How Taxpayers Subsidize Union Avoidance by Wal-Mart and Nissan

Dirt Diggers Digest

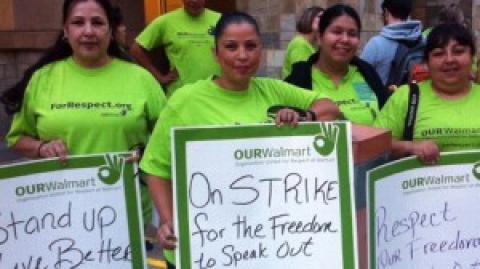

The study, which updates a 2004 report by the committee, reviews the hidden taxpayer costs stemming from the fact that many Wal-Mart workers have no choice but to use social safety net programs -- such as Medicaid, Section 8 Housing, food stamps and the Earned Income Tax Credit -- that were designed for individuals not in the labor force or those working for small companies that failed to provide decent compensation, not a leviathan with $17 billion in annual profits.

Spread the word