher cash wages. In short, cutting Medicare from federal spending on Medicare simply offloads costs currently managed by the federal government onto households. And the federal government has demonstrated a much greater ability to control these costs.

Finally, it’s important to note, if the huge reduction in the growth of health care costs that has characterized the last decade is sustained, then the increased revenue needed to honor existing federal spending commitments is largely a one-time increase in revenue levels, not an ongoing ratchet over time. In the years before 2010, long-run deficit projections seemed to show ever-spiraling increases in federal spending that would have required ever-higher rates of taxation to meet without cuts. This upward spiral was often attributed (at least in part) to demographics, as federal retirement programs (Social Security and Medicare, lumped together) were identified as key drivers of spending growth. However, the purely demographic effect on spending is largely just a one-time shift in spending levels reflecting the baby boom generation retiring over the next 20 years. After this one-time absorption of baby boomers, there was perceived to be little upward pressure on spending stemming from demographics.

This can be seen most clearly by disentangling trends in Social Security from trends in Medicare. Social Security spending is essentially driven entirely by demographics—people become eligible for it by reaching retirement age. Medicare spending trends, conversely, are driven by both demographics (people reaching the age of eligibility) and by the rising per capita cost of health care. The CBO’s 2007 long-run budget projections exhibit entirely different trajectories. Social Security spending undertakes a level shift between 2015 and 2030 and then largely stays constant (as a share of gross domestic product). Medicare, on the other hand, sees its cost continually spiral upward. And the cause of this upward spiral is entirely the excess cost of health care.

By 2016, the rapid deceleration of health care spending has led the trajectory of Medicare spending to converge to Social Security, as shown in Figure C. In short, a decade ago, relying only on new revenues to ensure long-run fiscal sustainability would have required a rapid upwards ratchet in taxation to cover health spending. This is no longer true.

What about nonhealth federal spending?

So far, we have documented that essentially all of the rise in projected federal spending over the next 30 years can be accounted for by rising health care spending, and that much evidence suggests that having the federal government manage these health care costs instead of households is likely to boost living standards. This raises a related question of whether or not current federal spending commitments besides health care are valuable enough to be preserved and financed with new revenue rather than be cut back (possibly to make way for more health spending)?

There is plenty of reason to think the answer to this is yes. The social insurance, income support, and public investment functions of the federal budget are, by and large, run efficiently and provide huge value to American families. There is no compelling economic reason to think they should be substantially scaled back.

Social insurance

The American commitment to social insurance is quite thin compared with the commitment of our international peers, and a large body of research argues strongly that social insurance programs are not a drag on economic growth.3 But they are supremely valuable to those who receive them. For example, in 2014 61.1 percent of “aged households” in the United States relied on Social Security for more than half of their income, and 33.4 percent relied on it for more than 90 percent of their income.4 The insurance products provided by Social Security (disability insurance, survivors’ insurance, and fully inflation-adjusted annuities) are just not offered by private markets, and yet are extraordinarily valuable. The introduction and expansion of Social Security led to rapid and significant reductions in elderly poverty. This seems like an achievement to be at least sustained (if not expanded upon).

Similarly, unemployment insurance (UI) in the United States is extremely stingy by advanced country standards, yet the benefits of UI are large. For one, it acts as an important macroeconomic automatic stabilizer. For another, it allows liquidity-constrained households to maintain consumption during periods of joblessness, which both supports economy-wide spending but also improves matching in the labor market, by allowing potential workers to wait a bit and search for a job that is a good fit, rather than being forced by desperation into taking the first available job.

Income support and safety net spending

The income support portion of the federal budget is similarly thin by international standards. Figure D shows the difference in poverty rates pre- and post-taxes and transfers for a range of countries. The larger this difference, the more a country’s tax and transfer system aids in reducing poverty. It is apparent that the United States makes a smaller policy effort to reduce poverty through the tax and transfer system than essentially any other advanced nation.

Yet despite this poor relative effort, the programs that do exist have been the only reliable economic tool lowering poverty rates in the United States over the past generation, as rising inequality has kept the benefits of economic growth from decreasing market-based poverty (poverty as measured by the incomes households bring in before government taxes and transfers such as Social Security). For example, market-based poverty actually rose between 1967 and 2007, but increased transfers reduced the overall poverty rate (as measured by the supplemental poverty measure, or SPM), from 19.3 to 14.3 percent (Fox et al. 2014).

Further, recent research provides evidence that much of what is classified as income support in the federal budget actually generates high investment returns as well. One study finds large improvements in the health of adults who had access to food stamps when they were children (Hoynes, Schanzenbach, and Almond 2014). Another shows that childhood access to Medicaid also leads to improved adult outcomes (Brown, Kowalski, and Lurie 2015). Finally, even straight transfers of cash to poor households with children are found to improve school performance and academic achievement (Duncan, Ziol-Guest, and Kalil 2008).

Public investment

Finally, it is worth noting that the current level of public investment provided for by the federal budget is likely already too low. Figure E shows trends in public investment and productivity growth over the past 50 years. The relationship in the chart is confirmed by dozens of academic studies: public investment boosts private productivity growth and carries quite high rates of return. Given that recent years have seen a sharp deceleration in productivity growth, it seems clear that maintaining the current level of federal commitment to public investment should be the minimum we do.

Stopping (or reversing) the rise in inequality

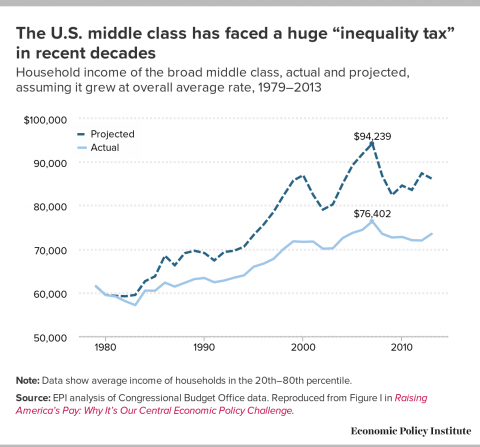

Finally, besides the effects of the Great Recession, the single-most destructive trend for low- and moderate-income Americans’ living standards in the past generation has been the rise in inequality. Bivens (2016) shows that for the bottom 90 percent, this rise in inequality has put more downward pressure on household income growth since 1979 than the slowdown in overall economic growth that occurred during this time. Figure F shows actual income growth for the middle 60 percent of American households and what this growth could have been had their incomes risen in line with overall average income (i.e., had no increase in inequality taken place). The difference between these lines can be thought of as an inequality tax that has lowered incomes for the vast majority. By the time the Great Recession hit, this inequality tax was suppressing middle-class incomes by nearly a quarter, or roughly $18,000 per year.

Fiscal policy is the most direct policy lever that can be used to lean against this rising tide of inequality and redistribute income from those who have seen the biggest gains in market-based income to those who have seen market-based incomes stagnate. This fiscal policy effort should include changes on both the spending and the revenue side of the budget to push back against inequality.

On the spending side, there are clearly ways that the United States could deepen and modernize its social insurance and income support programs to move us closer to international norms. As noted earlier, our attempts to fight poverty with taxes and transfers have constituted the only progress made on this front in the past generation of economic life, yet these efforts remain paltry in international comparisons. Key low-hanging fruit for making progress on these scores include modernizing the unemployment insurance system and extending the earned income tax credit to childless adults.

Further, public investment in rebuilding core infrastructure has been shown in much research to provide large economic benefits. But public investment need not be restricted to just this “core” infrastructure (streets, bridges, and sewers)—much additional evidence shows that investments in education, clean energy, and early child care and development would similarly yield large social returns. Importantly, these returns are likely to be more broadly distributed than returns from private investment.6

In short, expanding federal commitments to social insurance, income support, and public investment seems like a wise and decent response to the very large increase in income inequality that has occurred over the past generation. Such an expansion would require an increase in revenues, and to maximize the extent that such a new policy package would lean against inequality, it makes sense to finance much of this with progressive revenue sources.

Taxes were made less progressive over much of the last generation

If there was any economic policy benefit stemming from the rise in income inequality over the past generation, it should have been rising tax revenues resulting from a progressive tax system. Unfortunately, policymakers have too often squandered this potential benefit by cutting taxes—including often large tax cuts for high-income households.

Table 1 shows the static revenue attainable (in billions of 2013 dollars) from returning federal tax levels for the top 1, 5, and 10 percent simply to the rates they paid in 1979. In 2013, taxing the top 1 percent as they were taxed in 1979 would have brought in $22.6 billion, for the top 5 percent the revenue possible would be $37.0 billion, and for the top 10 percent it would be $64.1 billion. This roughly $64 billion would close about a quarter of “fiscal gap” in the last year (see CBO 2016a). Further, top tax rates certainly do not have to be capped at 1979 levels. As we will detail later, there is evidence that the revenue-maximizing top income tax rate may be as high as 83 percent. Further, besides just raising rates, a number of base-broadening measures with progressive incidence could also be enacted.

The table also shows the extent to which Republican administrations have rolled back progressive taxation while Democratic administrations have raised taxes on higher-income households. In general, households in the top income groups saw their tax rates fall during the administration of Ronald Reagan, rise during the administration of Bill Clinton, fall again during the George W. Bush administration, and eventually tick back up significantly in the second term of Barack Obama, following tax changes in 2013 stemming from the so-called “fiscal cliff” deal, the American Taxpayer Relief Act of 2012 (ATRA). It should be noted, however, that income tax rates for the bottom 80 percent of households have fallen steadily over time across all administrations.

To see what is behind the loss of tax progressivity, Table 2 focuses on the differences in the average effective tax rates (individual, payroll, and corporate) faced by income groups in 1979 and 2013. In particular, the highly progressive corporate income tax (since 75 percent of its incidence is assigned to owners of capital) has significantly eroded as a revenue source. The top 1 percent faced effective corporate rates of 11.1 percent in 1979, now they face an effective rate of only 7.7 percent. Likewise, increasing average payroll tax rates have less effect on the top 1 percent due to income over $118,500 being exempt from the Social Security portion of the payroll tax (the largest portion).

The loss of federal tax progressivity is magnified because federal taxes are just one component of total taxes—and they have always been by far the most progressive component of overall taxes. As Figure G shows, federal taxes constitute about two-thirds of total tax collections, while state and local taxes make up one third. This makes federal taxes crucial, because state and local taxes are overwhelmingly regressive and mitigate a significant amount of the tax progressivity of federal taxes.

Just how much state and local taxes dilute the progressivity of the tax system can be seen in Figures H, adapted from Citizens for Tax Justice (CTJ 2016). This figure shows that once state and local taxes are accounted for the overall effective tax rates on the bottom 20 percent are in fact quite high—19.3 percent. Further, while the tax system is progressive overall, it flattens out considerably near the top. The fourth quintile (taxpayers in the 61st to 80th percentiles) pay effective tax rates of 30.6 percent, while the top 1 percent faces an only slightly higher effective rate of 33.7 percent.

The Institute on Taxation and Economic Policy (ITEP 2015) also notes that some states’ tax systems are particularly regressive. For instance, in Washington, which has no income tax, the bottom 20 percent pay an effective rate of 16.8 percent while the top 1 percent pay 2.4 percent; in Florida, which also has no income tax, the bottom 20 percent pay an effective rate of 12.9 percent while the top 1 percent pay only 1.9 percent. When one-third of the average individual’s tax bill is this starkly regressive, the final two-thirds, federal taxation, are vital to ensuring the overall progressivity of the entire tax system.

Can raising top tax rates stop even pre-tax inequality from rising?

The most important and well-established channel through which higher tax rates on high-income households can combat inequality is by making more public spending possible. Whether it’s preserving current federal spending commitments or creating new commitments, federal non-defense spending is extremely progressive in incidence, so anything that allows it to be expanded will be a progressive win.

But the beneficial inequality-fighting effects of higher top tax rates may be even larger than this. Thomas Piketty, Emmanuel Saez, and Stefanie Stantcheva (2014) build a framework for and find evidence suggesting that high marginal income tax rates may be a crucial economic tool for shifting economic leverage and bargaining power toward low- and middle-wage workers. Essentially, if higher marginal tax rates reduce the incentive for well-placed economic actors (think CEOs) to claim as much of an enterprise’s income as possible, it may leave more money on the table for raises for rank and file workers. To believe this channel is important, one has to think that bargaining power matters for wage determination, but, a host of economic evidence indicates exactly this.

Piketty, Saez, and Stantcheva (2014) find that the empirical evidence is indeed consistent with these compensation bargaining effects, both within the United States over time and across a range of advanced countries. Figure I, taken from Piketty, Saez, and Stantcheva, shows visually how this zero-sum transfer seems likely at play across countries. Relative to the top 1 percent, income growth for the bottom 99 percent slowed most where top income tax rates were cut the most.

In this international evidence, Piketty, Saez, and Stantcheva also look at the link between top tax rates and economic growth. They find (as many others have before them) no significant relationship between the two; higher tax rates (again) just do not kill the golden goose of economic growth.

While the evidence from the macro level is suggestive, Piketty, Saez, and Stantcheva (2014) also consider micro-level evidence drawn from CEO pay. They check the extent to which CEO pay responds to top tax rates, and the extent to which such a response comes through the compensation bargaining channel instead of productive effort (i.e., the extent to which CEOs secure pay increases through their bargaining power rather than by becoming more productive top managers) . They find evidence “that CEOs are rewarded for luck and that the prevalence of pay for luck is reduced by top tax rates.” They also find evidence that CEOs are more rewarded for luck than the average worker, and that workers’ pay for luck is not sensitive to the fall in top tax rates—consistent with a CEO zero-sum compensation bargaining explanation and inconsistent with productivity explanations. They also find international evidence suggesting that CEO compensation is more in line with rent-seeking. This is consistent with evidence from Bivens and Mishel (2013) who also found that the pay of CEOs and financial professionals is indicative of rent seeking.

That the rise of top incomes seems consistent with zero-sum redistribution rather than net income generation is critical to income tax policy. Rather than being worried about choking off growth—and modest growth at that—policymakers should be more concerned that growing top incomes are coming at the expense of the vast majority. Piketty, Saez, and Stantcheva (2014), using estimates consistent with their evidence, find that the optimal top income tax rate when taking into account compensation-bargaining and rent-seeking is 83 percent. The intuition for why such a high tax rate is optimal is exactly that though high top income tax rates could modestly slow growth, these rates are a critical tool holding back CEOs and other top earners from engaging in rent seeking bargaining at the expense of the rest of us. While a top rate of 83 percent is certainly currently politically unlikely, concerns about rampant income inequality should mean that at the very least there is little to be lost from experimenting with continuing to raise top marginal income tax rates.

Meeting all three fiscal challenges with one policy tool: progressive taxation

There is one policy lever that threads the needle in regard to meeting all the concerns noted above: making sure that fiscal policy does not drag on recovery, ensuring long-run fiscal sustainability, and pushing back against the rise of inequality. This lever is progressive taxation, and in particular progressive taxation that obtains a larger contribution from the very top of the income distribution.

There is a wide literature now on which fiscal policies provide the most stimulus or drag.7 This literature highlights that progressive tax increases provide less fiscal drag than any other deficit-reducing policy. This means that if policymakers are determined to start deficit reduction sooner rather than later, it makes by far the most sense to begin this deficit reduction with progressive tax increases, as these will impose the least drag on continuing recovery.

The rise in inequality over the past generation argues strongly that the burden of financing current federal spending commitments in the long run should be largely borne by that relatively small group of households that have disproportionately benefited from economic growth in recent decades. Further, a deeper and more modern system of social insurance and income supports are needed if policymakers want to guarantee going forward that living standards for the vast majority will keep pace (at least roughly) with overall economic growth.

Because spending can be targeted at low- and middle-income households, it is often thought to be the more powerful tool in the fiscal policy kit to raise living standards. But new research shows that more progressive taxes—and particularly higher top marginal rates—can also be powerful dampers on the rise in market-based inequality. In essence, by directing more pre-tax income to the vast majority, higher top marginal rates carry the promise of reducing how much redistributive spending is needed to keep low- and middle-income households’ incomes in line with overall growth.

The ability of progressive tax increases (particularly if they are used to finance transfers to low- or moderate-income households) to directly lean against rising market-based inequality is obvious. However, these increases may not just lean against the rise in market-based inequality, they may help contain this market-based rise directly. A relatively new set of literature highlights the fact that incomes in the U.S. economy are not distributed in competitive markets based simply on individuals’ marginal productivity. Instead, income distribution is largely a function of bargaining power. Well-placed economic actors (think corporate CEOs) balance the benefits of bargaining hard against their employees and shareholders for every last dime in compensation they receive against the costs of this strategy (public outrage over the scale of compensation and tactics used to achieve it). Higher marginal tax rates tilt this calculus away from hard bargaining and may make the “outrage constraint” more binding. In this way, higher marginal tax rates may actually compress the pre-tax distribution of income.

Some policy guidance for raising revenue progressively

This final section ends with broad guidelines about how policymakers should approach the problem of boosting revenue collected from progressive sources. Too often the issue of progressive tax increases is framed simply as raising the top marginal income tax rate. The United States certainly has a top rate today that sits below the revenue-maximizing rate, so some increase in this should be part of the progressive revenue equation. But there are numerous other policy options that can raise revenue progressively. Most of these can be split into two broad categories: traditional tax reform on earned income that seeks to both raise rates and broaden the tax base and tax reform aimed at narrowing the gap in tax rates faced by earned income and income derived from wealth.

In the rest of this section, while not endorsing any exact parameter value, it is nevertheless convenient to reproduce a table (Table 3 below) of EPI Policy Center’s analysis of the Congressional Progressive Caucus budget for fiscal year 2017. This gives a general idea of the amount of revenues available through enacting various progressive policy options.

Raise rates and broaden the base on earned income

Broadening the tax base and raising top tax rates should be seen as complements, not substitutes (Fieldhouse 2013). This stands in contrast to the adage, adopted following the passage of the bipartisan Tax Reform Act of 1986, that tax reform should broaden the base and lower the rates. After all, if the main problem to be solved in tax reform today is insufficient revenue, it seems odd indeed to think lower rates should be a clear priority.

The driving force behind this complementary interaction between base-broadening and rate increases is tax avoidance. When the income tax base is riddled with loopholes, those at the top can easily pay an accountant to ensure that their income appears in lower-taxed forms. In such a scenario, increases in top tax rates will be easily dodged as those at the top shift the form or timing of their income. The prototypical example here is the carried interest loophole, through which the income of investment managers is considered capital income, and hence taxed at the 23.8 percent rate charged to capital gains rather than the full top income tax rate on earned income of 43.4 percent. If the top individual federal income tax rate on earned income were increased to 80 percent tomorrow, hedge fund managers would not pay a penny more, and we would likely see even more income start being attributed to capital. In contrast, the loophole itself could safely be ignored if the rates on capital and labor income were equalized.

Jon Gruber and Emmanuel Saez (2002) find that the taxable income of high-income households after deductions is much more responsive to changes in tax rates than their taxable income before deductions. This means that the increase in tax revenue following rate increases is constrained by high-income households’ ability to exploit loopholes. Peter Diamond and Saez (2011) use these estimates to show how revenue-maximizing top income tax rates vary depending on how broad the tax base is. They estimate that the optimal top tax rate using the current taxable income base is 54 percent. However, eliminating deductions allows for a broader base and less ability to shift income to tax-favored forms, and they find the optimal top tax rate with a broader income base with no deductions would be 80 percent.

Therefore, the elimination of some deductions, exclusions, and other various loopholes increases the revenue-maximizing top rate. Throwing away this potential benefit by cutting rates seems odd in an economy that will likely need more revenue in the future. Further, base-broadening can, by itself, add to the tax code’s progressivity. Various deductions, exclusions, and loopholes in the tax code are overwhelmingly regressive and their elimination would allow increased top tax rates to translate into even higher effective rates on top incomes.

A key example is the numerous deductions in the tax code, for items such as mortgage interest payments, state and local income taxes, and charitable contributions. A deduction, by its nature, benefits those who have the highest marginal tax rate, meaning that their value is slanted toward higher-income households. These deductions as well as some other features of the tax code (tax exclusions for the value of employer-provided health benefits, for example) are often labeled “tax expenditures.”

It is occasionally claimed that these tax expenditures are not hugely important for the very rich (say the top 1 percent), but are instead really important to the entire top fifth of the income distribution. However, for some deductions such as the deduction for state and local taxes and the deduction for charitable contributions, this is an incorrect perception. According to the CBO (2013b), 80 percent of the benefit of the deduction for state and local taxes goes to the top 20 percent, with 30 percent of the benefit going to the top 1 percent alone. Likewise, 84 percent of the benefit of the deduction for charitable interest goes to the top 20 percent, with 38 percent of the benefit going to the top 1 percent. For some other deductions and exclusions, while it may not be the very top of the income distribution that benefits the most, the stark regressivity up until that point should not be ignored. While “only” 14 percent of the benefit for the exclusion of net pension contributions and earnings goes to the top 1 percent, this is almost as much as for the bottom 60 percent (which receives 16 percent of the benefits). Similarly, while only 15 percent of the benefit of the mortgage interest deduction goes to the top 1 percent, only 8 percent of its benefit goes to the bottom 60 percent.

One obvious policy response to the issue of deductions is to cap the tax benefits of a deduction at 28 percent. This is a policy that would essentially only affect taxpayers at the $250,000 threshold and above. Capping the value of deductions at 28 percent would raise $646 billion over 10 years, making it strongly progressive and effective as a revenue-raiser.

Idiosyncratic objections to such a policy are often shortsighted. For example, scaling back the deduction for charitable giving is often greeted with staunch opposition from nonprofit groups and charities. But a package of reforms that did this and also increased estate taxes would almost surely offset any effect of eliminating the charitable deduction in terms of total money flowing to the nonprofit sector.

Taxing capital and wealth

The most egregiously regressive tax expenditure is the preferential rate on capital gains and dividends. According to CBO (2013b), the bottom 40 percent get effectively nothing from this expenditure. The next 40 percent get only 7 percent of its benefits, and the top 20 percent claim 93 percent of the benefit. The top 1 percent get fully 68 percent of the benefits.

Besides base-broadening, addressing this tax expenditure would also be an important step forward in reducing the gap in tax rates faced by income earned from labor versus income accrued from wealth-holding. Raising tax rates faced by capital income is a key part of bolstering the progressivity of the tax code. According to the CBO (2016c), the top 1 percent of households earn 54 percent of total capital income; the bottom 90 percent of households earn just 22 percent.

However, there is a loophole for capital income that makes simply taxing unearned income at the same rate as earned income not enough—the step-up basis for capital gains at death. The step-up basis allows for capital gains held until death to go untaxed. In the absence of closing this loophole, higher rates of capital taxation will still be avoided. Repealing the step-up basis of capital gains at death would raise $825 billion over 10 years.

There are many ways to increase the effective tax rates on capital and wealth, some less obvious than others. For instance, the corporate income tax is widely viewed as falling on capital. The details of corporate income taxation are described in full in the following text box.

Other options for taxing wealth include a financial transactions tax—a small tax on the sale of stocks, bonds, derivatives, and other investments. A financial transactions tax (FTT) would be highly progressive, its incidence falling proportional to the distribution of wealth in the economy. And it would be an efficient way to raise between $110 and $403 billion per year in gross revenues (Bivens and Blair 2016a). There are also other options for raising revenues from the financial sector. Taxes could be placed on the size, leverage, or other possible measures of the riskiness that banks pose to the economy. One such option, an excise tax on systemically important financial institutions, could raise $111 billion over 10 years.

Larger and more robust taxation of inherited wealth is also a necessary component of a progressive tax system. An increased and broader estate or inheritance tax mitigates the effects of inherited wealth on inequality. Senator Sanders’ Responsible Estate Tax Act of 2010 would raise $231 billion over 10 years.

Another key issue in taxing wealth is ending the loophole that allows heirs to avoid paying capital gains taxes on inherited wealth. Take the example of somebody who bought Amazon stock in 1997 at $1.50 per share. They then pass this stock onto their heirs in 2016 when the stock is trading at over $800 per share. These heirs would face no taxation on the capital gain. Ending this “step-up” basis would not only raise money directly, it also increases the revenue-maximizing rates on capital gains by foreclosing avoidance schemes.

Using the corporate tax code to tax wealth

The corporate income tax stands as the clearest indicator of the erosion of progressive taxation. The corporate income tax in general is progressive because most analysts agree that its burden (or “incidence”) largely falls on capital. For instance, the CBO assigns 75 percent of the incidence of the corporate income tax to capital and only 25 percent to labor. And as we have detailed, the distribution of capital is steeply skewed.

However, as Figure J shows, the corporate income tax has eroded substantially since the 1950s. Despite corporate profits accounting for 8.5 percent of GDP the corporate income tax only brings in 1.9 percent of GDP.

The top corporate income tax rate was slashed from 52 percent in the 1950s to 34 percent by the end of the 1980s, driving the initial steep decline. Since then, the amount of revenue brought in by the corporate income tax has largely followed the business cycle. But, recent high profits as a percentage of GDP have hardly translated to higher revenues. This recent trend is largely driven by tax avoidance, both corporate income tax avoidance by multinational corporations and tax avoidance facilitated by the reclassification of corporate income.

Through a loophole known as deferral, large multinational corporations are able to indefinitely put off paying the full 35 percent tax rate on profits that they book offshore. And these ostensibly offshore profits are hardly earned abroad; they are largely profits that have been shifted abroad through creative accounting maneuvers. Kimberly A. Clausing (2016a) estimates that the United States currently loses over $100 billion a year in revenue due to income-shifting by multinational corporations. Closing the deferral loophole and ending the active financing exception that also facilitates this income shifting—as well as instituting strong anti-inversion proposals to ensure that U.S. companies do not simply relabel themselves as “foreign” following closure of the loophole—could raise about $1 trillion over 10 years.

Offshore tax avoidance isn’t the only type of corporate tax avoidance, and the U.S. Treasury is likely losing about as much money per year here at home with the rise of pass-through corporations. As laid out in Cooper et al. (2015), while the capital income of a standard c-corporation faces a total (corporate income level plus taxes on dividends) average tax rate of 31.6 percent, that capital can escape much of this taxation by reclassifying as either an s-corporation, and thereby face an average tax rate of 25 percent, or as the particularly lucrative form of a partnership, thereby facing an average tax rate of only 15.9 percent. They find that the rise of pass-through businesses accounts for 41 percent of the increase in top 1 percent income share. The Tax Policy Center (2016) estimates that 69.8 percent of partnership and s-corporation income goes to the top 1 percent and 33.5 percent of partnership and s-corporation income goes to the top 0.1 percent.

Low tax rates can be attained through pass-through business in a number of ways. For instance, the income of investment managers tends to be classified as partnership income, underscoring the importance of raising top income tax rates and equalizing the treatment of capital and labor income. But, what makes partnerships particularly lucrative for tax avoidance is their opaqueness. Cooper et al. (2015) find that when they collapse all circular partnerships (those for which partnership income cannot be uniquely linked to a nonpartnership owner) into one, this implies a tax rate of 8.8 percent. Clausing (2016b) proposes levying a small tax on interpartnership dividends in order to minimize the tax opportunities afforded by partnership opaqueness. Cooper et al. find that if pass-through activity had remained at 1980s levels, tax revenue in 2011 would have been approximately $100 billion higher.

Executive bonus pay is another corporate policy response to tax policy, as certain types and amounts of executive bonus pay are deducted under the corporate income tax. While curbing corporate deductions for stock options and limiting the deductibility of executive bonus pay would bring in only $74 billion over 10 years, clamping down on the explosion of CEO pay nevertheless serves a useful role for social norms.

We should at least track flows of wealth

Outside of taxation, policies to facilitate wealth tracking are necessary to ensure that those at the top actually pay their taxes instead of simply hiding them in tax havens abroad. Tax havens pose a problem not just because of legal corporate tax avoidance, but also illegal income tax evasion. Gabriel Zucman (2014) estimates that about 8 percent of the global financial wealth of households is held in tax havens or about $7.6 trillion at the end of 2013. Zucman notes that his method “probably delivers a lower bound,” as it is based only on financial assets and makes note of two other estimates: the Boston Consulting Group (2014) estimates an $8.9 trillion figure, and James Henry (2012) estimates a $32 trillion figure. Based on Zucman’s estimates, $1.2 trillion of U.S. wealth is held in tax havens. This amounts to $36 billion in lost tax revenue in 2013. Zucman proposes a world financial registry to ensure collection of both corporate and individual income taxes “to check that taxpayers duly report their assets and income, independently of what information offshore bankers are willing to provide.”

Lots of money could be raised with smart and progressive strategies to boost revenue

Contrary to some very loose analysis, the richest Americans are not tapped out, and efforts to boost tax progressivity have not been maximized. For some simple reference, the CPC budget referenced earlier raises $1.6 trillion over the next 10 years just through three steps: ending the “step-up basis” for inherited wealth, equalizing capital and labor income tax rates, and boosting top tax rates for those with incomes over $1 million as described in Rep. Schakowsky’s Enact Fairness in Taxation Act. A well-designed financial transactions tax could potentially raise even more than this.

Josh Bivens joined the Economic Policy Institute in 2002 and is currently the director of research and policy. His primary areas of research include macroeconomics, social insurance, and globalization. He has authored or co-authored three books (including The State of Working America, 12th Edition) while working at EPI, edited another, and has written numerous research papers, including for academic journals. He appears often in media outlets to offer economic commentary and has testified several times before the U.S. Congress. He earned his Ph.D. from The New School for Social Research.

Hunter Blair joined EPI in 2016 as a budget analyst, in which capacity he researches tax, budget, and infrastructure policy. He attended New York University, where he majored in math and economics. Blair received his master’s in economics from Cornell University.

Spread the word